luismmolina

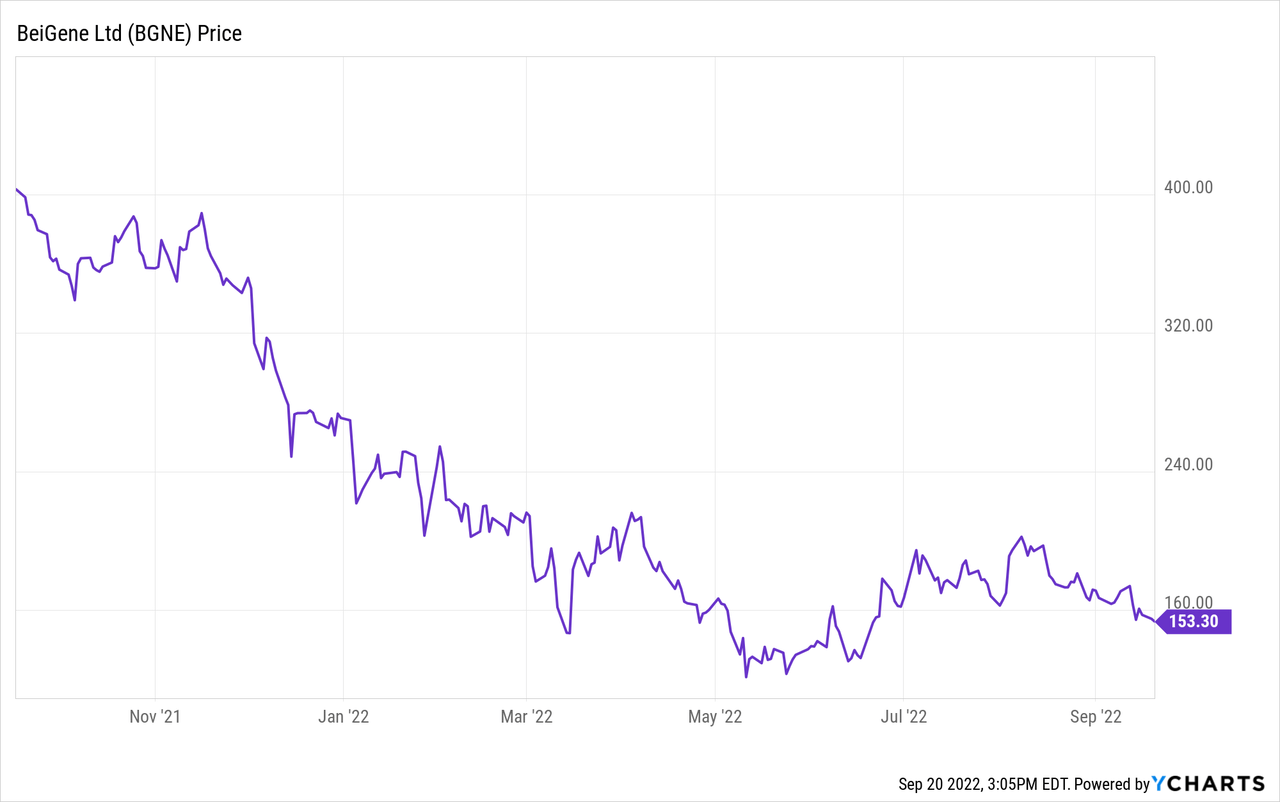

BeiGene (NASDAQ:BGNE) is a Chinese biotechnology pharmaceutical company with a growing portfolio of approved cancer treatments. Like most of the pharma sector, it has seen a remarkable drop in its stock price over the last year. It closed on September 19, 2022, at $154.82. Compare that to the 52-week low of $118.18 and the 52-week high of $413.33, and it looks like it might be a good time to buy, provided the company has a bright future. In this article, I will examine BeiGene’s Q2 results, its currently available medicines with their future revenue potential, and the company’s pipeline of potential products.

Q2 2022 BeiGene Results

BeiGene Q2 2022 results included revenue of $342 million, which was more than double the $150 million recorded in Q2 2021. Revenue growth was led by Brukinsa, with $129 million, up from $42 million a year-earlier. Tislelizumab sales hit $105 million, up from $75 million a year-earlier. Sales of Amgen (AMGN) products were $29 million while sales of Bristol Myers (BMY) products hit $23 million. An additional $37 million came from collaboration revenue, primarily from Novartis (NVS) for tislelizumab.

Expenses for research, development, sales, and administration were more than high enough to eat through the revenue and put earnings at a net loss of $571 million or $0.43 per share. The loss was amplified by the strengthening of the U.S. dollar. Given its ramping revenue, BeiGene has also been ramping its research and development spend. That makes sense for a pharmaceutical company that is growing and has a strong pipeline that can generate future revenue and profits.

At the end of Q2, BeiGene had $5.7 billion in cash, even after cash used in operating activities ran to $380 million in the quarter. As revenue ramps, the cash use per quarter should decrease, so it is likely that the company can reach cash flow break even before running through all that.

BeiGene’s Medicines: Brukinsa, Tislelizumab, and Licensed Products

Brukinsa (zanubrutinib) is BeiGene’s leading revenue generator. It is a BTK (Bruton’s tyrosine kinase) inhibitor. Brukinsa was first approved by the FDA for treating second-line mantle cell lymphoma in November 2019, with orphan drug designation. The label was expanded in 2021 for Waldenstrom’s macroglobulinemia and separately for marginal zone lymphoma. It was further approved for use in the EU in 2021. Its clinical trials generated strong statistics, for instance, an overall response rate, or ORR, of 84% and a complete response rate of 59% for mantle cell lymphoma. The revenue ramp is perhaps the best indicator that the therapy has been well-received by the medical community. Brukinsa is a small molecule that is administered orally. It is also in pipeline studies for B-cell malignancies, follicular lymphoma, and related cancers. Given that it is relatively early in the ramp and label expansion is likely, revenue could continue to ramp for years.

Tislelizumab is a PD-1 antibody, of which several are already on the market, notably Opdivo and Keytruda. It has been approved for use for Hodgkin’s Lymphoma and urothelial carcinoma in China. It is in trials for many other indications, mainly as a combination agent. Given the widespread use of PD-1 antibodies, it is also likely to continue to ramp revenue. It was first approved in December 2019. It is also being licensed to Novartis. In Q2 2022 BeiGene gained approval in China for tislelizumab in combination with chemotherapy as a first-line treatment of recurrent or metastatic nasopharyngeal cancer. In August 2022 BeiGene announced positive Phase 3 results for hepatocellular cancer.

Pamiparib, a PARP inhibitor, was approved in China for relapsed ovarian cancer in May 2021. However, revenue for this therapy was not mentioned in the Q2 results press release. Pamiparib is also in some clinical trials as a combination therapy.

BeiGene licenses two cancer products for sale in China: Blincyto and Kyprolis from Amgen. It also has some residual income from older licenses from Celgene that Bristol Myers-Squibb has been withdrawing.

BeiGene’s Platform and Pipeline

The BeiGene pipeline of potential therapies is very broad. Continued label expansion, including as combination therapies, of Brukinsa and tislelizumab are dominant features of the pipeline.

Ociperlimab is in several trials. It is an anti-TIGIT agent. As a monotherapy, it is being tried for R/R DLBCL, and in various combinations for HCC and NSCLC. DKN-01 is an anti-DKK1 agent being tested for gastric cancer. BGB-11417 is a BCL2 inhibitor that is currently in Phase 1 for CLL, NHL and AML. Zanidatamab is an anti-HER2 bispecific antibody in a Phase 2 study for second-line biliary tract cancer.

Most of the trials in the pipeline are in Phase 1 or 2, which means there may not be any additional commercial approvals in the near term, but there should be continuing data readouts and potential approvals over the next 5 years.

Delisting Risk

As explained in BeiGene Takes Action to Mitigate Delisting Risk, there is some risk that BeiGene could suffer from U.S. – China tensions. To mitigate the risk of delisting from the NASDAQ exchange, BeiGene has added Ernst & Young as its accountant for U.S. financial reporting.

Analysis and Conclusion

BeiGene is rapidly ramping revenue with approved drugs. It is also seeking to expand the labels of those drugs. Its PD-1 antibody could get substantial help in international markets from its deal with Novartis. The stock price itself is reasonably near a 52-week low. On the other hand, even that stock price anticipates a tremendous amount of future revenue growth. BeiGene’s market capitalization is over $16 billion. In the latest quarter, it lost $571 million. Losing money is not unusual for a biotech company at this stage, and there is plenty of cash to sustain that for a few years. But there are no guarantees that the labels of current drugs will be further expanded or that novel drug candidates will ever receive regulatory approval. My subjective judgement is that the company will become successful enough over the next few years to justify its current market capitalization. The longer the run I look at, the more I see a good chance of returns for investors. But, for now, I will err on the side of caution and call it a Hold.

Be the first to comment