Sergio Delle Vedove/iStock Editorial via Getty Images

Introduction

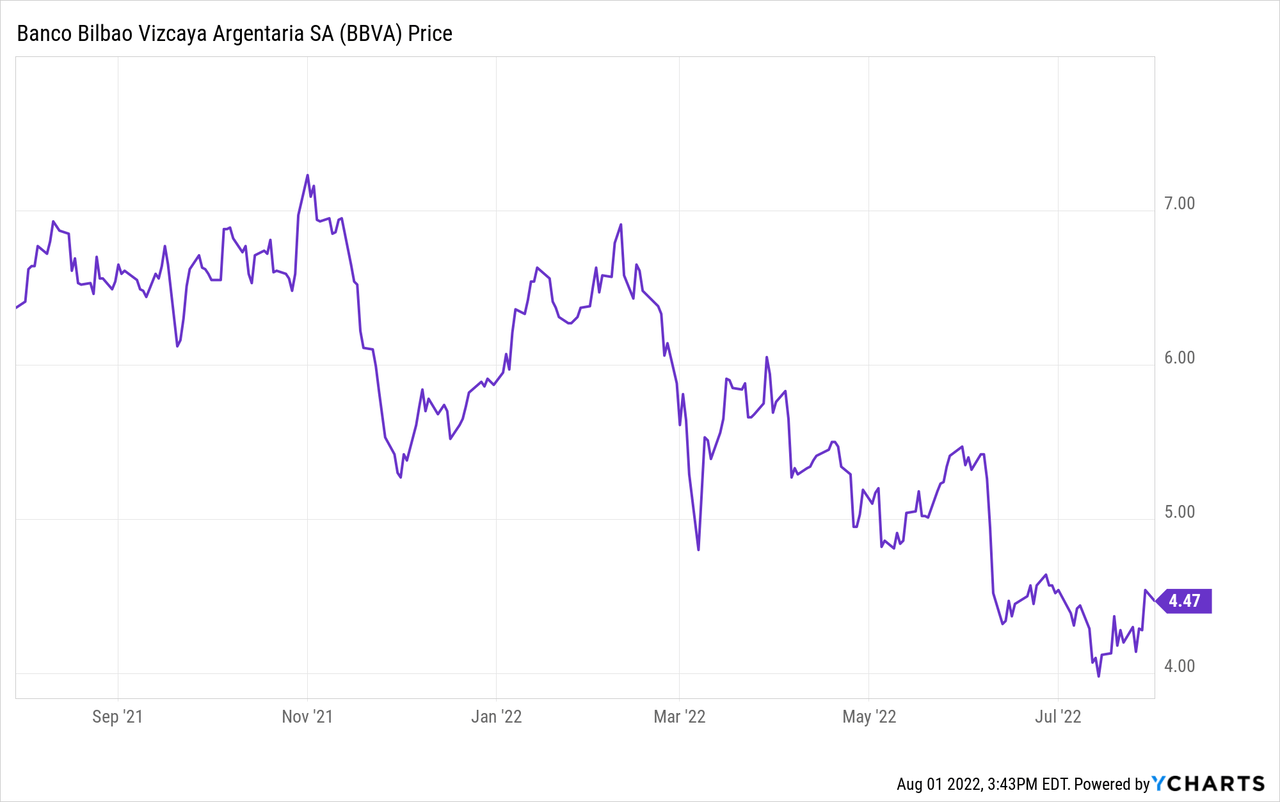

I am keeping my eye on BBVA (NYSE:BBVA) as I see this bank as an excellent vehicle to gain some exposure to for instance Mexico and other developing nations like Peru, Colombia and Argentina. Turkey could also be an interesting growth market for BBVA but the hyperinflation there is making things a bit tougher than I would like. That being said, the very weak Turkish Lira provided an excellent set-up for BBVA to make an all-cash offer for the shares in Garanti Bank it didn’t own yet.

The current weak share price is mainly caused by the proposals for a new bank tax in Spain. The details were recently unveiled and I will discuss those in this article. Although BBVA’s US listing is pretty liquid, I will refer to the main listing in Madrid as BBVA also reports its earnings in Euro.

Despite the hyperinflation in Turkey, BBVA is navigating through the muddy waters

The main focus of this article is on the capital ratios and the impact of the new bank tax so I will not discuss every jurisdiction BBVA is active in detail here.

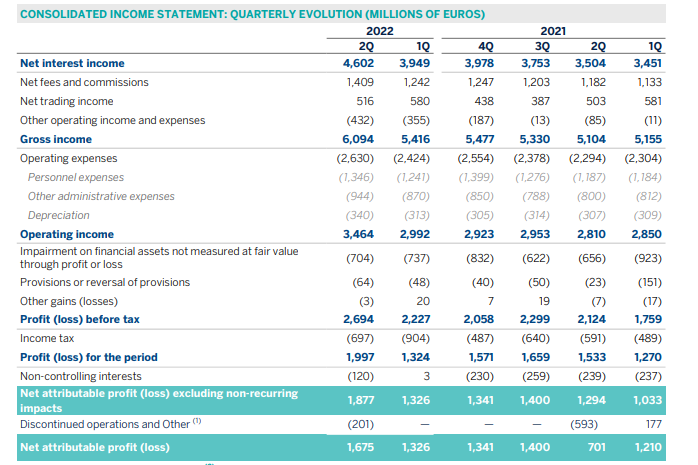

During the second quarter, the bank saw its net interest income increase by more than 15% to 4.6B EUR while the net fees and commission income increased as well. This pushed the gross income up by in excess of 10% on a QoQ basis to almost 6.1B EUR and despite some slightly higher operating expenses, the operating income increased by in excess of 15% to 3.46B EUR. This resulted in a pre-tax income of 2.7B EUR and a net income of 2B EUR of which 120M EUR was attributable to minority interests and an additional 201M EUR was generated by ‘other’ expenses, related to the purchase of offices in Spain.

BBVA Investor Relations

This means the net income attributable to the shareholders of BBVA was 0.25 EUR per share and excluding the impact of the purchase of the offices, the EPS was 0.28 EUR per share, making it one of the best quarters in the past few years. And this quarter includes approximately 704M EUR in loan loss provisions, which is pretty stable and consistent with the previous quarters.

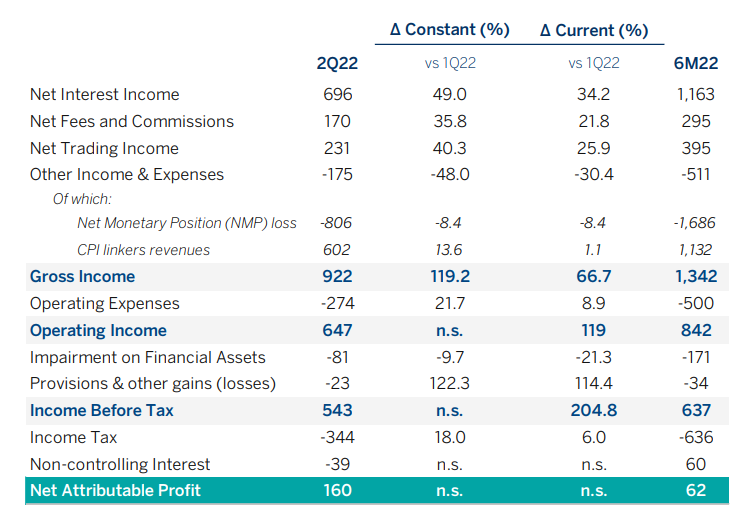

This pretty strong result was obtained despite the headwinds in Turkey where the hyper-inflationary environment is definitely leaving its marks. Notwithstanding this very difficult business environment, BBVA’s Turkish subsidiary reported a net attributable profit of 160M EUR despite an average tax rate of in excess of 60% on the pre-tax income (as some of the provisions and losses were not deductible).

BBVA Investor Relations

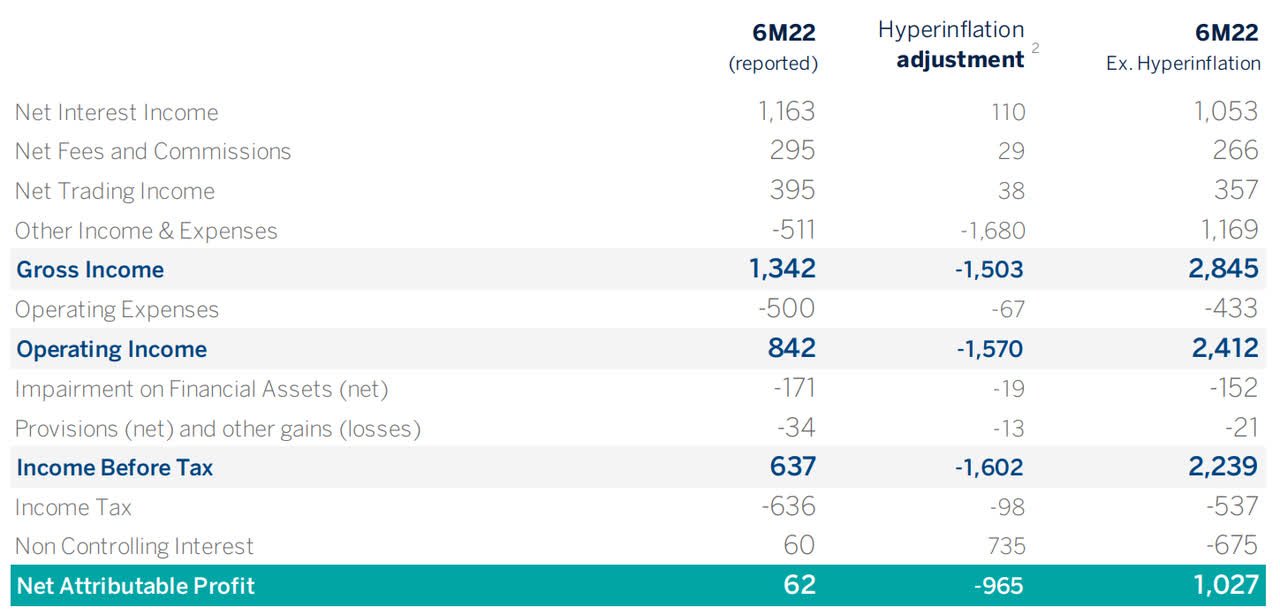

But just to show how important the inflation was for the results of the Turkish division, excluding the adjustments, the net income in the first semester would have been sixteen times higher.

BBVA Investor Relations

The TBV is increasing, the CET1 ratio remains acceptable, so why is the market not impressed?

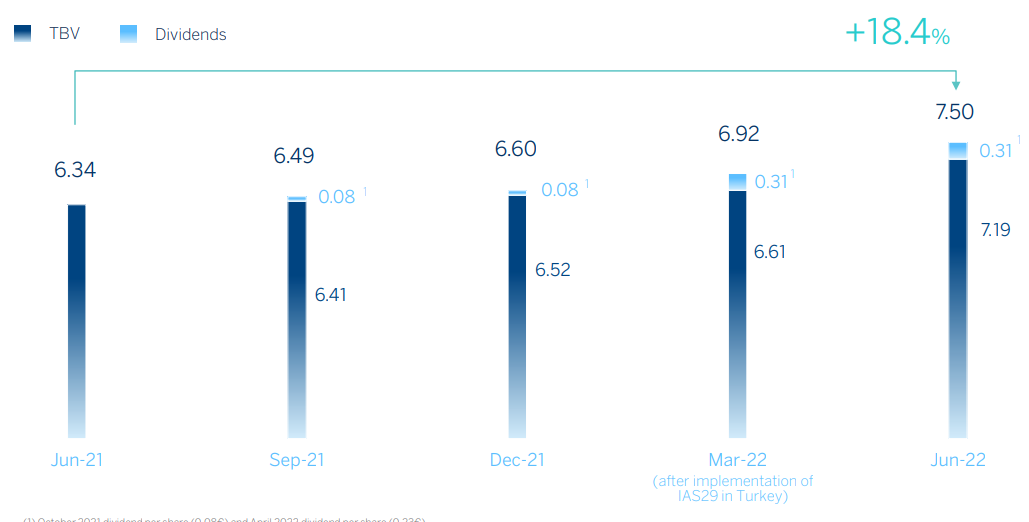

BBVA has been flying under the radar a little bit despite the strong tangible book value evolution as well as the capital ratios. In the past twelve months, the TBV has increased in excess of 10% to 7.19 EUR per share as of the end of June, despite paying 0.31 EUR in dividends. So the total value creation in the past twelve months was just under 1.20 EUR per share of which the majority was retained on the balance sheet.

BBVA Investor Relations

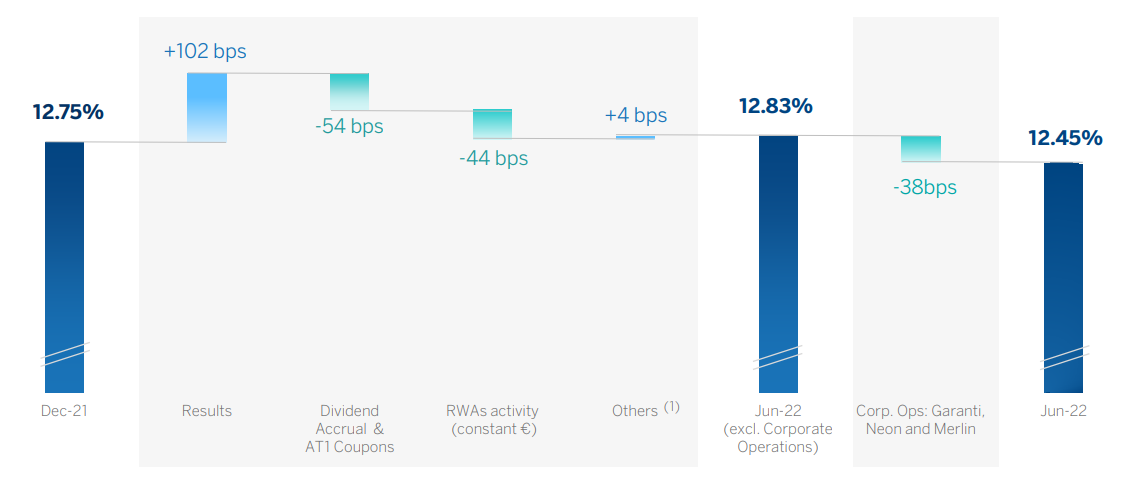

The retained cash helped BBVA to bankroll the acquisition of the Turkish Garanti bank while keeping its capital ratios strong. After all, the bank knew this year would be a tough one for the capital ratios as the Turkish acquisition and the purchase of an office portfolio from Merlin Properties caused a 30 bps hit to the CET1 ratio. The combination of corporate events and RWA activity had a negative impact of about 82bps on the CET1 ratio which would otherwise have come in at in excess of 13%.

BBVA Investor Relations

In the final quarter of this year, BBVA expects another regulations-related hit of 35bps but this should be fully compensated by the impact of the retained earnings and I think we can even expect the CET1 ratio to increase to above 12.5% by the end of this year. The Q3 results will indicate whether or not this is feasible.

The details of a new bank tax were unveiled in the Spanish parliament last week and they are essentially calling for a 4.8% temporary tax on Spanish banks. Interestingly, the tax will not be levied on the pre-tax income of a bank, but on the net interest and fees ‘charged to the client’. So on the income before even taking the operating expenses into account which makes this sound like a revenue-based tax from what I gather. The subject was touched upon during the Q2 conference call and BBVA’s CEO expects a 250M EUR annual hit from this tax. That’s actually still pretty manageable as this would reduce the earnings per share by just 4 eurocents (and thus about 5 percent of the full-year earnings but it is understandable the bank is protesting as there’s no guarantee the tax will ever disappear).

Investment thesis

While a Spanish bank reminds people of the 2008 Global Financial Crisis and the Spanish sovereign debt crisis of a decade ago, I do think the banking sector has changed in the right direction. Also keep in mind BBVA offers exposure to developing countries as well so it is not a ‘pure’ Spanish bank. And for all the issues coming along with developing a banking system in developing nations, BBVA is doing a good job. The Turkish and Argentinean situation aren’t easy for BBVA but the bank is still profitable (in EUR-reported results) in both geographical areas.

It’s perhaps too early to think about the dividend but considering we are on track for an EPS in the 80-90 cents range (this will also depend on when the new bank tax will get executed) and considering BBVA is guiding for a 40-50% payout ratio, we will likely see a dividend in the 0.32-0.45 EUR per share range. As last year’s dividend was 31 cents per share, I think we will likely see a small increase notwithstanding the headwinds. The lower end of my expectations would indicate a 7.3% dividend yield (subject to the 19% Spanish withholding tax) and that’s quite attractive given the 40% payout ratio I used.

Be the first to comment