gchapel

It’s been a mixed Q2 Earnings Season for the Gold Miners Index (GDX), with several producers posting decent operational results but revising their costs guidance higher. However, Barrick Gold (NYSE:GOLD) could be an exception, posting solid results despite the difficult environment and on track to deliver into the high end of cost guidance. While there were some minor negative developments in the quarter, the company’s results were solid overall, and it looks like we’ve seen peak all-in sustaining costs. At a share price of US$16.00, I see a 70% upside to fair value, with the bonus being its ~4.0% – ~6.25% dividend yield under its new framework.

Barrick Gold Operations (Company Presentation)

Q2 Results

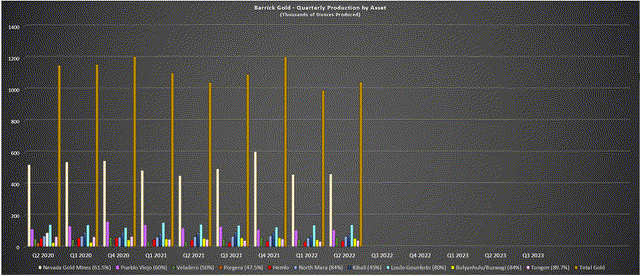

Barrick released its Q2 results this week, reporting quarterly production of ~1.04 million ounces of gold and ~120 million pounds of copper. This represented flat gold production from the year-ago period but a 25% increase in copper production from Q2 2021 levels. The solid results were helped by a much stronger quarter from its Carlin Complex in Nevada (+28% production growth year-over-year – albeit up against easy comps), another solid quarter from Loulo-Gounkoto (which was up against tough comps), and a much better quarter from Veladero.

Barrick Gold – Quarterly Production by Mine (Company Filings, Author’s Chart)

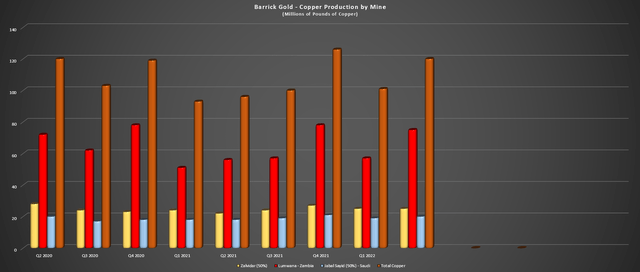

Looking at Barrick’s copper business, production soared to ~120 million pounds, benefiting from higher production at all three operations. The stand-out performer was Lumwana, which produced 75 million pounds of copper at cash costs of $1.68/lb, representing its second-best production quarter in the past two years. While the copper price correction did impact revenue in this side of its business (an average realized price of $3.76/lb vs. $4.57/lb), the higher sales volume picked up much of the slack.

Quarterly Copper Production (Company Filings, Author’s Chart)

While Barrick’s copper business currently represents only a fraction of its total revenue, it’s worth noting that this side of the business should see a massive boost later this decade. This is based on Barrick’s optimism about the Reko Diq Project (50% ownership), a project that’s expected to be constructed into two phases and could head into production as early as H2 2027. While still in its early stages and awaiting a new Feasibility Study, it is projected to have a 40+ year mine life, with a resource of 31 billion pounds of copper and over 25 million ounces of gold (M&I resources only).

Reko Diq Project (Company Presentation)

Assuming the production of ~700 million pounds per annum and Barrick’s stake would push Barrick’s copper business to 800+ million pounds of copper per annum, or ~80% growth from the FY2022 guidance mid-point. Meanwhile, on a shorter-term basis, Barrick reported phenomenal exploration results from its Jabal Sayid Mine, with intercepts that included 54.04 meters of 15.83% copper and 59.73 meters of 4.87% copper in a high-grade feeder zone intersected at depth. So, while it was a softer quarter for the copper business on revenue/margins, there is meaningful upside long-term from existing assets and Reko Diq.

Meanwhile, in Barrick’s gold business, the company is on track to produce 4.25+ million ounces of gold this year, which is down year-over-year (FY2021: 4.4 million ounces of gold) and may disappoint investors. That said, there is growth in the tank. Beginning with Pueblo Viejo, this asset should contribute considerably more ounces and see a massive production boost with its tailings/plant expansion. In fact, the asset should maintain an average annual production profile of 800,000 ounces per annum (100% basis), with the mine life extending into the 2040s. Importantly, this is a low-cost asset (H1 2022 cash costs: $703/oz), so the expansion will benefit Barrick’s cost profile.

Cortez Complex Operations (Company Presentation)

Elsewhere, Barrick has Goldrush (which did see a slight delay) in the wings at its Cortez Complex, which will boost annual production to 1.0+ million ounces per annum once in full production (100% basis at complex). It also has incremental growth opportunities with high-grade deposits like REN and North Leeville, which boast industry-leading grades (7-11 grams per tonne of gold in resources). Finally, Cortez has further upside with Fourmile; Turquoise Ridge will see higher output from the third shaft project, and Porgera (also seeing delays) should come online by Q4 2023. So, while gold production could dip as much as 4% year-over-year at higher costs, I expect it to be back above FY2021 levels in 2023, erasing this temporary dip.

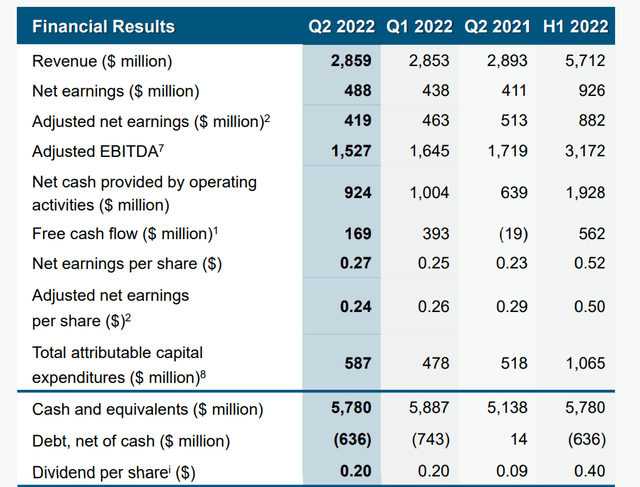

Financial Results & Medium-Term Outlook

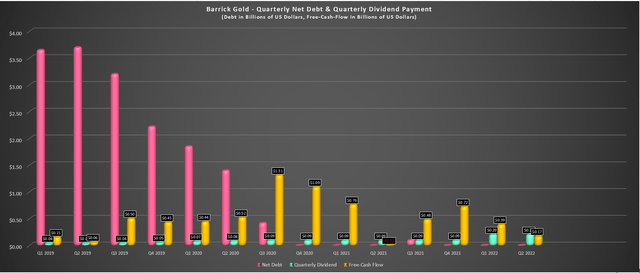

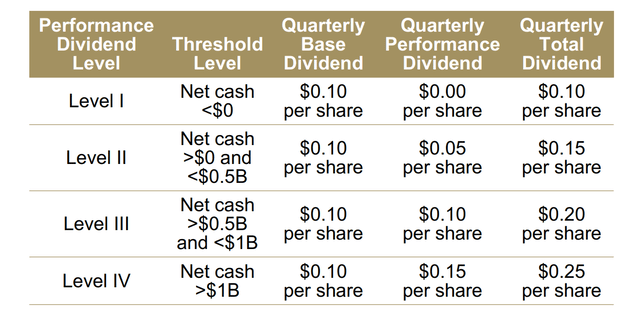

Moving to the financial results, Barrick reported revenue of ~$2.86 billion, a 1% decline from the year-ago period. This was related to fewer ounces sold, partially offset by a higher gold price in the period ($1,861/oz). However, operating cash flow increased year-over-year to $924 million vs. $639 million, and free cash flow increased to $169 million vs. a cash outflow of $0.20 million in Q2 2021. This increase in free cash flow was despite higher capital expenditures in the period with its busy project pipeline, helped by lower cash taxes and favorable movements in working capital. The result was that Barrick ended the quarter with a strong balance sheet (~$630 million in net cash), triggering a $0.20 quarterly dividend under its new framework.

Barrick Gold – Quarterly Net Debt, Free Cash Flow, Dividends (Company Filings, Author’s Chart)

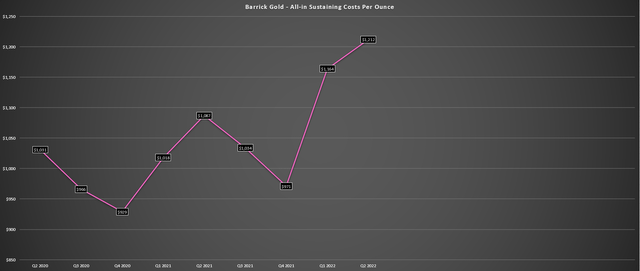

Unfortunately, margins did slide in the period, with Barrick’s AISC margins sliding to $649/oz, down from $733/oz in the year-ago period. This was related to an increase in costs due to inflationary pressures, and Barrick is now expecting costs to be at the high end of guidance or slightly above the top end. However, this assumption is based on a $110.00/barrel oil price assumption in H2 2022, which I see as highly unlikely. It’s also worth noting that while costs did climb from $1,087/oz to $1,212/oz in the period, sustaining capital was up sharply vs. last year, and production is back-end weighted to H2 2022 benefiting unit costs in the second half.

Barrick – All-in Sustaining Costs Per Ounce (Company Filings. Author’s Chart)

Some investors might look at the above chart and want to run in the other direction, especially with the gold price taking the elevator down from its Q1 2022 high above $2,000/oz. However, it’s important to note that this looks like peak costs for Barrick with sustaining capital elevated (Q2 2022 vs. Q2 2021), a lower production quarter than the 2023/2024 run rate (1.1+ million ounces per quarter), and what looks to be peak oil prices ($125.00/barrel in June). So, while some investors might be discouraged by the Q2 2022 margins that hit a multi-year low, I think this is a buying opportunity if one is willing to look past the weak Q2 results from a margin standpoint.

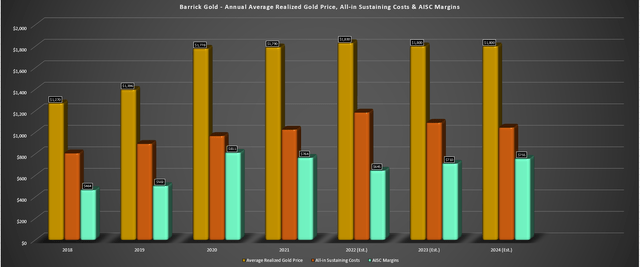

Barrick Gold – Realized Gold Price, All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

My view that this is a buying opportunity is evidenced by the above chart, which shows that while AISC margins could decline to $645/oz in FY2022, they should improve to $710/oz in FY2023 and $750/oz+ in FY2024. Notably, these forecasted margin profiles do not require higher gold prices and assume a $1,800/oz gold price. As discussed earlier, this is because Barrick has a heavy-capex year from a sustaining capital standpoint divided by lower production (on track to increase), and it continues to invest in helping to claw back lost margins.

One minor example is the expansion of its solar plant (60MW vs. 20MW) and the addition of a battery energy storage system at Loulo-Gounkoto, which will replace 20 million liters of heavy fuel oil per annum and dramatically reduce greenhouse gas emissions. In addition, higher production at Turquoise Ridge should lead to a meaningful improvement in costs in 2023/2024 and the benefit of the high-margin Goldrush Project. To summarize, this cost spike appears to be an aberration and not what should be expected going forward. Therefore, this is still a $700/oz+ AISC margin business or better (~39%) even at $1,800/oz gold.

Valuation

Based on an estimated ~1,760 million shares outstanding at year-end and a share price of US$15.50, Barrick now trades at a market cap of ~$28.2 billion and an enterprise value of $27.6 billion. This is a very reasonable valuation for a business expected to generate ~$4.4 billion in cash flow this year ($2.50 per share), and ~$1.5 billion in free cash flow. Looking ahead to FY2023, these numbers are expected to improve significantly with higher copper & gold production and much lower sustaining capital expenditures as major projects wind down. This should allow Barrick to generate cash flow per share of $2.70 and free cash flow of $2.1+ billion, translating to a nearly 8% free cash flow yield.

Barrick Financial Results (Company Presentation)

While businesses with higher free cash flow yields are available in the market, Barrick and other gold producers have two key differentiators. First, these assumptions are based on a sub $1,800/oz gold price and sub $3.75/lb copper price, providing significant leverage to these estimates if we see a recovery in both metals. Secondly, Barrick and gold producers are often criticized for being price takers as a risk to the investment thesis, not controlling the price of the commodity they sell.

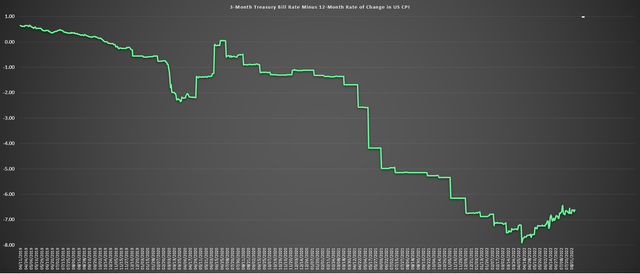

Negative Real Rates (YCharts.com, Author’s Chart)

While this can lead to weaker margins like we’re seeing (inflationary pressures, dip in gold prices), they benefit from insatiable demand, a key differentiator in a recessionary environment. The reason is that while companies in the retail space, such as restaurants, might be able to continue to raise prices at 5-7% per year to boost sales, there is a limit to their demand, especially among less affluent consumers. Meanwhile, difficult economic backdrop or not, Barrick will have a buyer for its product (dore bars), and the gold price will take care of itself (even if it’s in a temporary funk), especially with real rates still deeply in negative territory.

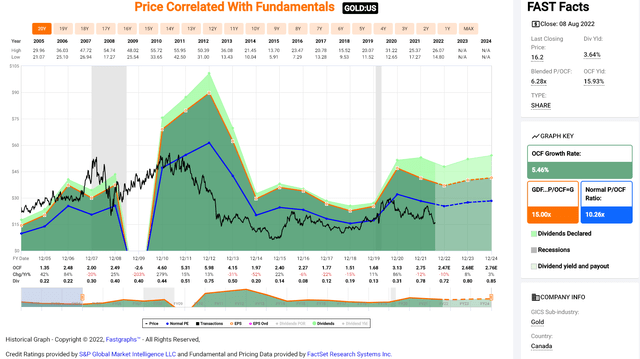

Barrick – Historical Cash Flow Multiple (FASTGraphs.com)

Historically, Barrick has traded at ~10.3x cash flow, placing its fair value at $27.80 per share (FY2023 estimates), translating to a 74% upside from current levels. I believe a cash flow multiple of 11 can easily be justified for the world’s 2nd largest producer, but even at the historical average (10.3x cash flow), there’s immense value in the stock here. This is especially true when we factor in its dividend yield, which could pay up to $1.00 per share annualized if the cash balance continues to build (6.25% yield). So, for investors looking for generous returns to shareholders in a business with a high single-digit free cash flow yield, even under conservative commodity price assumptions, Barrick is an excellent way to diversify one’s portfolio.

Barrick – Dividend Framework (Company Filings)

More important than any of these valuation metrics, though, Barrick is hated, as is the gold space, and the calls of $2,500/oz and $3,000/oz have been drowned out by forecasts of $1,200/oz – $1,400/oz and constant mockery of the sector by Monday Morning quarterbacks. This should be music to the ears of those invested in the sector because there are few better setups than a loathed industry group that sports respectable margins, strong balance sheets, considerably more discipline than the past cycle, and generous shareholder returns. There are no guarantees in life or investing, but buying great businesses paying high yields when they’re hated is not a bad way to allocate one’s capital.

Summary

Barrick may not be a growth company today, but there’s no disputing that it’s a value stock based on its current valuation metrics. That said, the company is steadily building up its pipeline to work towards growth later this decade to potentially surpass the 5.0 million ounce mark. Plus, it will enjoy 10% production growth (2022-2024) with higher production from Pueblo Viejo, Cortez, Turquoise Ridge, and Porgera. Hence, I see this lower production year with elevated costs related to inflationary pressures and supply chain headwinds as an opportunity to buy the stock at fire-sale prices.

Be the first to comment