Khanchit Khirisutchalual

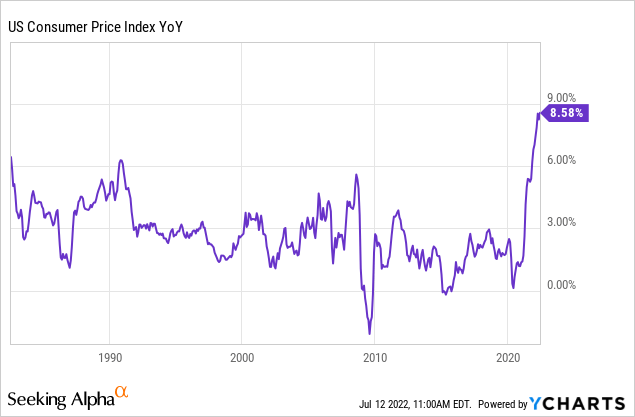

Inflation has reared its ugly head and now sits at four decade highs:

Between the massive government stimulus of 2020-2021, production and supply chain disruptions associated with government restrictions in the wake of COVID-19, extravagant money printing and artificially low interest rates from central bankers, unleashed pent-up consumer demand and savings as COVID-19 restrictions were lifted, and most recently the war in Ukraine, the supply-demand imbalance for goods has numerous catalysts which have combined to unleash the perfect storm that we are currently dealing with.

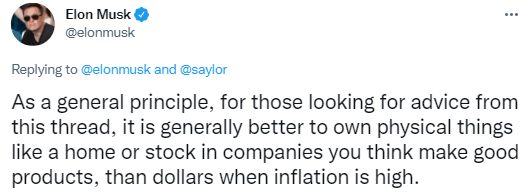

For investors, this poses a particular problem, as – in addition to reducing the purchasing power of their current principal – inflation is squeezing the profit margins of many businesses, thereby reducing cash flow both nominally and in real purchasing power terms. One popular method for fighting inflation is to invest in real assets like real estate. As Elon Musk recently tweeted:

Elon Musk Tweet (Twitter)

In this article, we are going to discuss two REITs that are particularly well positioned to battle inflation.

#1. W. P. Carey (NYSE:NYSE:WPC)

WPC is a triple net lease REIT with roughly 50% ABR exposure to industrial and logistics real estate and the other half mostly stemming from essential retail, investment grade office, and personal storage properties.

While triple net lease REITs are typically viewed as bond proxies which are negatively impacted by high inflation, WPC is uniquely positioned to benefit from high inflation.

60% of its ABR is actually linked to CPI (40% of ABR comes from uncapped CPI-based rent escalations), with rent escalators that regularly reset based on current inflation rates. This point was discussed on a recent earnings call:

Higher inflation had a positive impact on our same-store growth during the third quarter, especially for leases tied to uncapped CPI. However, it is really just the start, with the bulk of the impact occurring over the next few quarters…With inflation picking up in recent months, we expect leases tied to inflation to drive rent growth, and strongly outpace the 2.3% average fixed rent bump we saw for the third quarter. Inflation began to flow through to rents during the third quarter, although on a relatively small portion of our portfolio. Leases with CPI-linked rent increases, they went through scheduled rent adjustments during the quarter, experienced rent increases averaging 3.3%. The vast majority of CPI-linked leases, that did not bump during the third quarter, are scheduled to do so over the next 9 months, adding about 100 basis points to our same-store rent growth based on current inflation forecasts.

This improvement continues to drive growth, with Q1 same-store contractual rent growing by 2.7% year-over-year, up significantly from a normal quarterly range of 1.5% to 2.2% over the past few years. This growth is expected to only improve moving forward as more CPI-linked rent escalators flow through in the coming quarters.

WPC is also growing aggressively via acquisitions with ~$2 billion in properties acquired in 2021 and up to that many expected to be acquired again this year.

Between strong same-store sales growth from CPI-linked leases and its robust acquisition pipeline, WPC should be able to grow cash flows per share on a pace that largely helps to preserve shareholder’s wealth in real terms.

On top of that, the valuation remains reasonable, with a 5.2% forward dividend yield providing attractive current income alongside the accelerating growth and the price to NAV ratio is currently 1.11x, which is slightly below its 5-year average of 1.15x. This implies that investors can invest in a solid investment grade and highly recession-resistant business at a reasonable price, while also enjoying an attractive combination of current income and inflation protection.

#2. AvalonBay Communities (NYSE:AVB)

Multifamily apartments are typically much more recession resistant than REITs with longer lease profiles since most leases are one year or less in length. As a result, as inflation rises, multifamily unit rental rates typically do as well. This inflationary cycle is no exception, with multifamily rentals rates up by 20% or even higher over the past few years.

According to a recent edition of National Rent Report:

“Rent growth accelerated slightly again this month, with our national index up by 1.2% over the course of May. So far this year, rents are growing more slowly than they did in 2021, but faster than the growth we observed in the years immediately preceding the pandemic…Over the first five months of 2022, rents have increased by a total of 3.9%, compared to an increase of 6.1% over the same months of 2021. Year-over-year rent growth currently stands at a staggering 15.3%, but is down slightly from a peak of 17.8% at the start of the year.”

As a coastal luxury apartment REIT, AVB is investing aggressively to rapidly expand into faster-growing markets in Texas, Florida, and North Carolina.

AVB’s Q1 results were quite strong, with core FFO per share growing 15.9% year-over-year from $1.95 to $2.26, driven primarily by same-property NOI growth and secondarily by development completions. On the organic growth side, same-property cash rental revenue rose by 9.9%.

Growth was particularly strong in South Florida (24.8%), Pacific Northwest (13.3%), and New England (12.3%), while even its Northern California market – which is facing headwinds from people leaving the area – generated 5.4% same-property rent growth.

AVB is also generating meaningful growth through its formidable development capabilities. Last year AVB completed $1.1 billion of new developments at estimated stabilized cap rates of 6-6.5% and in the first quarter of 2022 the company leased up its newest development projects at a stabilized NOI yield 6.9%. These cap rates are nearly double to the prevailing cap rates at the moment, reflecting just how powerful its development business is at creating value for shareholders. Moving forward, AVB expects to continue unlocking a lot of value for shareholders through its 16 community development projects at a total estimated cost of a little over $2 billion. The company also has a land bank for future developments worth at least $4 billion.

Despite this very strong same-store and development-fueled growth momentum backed by an A- credit rating and a business model that is proven to be resistant to inflation, AVB currently trades at a discount on a P/FFO (19.10x compared to 5-year average of 21.25x), P/AFFO (20.55x compared to a 5-year average of 22.91x), and P/NAV (0.79x compared to a 5-year average of 0.95x) basis.

Investor Takeaway

While inflation appears unlikely to subside anytime soon, investors fortunately still have some good options for investing in an inflation-resistant manner. With CPI-linked triple net leases offered by WPC and short-term contracts in high quality multifamily rentals offered by AVB combining with strong growth profiles for both businesses, investors can invest on a value basis while also sleeping well at night knowing their savings are backed by strong business models, rock-solid investment grade balance sheets, and attractive current dividend yields.

Be the first to comment