AmandaLewis/iStock Editorial via Getty Images

Barclays (NYSE:BCS) has quite a diversified business model which includes both a bulge bracket investment bank as well as the UK and U.S. consumer banks (the latter is a Credit Cards business). This positions it well to weather the current macro environment.

It targets RoTE above 10% for full-year 2022 even when you include the Legal and Conduct costs of GBP500 million expected in Q2’2022. Amazingly, it trades at just over ~0.5x tangible book value which suggests an earnings yield close to ~20% given the current share price.

Barclays has a strong capital ratio (“CET1”) of 13.8% as of Q1’2022 which is above the mid-point of its 13% to 14% target. As such, it is expected to generate a significant amount of excess capital with an earnings yield of 20%.

Shareholders should therefore continue to benefit from very accretive buybacks as well as a progressive dividend.

The main concern currently holding the share price back relates to the global macroeconomic uncertainties and especially the fears of a recession both in the UK and the U.S.

(All charts are taken from the Barclays Investor Relations website)

The current macro situation and banks

This is quite an interesting macro situation for a bank like Barclays.

The investment bank clearly benefits from the volatility in its trading desks. And the current volatility in fixed income, as well as FX, is a bonanza for the large investment banks. Institutional investors are forced to keep on repositioning their fixed income portfolios and the bid-offer gaps are wider than usual. So the intermediaries, such as BCS, benefit from both volumes and margins. Similarly, corporates’ treasuries are also very active in seeking to hedge interest rates and FX exposures.

These revenue tailwinds, however, are somewhat offset by lower income on the Banking side as debt and equity issuances dry up and M&A advisory mandates are mostly on hold.

Overall though, the trading revenue benefits should outweigh the slow issuance markets. And once the market turmoil ends, there will be a revenue catch-up in debt, equity issuance as well as M&A advisory – so most of that income will be delayed as opposed to lost revenue.

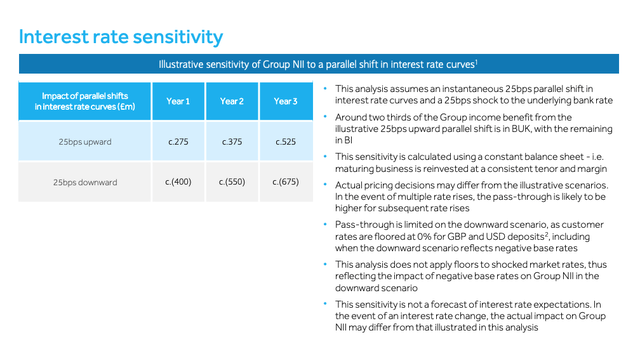

On the consumer side, banks benefit from a hike in interest rates. BCS provided an illustrative forecast of what a +25 bps parallel hike means for its pre-tax income:

As can be seen from above, a mere increase of 25 bps is forecasted to contribute as much as GBP525 million pounds to the bottom line. Currently, it is expected that the Bank of England could raise rates to as high as 3% (or even higher). Whilst I am not proposing one should extrapolate the above projection linearly (given deposits betas are higher as interest rates increase), it would still likely mean several billions of incremental pre-tax income that would go straight to the bottom line.

Credit risk and recession

On the flip side, the main risk investors are concerned with is outsized credit losses in a recession scenario. This is likely to manifest mainly in the U.S. and UK unsecured lending (i.e. mainly the Cards business).

This is a valid concern of course but Barclays has a very conservative provisioning methodology. The CFO recently explained this in an analysts’ meeting:

….I would say in terms of pressure, in the opposite direction, we obviously have the uncertain macroeconomic environment that we have now. There is the question of credit risk. We feel like we are well covered, we’ve got a good balance sheet position. So, if you look at our unsecured ratios or even if you look at the totality, we’ve got £6.0bn on the balance sheet, £3.5bn of which is against non-defaulted stock, so well prepared in terms of impairment

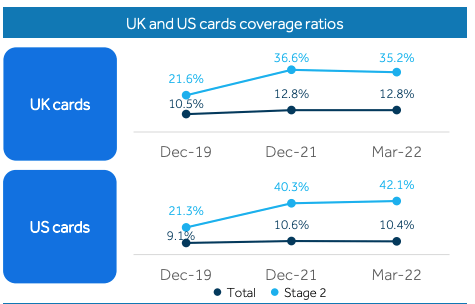

This can also be seen in the Q1’2022 earnings presentation:

Investor Relations

As can be seen from above, the coverage ratios (i.e. level of provisioning) are still significantly higher than pre-pandemic, even though, Barclays expects lower credit charges in the next few quarters. Barclays is clearly sandbagging should the macro-environment significantly deteriorate.

Final thoughts

The thesis is relatively straightforward. Barclay’s diversified business model is resilient and should benefit from an inflationary environment.

The upsides include a trading income bonanza, higher yields, and nominally higher GDP (and spending in the economy benefiting its Payments division).

The potential risks (predominantly credit risk) are well-managed by careful risk management and a conservative level of provisioning.

The firm is set up to deliver ~20% earnings yield (sustainably so) yet trades at 50 cents in the dollar.

At the same time, it takes advantage of the distressed valuation by buying back stocks.

Investors should look through the noise and realize the value in the shares at the current share price. I remain very bullish.

Be the first to comment