triloks/E+ via Getty Images

Plains All American Pipeline (NASDAQ:PAA) just announced its dividend, unchanged ($0.215), payable in August. The timing isn’t unusual, but it does add clarity for investors that the ongoing business is still in good shape. The stock price since has held above or near $10, just skating along. Getting paid while skating is optimal for some investors, but it doesn’t preclude the continue watch for afternoon thunderstorms. Recent events from two sides of government create a weather watch. In West Virginia, the Supreme Court blocked rouge actions from unelected bureaucrats, but clever reprisals from those same bureaucrats could bring back the necessity for thunderstorm watching. My youthful experience taught how much rain and skating don’t get along. But, in the meantime, let’s skate together.

Last Quarter Results

At the last quarterly report, the company announced strong financials raising this year’s EBITDA upward by almost $100 million to near $2.3 billion. We aren’t sure exactly why it isn’t higher with four times $615 (1st quarter result) million equaling $2.45 billion. This suggests that even higher EBITDA adjustments upward are likely coming.

Management also noted,

“We believe the call in North American shale, more specifically, the Permian, will remain strong for decades and that our integrated midstream asset base and business model will play a critical role connecting energy supply with global demand.”

It is within this realm that a fire fight between the warm front and cold front, intense or not so intense, is eminent.

Plains in a Nut Shell

Before we discuss further coming events, let’s take a short skate around the company. Plains is basically a fossil fuel transportation business with an element of storage. Yahoo Business describes it thus,

“Plains All American Pipeline, L.P., through its subsidiaries, engages in the pipeline transportation, terminalling, storage, and gathering of crude oil and natural gas liquids (NGL)) in the United States and Canada. The company operates in two segments, Crude Oil and NGL. The Crude Oil segment offers gathering and transporting crude oil through pipelines, gathering systems, trucks, and at times on barges or railcars. This segment provides terminalling, storage, and other facilities-related services, as well as merchant activities.”

Again, the Permian Basis is key to its future.

A Background Behind the Results

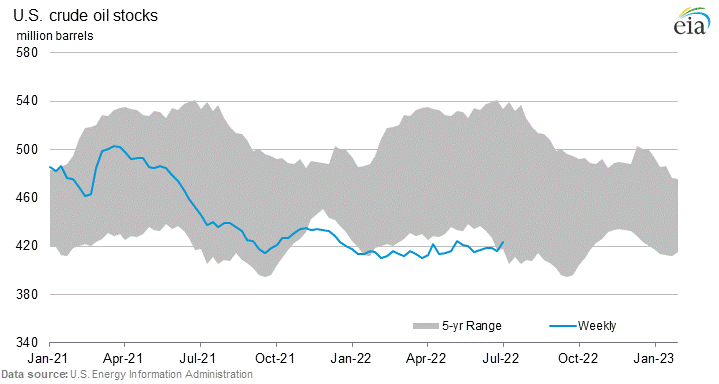

Two graphs created by the EIA speak about all needed concerning the background, both found in an article at Oil Price by Josh Owens. The 1st is a chart showing crude oil storage’s five year range (shaded) versus this year’s weekly average, cyan line. Crude, in storage, is simply collapsing being held up in recent times by the million barrels per day release from the strategic petroleum supply.

EIA

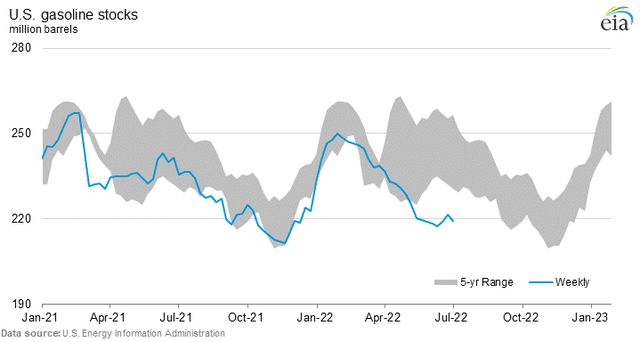

It gets even worse after viewing the storage chart for gasoline.

The collapse in gasoline storage is even more pronounced. The need to drill for, produce and transport couldn’t be plainer, pun intended.

Watching the Skies for Thunder Storms

Fox Business News contributor and former economic advisory to the President, Larry Kudlow, commented on a head scratching action from the Environment Protection Agency (EPA) concerning the Permian Basin, which generates just under half of American crude oil. The EPA claims that the Basin is just now non-attainment with respect to ozone. The impact might include “significant reduction in the region’s rig count, severely limiting the domestic industry’s efforts to increase U.S. oil production.” With Plain’s dependence for growth from Permian, it could result in material growth impacts.

From a Forbes opinion piece, David Blackmon, a Senior Contributor, wrote,

“Thus, while the President claims to want to “work like the devil” to lower gasoline prices and Energy Secretary Jennifer Granholm claims Mr. Biden is “using every tool” at his disposal to do so, the EPA is working to create the exact opposite impact.”

He also added many expect that the recent West Virginia Supreme Court ruling will have zero or little impact on inhibiting government action.

Added Risk

We aren’t lawyers and don’t pretend to be. In West Virginia, the Court reigned in the EPA’s attempts to hassle coal fired power plants especially in West Virginia with unfounded regulations which would have resulted in diminished operational viability. The reasoning by the Court involved the “major questions doctrine,” a doctrine that among other matters involves clipping regulatory wings particularly when clear intent wasn’t a part of the forming legislation.

From an opinion posted by Stanford School of Law,

“Going forward, all federal agencies . . . will need to show that their actions are supported by clear, express statutory authority, at least when their actions might be adjudged to have “vast economic and political significance.” Agency attempts to use “long-extant” statutory language that the agency never wielded will be intensely scrutinized. Regulatory changes that affect an entire industry at a fundamental level will be highly suspect. And if Congress has “conspicuously and repeatedly declined to enact” a similar rule, the agency’s decision to nevertheless issue a regulation will rarely pass muster.”

The recent action by the EPA to clip the production growth wings at Permian likely flags all the warnings put forth in West Virginian by the Court except for the statutory power. It is clear that the EPA has statutory power for regulating ozone, but their action will be flag by its timing and crippling industry effect “major questions doctrine” on this industry and the American economy. Law suits from the private sector are coming, maybe multitudes. The government will be asked to answer why on timing when for years Permian has been successfully in operation and American crude oil production is clearly in short supply. Or in other words, asked to answer why this isn’t again governmental agenda based harassment of private business and “unprecedented power over American industry?” What is clear is the Supreme Court will be listening.

The Option Using Options

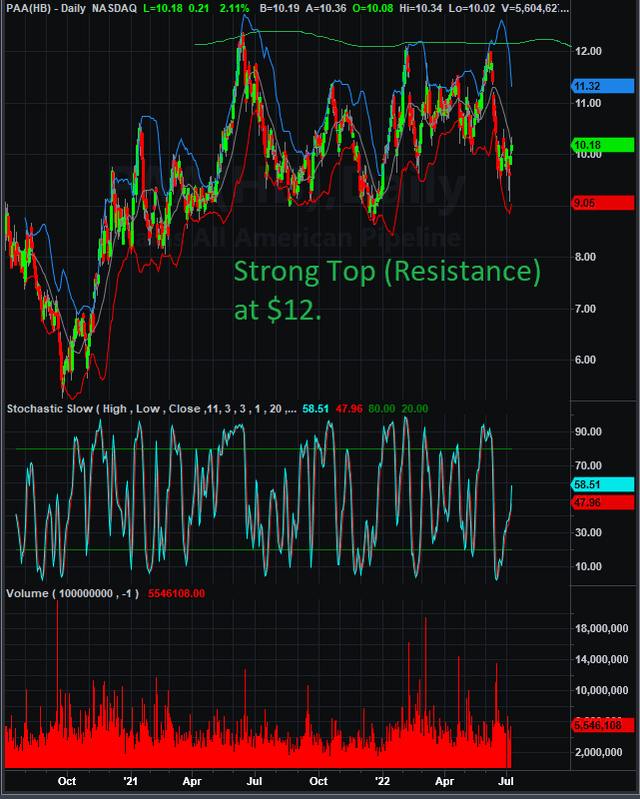

Continuing on the investment strategy, gathered from a daily chart generated with TradeStation Security software of Plains, it is clear that a price of $12 is a point of major resistance.

Selling short call options when prices reach near $12 might be a good means to significantly enhance yield.

Investing Vs. Risk

Investing includes managing risk. We don’t know the final answers with industry and the EPA, but it seems that production and drilling at some level will continue offering investors a return with either no or lower growth until the legal issues sort out. It is also clear that the price of crude oil will increase drastically should the EPA decide and be allowed to continue with significant impact at Permian. Through this, we sense that skating along with Plains while being paid is still a viable investment, but investors must also be aware of possible forming thunderstorms, because skating and rain just don’t mix.

Be the first to comment