rlesyk

Investment thesis: As we await the impending decision by the Pakistani authorities in regard to Barrick Gold Corporation’s (NYSE:GOLD, TSX:ABX:CA) Reko Diq $7 billion project, which could potentially start producing gold & copper by 2027 if all goes well, it might be worth taking a look at the benefits versus potential risks associated with the project. As the question arises in regards to how to gauge the decision, whether it will be negative or positive, short term versus long term, as well as potential benefits versus potential risks, I personally see it as a net positive overall from a financial point of view. However, Barrick will be saddled with additional major, and permanent geopolitical risks, which cannot be ignored.

About the Reko Diq project and the main potential benefits and risks for Barrick

The copper and gold deposits at Reko Diq are considered to be among the largest that are yet to be tapped across the world. There is an estimated 3 billion tons of ore in the measured and indicated category worth digging up at the site, with an average of .26g/tonne of gold estimated to be concentrated in the ore. Doing the math, it comes out to 780 tons of gold in place. The copper concentration is estimated at .48%, meaning that about 4.8 kilograms of copper can be found on average/tonne of ore. That brings the copper resource to 14,400,000 tonnes. At current prices, the value of the gold is estimated at $45 billion, while the value of the copper in place can be estimated to be at about $118 billion. There is a further resource of 2.9 billion tonnes of ore in the inferred category, with a concentration of .18g/tonne of gold, and a .35% concentration of copper. No doubt, at least a part of this resource category can be upgraded in time.

The other significant fact about this proposed project, which may or may not move forward, and based on what now seems to be an imminent decision, is its location.

Barrick Gold

As we can see, the location of the mine is wedged between Afghanistan and Iran. The Pakistani region of Balochistan has seen sectarian violence in the past. It also goes without saying that being that close to the Afghan border is a potential security risk, given the unstable nature of that country. There seems to be some stabilization, mostly due to regional efforts, including China’s, to economically stabilize Afghanistan. It remains a huge question mark whether there will ever be long-term stability there. Afghan violence has spilled over into Pakistan occasionally, therefore, anything is possible. Finally, Pakistan is increasingly becoming a country associated with the regional constructs of geopolitical alliances, mostly led by China. As the world is starting to split in two, a Western-based company operating deep inside the territory of an opposing alliance can easily find itself facing obstacles and retribution, which could potentially amount to a total loss of investment.

The resources that the project provides to Barrick are the main reason why it may make sense to overlook the geopolitical risk and pursue it.

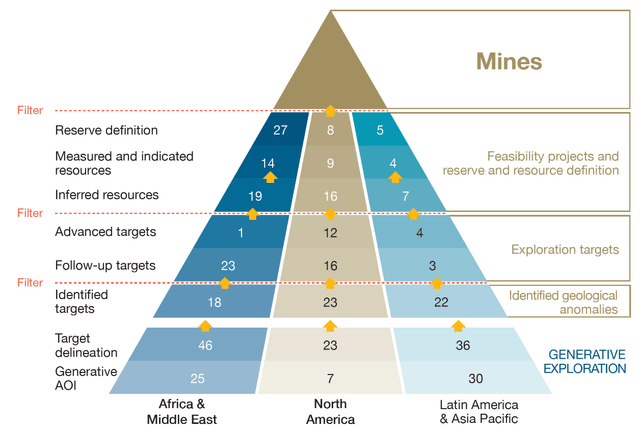

Reserves in millions of ounces (Barrick Gold)

As we can see, Barrick is counting on a constant trend of upgrading resources in order to replenish reserves and maintain production at its existing assets. That can extend the life of existing projects, but it is not a platform for potential expansion. The Pakistan project would represent a major expansion, which would not be possible without the Reko Diq decision going in its favor.

Phase 1 & Phase 2 would together add about 670,000 troy ounces/year in new gold production, based on the data I mentioned, for many decades to come. That is an extra revenue addition of almost $1.2 billion per year half of it going to Barrick, before subtracting royalties and so on. The copper extraction revenues would eclipse gold, with 384,000 tons of production per year. It would bring in as much as almost $3 billion in yearly revenues, before royalties. Half of those copper revenues will also be attributable to Barrick, given that it has a 50% interest in the project. We should keep in mind that royalties on Barrick’s share of the production are likely to be a volatile variable in Pakistan, with rates changing frequently.

Barrick’s revenues would see a significant rise, with a yet-to-be-determined impact on profits if the project will get the green light

For the first nine months of the year, Barrick saw revenues of $8.24 billion, with net earnings of $1.17 billion, for a profit margin of over 14%. Based on these results, the Pakistan project would lead to an increase in revenues by about a fifth, and assuming similar profit margins, net earnings would rise by about a fifth as well. Whether the latter will be true in practice depends on many factors, such as what the final royalties regime will look like and whether that might change in time or not. It also remains to be seen just how profitable the exploration of the reserves will be in practice.

It should be noted that Barrick’s current debt of $5.1 billion would see a surge as well. These are not optimal times to take on large debt-fueled projects, given the higher interest rate environment faced by markets. As more debt will be incurred, and old debt is gradually rolled over at higher interest rate levels, debt-servicing costs could become a factor in affecting profitability. On the other hand, a low-wage environment and other cost advantages could in theory more than offset any operational disadvantages, such as poor infrastructure, and perhaps even higher security costs associated with working in a volatile region.

Investment implications

If this project will get greenlighted by the Pakistani authorities, on one hand, Barrick’s stock needs to be re-evaluated for much higher reserves, significantly improved revenues and assumed profits prospects going forward. On the other hand, we have a higher geopolitical risk profile, which increasingly needs to be priced in as well, as difficult as that might be. We also have to factor in the costs to investors in terms of the financing of the project, regardless of how Barrick will approach it.

On balance, I see it as a positive for long-term investors, especially within the context of what I see as a continued global commodities bull market for much of the rest of the decade. While I did not discuss it in this article, I also see improved prospects for a significant long-term gold price leap, on higher inflation, more fiat system global-scale volatility, as well as a weakened argument in favor of various cryptocurrencies as an alternative to precious metals as a store of value. For these reasons, while I do see the risks involved, I find the potential go-ahead of this project for Barrick Gold Corporation to be a significant net positive.

Be the first to comment