BalkansCat/iStock Editorial via Getty Images

All values are in CAD unless noted otherwise.

BCE Inc. (NYSE:BCE), formerly known as Bell Canada Enterprises Inc, is one of the three leading telecommunications companies in Canada. The other two being Rogers Communications Inc. (RCI) and TELUS Corporation (TU). We have written about the latter quite a few times. This will be our first foray into the world of BCE.

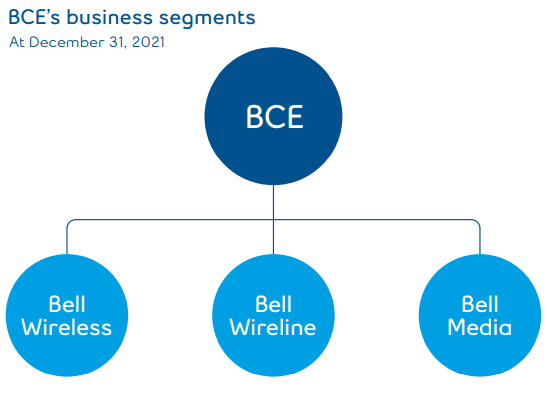

BCE provides wireless, wireline, internet and television products and services to residential, business and wholesale customers across the country. Its Media arm provides conventional TV, specialty TV, pay TV, streaming services, digital media services, radio broadcasting services and advertising services. All of its products and services are reported under three segments.

BCE Inc. MD&A

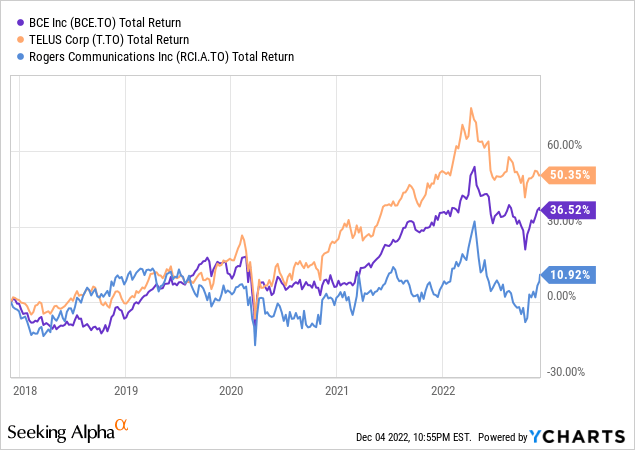

While the wireless and media businesses are provided nationally, wireline is primarily in Ontario, Quebec, the Atlantic provinces and Manitoba. The work from home culture has worked in the sectors favor and while it has been a rollercoaster, BCE has provided positive returns to its investors over the last few years.

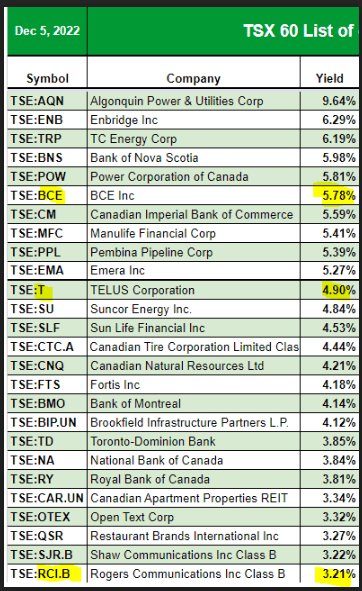

Of the trio, BCE leads in terms of dividend yield.

Dividend Strategy.ca

We will look at whether that generous yield is sustainable and enough of a reason to love the stock. But first, a quick review of the recent results.

Q3-2022

Q3-2022 results were generally a bit below consensus from the standpoint of EBITDA which came in at $2.588 billion. This was a modest 1.2% increase over 2021. The weakness was in the ARPU number which came in at $60.76 with analysts looking for north of $61.00. That said, Postpaid additions were over 168,000 and that was extremely impressive. Our take is that BCE’s wireless segment is showing effects of a strong economy but bottom-line impacts were moderated due to competitive pressures.

The media side looked weak and this was despite low expectations following a tough ad market. The $182 million in adjusted EBITDA was a whopping 15% drop from last year. Through all of this, the bottom-line number of earnings, at 88 cents did beat all estimates across the board but that was primarily due to a reversal of a $80 million tax provision. Absent this, the earnings would have undershot by about 5 cents per share.

Valuation & Outlook

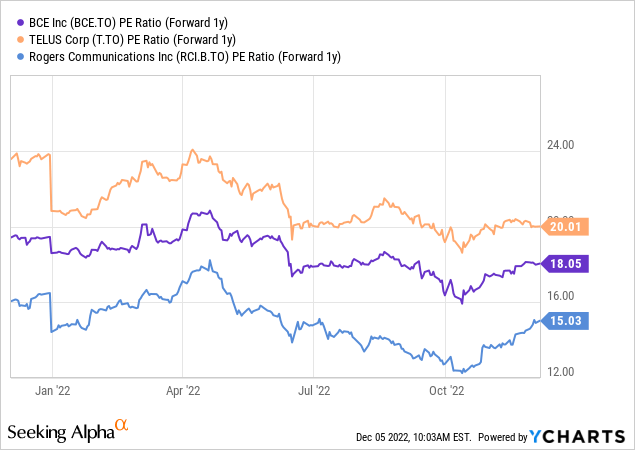

BCE’s recession resistant business works fine through most economic environments and investors tend to pay a hefty multiple for it. Even after the drop from the 52-week highs, the stock can hardly be considered cheap at 19X this year’s earnings. Based on next year’s estimates we are looking at an 18X number, which is in the middle of the pack compared to the other two sector behemoths.

Of course, those earnings estimates are likely to prove optimistic in a recession. The company also trades at 9.3X EV to EBITDA and as we recently discussed, all three Canadian telecoms are very expensive relative to AT&T Inc. (T) and Verizon Communications Inc. (VZ).

So, by no conventional measure is BCE cheap. What is likely to be a big attraction here is the giant dividend yield. 5.78% from a recession resistant business does get the salivary glands going. Interestingly though, the 5.78% yield is not spectacularly higher than the 5-year Government of Canada bond yield. In other words, if you take into account risk free rates, the stock does not look very special. Outside of the COVID-19 breakdown in the stock, generally good entries have come when you could buy BCE at 3.5% spread to the 5-year Government of Canada bond yields. That of course would suggest a lower price point (7% yield) and one we think we will get.

On that same subject, one has to ask whether that dividend yield is sustainable. BCE’s dividend payout ratio is likely to be close to 110% this year and the next. It was also comfortably above the 110%-mark last year. What gives? BCE has taken the longer-term view of earnings and decided to keep raising the dividend through relatively low earnings. While that could get alarming, we are not worried. The key rationale from us is that BCE’s net debt to EBITDA is hovering near 3.0X and it can overpay on a shorter-term basis. To this logic, we will add that the capex cycle looks to be peaking and BCE should be able to cover the dividend fully from free cash flow next year, even if the EPS number will still show overpayment.

Verdict

The dividend remains the main attraction here and if you take a 10-year outlook, even with zero dividend increases, you are likely to get solid returns. This is even if you account for just 4% earnings growth annually. The big risk to the double-digit return thesis is a marked valuation compression. We would not rule this out. If you envision an earnings multiple of AT&T or an EV to EBITDA multiple of VZ at the end of your 10-year cycle, you can see the horrors of this forecast. This is a major danger with the stock trading at a very lofty valuation relative to risk free rates. At present, we rate it at a hold and would get interested if we saw something close to a 7% dividend yield. We will add here that we like it the most out of the three Canadian telecom players, but we still won’t buy the common shares.

Investors looking for a safe yield from BCE with lower risk, can consider the preferred shares trading on the TSX. These are quality preferred shares and we think the credit ratings actually understate their creditworthiness.

BCE

BCE is also buying back these under par and that likely puts a floor a little below where they trade today.

On November 2, 2022, BCE’s Board of Directors authorized the company to renew its NCIB to purchase for cancellation up to 10% of the public float of each series of BCE’s outstanding First Preferred Shares (Preferred Shares) that are listed on the Toronto Stock Exchange (TSX). The NCIB will extend from November 9, 2022 to November 8, 2023, or an earlier date should BCE complete its purchases under the NCIB. The actual number of Preferred Shares to be repurchased under the NCIB and the timing of such repurchases will be at BCE’s discretion and shall be subject to the limitations set out by the TSX. BCE is making this NCIB because it believes that, from time to time, the Preferred Shares may trade in price ranges that do not fully reflect their value.

Source: BCE Q3-2022 Financial Report

We are on the lookout for opportunities in this space.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment