zenstock/iStock via Getty Images

Introduction: BEEM Looked Like It Was Falling Off The Beam.

Beam Global (NASDAQ:BEEM) began 2021 in a difficult place. In January, Seeking Alpha published a short-seller report Falling Off The Beam – Beam Global Presents Significant Downside Risk from @Mariner Research that contained the following key problems:-

1. BEEM’s revenues have stagnated.

2. BEEM’s backlog has shrunk.

3. BEEM’s products are not profitable.

4. BEEM’s municipal customers are facing budget headwinds.

5. BEEM’s Key product, the EV ARC, is far behind on-grid systems and is more expensive.

Since the report, the share price of BEEM has fallen 61%. The report was well-timed and will have been a very successful trade.

In the Press release for the 2020 full-year reports, BEEM management seemed to confirm much of what the Mariner report contained, saying initial costs have started high and that deployment costs are higher than expected. They also confirmed that the backlog had shrunk, that gross margin had fallen, and that operating costs were higher than expected.

12 months have now passed, and I believe that BEEM has successfully addressed all of these issues. In my view, BEEM had an outstanding 2021 on a number of metrics and is now a desirable investment proposition. This article will address the progress BEEM made during 2021 and the reasons for my Bullish stance.

Readers should bear in mind that Beam Global is still a small company (Market Cap $200 million). It has one product an innovative line of Solar-powered charging stations, and BEEM has an at-risk of performing badly warning from Seeking Alpha. Short interest is 33% of the float, and only 3 of 6 analysts following BEEM rate it a buy, as a result, due diligence is required.

BEEM Products: The Competitive Advantage.

This San Diego-based company currently has two products for sale the EV ARC (for charging cars by solar) and the Solar Tree for charging Heavy-duty vehicles by solar. 2021 was a break-out year for these products; an EV ARC sells for around $65,000, and in 2021, they sold 119 of them, having manufactured 124. That is an increase from 69 systems sold in 2020 (a 72% increase). Source Earnings call

Problem 1. BEEM’s revenues have stagnated. Solved.

They are moving into 2022 with a company record backlog of orders, whereas they ended 2020 without any backlog. Sales were up 131%, accounting for the backlog. Source Earnings call

Problem 2. BEEM’s backlog has shrunk. Solved.

A BEEM EV ARC in situ (Beam Global Website)

The EV ARC has several features that stand out from the competition. It fits in the size of a standard parking bay and does not need to be grid-connected. It is the only 100% renewable energy, transportable, off-grid EV charging option available. Deployment of the EV ARC offers it a significant competitive advantage. It is held in place by gravity resulting in No permitting, No construction, No electrical work, and No utility bill.

They can be deployed immediately. On the website, Beam claims their record is 4 Minutes! It takes the competition months. It is worth looking at the website to get a more in-depth view of these products.

The unit is movable. An EV ARC can be relocated, allowing the customer to follow EV charging needs.

BEEM Sales

BEEM continue to invest in, and receive results from, their government relations department. BEEM has a GSA contract (known as a Federal Supply Schedule), a long-term government contract allowing government agencies and bodies to buy easily. This contract had some significant upside in 2021; BEEM received its largest single order of 52 systems to California’s department of general services and 21 systems to the US Marine Corps. In total, BEEM received orders from 20 US states through the GSA. In the most recent earnings call, Desmond Wheatley, President, and CEO gave a very upbeat view of the GSA, saying (P6 para 3) that the orders received in 2021 would seem insignificant as the contract spins up for the remainder of 2022.

Problem 4. BEEM’s municipal customers are facing budget headwinds. Solved.

Interestingly, Utility companies are becoming BEEM customers where you might have expected them to be competitors. The EV ARK allows utility companies to quickly and easily add resilient EV charging. The EV ark will work during brownout and blackout events providing EV charging and emergency electricity supplies.

Another surprising customer set is the EV Charging networks. In 2021, BEEM supplied units to Chargepoint, Blink, Electrify America, and ENEL. They will deliver to any EV charging network as they do not offer a network of their own. BEEM sells the product, not the project.

BEEM currently has a $90 million pipeline, and it is growing fast. They have reported that initial orders are getting bigger, and the time between inquiry and order is getting smaller.

Problem 5. BEEM’s Key product, the EV ARC, is far behind on-grid systems and is more expensive. Not actually a problem if Utility companies and charging companies are buying the product then its reduced performance relative to a grid system is not an issue.

BEEM Manufacturing Excellence.

Factory investment during 2021 has increased the potential output. They now have six final assembly workstations (this had been a bottleneck previously). Each workstation can produce one EV ARC per shift. That means on the current five-day single shift week, they have the capacity for 1,350 ARC EV units per year (Enough capacity for a tenfold increase in sales). I think it is pretty likely they will be running multiple shifts within 18 months.

BEEM has increased factory headcount, improved tooling, and equipment, invested in extra training for its staff, increased the technical requirements for new team members and added manufacturing leadership.

This has increased the pay per hour their staff receives and hence total costs, but the margin improvements are dramatic. They absorbed increased costs and maintained margin while increasing production levels. In 2021, COGS increased by 10%, all absorbed (not passed to customers) without impact on margin, which is excellent. Direct labor cost per EV ARK is down 36% in two years. They have said that they will be passing on some costs in 2022.

Cost control, usually the weak point of these small growing tech companies, is going exceptionally well. Costs are increasing at a slower rate than revenue. Revenue increased by 45%, total operating expenses increased by 24%, and COGS by 45% after absorbing a 10% increase from suppliers.

Problem 3. BEEM’s products are not profitable. Solved.

Acquisitive In A Good Way

Batteries are the single largest cost to BEEM; battery costs make up 10% of COGS. Batteries are getting harder to source, and prices are rising. BEEM solved this problem by bringing battery production in-house. BEEM acquired the battery and energy storage company AllCell Technologies (Chicago). BEEM believe they have saved 7% on the cost of a battery, and with the two companies working together are looking at a 15% saving in the future.

The AllCell deal was all stock, and the company came with no debt. So no cash was needed or raised. Acquiring a related business that will reduce overall costs without diluting shareholders is a sign of disciplined management.

The AllCell takeover, apart from delivering batteries to their EV ARC products, brings with some other opportunities. AllCell has a raft of patent-protected energy storage and battery technology that will add further competitive advantage to BEEM while increasing their salable products.

BEEM Financials

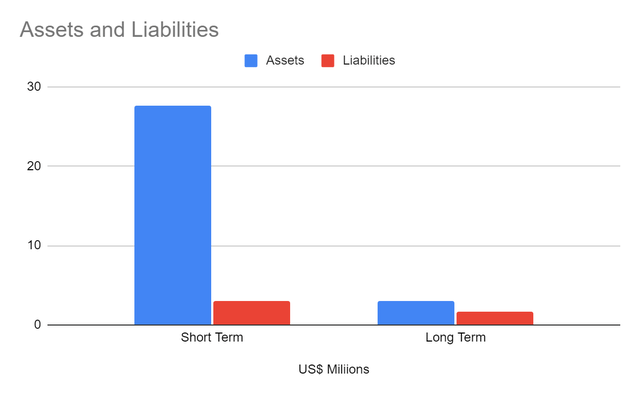

BEEM has a strong financial position, BEEM is debt-free, and it has $21.9 million in cash and short-term investments, giving it a 3-year cash runway. Its balance sheet is solid:

BEEM Assets and Liabilities (Seeking Alpha, BEEM Financials)

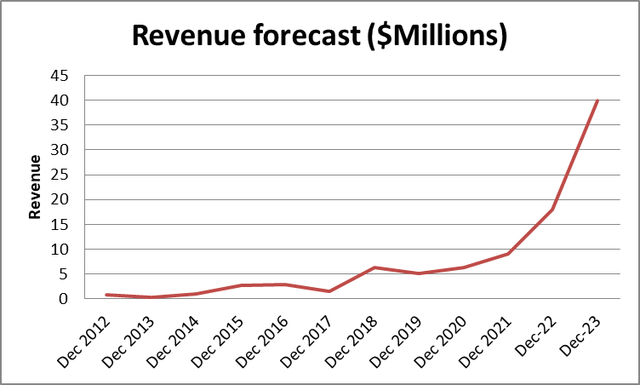

Revenue has been increasing steadily, and using the information given at the last earnings call, I am predicting sales of $18 million in 2022 and $40 million in 2023. These forecast figures are about 1 year ahead of the forecasts from Wallstreet and would have BEEM become profitable in 2022 rather than 2023 as Wallstreet is suggesting.

BEEM past and forecast revenue (Author forecast (data Seeking Alpha))

Conclusion

It is my belief that BEEM had a transformational 2021, it has increased its revenue, improved its manufacturing operation, secured a supply of its mission-critical Battery technology, improved its margins, and built a significant demand for its products with a wide array of customers.

BEEM has a management team focused on making a profit from its products. They are investing in their staff and facilities. They have excellent sales to government and commercials, and they are operating in a market that looks set for exponential growth.

They are small, and with that comes additional risk, but they have a solid balance sheet and a great product.

I am a buyer and expect to double my money in the next 12 months.

Be the first to comment