megaflopp/iStock via Getty Images

Introduction

Bausch + Lomb (NYSE:BLCO)(TSX:BLCO:CA) is one of the oldest operating companies in the US, having been founded in 1853 as a small optical goods store in New York. In the early years, the company produced rubber eyeglass frames and a variety of optical products that required a high degree of manufacturing precision. The company made lenses for cameras that captured the first satellite image of the moon, and during World War II, Bausch + Lomb made sunglasses for the United States military. It later sold its popular Ray Ban segment to the Luxottica Group in 1999.

Currently, the company manufactures and distributes contact lenses, eye drops and ophthalmic medicines and has a portfolio of more than 400 products sold in nearly 100 countries.

Soft lenses and eye drops are a consumable products, consumables deliver a stable revenue stream. The company offers a variety of lenses that provide a competitive advantage for every type of consumer.

Consumers are quite clingy in the choice of lenses and eye drops. If a type of lens fits just fine, we stay true to it. We tend to buy it until the product no longer meets our expectations. I wear lenses myself and because I spend a significant amount of time in front of a screen, I prefer lenses with a low water content. It’s a personal choice of course.

The long-term outlook looks bright due to the strong catalysts, but the short-term outlook is mixed due to the IPO lock-up date.

I would wait to see what September brings and gradually load-up shares in the months thereafter. The stock is then a strong buy with a price target of $26.

Business Overview

Bausch + Lomb operates globally as an eye health company. They offer eye care products such as contact lenses and ocular health products. In addition to their eye care products, the company also sells surgical products. Bausch + Lomb develops, manufactures and distributes surgical vision enhancement systems.

Sales are divided into the Vision Care segment (63%), the Surgery segment (20%) and the Ophthalmology segment (17%).

The Company Offers A Variety Of Lenses That Provide A Competitive Advantage

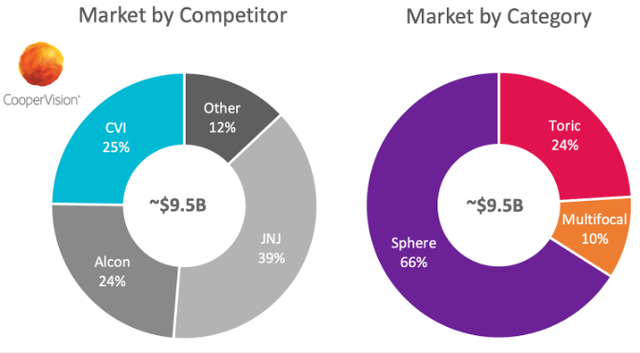

Bausch + Lomb is still a small player in the lens market. Johnson & Johnson (JNJ) controls most of the market with Acuvue. This is an advantage for Bausch + Lomb as it offers the opportunity to differentiate itself within the market to gain market share.

Soft Lenses Market Share Overview (2Q22 Investor Presentation, Cooper Vision)

Office workers usually prefer lenses with a low water content. These absorb less eye fluid, so that the eye remains sufficiently wet when concentrated. Most consumers prefer lenses with a medium water content (about 50%). Other consumers prefer lenses with a high water content. It is a personal choice.

Bausch + Lomb offers a range of high-quality lenses, which are lenses with a high oxygen permeability for long-term wearing comfort. These lenses allow a lot of oxygen through, so that the eyes are less tired in the evening, these lenses are often made of silicon hydrogen.

High Quality Lenses

Bausch + Lomb offers the following high-quality lenses:

|

Name |

Type |

Introduction year |

Water content |

Oxygen permeability [dK/t] |

|

ULTRA ONE Day (Infuse) |

Daily disposable lenses |

2020 |

55% |

134 |

|

Biotrue ONEday |

Daily disposable lenses |

2014 |

78% |

42 |

|

Purevision 2 |

Monthly lenses |

2011 |

33% |

138 |

|

ULTRA |

Monthly lenses |

2014 |

46% |

163 |

Bausch + Lomb has a competitive advantage over the following contact lenses:

- ULTRA One Day (Infuse) daily disposable contact lenses

- Most advanced specifications for the average consumer available on the market.

- Most expensive lenses on the market. About 50% more expensive than close competitors CooperVision Clariti 1 Day, and J&J Acuvue Trueye 1 Day.

- Bausch + Lomb Biotrue ONEday daily disposable contact lenses

- The first contact lens ever produced with the same amount of water as the human eye.

- In contract to competitors, this lens has a high oxygen permeability.

- Price is only slightly more expensive than close competitor Dailies AquaComfort Plus.

The other two contact lenses that Bausch + Lomb offers are less competitive. Purevision 2 monthly lenses compete with Alcon’s (ALC) more popular Air Optix Plus Hydroglyde and Air Optix Aqua. The price is comparable to Air Optix Aqua, so it’s more of a personal choice here. ULTRA monthly lenses compete with CooperVision’s (COO) more popular Biofinity (and Biofinity Energys). But ULTRA is 50% more expensive than Biofinity and about 15% more expensive than Biofinity Energys. In general, monthly contact lenses are much cheaper than daily contact lenses. The 50% price increase relates to an increase of only €5/month here in the Netherlands (about $5 in the US). It is a personal choice to choose ULTRA or Biofinity (or Energys). Strong growth or at least stability in sales is expected in lenses with a competitive advantage.

Budget Contact Lenses

Budget contact lenses have a low oxygen permeability, contact lens wearers are more likely to get tired eyes, especially in the evenings. Bausch + Lomb offers the following lenses:

|

Name |

Type |

Introduction year |

Water content |

Oxygen permeability [dK/t] |

|

SofLens Daily Disposable |

Daily disposable lenses |

2008 |

59% |

22 |

|

SofLens 38 |

Monthly Lenses |

1993 |

38% |

27 |

|

SofLens 59 |

Monthly Lenses |

2018 |

59% |

22 |

SofLens 38 is the only affordable monthly lenses available with a low water content. Bausch + Lomb has a competitive advantage on all affordable lenses in this category because these lenses are the most affordable lenses on the market.

To Summarize

I expect continued growth for ULTRA ONE DAY (also called Infuse) because these contact lenses have the most advanced specifications and are suitable for the high-end consumer. The Biotrue ONEday (daily disposable lenses) are suitable for the average consumer who fits lenses with a high-water content well. Because the price is attractive compared to the lenses of competitors, I expect continued growth in this market.

I expect at least stability or growth in the budget market, especially during an economic recession. Bausch + Lomb offers the most affordable budget lenses available on the market, which should be favorable during tough times.

However, these assumptions simplify the choice of the many types of lenses on the market. Each lens is unique: the thickness, wetting agents, UV resistance and the like all contribute to wearing and viewing comfort. Some lenses are 50% more expensive than others, while the water content and oxygen permeability are almost the same. Is it worth paying 50% more for lenses that include a wetting agent, UV resistance filter, or a different thickness? That ultimately determines the consumer.

It is therefore difficult to make a good comparison. Choosing lenses remains a personal choice, but I hope this has given you rough guidelines as to how Bausch + Lomb stands in the market in my view.

What I find interesting about Bausch + Lomb is that the company dominates the entire budget market. US GDP has fallen, a recession is looming and consumers can save on their contact lenses and opt for Bausch’s. In addition to dominating the budget market, Bausch + Lomb innovate strongly by offering new top-quality lenses that are way ahead of their competitors. In addition to the sale of contact lenses, Bausch + Lomb monthly lenses are cleaned with contact lens solution, which gives an extra boost to sales. Bausch + Lomb clearly offers products with a competitive advantage and I expect them to continue to grow in sales year on year.

Now we know roughly how Bausch + Lomb stands in the market compared to competitors, but is that also reflected in the revenue?

Vision Care And Surgery Segment Grows Strong In Q2 22

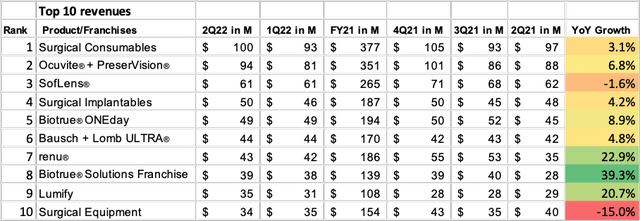

In the table below, I’ve written the top 10 product revenues and their year-over-year growth. From the contact lenses sales segment, the most affordable SofLens series lenses generate the most revenue, but they are losing popularity as revenues fell 2% year-over-year. In second place is Biotrue ONEday, with sales growing 9% year-over-year. Third comes ULTRA lenses and sales grew 5% yoy. These are the lenses that have the competitive advantage.

Top 10 Revenues, Bausch + Lomb (2Q22 Results And Author’s Own Calculations)

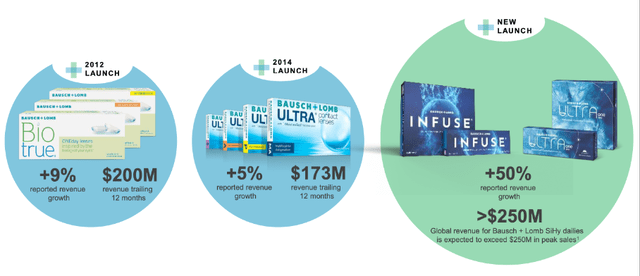

The sales of ULTRA lenses consist of ULTRA monthly lenses (launch 2014) and ULTRA one-day lenses (new launch). The new ULTRA one day lenses reported strong sales growth and Bausch + Lomb expects peak sales to exceed $250 million. The new ULTRA disposable contact lenses are made of SiHy materials. And according to Bausch + Lomb, the global SiHy market is growing at a CAGR of ~11%. The lenses are clearly in a growing market for the coming years.

Soft Contact Lenses Highlights (2Q22 Investor Presentation)

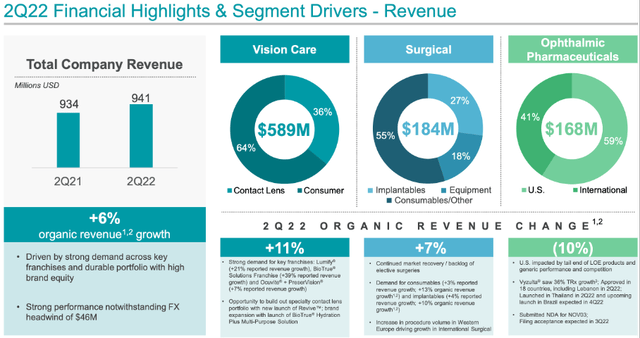

The organic consolidated sales growth of 6% was primarily driven by strong growth in Vision Care and strong growth in the Surgical segment.

Sales growth in the Ophthalmology segment decreased year on year. Mainly caused by loss of exclusivity products and generic performance and competition.

Financial Highlights and Segment Drivers (2Q22 BLCO Investor Presentation)

Upcoming Catalysts And Forward View

Fortune Business Insights expects the lenses market to grow at an annual rate of 6% from 2022 to 2029. Bausch + Lomb operates in a growing market. I quoted a news item from Seeking Alpha:

B+L has advantages from name recognition and limited competition in many areas it operates. Miehm mentioned that the company will benefit from tailwinds including an aging population, increasing time in front of screens, rise in diabetes worldwide, and higher rates of myopia, dry eye and age-related macular degeneration.

To ensure growth for years to come, Bausch + Lomb has strong catalysts:

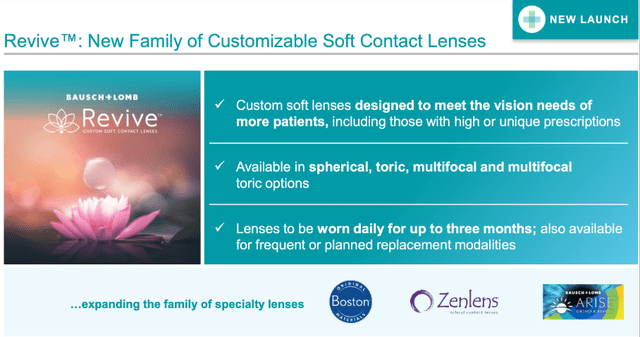

- Introducing Revive, the customizable soft contact lenses.

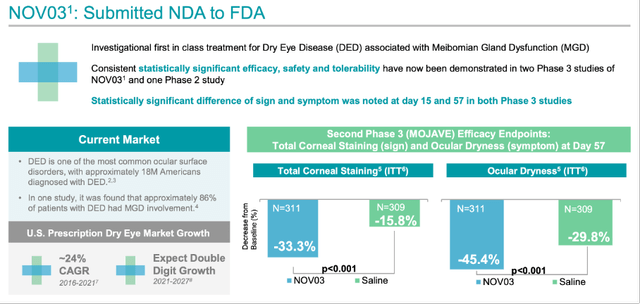

- Dry eye treatment introduction (NOV03): NDA submitted to FDA.

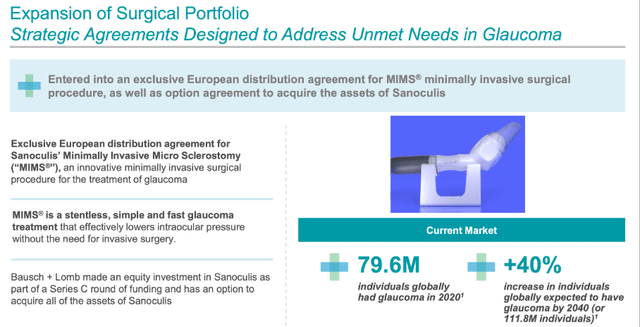

- Expansion of the surgical portfolio.

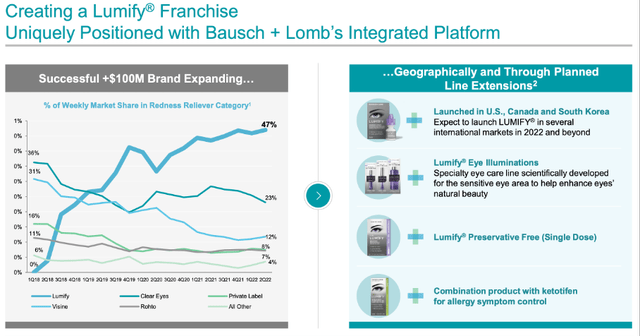

- Bausch + Lomb strong marketing capabilities characterized by Lumify increased market share.

1) Bausch + Lomb is expanding its current product portfolio with Revive. These are customizable soft contact lenses for a broad range of patients. The adjustable parameters are the lens diameter, base curve and power for optimal fit.

Revive customizable soft contact lenses (2Q22 Investor Presentation)

Revive will help meet a wider range of patient needs. Patients who will benefit from Revive will most likely be patients with a unique prescription or physical feature such as unusual pupil size.

CooperVision’s BYO AB and BYO Premium are competitors of Revive. The closest competitor is BYO AB because the oxygen permeability matches that of Revive. The water content of Revive lenses (49%) is lower than that of BYO AB (58%), so for the customer it is a personal choice here. I don’t know if Revive lenses are more affordable than BYO AB, so Bausch + Lomb’s competitive advantage is still unknown. Revive adds another opportunity to a niche market.

2) Introduction of treatment for dry eye (NOV03). A picture paints a thousand words:

NOV03 (2Q22 Investor Presentation)

Quoted from the presentation:

“Dry eye disease is one of the most common ocular surface disorders, with approximately 18M Americans diagnosed with DED.”

While Bausch + Health expects double-digit growth, Fortune Business Insights expects the dry eye market to grow at a CAGR of 5% to $6.54 billion by 2027. Nevertheless, the dry eye market is a large and growing market and Bausch + Lomb is well positioned to generate revenue from it.

3) Expansion of the surgical portfolio. Since nearly 80 million individuals worldwide had glaucoma in 2020, there is a large market for Bausch to penetrate.

Expansion Of The Surgical Portfolio (2Q22 Investor Presentation)

In glaucoma, the optic nerve is damaged, causing the visual field to gradually disappear. In most cases, the eye pressure is too high, but the eye pressure can also be normal. Usually the eye pressure is lowered by means of eye drops.

If the eye pressure doesn’t get lower, laser treatment or surgery is performed. Only patients with advanced or difficult-to-treat glaucoma undergo surgery. Bausch + Health is clearly well positioned in a large market, but it is unclear how many patients are using this simple and fast glaucoma treatment.

4) Bausch + Lomb has targeted TikTok users to “dance with their eyes” as a marketing stunt that has racked up nearly 14 million views to date. Users could win a makeover with Vincent Oquendo, Lumify increased its market share to 47%.

Market Share Growth Of The Lumify Franchise (2Q22 Investor Relations)

This is a perfect example of a good marketing stunt. Management has done a great job in launching this well-targeted marketing campaign to increase market share. Possibly more marketing stunts will follow because this was a great success.

Valuation

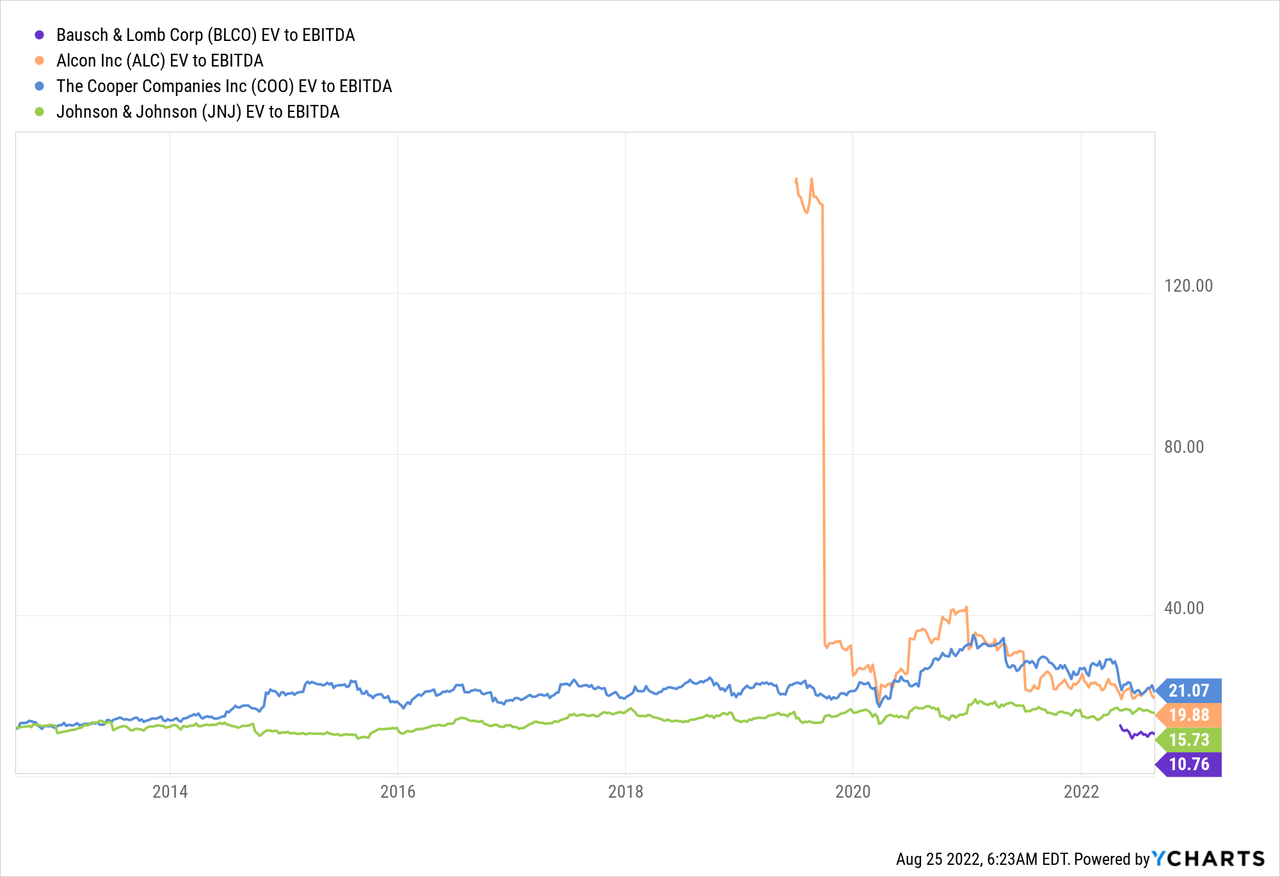

The current valuation is compared with that of competitors. The Enterprise Value/EBITDA was chosen to determine the relative valuation. This ratio takes into account cash and debt to reflect a fair and relative valuation. Bausch + Lomb’s competitors include Johnson & Johnson, Alcon and CooperVision.

Johnson & Johnson is a conglomerate made up of divisions that go beyond eye care. Because J&J has a large market share in eye health, I include J&J in the EV/EBITDA chart.

|

Company |

EV/EBITDA |

10-yr average EV/EBITDA |

|

Bausch + Lomb |

10.5 |

10.8 |

|

J&J |

15.9 |

13.7 |

|

Alcon |

19.5 |

26.5 |

|

The Cooper Companies |

21.3 |

21.0 |

Source: Author’s Own Calculations.

Compared to competitors, Bausch + Lomb is severely undervalued. Direct competitors such as Alcon and The Cooper Companies trade at twice the EV/EBITDA ratio. And J&J’s EV/EBITDA is approximately 50% higher than B+L’s. With an EV/EBITDA of 16, Bausch + Lomb should be trading at a stock price of $26 (representing 64% upside potential)

Risks

Bausch + Lomb recently went public and has been partially spun off from Bausch Health. As a result, there are quite a few risks regarding the Bausch + Lomb stock price trend. As SA contributor Mike Zaccardi wrote, Bausch + Lomb will soon be completely spun off from Bausch Health. Nearly 90% of the shares are still owned by Bausch Health.

Their Aug. 9 SEC filing (quarterly report) states the following:

… (including the Company’s expectation that the spinoff will be completed following the expiry of customary lock-ups related to the B+L IPO and achievement of targeted debt leverage ratios, subject to receipt of applicable shareholder and other necessary approvals)…

The IPO lock-up expiration date has been set at September 7. After that period, early investors can sell their shares bought during the Bausch + Lomb IPO. Bausch Health plans to sell shares of Bausch + Lomb to reduce their massive debt burden.

The price of Bausch + Lomb is expected to fall as Bausch Health aggressively sells shares. But for Bausch Health, it’s in their best interest to sell the stock at a high price. The shares are sold gradually, which means that the downward pressure on the share price will be less. The following affects the period in which the shares are sold (Q2 22 report):

… the market or other conditions are no longer favorable to completing the spinoff … Norwich Legal Decision may affect the timing of, or our ability to complete the B+L Separation …

Norwich is trying to submit a generic version of Bausch Health’ Xifaxan. A recent article on SA showed that Bausch Health was not winning on polymorphs and IBS-related claims that would allow Norwich to launch the generic version of Xifaxan. This is very bad news for Bausch Health as they would lose a large revenue stream in the midst of their debt crisis. The decision also affects the time frame to complete Bausch Health’s Bausch + Lomb IPO separation.

The recent Bausch Health article showed that the company is making progress toward separating Bausch + Lomb. Bausch Health has transferred 38.6% of Bausch + Lomb common stock to an existing wholly owned subsidiary of the company without restrictions. A total of 50.1% of Bausch + Lomb shares were still owned by the limited subsidiary; the company could therefore still consolidate Bausch + Lomb profits on their balance sheet. The transfer will further enable the company to sell their Bausch + Lomb shares.

To summarize, there may be more volatility in Bausch + Lomb shares after the IPO lock-up expires on Sept. 7. Bausch + Lomb has a positive long-term outlook, but short-term headwinds. The stock is a strong buy after the lock-up date.

Conclusion

Bausch + Lomb manufactures and distributes contact lenses, eye drops and ophthalmic medicines and has a portfolio of more than 400 products sold in nearly 100 countries. Soft lenses and eye drops are a consumable product, consumables deliver a stable revenue stream. Many of Bausch’ soft lenses have a competitive advantage over competitors. Some are of the highest quality and others are designed for consumers on a budget. Consolidated sales are split into the Vision Care segment (63%), the Surgical segment (20%) and the Ophthalmology segment (17%). The organic consolidated sales growth of 6% was primarily driven by strong growth in Vision Care and strong growth in the Surgical segment.

The long-term outlook looks bright but there are short-term headwinds.

Strong catalysts:

- Introducing Revive, the customizable soft contact lenses.

- Dry eye treatment introduction (NOV03): NDA submitted to FDA.

- Expansion of the surgical portfolio.

- Bausch + Lomb strong marketing capabilities characterized by Lumify increased market share.

Risks:

- Expiry date IPO lock-up (September 7). Bausch Health will gradually sell shares of Bausch + Lomb as the company seeks to reduce its debt.

The stock valuation is favorable as the EV/EBITDA ratio is half that of closest competitors. Bausch Health will not sell BLCO shares at an undervalued price. I would wait to see what September brings and gradually load up shares in the months thereafter. The stock is then a strong buy with a fair price target of $26.

Be the first to comment