blackdovfx

Bausch + Lomb Corporation (NYSE:BLCO), because of the sector it competes in and its strong branding power, has the ability to perform relatively well under the current market conditions it faces, including inflationary pressures, the impact of the strong U.S. dollar on its results, and the increase in cost of capital.

While the impact of FX on the company’s most recent quarter stole some of its thunder, overall, I was impressed with its performance, considering it went public at a very inopportune time, and its share price, while volatile, has found support at a little over $12.00 per share.

With R&D spending targeted for 8 percent at this time, along with the launch of 15 new products in 2023, the company is taking the right steps to ensure future growth while its existing product line provides good results for the near term.

In this article, we’ll look at some of the numbers and their implications, temporary headwinds, and the strong brands the company has in a market sector where demand never goes away.

Some of the numbers

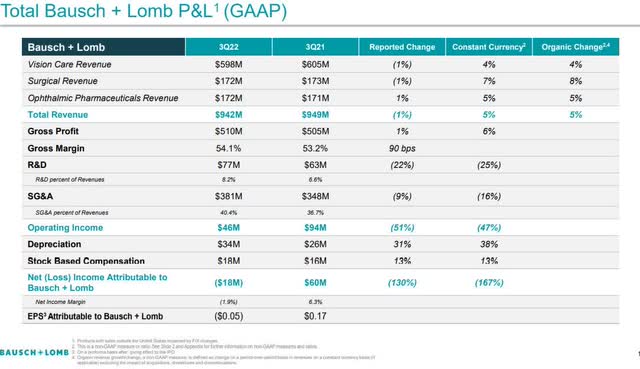

Third quarter revenue was $942 million, down from the $949 million in revenue in the third quarter of 2021. The company noted that revenue growth was $48 million in the quarter but was offset by FX headwinds of about $55 million.

Adjusted gross profit in Q3 was $570 million, down 3 percent from the $585 million in adjusted gross profit in the third quarter of 2021. Adjusted EPS was $0.31.

Adjusted gross margin in the reporting period was 60.5 percent, falling from the 61.6 percent adjusted gross margin year-over-year, down 110 basis points. Most of that attributed to the increase in inflation that resulted in higher rising costs of inputs, labor, energy and transportation. Consequently, adjusted SG&A was up by about $12 million year-over-year. Adjusted EBITDA in the third quarter came in at $187 million.

Adjusted cash flow was $48 million in the quarter. That brings total adjusted cash flow to $216 million so far this year.

Debt at the end of the reporting period was near $2.5 billion, with a net leverage ratio of about 2.9 times.

In order to lower the impact of inflation on its performance, the company has numerous ways to cut costs while using its brand strength to increase prices on strategic products.

As for guidance, management maintained organic revenue growth to be in the 4 percent to 5 percent range for full-year 2022, or $3.7 billion to $3.75 billion.

Gross margin is expected to be at around 60 percent, with adjusted EBITDA guidance being changed to a range of $750 million to $755 million.

FX headwinds for the year is projected to be around $210 million, up $50 million from the prior $160 million guidance.

Breaking down organic growth and market share

With over 400 products on the market, it’s not practical to break them all down, but in this part of the article, we’ll look at some of the more important products and their market share, as well as organic growth.

First, B&L operates in three segments: Vision Care, surgical, and Ophthalmic Pharmaceuticals. Vision Care accounts for most of the revenue, generating $598 million in the quarter, down from $605 million in Q3 of 2021. Surgical and Ophthalmic Pharmaceuticals were both $172 million, with Surgical down $1 million from last year in the same reporting period, and Ophthalmic Pharmaceuticals up $1 million year-over-year.

Vision Care

Some of the notable performers in vision care included PreserVision Eye Vitamin, which was up 6 percent organically. It’s the market leader in that market segment, with an extraordinary market share of 95.1 percent in the reporting period, up 120 basis points year-over-year.

Revenue from LUMIFY was up 7 percent in the quarter, capturing a record 49 percent market share. LUMIFY treats redness in the eye. When it recently launched in the Canadian market, sales soared.

Biotrue hydration, a part of its Biotrue franchise, has been seeing strong revenue growth as well, with market share up 410 basis points year-over-year. Artelac, a product that treats dry eye, enjoyed organic growth of 11 percent in the quarter. Artelac has generated over $100 million in revenue for BLCO. In the reporting period, there were some delayed shipments of Artelac because of Hurricane Ian which is expected to be recovered in Q4.

Lens revenue in the quarter climbed 6 percent organically, with solid growth in all three of its lens franchises. Management pointed out it is especially excited about the potential of its DLI lenses. The company sees it as a long-term growth driver.

Surgical segment

Revenue in its surgical segment was $172 million, up 8 percent organically. As procedure volume increased in the quarter, it helped drive 6 percent growth in consumables.

Implantables enjoyed 14 percent organic growth, driven primarily by its “premium and standard IOLs portfolios.”

The equipment portfolio was up 3 percent organically but has room for improvement because of some limited availability of supply.

With a significant amount of pent-up demand in its cataract business resulting in a backlog as a result of the impact of COVID-19, expectation there is that business should be a strong catalyst over a long period of time. In 2023, the company has several launches in the surgical segment which, when combined with the supply and delay issues of its other categories, could surprise to the upside in 2023, and into 2024.

Ophthalmic Pharmaceuticals segment

Revenue in the third quarter in its Ophthalmic Pharmaceuticals segment was $172 million, up 5 percent organically. Leading the way there was sales in the international markets, which were up 15 percent organically. The top markets there were improvements in the Chinese market and an increase in the number of surgical procedures in Europe.

With headwinds in the U.S. diminishing in relationship to VYZULTA brands, products like VYZULTA TRx grew by 29 percent during the quarter, with revenue growth up 4 percent. BLCO is in the midst of expanding the VYZULTA brand internationally, with a second-quarter launch in Thailand, and another launch in Brazil by the end of 2022.

Product pipeline

Preparing for 2023, BLCO is preparing to launch 15 new products targeting categories that are high-growth and high-margin premium products for the purpose of improving its top and bottom lines. Among the categories are premium pharmaceuticals and IOLs. One of the products the company is especially excited about is NOV03, developed to treat “dry eye disease associated with meibomian gland dysfunction.” It has yet to be approved by the FDA, but if it is, it will launch in the second half of 2023.

The market for this disease is a large one with about 18 million Americans alone suffering from the effects. NOV03 is designed to improve evaporative dry eye, a need that around 90 percent of patients with dry eye have yet to be addressed.

The prescription dry eye market in the U.S. alone has grown at a CAGR of close to 24 percent from 2016 to 2021. BLCO considers NOV03 to be a long-term revenue generator for the company. In its Surgical business, the company is getting ready to launch its eyeTELLIGENCE system, “a cloud-based digital platform that will help streamline the complex processes from pre-surgery assessment to post-synergy evaluation.”

With the ability to integrate the various aspects of cataract and other eye-related surgeries, this could increase market share in those surgical procedures because of the added value to surgeons because of the increase in efficiency in the process, gaining mindshare for surgeons. This could be a compelling service because the backlog in cataract surgeries are certain to be filled over the next couple of years, and possibly longer. Another surgical product expected to launch is the 3D Microscope, a “fully digital surgical visualization platform that can be integrated with BLCO’s eyeTELLIGENCE digital platform. It’s easy to see how getting surgeons to commit to one or the other of these products can lead to further adoption of the other, which will result in long-term usage and revenue streams.

The addressable market is about $400 million, growing at a CAGR of 6 percent.

What’s important to me with products like this is, they represent significant markets that have growth potential for many years into the future. When BLCO grabs market share in each one of them, the total revenue from the growing number of products it has will continue to increase. There are a number of other products set for release in 2023, but the point is the company continues to spend on R&D at a pace of about 8 percent of revenue under tough economic conditions, and it has a strong chance of paying off for the company as it increases its product base, especially on the premium side of the market.

Based upon its highly successful launch of LUMIFY in Canada, along with other past successful launches, BLCO’s record suggests 2023 should result in more building blocks put in place for long-term improvement in revenue and earnings.

BLCO believes the fundamental aspects of the eye care market will remain in place for a long time, and it’s laser-focused on increasing revenue growth in that important unit.

Conclusion

The FX headwinds faced by BLCO, while substantial, are only temporary in nature, and will be reduced substantially in the future.

The fundamentals of eye care remain strong, and demand is stable even under conditions where consumers are being more circumspect in their spending and outlook.

Considering the long haul, there are a number of opportunities for the company to widen margins and boost earnings while growing revenue. From studying the company, it looks like the three segments it operates in are poised to improve margins in the months and years ahead, based upon its product pipeline that features high-margin, premium offerings, increased scale in its lenses and its wide-margin Opto portfolio.

Even with the temporary headwinds the company faced not too long after it went public, I really like what I’m seeing concerning the long-term potential of the company, which is probably the most trusted and known brand in the eye care field.

Problems with eyes aren’t going away, and BLCO has developed over 400 products and services to treat them, with a number of them having significant market share.

Its presence in over 100 countries is a temporary headwind because of the strong U.S. dollar, but over time it’s definitely going to be a positive catalyst as it expands its reach and grabs market share in a number of geographic and product markets.

Since the company went public, it has an all-time high of $20.20 and a low of $12.20. It was trading at $14.29 as I write. I think that’s a good entry point, and even if it pulls back again on CPI news or Fed policy, the fundamentals of the eye business and successful introduction of numerous products serving patients that need eye care, the company is well-positioned to grow for long into the future, and I believe, will surprise to the upside once the current economic issues are mitigated.

Be the first to comment