Scott Olson

One may argue that Berkshire Hathaway Inc. (NYSE:BRK.A, NYSE:BRK.B) should be particularly successful when interest rates are on the higher side and markets are turbulent. Well, it seems like we are right there! So, are we supposed to open or increase positions presently?

Berkshire keeps trading a sum of equity and float

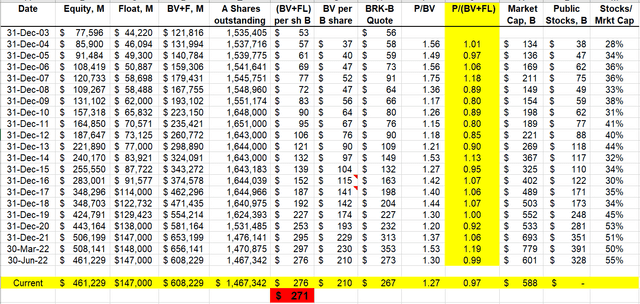

For some time, I have advocated this approach (please see other Berkshire Hathaway-related posts on my author’s page) presenting some arguments for why it makes sense. Let us update our regular table:

BRK as a sum of equity and float (company, author)

The average P/(BV+F) (yellow column) in the table is 0.99 with a standard deviation of 0.12.

At the end of the last quarter, BRK was trading at $273 vs. $276 of BV+F. The S&P index is down 4.9% since. We can apply this figure to the value of the stock portfolio at the end of Q2, adjust for 21% corporate tax, and estimate BV+F right now. The answer is $271 shaded in red in the table. This method allows tracking BV+F dynamically as opposed to the data at quarter-ends only. By this metric, BRK currently does not represent an outstanding value.

I do not claim that the sum of equity and float represents BRK’s intrinsic value. It just trades this way. Still, this method grasps some essence of an insurance company from “the first principles” – i.e., the company’s balance sheet.

When acquiring Geico, Buffett paid for it almost exactly the sum of its equity and float. Consequently, in Buffett’s eyes, an outstanding insurance company (from his writings, we know that this is precisely how Buffett thought about Geico) could be worth more than the sum of equity and float. Of all the big P&C insurers I am aware, only Progressive (PGR) is trading stubbornly higher than BV+F. Perhaps, we should not be surprised that much, as over the last several years, PGR has consistently beaten Geico!

Since BRK’s diverse assets are more productive than bonds on PGR’s balance sheet, it implies that BRK is, perhaps, permanently undervalued. It may be due to the conglomerate’s discount or fears of Buffett being irreplaceable.

Certainly, it is possible to value BRK as a multiple of its book value. From our table, this multiple is 1.37. While mysterious, it is compatible with Buffett’s old preference to buy back shares at 1.2 of BV. Between the two methods, I prefer to use BV+F, as there is some logic behind it vs. no visible logic whatsoever behind 1.37.

One may object that BV+F does not represent BRK’s earning power. Instead, one should analyze and value each BRK segment individually and value the company as the sum of the parts (SOTP). I may agree with it in principle but not in its practical implementation.

How would one value BRK’s railroad (BNSF), for example? Typically by comparing it with a publicly traded railroad, usually Union Pacific (UNP). By following this path, the SOTP analysis loses its claim to calculate BRK’s intrinsic value by analyzing its earning power. The same is true for BRK’s utility BHE. And so far, I have not seen any serious attempt to value BRK’s insurance empire, either. Nor am I sure it is really needed. To perform SOTP, one tames lots of moving parts and accepts certain rather arbitrary assumptions about many of BRK’s businesses. It makes analysis prone to mistakes.

In my opinion, numerical valuation should preferably be kept rather simple even for a massive enterprise, like BRK. If it is not possible it is an indication to avoid valuing at all. “Too difficult” in Buffett’s words.

In this regard, BV+F is as simple as it gets. For other insurance companies, one calculates float from the balance sheet, which is rather straightforward. But for BRK, even this is not necessary – the company communicates its float specifically every quarter.

Berkshire on Reddit

I was not following the Berkshire section on Reddit until one of my readers advised me of it. It turned out that my articles were being reproduced there (here for example). Even though I was not aware of it, I do not mind at all.

The same reader also sent me a Reddit reference to another valuation method very similar to the one I am proposing. The story is rather captivating.

David Sanford (Sandy) Gottesman is a recently deceased (September 28, 2022) American businessman and investor. He founded First Manhattan Co (FMC) and was close with Warren Buffett. Allegedly, he was also the second biggest personal shareholder of BRK, holding more than Charlie Munger!

His company FMC provides investment management services to high-net-worth individuals and other clients and has a lot of BRK in its portfolios.

Based on Reddit, FMC (and probably Mr. Gottesman) was buying BRK whenever it was trading below BV+Float+1/2 of deferred taxes on stocks. Allegedly this formula was not shared publicly until very recently.

Mr. Gottesman met Buffett in 1963 and must have come up with his formula long before me (I started using it in the late nineties). Since Mr. Gottesman often spoke on the phone with Buffett on a daily basis and visited him many times in Omaha, Buffett himself may be quite familiar with the formula.

The minute I saw Mr. Gottesman’s formula a couple of days ago, I immediately recognized the difference – I was thinking along the same line but decided not to adjust for deferred taxes.

But first of all, why are we supposed to add half of the deferred taxes on equities? Book value deducts deferred taxes on equities in full as reported on the balance sheet. However, a long-term investor will actually pay these deferred taxes far in the future if ever. So, assuming a long holding period, the present value of deferred taxes should be lower compared with the accounting value. That’s why compounding is so important!

When analyzing BRK and Markel Corporation (MKL) (another long-term holder of stocks), I came up with a simple rule: the present value of deferred taxes is equal only to 45% (or roughly half!) of the deferred taxes on the balance sheet if holding period is 5 years. (The same number for 10 and 15 years are 36% and 30%.)

However, I decided not to use this to value Berkshire for several reasons. First, the difference is not that big. At the end of Q2 22, BRK had about $37B of deferred taxes on stocks. Half of it represents only ~3% of BRK’s market cap. Secondly, as you have seen, the average Market Cap/(BV+F) is 0.99, and one can hardly seek a better predictor. Thirdly, we do not know what Buffet’s and Munger’s heirs’ preferred holding period will be. Fourthly, I prefer to be more conservative in selecting between two methods with everything being equal. And finally, the simpler the better.

I will keep using my method, but it was flattering to learn about Mr. Gottesman’s approach.

Conclusion

While BRK is trading close to BV+F, there are several catalysts for the stock. Higher interest rates are favorable for Berkshire because of $100B+ of cash on its balance sheet. Due to the drop in the stock market, Berkshire may also find good acquisition targets in different segments. The closing acquisition of Alleghany Corporation (Y) anticipated in Q4 will provide a small bump as well. And I am generally optimistic about the creeping (partial) acquisition of Occidental Petroleum (OXY).

But this is counterbalanced by geopolitical concerns. As Buffett reminds us from time to time, Berkshire is defenseless against nuclear weapons. I recently published “Asset allocation and nuclear threat” in which I tried to sum up my attitude toward buying stocks today. I keep holding BRK without attempting to add to my position.

Be the first to comment