JHVEPhoto

In this analysis of Becton, Dickinson and Company (NYSE:BDX), we analyzed the healthcare sector and the equipment market based on its Q1 2022 TTM market share and growth to determine how the company performed in relation to its competitors. Lastly, we looked into the company’s revenue growth boosted by acquisitions.

Strong Growth Momentum in Healthcare Sector

To determine the performance of the healthcare sector in Q1 2022, we compiled the top 5 companies’ revenue growth within each industry in the Healthcare sector including Equipment, Supplies, Distributors, Services, Managed Health Care, Health Care Technology, Biotechnology, Pharmaceuticals and Life Science Tools.

|

Industry (Healthcare) |

Q1 2022 TTM QoQ Growth |

|

Equipment* |

1.9% |

|

Supplies |

2.0% |

|

Distributors |

3.2% |

|

Services |

1.2% |

|

Managed Health Care |

4.1% |

|

Health Care Tech |

5.6% |

|

Biotechnology |

6.2% |

|

Pharmaceuticals |

6.5% |

|

Life Science Tools |

3.3% |

|

Average Healthcare |

3.8% |

*Top 15

Source: Company Data, SeekingAlpha, Khaveen Investments

Based on the table above, the average growth of the healthcare sector in Q1 2022 based on TTM revenue growth of the top 5 companies within each industry was 3.8%. 4 out of the 9 industries had above-average growth including Managed Health Care, Biotechnology and Pharmaceuticals. On the other hand, the remaining industries including Healthcare Equipment (1.9%) had below-average growth. The pharmaceuticals industry had the highest revenue growth rate of 6.5% within the healthcare sector followed by biotechnology with the second highest revenue growth rate of 6.2%. In comparison, the biotechnology and pharmaceutical markets were forecasted to grow at a CAGR of 17.8% and 7%. In comparison, the global medical devices market is forecasted by Fortune Business Insights to grow by a lower CAGR of 5.5% through 2029. For the healthcare sector as a whole, the rise in demand for healthcare services is attributable to factors such as population growth, income levels and health awareness according to Frost & Sullivan.

Overall, while we believe the healthcare sector could have a positive outlook in 2022, as all of the industries had positive revenue growth in Q1 2022 which indicates the strong momentum in the sector, we expect the healthcare equipment industry to lag behind higher growth industries such as biotechnology and pharmaceuticals which were forecasted to grow at a higher long-term CAGR.

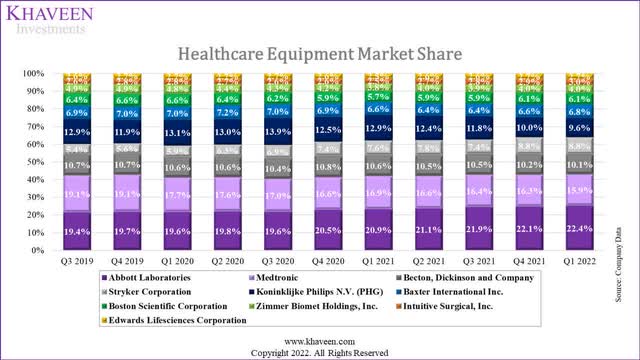

Positive Growth Outlook of 9.4% for Healthcare Equipment Industry

Company Data, Khaveen Investments

|

Company |

Q1 2022 TTM Revenue ($ mln) |

Market Share (Q1 2022) TTM |

Q1 2022 TTM QoQ Growth % |

Actual Revenue vs Analyst Consensus Difference % |

Revenue Guidance |

|

Abbott Laboratories (ABT) |

44,514 |

22.4% |

3.3% |

8.2% |

7.5% |

|

Medtronic (MDT) |

31,686 |

15.9% |

-0.3% |

-4.0% |

4.5% |

|

Becton, Dickinson and Company |

20,031 |

10.1% |

0.5% |

4.8% |

7.25% |

|

Stryker Corporation (SYK) |

17,430 |

8.8% |

1.9% |

2.2% |

7.00% |

|

Koninklijke Philips N.V. (PHG) |

19,081 |

9.6% |

-2.3% |

-2.3% |

N/A |

|

Baxter International Inc (BAX) |

13,545 |

6.8% |

6.0% |

4.5% |

24.50% |

|

Boston Scientific Corporation (BSX) |

12,162 |

6.1% |

2.3% |

2.7% |

4.50% |

|

Zimmer Biomet Holdings, Inc. (ZBH) |

7,898 |

4.0% |

0.8% |

4.4% |

-1.00% |

|

Intuitive Surgical, Inc. (ISRG) |

5,906 |

3.0% |

3.4% |

4.2% |

14.00% |

|

Edwards Lifesciences Corporation (EW) |

5,357 |

2.7% |

2.4% |

2.3% |

7.5% |

|

Hologic, Inc. (HOLX) |

5,392 |

2.7% |

-1.9% |

11.6% |

N/A |

|

Smith & Nephew plc (SNN) |

5,212 |

2.6% |

0.9% |

0.0% |

4.50% |

|

STERIS plc (STE) |

4,585 |

2.3% |

7.9% |

2.6% |

11.00% |

|

ResMed Inc. (RMD) |

3,540 |

1.8% |

2.8% |

-3.9% |

21.00% |

|

QuidelOrtho Corporation (QDEL) |

2,326 |

1.2% |

36.9% |

-2.4% |

N/A |

|

Average |

4.3% |

2.3% |

9.4% |

Source: Company Data, Khaveen Investments

Based on the table above, we analyzed the top 15 healthcare companies by revenue and obtained an average revenue growth QoQ of 4.3% in Q1 2022 (‘TTM’). The company with the highest growth was QuidelOrtho with a growth rate of 36.9% followed by STERIS at 7.9% and Baxter International (6%). Only 3 companies (Quidel, Baxter and STERIS) had above-average growth in the quarter. According to Quidel’s management in its latest earnings briefing, its strong growth in the quarter was driven by the performance of its Rapid Immunoassay product portfolio which revenues grew by 275%. In comparison, non-COVID sales grew by 56%.

On the other hand, Becton Dickinson had below industry average growth of 0.5% but still surpassed analyst revenue consensus. Specifically, the company’s COVID-only testing revenues which represented 4.2% of total revenues declined by 55% YoY from $474 mln in the prior year’s quarter. Besides Becton Dickinson, 9 companies beat analyst consensus while 4 companies (Medtronic, Philips, ResMed and Quidel) failed to beat analyst consensus estimates.

Furthermore, we compiled the revenue guidance of each company for 2022 of the top 15 companies within the healthcare equipment industry (except Philips, Hologic and Quidel) and obtained an average of 9.4% thus indicating a positive growth outlook.

Insignificant Revenue Contributions from Acquisitions

Based on its latest earnings briefing, the company committed $500 mln for the completion of 4 acquisitions for the fiscal year to date.

We believe that the current environment coupled with our strong cash flow and robust M&A funnel positions us well to create value through our tuck-in M&A strategy while remaining disciplined. – Tom Polen, President, CEO & Chairman

In the past quarter, it completed the acquisition of Cytognos, as an addition to its Biosciences business, with an estimated revenue of $6 mln according to ZoomInfo and 3 acquisitions in the prior quarter including Scanwell Health (estimated revenue of < $5 mln) and TissueMed (estimated revenue of $ 6 mln).

|

Acquisition |

Revenue ($ mln) |

% of Total Revenue |

|

Cytognos |

6 |

0.03% |

|

Scanwell Health |

<5 |

0.02% |

|

TissueMed |

6 |

0.03% |

Source: Company Data, ZoomInfo, Khaveen Investments

However, despite these acquisitions, the incremental revenue to the company is insignificant as it only represented between 0.02% and 0.03% of its total revenue to the company based on its 2021 revenue ($20.2 bln). Based on its earnings briefing, management highlighted its strong cash flow and robust M&A strategy but expects its revenue growth for the full year in 2022 to be driven by its main segments including BD Legacy (guidance of 6.75% to 7.75%) and RemainCo (7.25% to 8.25%). Thus, we do not expect its M&A activity to be the main driver of its revenue growth for the year.

Risk: Low Revenue Growth

Compared to the healthcare equipment industry, the company had below-average revenue growth of 0.5% in Q1 2022 TTM. Moreover, its revenue guidance of 7.25% for Q2 2022 is below its average growth rate of 10.9% (5-year average) and 10.87% (10-year average), indicating its slowdown in growth.

Verdict

All in all, despite the positive growth of the healthcare sector, the healthcare equipment industry had lagged with below-average growth. Moreover, the company has had below-average growth compared to the top 15 companies within the healthcare equipment industry as well as insignificant revenue contributions from its acquisitions. Therefore, we based our price target on the lower end of analyst consensus at $235.

Be the first to comment