Ekspansio/E+ via Getty Images

Company overview

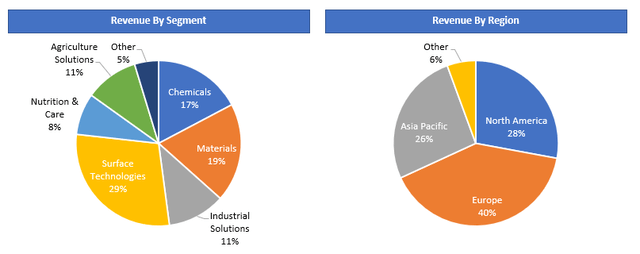

BASF SE (OTCQX:BASFY) is one of the largest diversified chemicals companies in the world. While the company is based out of Germany, it has a global footprint and operates across six segments. Below is a graphical break-down of 2021 revenues by segment and geographic location.

Based on BASF July 2022 Factbook

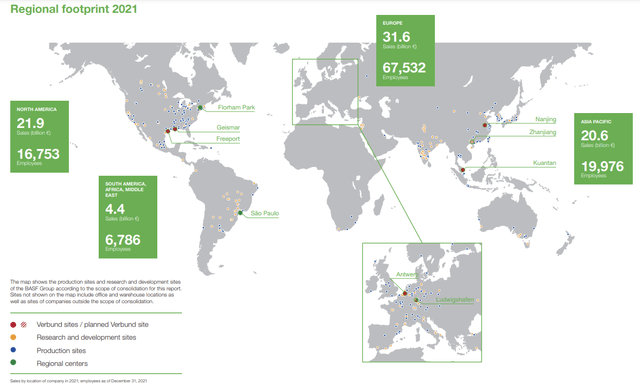

The company currently operates six “Verbund” sites which integrate production plants, energy and material flows, logistics, and site infrastructure all within a single location (a seventh Verbund is currently under construction). Below is a detailed map of BASF’s global operating footprint displaying their Verbund and other production sites.

As might be expected of a mega-cap German materials company, BASF can be characterized as a mature/low growth dividend paying stock which averages a mid-teen return on equity while operating in a cyclical industry. While these characteristics ordinarily do not lend towards fertile hunting ground for outsized returns, I believe that a confluence of factors has turned BASF into a ripe candidate for strong risk-adjusted returns over the next six months.

Now is the winter of our discontent

While 2022 has been a challenging year for the global economy, Europe’s situation has become a full-blown Shakespearean tragedy. The core of Europe’s troubles (as with the U.S.A.) is rampant inflation, particularly energy inflation.

Europe has been aggressively pursuing “green” energy initiatives which have included efforts to eliminate domestic production and use of traditional fossil fuels such as coal, oil, gas, etc. After Russia invaded Ukraine, energy prices skyrocketed and Russia began curtailing western-bound gas supplies to continental Europe. This resulted in parabolic increases in the cost of domestic gas, coal, and electricity and has led to the ongoing and well-publicized European energy crisis.

economist.com

As cold weather nears, there have been fears that the continent could deplete energy stockpiles and face a scenario where industry grinds to a halt, consumers are stuck with exploding utility bills, and residents could literally freeze without heat. Throw in the threat of nuclear bombs and it’s no exaggeration to say that sentiment towards Europe’s situation has turned apocalyptic.

Impact on BASF

These headwinds have a multipronged negative impact on BASF. First is the simple fact that BASF’s industry is relatively cyclical and is suffering from the resultant global macro slowdown. And second, BASF consumes a very large amount of natural gas, both to power their operations and as feedstock for their products.

As noted on their Q2 2022 earnings call, 60% of their 2021 European natural gas demand went towards power and steam production while the remaining 40% went to feedstock. Of this 40% for feedstock, 50% went towards ammonia production. Increased costs negatively impact margins and create the risk that production would need to be halted or curtailed if the German government determines that there is simply not enough gas to go around.

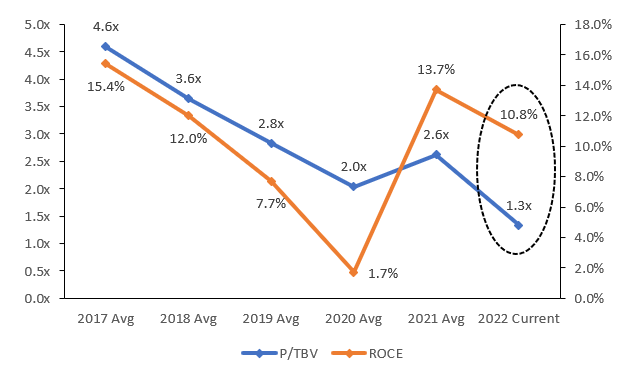

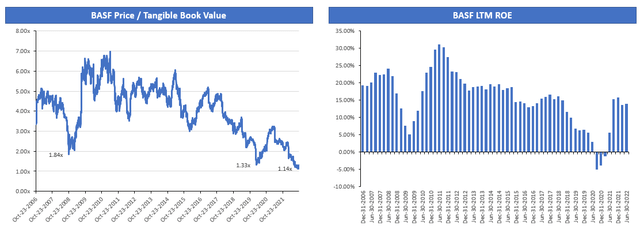

As a result, investors have become very bearish on European equities and particularly on industrial material names like BASF. In fact, BASF has recently been trading at a price to tangible book value which is even lower than levels seen during both the depths of the COVID crisis as well as the Great Financial Crisis!

Investors would have done very well to have bought BASF during the depths of the 2008 and 2020 panics. Do we have reason to be optimistic this time around too?

Europe will do just fine

When Pierre Andurand speaks, investors should tune in. He is the French founder of one of the most successful energy-focused hedge funds in the world, Andurand Capital. In late September, Pierre appeared on Bloomberg’s Odd Lots podcast and laid out his thesis on how Europe should easily survive the winter. In short, LNG imports combined with modest demand reductions should be sufficient to offset Russian gas supplies (see here for more details).

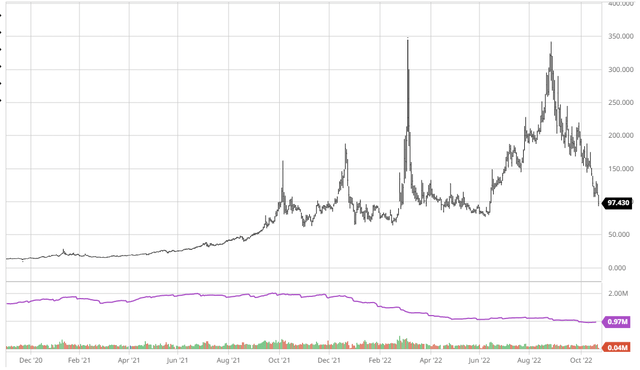

Pierre seems to have been on the right track. Less than a month later we learned that Germany’s gas storage facilities were 95% full weeks ahead of a November 1st deadline. Commodity prices have reacted accordingly. While Dutch TTF gas futures (Europe’s benchmark natural gas contract) are still high by historical standards, they are well off the parabolic “end of the world” levels.

All of this might come as a surprise if one were only paying attention to all of the doom and gloom headlines that continue to come out every day.

Then there is the persistent narrative which postulates that even if Europe limps through the winter, the continent is permanently impaired since Russian gas will never come back. This is myopic linear thinking at its worst. It will be messy and will take time, but Europe will move beyond Russian dependence and regain energy security. As Reuters reported on October 20th, Germany is already doing the unthinkable – opening talks surrounding the development of new natural gas fields to meet continental demand.

In a draft document seen by Reuters, Germany said EU countries should agree at the summit to “work together with countries that have the capacity to develop new gas fields, as part of the Paris Climate Agreement commitments”.

Germany is racing to find alternatives to Russian fossil fuels – both by expanding renewable energy faster, and importing more non-Russian gas.

BASF’s earnings remain robust

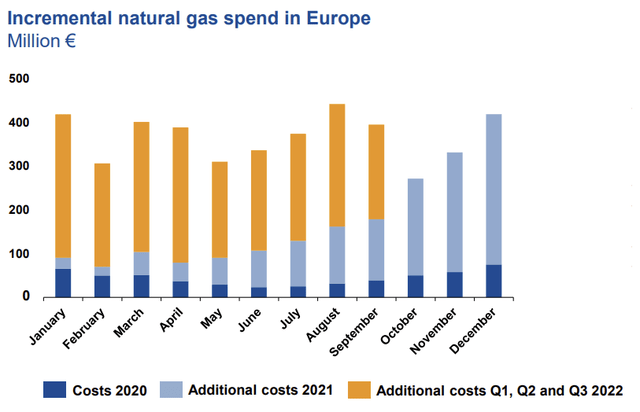

Regardless of the path forward, Europe has already been burdened with exploding energy costs and a severe economic slowdown. BASF stated within their 3rd quarter 2022 presentation that the Company incurred EUR 2.2B in additional natural gas costs YTD versus 2021.

2022 results have also been dragged down by a weak global construction market as North America and Europe grapple with higher interest rates while China continues to digest its own domestic real estate bust.

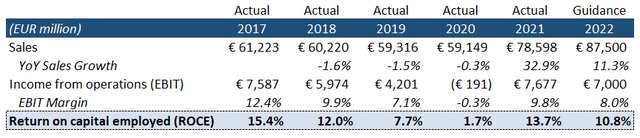

Have BASF’s revenues and earnings fallen off a cliff as a result? While margins have weakened since 2021, results remain robust. BASF has successfully passed on increased costs while certain key customer industries (e.g., transportation and agriculture) have helped buoy results.

Management highlights the return on capital employed (ROCE) as their key internal KPI and has guided it to between 10.5% and 11% for 2022. This is quite the juxtaposition against the market’s winter apocalypse doom and gloom. To again return to BASF’s price to tangible book, the market appears to have disconnected from a rational relationship with ROCE.

Compiled by author

Separating cyclical from structural

While the cyclical storm will pass, it should still be acknowledged that Europe does face structural headwinds as well. Management called out three specific challenges faced in the European market:

- The chemicals industry has experienced weak growth in Europe over the past decade

- In the mid to long term, European energy/gas prices will likely continue to remain volatile and have some element of structurally increased prices

- Uncertainties due to the enormous number of regulations planned by the E.U. are weighing on the chemical industry

As a result, management is targeting EUR 500M in new cost savings initiatives within the European chemicals segment, which amounts to roughly 10% of segment costs.

We cannot stick our heads in the sand and hope that this difficult situation will resolve itself on its own. We, as a company, must act now. Our cost savings program aims to secure our medium- and long-term competitiveness in Germany and Europe.

I find it encouraging that management is taking the current situation seriously and that they are actively demonstrating that they are willing to take proactive action to protect shareholder returns.

BASF fair value

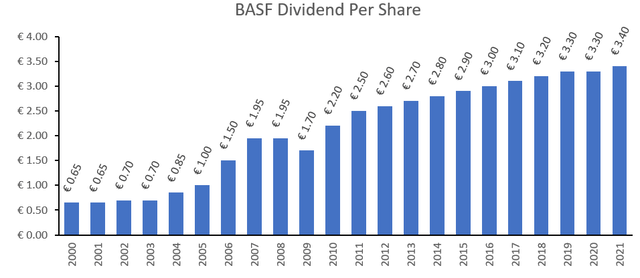

When thinking about “fair value” it should be remembered that BASF is a large/mature dividend-paying stock. Management is very protective of the dividend and they repeatedly emphasize throughout their investor materials that it is their goal to increase the dividend every year.

BASF’s share price decline has brought the dividend yield all the way up to a juicy 7.4%. When yields become this high, some investors are inclined to start ringing alarm bells for dividend cuts, but I find this unfounded given that BASF’s guided 2022 EBIT of ~EUR 7B is more than double the ~EUR 3.1B annual dividend. BASF has only cut the dividend once since the year 2000, during the GFC. Even then it was only a 13% reduction and was fully reversed the following year.

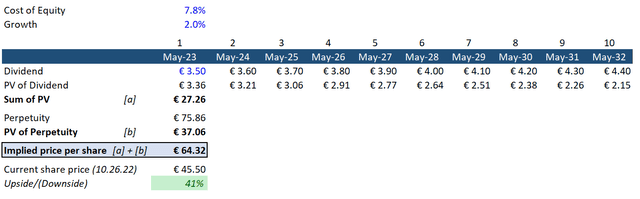

With that said, the dividend discount model is a simple and effective valuation method for a company like BASF. I will assume that the company continues to increase the dividend by EUR 0.10 every year for the next ten years and that it then grows by 2% thereafter in perpetuity. I will assume a cost of equity of 7.8% which is sourced from valueinvesting.io. This results in a fair value of about EUR 68 and implies roughly 40% in upside from today’s levels.

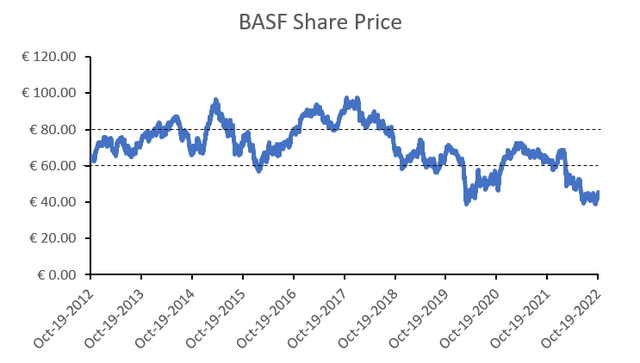

Not surprisingly, this estimated fair value falls right in the middle of the range that BASF has typically traded in over the past ten years. I believe that this is because BASF is something of a fixed income proxy. Its value comes from its strong and steady annual dividend.

Summary of investment thesis

This leads back to my rationale in owning BASF. BASF is not going to be a multi-bagger, but I believe we’ll see that their business holds up just fine by the time the spring of 2023 arrives. If that is the case, I would expect this unjustified drop in value to reverse and for BASF to return back to a share price which is closer to fair value, representing +40% in potential return in less than six months.

The fact that BASF now trades near its tangible book value also offers an element of downside protection and enhances the risk/reward characteristics of a BASF investment. As of now, I would not expect BASF to experience significant operating losses, making it unlikely that BASF should trade significantly below tangible book value for a meaningful period of time.

Final notes on foreign investments

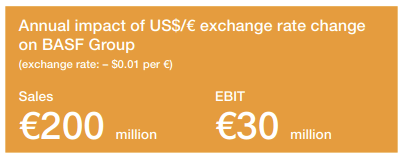

While BASF’s common stock trades on the XETRA German Electronic Exchange, U.S. investors can purchase the stock via the ADR (OTCQX:BASFY). But given BASF’s shares are denominated in EUR, investors should remember that the value of the ADR will be impacted by the EUR/USD exchange rate. This is partially offset by the fact that BASF’s earnings benefit from a stronger USD. BASF helpfully estimates revenue and EBIT sensitivity to a $0.01 change in EUR/USD as follows:

BASF June 2022 Fact Book

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment