Dilok Klaisataporn

Bear Market: Good News For Accumulators

More investing mistakes are made in bull markets than bear markets.

I had that realization recently when I thought about the kinds of stocks I’m buying now versus the kinds of stocks I was buying in late 2021 and in the six months or so before the pandemic began.

In 2019 and early 2020 and late 2021, when stocks and REITs (real estate investment trusts) were richly valued, I was still buying stocks, though perhaps not as much in terms of dollar value and certainly not with the same degree of urgency. But most of the highest quality, fastest growing stocks in my portfolio and watchlist were bid up to unattractively high valuations and low dividend yields.

What is an investor to do during such times? Well, what I wish I’d done was to build up a cash position to use as dry powder, available to deploy when stock prices dropped back to what I considered attractive prices.

What I did instead was reach for yield. I bought stocks and REITs that still had a decently high yield, since the highest quality and fastest growing companies weren’t attractively priced.

I’ll give you two examples.

In November 2021, I pitched Spirit Realty Capital (SRC) as a buy (see “Spirit Realty Capital Is Unfairly Maligned By The Market“), and I was putting my money where my mouth is by buying it myself. Now, don’t get me wrong. I like SRC. I’m still happy to own it. But I wish I’d saved my money and waited for a more opportunistic price to buy it rather than simply buy it in November 2021 because of an impulse to put cash to work in the highest yielding name in the space.

Also, early this year, I pitched Apartment Income REIT (AIRC) as a buy (see “Apartment Income REIT Deserves A Higher Valuation“), if I’m honest, largely because it was the cheapest and highest yielding multifamily REIT. I ignored some of the problems, namely its complex balance sheet and high property turnover, because I wanted to buy a cheap apartment REIT when all other apartment REITs seemed too expensive.

Both REITs are down big from when I was buying them: SRC by 22% and AIRC by 32%.

I delve into these mistakes to highlight the point that more investing mistakes are made during bull markets than bear markets. I’m convinced of it.

The stocks I’m buying now are far higher quality and rarely ever sell off to the degree that they have today.

The fact that the stocks of high-quality companies have sold off so much this year is fantastic news for accumulators – those who are still working, building their nest egg, and putting new money to work in the market.

For withdrawers (those withdrawing money from their investment accounts for spending purposes), there isn’t much upside to bear markets. But for those with money to invest, either in a lump sum or in regular installments (from a paycheck or dividends), bear markets are actually an opportunity to make great investment decisions that will benefit them for decades to come.

Three Suggestions For Investors Amid Bear Markets

Here are three suggestions to help you get through a bear market:

- Don’t overreact. During bull markets, investors tend to make mistakes because they often get caught up in the fear of missing out as stock prices rise. During bear markets, as stock prices plunge, investors tend to succumb to the opposite fear – fear of losing everything. The market is bipolar, jumping from mania to depression. Don’t follow it with your own emotions. Stay calm and invest on!

- Invest Consistently – Not All At Once. If you have a big lump sum of cash, good for you! But remember that no one can consistently time the market. You almost certainly won’t invest right at the bottom of stock prices. Thus, whether you have a lump sum or are simply investing the savings from your paycheck or from dividend payments, deploy capital slowly and methodically.

- Raise Your Portfolio Quality. Instead of merely buying the cheapest stocks that have been beaten to a pulp by Mr. Market, use this rare opportunity to buy discounted blue-chip companies that almost never suffer declines this big. This has both a long-term and short-term benefit. In the long run, high-quality and industry-leading blue-chip stocks should perform the best. And in the short run, these higher quality names are less likely to suffer major blows to their cash flows and/or balance sheets during a recession.

That last point – that higher quality companies are likely to perform at least a little better than the average stock during a bear market/recession – is already being borne out in this year’s stock market performance.

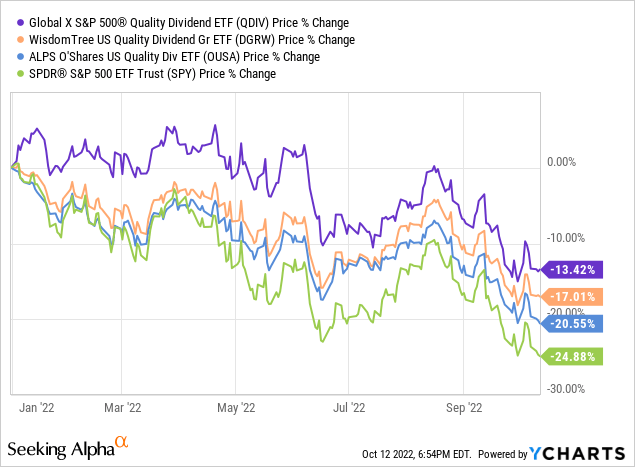

Just look at the performance of three quality-focused dividend stock ETFs (QDIV, DGRW, OUSA) against the S&P 500 (SPY) year-to-date:

The companies in these ETFs have better balance sheets, higher returns on equity and assets, and faster growth rates than the average stock. That’s what indicates quality.

But for investors who invest in individual stocks rather than ETFs only, I think one can do better than simply buying an index. After all, passive ETFs almost always rely on backwards-looking information to form their baskets of stocks. Handpicked stocks by informed and forward-looking stock-pickers can often do better than the ETFs at the same basic investing strategy.

In what follows, I will suggest 10 dividend growth stocks that I consider high-quality names. These companies are rarely ever so cheap as they are today.

10 High-Quality Dividend Growers On Sale

I admit: I’m a REIT junkie. Blame my background of working in residential and commercial real estate. Six of the ten stocks I’m about to talk about are REITs, because that’s my wheelhouse as an investor. They are a fantastic way for the average investor to gain exposure to commercial real estate. Hold them in a Roth IRA and enjoy that sweet dividend income tax-free.

But income is income. The combination of a relatively high dividend yield and a relatively high dividend growth rate are attractive no matter where they come from.

Here are ten stocks that feature dividend yields between 3.4% and 8.1% and that I believe should be able to continue growing their dividend payouts to investors indefinitely:

- Agree Realty Corporation (ADC): This retail-focused triple-net lease REIT wants to own the freestanding real estate of only the 20-30 largest and strongest national or regional retailers in the nation. This focus has created the most defensive retail portfolio in REITdom, wherein over 2/3rds of tenants are investment grade rated. A strong commitment to maintaining low leverage and a strong cost of capital have allowed the REIT to massively ramp up its investment volume in recent years to achieve high single-digit AFFO per share growth. Over $1 billion of liquidity is enough to keep up the REIT’s current pace of investments for about 3 quarters without any further need to raise more capital.

- Alexandria Real Estate Equities (ARE): As the undisputed leader in life science and laboratory real estate, ARE owns some of the highest quality and best located properties in the biggest R&D research clusters in the nation. These include Boston, San Francisco, San Diego, and Durham/Raleigh. Amid aging demographics, demand for space in these lab properties is ultra-high, exemplified by ARE consistently achieving double-digit rent growth. What’s more, the REIT’s huge in-house development pipeline represents plenty of future growth to be realized in the years ahead.

- Broadcom (AVGO): This semiconductor developer has irons in lots of fires. Its semiconductors end up in all sorts of items, from cloud computing and data centers to smartphones to WiFi routers and factory robots. This diversification protects AVGO from temporary weakness in any one category. And given the ever-increasing ubiquity of semiconductors in everything, AVGO stands to keep growing and throwing off a massive amount of free cash flow (almost a 10% FCF yield today) while continuing to invest in R&D for tomorrow’s products.

- Brookfield Renewable (BEP, BEPC): BEP is the leader in publicly traded renewable energy power producers, having been a public company in this space for over two decades now. The company’s legacy assets are hydropower dams, but it has invested heavily to massively expand its pipeline of renewable energy projects, which is over three times bigger than its installed portfolio of stabilized projects today. Developed nations’ push toward renewables is a massive, multi-decade tailwind for BEP that should ensure plenty of investment opportunities as far as the eye can see.

- Crown Castle (CCI): This exclusively US-based telecommunications REIT is perhaps the biggest beneficiary of the nationwide 5G rollout. Its 40,000 towers are growing cash flows as more tenants are being added over time, and its 115,000 small cell nodes are becoming more valuable to telecom providers to boost capacity in densely populated areas.

- EastGroup Properties (EGP): EGP’s mostly in-house-developed industrial parks in the Sunbelt region continue to put up double-digit rent growth numbers as demand for well-located industrial and logistics space continues to outpace supply. Though e-commerce’s share of retail sales has slid since its COVID-era peak, e-commerce growth continues on an absolute dollar basis. And as US companies onshore supply chains and rebuild inventories, EGP’s properties should continue to be in high demand for the foreseeable future.

- Essential Properties Realty Trust (EPRT): EPRT’s business model is to provide financing to private, middle-market American businesses through sale-leasebacks of those businesses’ owner-occupied real estate. The business will sell EPRT its properties while simultaneously signing a long-term triple-net lease wherein the tenant is responsible for all property-level expenses. While this may sound risky, the key to EPRT’s defensiveness lies in a few factors. First, its real estate is fungible and easily converted to other tenants or uses. Second, it includes landlord-friendly lease terms like cross default provisions across multiple properties and property-level financial reporting. Third, it purposely signs leases at below-market rents to make it easier for the tenant to succeed and minimize the downside in a situation where the property needs to be re-leased.

- Mid-America Apartment Communities (MAA): MAA’s almost exclusively Sunbelt focused portfolio has benefited massively from the pandemic-era population reshuffling, and it will likely continue to benefit as these markets remain some of the fastest growing parts of the country. The portfolio is diversified across urban and suburban, Class A and Class B properties, which should make performance strong whether the economy is strong or not.

- Main Street Capital (MAIN): This business development company (“BDC”) is widely considered the blue-chip name in its space, having grown its monthly dividend every year for 11 straight years while typically paying a special dividend too. MAIN exudes quality by maintaining an underleveraged balance sheet, focusing on higher quality companies as clients, and keeping lots of spare cash as “spillover” from previous successful investments.

- Medtronic (MDT): MDT makes medical device products across four categories: cardiovascular, medical surgical, neuroscience, and diabetes. The company is famous for making pacemakers, but it also makes blood sugar monitoring devices, ventilators, and countless surgical tools. Aging demographics and the standard American diet virtually ensure that demand for MDT’s products should continue to rise over time.

Here are the 10 picks broken out by dividend yield and 5-year average annual dividend growth rates:

| Stock | Dividend Yield | 3-Yr Avg Annual Div Growth |

| ADC | 4.3% | 7.6% |

| ARE | 3.5% | 5.8% |

| AVGO | 3.8% | 15.7% |

| BEP/BEPC | 4.5% | 5.5% |

| CCI | 4.6% | 9.3% |

| EGP | 3.5% | 15.3% |

| EPRT | 5.5% | 7.2% |

| MAA | 3.5% | 5.4% |

| MAIN | 8.1% | 2.4% |

| MDT | 3.4% | 8.0% |

| AVERAGE | 4.5% | 8.2% |

These picks are by no means the only undervalued dividend growth stocks worthy of investors’ attention in today’s market, but they are 10 of my favorites. They are all high-quality stocks that I’m buying today hand over fist.

Bear markets are an opportunity for investors to raise their portfolio quality by allocating capital to the higher quality stocks that rarely see steep drops.

Today, I’m doing just that. Why don’t you join me?

Be the first to comment