Kannan D

Thesis

BASF (OTCQX:BASFY) is down about 40% YTD and now trades at a highly attractive risk/reward level. For reference, the one-year forward P/E is x8 and the EV/EBITDA is as low as x5.8. Moreover, BASF’s 8% dividend yield appears sustainable and should provide investors not only a nice return on their investment, but also a possible floor to further downside. That said, BASF is clearly undervalued—in my opinion and accumulating an equity position at prices < $12 appears justified.

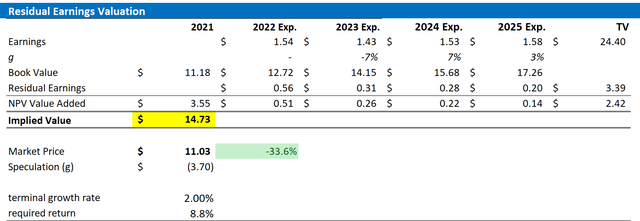

Personally, I value BASF at $14.73/share. I anchor my valuation on a residual earnings framework and EPS analyst consensus estimates.

About BASF

BASF is a diversified chemical company with headquarters in Germany. The company operates six major segments: Chemicals, Materials, Surface Solutions, Industrial Solutions, Nutrition & Care and Agricultural Solutions. But investors might want to consider a slightly more simple breakdown according to the industrial classifications Chemicals, Oil & Gas and Agriculture. With about 65% of the group’s revenues, Chemicals is BASF’s most important segment and focuses on basic petrochemical products. Oil & Gas accounts for about 25% of revenues and includes oil production in Nord Africa, the North Sea and South America. In addition, BASF is also an important gas distributor in Europe. Finally, Agriculture is about 10% of sales and includes exposure to crop protection and nutrition. Geographically, Europe is BASF’s largest market with about 55% of BASFG sales, followed by North America with slightly more than 220% and Asia with about 20%. BASF serves about 100,000 customers globally.

The Opportunity

BASF stock sold off heavily YTD as the market became increasingly concerned with macro-economic headwinds, including a slowing global economy, the energy crisis in Europe and hawkish central bank policies. For reference, BASFY stock depreciated 37% YTD versus 17% for the DAX.

Seeking Alpha

However, as of mid-2022, BASF earnings have remained stronger than feared and expected. In my opinion, the market discounted too much an EPS slowdown—which in any case appears to be transitory on a short-/mid-term basis. In Q1 2022, BASF generated $25.9 billion of revenues and a net income of about $1.3 billion. EBIT was about 16% above consensus estimates, driven by a revenue and profitability beat in all of BASF’s operating segments—except for Surface Technologies.

A quality company

Judging BASF business operations and financials from a long-term basis, or in other words cyclically adjusted, investors will find steady growth and value accumulation. From 2019 to 2022, revenues increased from $59.3 billion to $78.6b billion, representing a 3-year CAGR of about 10%. Respectively, earnings increased from $2.6 billion to $5.4 billion (27% EPS CAGR).

BASF’s balance sheet is strong. As of Q1 2022, the company recorded $4.7 billion of cash and short term investments and about $20.9 billion of BASFG debt. Given an annual operating cash-flow between $6 billion and $8 billion, BASF’s net debt position of about $15 billion should be easily sustainable and give opportunity for M&A optionality and shareholder-returns. That said, the 8% dividend yield (about $3 billion) should be sustainable as well.

Analysts do not forecast much growth for BASF. For 2022, 2023 and 2023 revenues are expected at $84.3 billion, $82.1 billion and $83.5 billion. Respectively, EPS is estimated at $1.54, $1.43 and $1.53 (Source: Bloomberg Terminal July 20th, 2022).

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the DAX 40 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 15, 2022. My calculation indicates a fair required return of 8.8%.

- To derive BASFY’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0 percentage points to reflect the balance of a secular decline for oil and gas business and the transition towards green energy.

Based on the above assumptions, my calculation returns a base-case target price for BASFY of $14.73/share, implying material upside of more than 30%.

Analyst Consensus EPS; Author’s Calculations

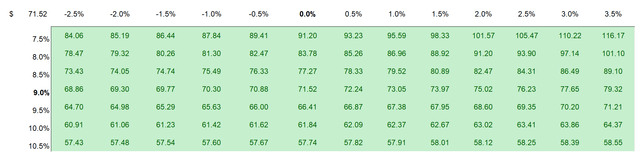

I understand that investors might have different assumptions with regards to BASFY’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculations

Risks To My Thesis

In my opinion, BASF stock is significantly de-risked at a P/E below x10 and the risk/reward looks favorable. In addition, the 8% dividend yield should cushion investors from further downside. However, I advise to monitor the following: First, much of BASF’s earnings strength is connected to supply/demand balances in oil & gas and petrochemicals products, which can fluctuate significantly over time. Second, BASF is based in Europe and exports most of its products, denominated in euro. That said, a strong euro would negatively impact BASF exports and thus sales potential. However, in the current environment, a strong euro should not be a significant worry for investors. Third, macroeconomic uncertainty relating to the monetary policy actions of the ECB and actions of the European government against Russia could impact BASF business operations.

Conclusion

BASF stock’s P/E multiple of x7.1 is trading at an approximately 2 sigma deviation below the company’s 2-year historical average of x13.2 P/E (Source: Bloomberg Terminal, 20th July 2022). In the past 2 years, BASF has traded at such a cheap valuation only 5% of the time. Thus, the buying opportunity should be obvious, in my opinion. Investors who buy BASFY at current levels enjoy ownership of a 150-year-old quality company and an attractive 8% dividend yield. My residual earnings valuation model indicates more than 30% upside for the base-case scenario. Buy.

Be the first to comment