White Label Strategy Could Be About To Payoff Big Time

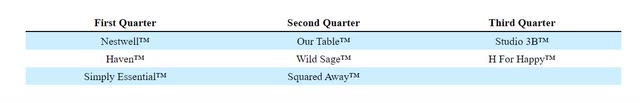

We believe Bed Bath & Beyond (NASDAQ:BBBY) is well-positioned to take advantage of powerful shifts in consumer behavior driven by surging inflation with its store brands strategy, developed over the last three years. Management took a big risk starting in 2019 to shift to so-called private-label products, or store brands. BBBY resells these off-label products through its own store brands for higher margins than it gets for national branded products.

The results through the May (last) quarter were disappointing and precipitated a change in CEOs, according to company filings. According to a Forbes article, former CEO Tritton “tried to replicate a strategy that had been profitable for other retailers — selling private label products (knock offs of popular brands at a lower price).” A recent WSJ story highlighted customer feedback that changes went too far and too fast, which alienated traditional BBBY shoppers.

We think that nearly 20% inflation (based on 1980 measures) is driving a powerful surge in customers buying cheaper store brands to make ends meet. BBBY is well positioned to capitalize on this shift in consumer buying behavior, made necessary by rising costs.

Bed, Bath & Beyond 10K S&P Global Market Intelligence

Pandemic-related disruptions worked against BBBY, but the return to stores this summer and fall could power significant upside potential relative to a very bearish Street Consensus. The big COVID winners in retail were players that could rapidly shift to online sales and fulfillment. Ample evidence of this can be seen by reviewing prior 10Qs for McDonald’s (MCD) and Amazon (AMZN). BBBY failed badly in this category over the last 2 years, per the WSJ story. With a meaningful return to normalcy last Spring, and continuing over the Summer and into the Fall, we increasingly believe that BBBY will be positioned to take advantage of newly price-sensitive customers that have little choice but to reduce spending amidst soaring price inflation that was less than 1% 15 months ago.

From Walmart’s earnings call:

The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars. We’re now anticipating more pressure on general merchandise in the back half.

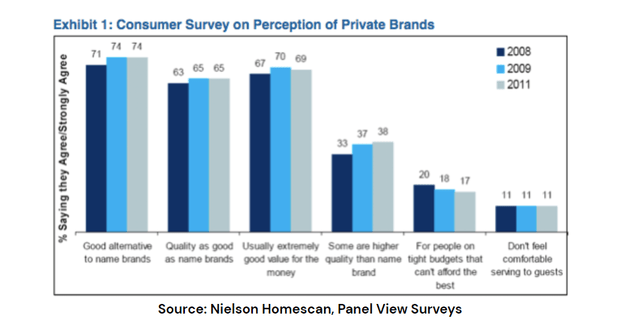

We believe BBBY’s operational weakness that hurt results over the last two years as COVID made customers prefer online and takeout purchasing may have become the company’s greatest strength now that management has revamped its supply chain, technology and product line issues. The WSJ cites a McKinsey & Co survey that shows 90% of respondents planning to buy white-label products would continue to do so after the pandemic was over. We think inflation will accelerate that trend in spades.

Peerless Progress

BBBY’s 955 stores are well-positioned to answer surging customer demand for lower price items just as many retailers such as Amazon are cutting back on private label offerings. Many retailers have grown in-store brands to almost a third of sales, per the WSJ.

Retailers like Walgreens (WAG) and Kroger (KOG) have increased the amount of white-label offerings recently. Walmart and Target (TGT) noted significant slowdowns in spending, but spending shifts led to some areas of strength (white-label good). Per Target’s earnings call:

In our other three core merchandise categories: apparel, home, and hard lines, we saw a rapid slowdown in the year-over-year sales trends beginning in March, when we began to annualize the impact of last year’s stimulus payments …Nevertheless, we’re still seeing healthy overall spending by our guests, even as their spending continues to evolve.

Others like Amazon are backing off private-label offerings for a variety of reason including seller complaints about predatory behaviors. This comes just as surveys and earnings season feedback from retailers support our view that consumers have little choice but to spend less, which translates into buying more white-label products. Our direct research supports the notion that the timing could be fortuitous for BBBY investors.

Fundamentals

It has been widely reported that Bed Bath & Beyond is struggling with falling sales, reduced liquidity and increased debt loads, but we think that is old news. SA’s Quant model rates the stock’s growth potential as ‘A’. We would agree but only because of what we hear from stores that we have contacted that inflation is driving more and more customers to their white label offerings. Further evidence shows up in the news that consumers have shifted to lower priced store brands in large numbers. Our calls to stores and onsite visits suggest that private label (typically outsourced from branded manufacturers and sold as store brands) products are cheaper than branded ones, though also somewhat lesser quality.

The next quarterly report at the end of September will provide more color on changes in buying patterns. Cash flow is negative at $384m and NI margin -11.7%, debt service is $16.5m/qtr and total debt is $3b with another $2.2b in liabilities; net cash is $139m and available credit is about $700m, according to BBBY filings. Management owns over 12% of common, representing a significant stake in the company’s future. Activist investors have recently bought stakes in the company as well, seeking to be a catalyst to positive change.

Risks

BBBY has underperformed badly for several years. It missed much of the Covid shift to online and curbside buying due to outdated software, supply chain limitations and strategic misfires, as described on the last earnings call. Recent management spent a lot of money updating software and supply chain to enable online selling and fulfillment.

It also took a significant risk by changing store layouts from the familiar look and feel that customers resonated with. BBBY made a big bet on white-label too early, before its fulfillment and logistics could support it. The results are high debt ($2.9b), low cash reserves ($107m) and negative operating results (-$337m OCF), per SA Data.

Inflation and the Fed’s reaction to it could cause consumer spending to fall significantly. If the economy falls into recession, it could cause retail sales to slow, which would hurt results. Should BBBY’s white-label bet fail to pay off, the stock could suffer materially. We visited several stores and hear from ‘power shoppers’ that traffic is not back to prior levels. These elements, and what we think is a looming recession, represent risks to our bullish stance.

Technical Analysis

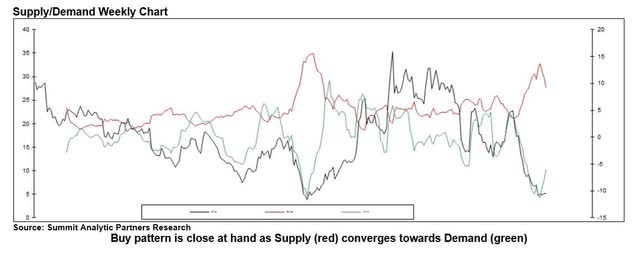

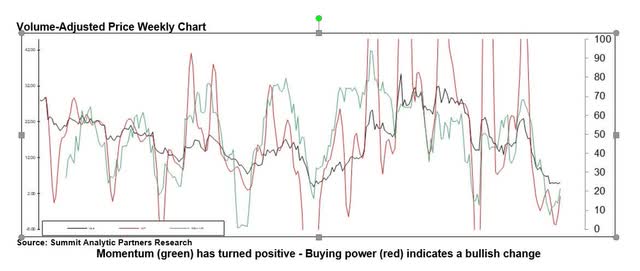

The chart for BBBY shows what could be the end of an Elliot 5 wave bearish correction, which would be bullish over the next several weeks to months for the stock. The alternate count is that BBBY has completed a drawn-out ABC correction. More data is needed to determine which count is operative, but the good news is that either way we can expect a bounce over the next several weeks to months. Our proprietary Supply/Demand models, which track the supply and the demand related to a stock’s money flows, show a similar pattern below.  Weekly data shows a potentially powerful rally coming, with buying power just starting to come back into the stock. RSI shows a meaningful bullish divergence as the stock completes a round-trip to its 2020 lows, giving further confidence to the pattern. Initial resistance comes in around $12-13 and secondary resistance around $18.50-19. We think BBBY could be a surprise beneficiary from inflation and consumer retrenchment, with an attractive chart to boot!

Weekly data shows a potentially powerful rally coming, with buying power just starting to come back into the stock. RSI shows a meaningful bullish divergence as the stock completes a round-trip to its 2020 lows, giving further confidence to the pattern. Initial resistance comes in around $12-13 and secondary resistance around $18.50-19. We think BBBY could be a surprise beneficiary from inflation and consumer retrenchment, with an attractive chart to boot!

Conclusion

We believe that BBBY is finally capturing the benefits of its prior CEO’s strategic plan to reposition the retailer from branded offerings into white-label products with higher margins. The rapid rise of inflation over the last 6 months is playing directly into the company’s hands, based on our primary research into customer buying behavior at the store level. There are clear indications in the financial press that a major shift towards cheaper alternatives for consumers is underway, supporting our bullish stance. Street consensus remains very negative with no upward revisions since the last eps report at the end of June. The past mistakes in strategy may have just been early. The stock shows favorable signs of renewed investor interest and our technical studies indicate the potential for upside in the next several weeks.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment