jetcityimage/iStock Editorial via Getty Images

Investment Thesis

BARK (NYSE:BARK) is a straightforward business trading at a heavily discounted valuation. The company is unprofitable and has some inventory issues, but the stock may make sense as a highly speculative investment. I believe the company may be significantly undervalued if it can reach profitability. I’m monitoring upcoming earnings reports to see the progress the company is making towards its goals.

BARK’s Operations

BARK has a simple purpose and business model. The business sells products to dog owners, primarily through direct-to-consumer subscriptions. All the products are created and branded by BARK. The company has stayed focused on this model since it was established ten years ago. In fact, the business is still led by one of its founders.

I like the company’s subscription based approach to its business. Companies which sell their services as subscriptions typically have more sustainable finances and aren’t as vulnerable to short term spending headwinds.

Secondly, businesses dealing with people’s pets are generally more recession resistant. I doubt the business will see a dramatic drop off in subscribers, even if growth moderates in the short term.

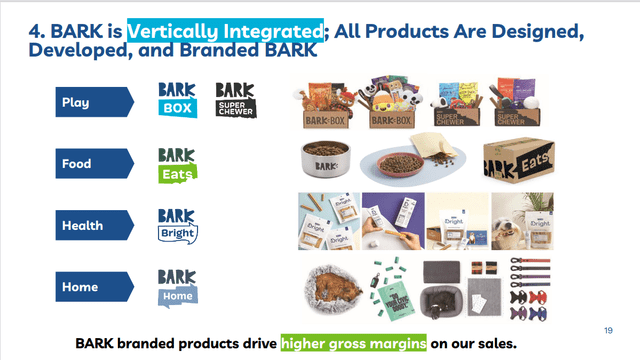

BARK’s Products (Bark May 2021 Investor Presentation)

The company is trying to leverage these advantages to strengthen its revenue base. Over the business’s lifetime, it has primarily focused on selling pet toys and treats. Now, the brand has started to expand its offerings. The company is focusing on more sustainable, defensive, and profitable product types.

In particular, the company is shifting its primary focus to its “BARK Bright” and “BARK Eats” offerings. These represent the company’s entrance into the dog healthcare and dog food businesses. There are limited operating results for both of the business segments. However, management seems confident in its ability to grow these segments using its existing customer base.

Growth

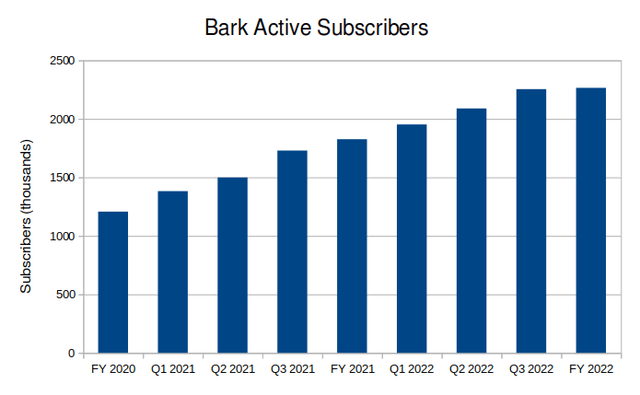

BARK’s growth has been strong over the past few years. The company has posted a net increase in subscribers each quarter for the past two years. The company’s revenue for both its direct-to-consumer and commerce segments have consistently increased year over year. These are strong metrics, although I’m curious how they will hold up during the upcoming quarter.

Created by author using data from 10-K and 10-Q filings

Not all metrics are positive, however. The company is experiencing significant revenue churn. Specifically, shipments over the last year have a churn rate of 7% per month, which seems very high to me. The company has to recruit a significant number of new customers each quarter just to maintain its current subscriber base.

The company expects top line growth to moderate over the next few quarters. BARK’s primary focus is now on new, more defensive segments. On its third quarter earnings call, management predicted that this shift would slow revenue growth in the near term.

Early results for these new segments seem promising. On their last earnings call, management said BARK Bright orders saw 121% year over year growth. That’s around 236,000 orders for the past year. These orders also have a 60% higher value than orders for toys. The CEO went on to say that the company’s food offerings are showing a similar growth trajectory. I believe these segments could provide a sustainable, resilient revenue base for the company in the future.

Inventory Control Issues

During my research process, I found that BARK is having some trouble managing its inventory. BARK wrote down $13 million in inventory in the last quarter. On the last earnings call, the company’s CEO described these as “shrink and other inventory related charges.” Management seemed evasive about the exact causes of this shrink, even when asked directly.

I think this may be related to a section recently added to the business’s latest 10-K filing. The company said it had “material weaknesses” in its financial reporting. The section implies that there was a lack of independent monitoring for account balances and inventory management.

Management insists that these problems have been fixed, and that controls won’t be a reoccurring issue going forward. But there isn’t enough clarity on exactly what these issues are for me to draw a conclusion on how this affects the investment. I still think this may be a risk, and I’ll have to watch upcoming earnings reports for related charges.

Valuation

The most notable part of BARK’s stock is its valuation. The stock is trading at a 10% premium to its book value. Adjusting for debt, the company’s enterprise value is about $115 million. This is extremely cheap for a company that made over $500 million in revenue last year. The business isn’t in decline, either. BARK grew its top line by over 30% last year. Management projects an increase of about 10% next year.

The company’s gross margins are solid as well. The company’s gross margins for its direct-to-consumer business are consistently around 60%. This gives BARK significant room to generate an operating profit.

It’s difficult to put a specific price target on the company. But BARK is currently trading at under 0.23 times EV/Revenue. This is a company with the potential for double digit operating margins. For a profitable company with this profile, I’d be willing to pay at least one or two times EV to revenue. I think it’s fair to say that the stock has significant upside if the company manages to become profitable.

Profitability

I’m most concerned by BARK’s profitability. Like many of its direct-to-consumer peers, the company is consistently losing money. This is offset by the business’s significant cash hoard. But free cash outflows for the past year are about the same as the company’s current cash on its balance sheet. The company has to shift its current trajectory to avoid becoming stuck in a poor financial position.

But unlike some of its peers, BARK’s management does seem to consider profitability as one of their top priorities. On its last earnings call, management gave promising profitability guidance for the next year.

For the first quarter of fiscal year 2023, we expect an adjusted EBITDA loss of $18 million, or roughly half of the full year loss in the first quarter. From there, we expect many of the operating and performance improvements we’ve made to the business will begin to materialize. While we are living in unpredictable times, and highly confident our ability to execute and deliver sustainable growth long-term. We will remain laser focused on capital efficiency and with $200 million of cash on the balance sheet, we believe that we have more than enough cash to get us to profitability.

This indicates to me that management is trying to get close to break even by the end of the year. I think this may allow the company to at least stop burning cash. Typically, just being profitable isn’t much of an achievement. But I think it is relevant for a company trading at such a low valuation. Even a modest profit could make the company’s stock undervalued. And, unlike many other speculative growth companies, I believe BARK has a reasonable path to profitability.

BARK’s Key Product Lines (Bark May 2021 Investor Presentation)

The company is actively focusing on its higher margin products (Bark Bright and BARK Eats). These products are also more defensive and will likely have lower churn associated with them. This means less money is spent advertising to new customers.

It helps that the company has an extensive list of existing customers to sell to. This data may be a key competitive advantage for BARK. These existing customer relationships decrease the cost of acquiring customers for newer services.

Final Verdict

I don’t feel there’s enough clarity into BARK’s operations to confidently buy its stock. But I believe the stock could increase by 100% or more if it simply becomes profitable. For this reason, I think it makes sense as a speculative buy for growth investors with a high risk tolerance.

Either way, the company’s next two quarters are going to be critical. I’ll be watching and analyzing these upcoming earnings reports. If the company posts meaningful progress towards profitability and the valuation stays the same, I may move BARK’s stock to a strong buy.

Be the first to comment