hatman12/iStock Editorial via Getty Images

Banks make their profits from the spread between the funds they take as deposits and the loan rate they lend out at. In the US, the Federal Reserve sets the “Federal Funds Rate” often referred to as the general “interest rate”. This is the overnight borrowing rate for banks and it’s used to influence monetary policy by raising the cost of credit and helps banks set their interest rates for consumers. In the UK, this is called the bank of England base rate, which has already been raised and is expected to continue to be increased in order to curb inflation. The Bank of England expects inflation to be a sky high 8% in spring and will take a couple of years to come back down to the 2% target.

When interest rates rise, banking profits can increase as their net interest margin (NIM) expands. Thus in this post I have done an overview analysis of the top four UK banking stocks across a variety of metrics. Barclays (LSE:BARC) (NYSE:BCS) scores the highest for liquidity as measured by CET1. In addition, the stock scores the 2nd highest across quality metrics such as Net Interest Margin (NIM) and Return on Equity. The stock is also cheapest on both a P/B and P/E Ratio. Let’s dive into the UK banking overview for more details.

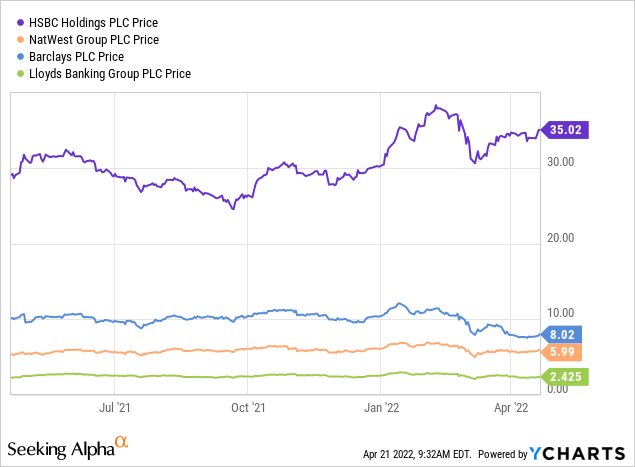

Price Action

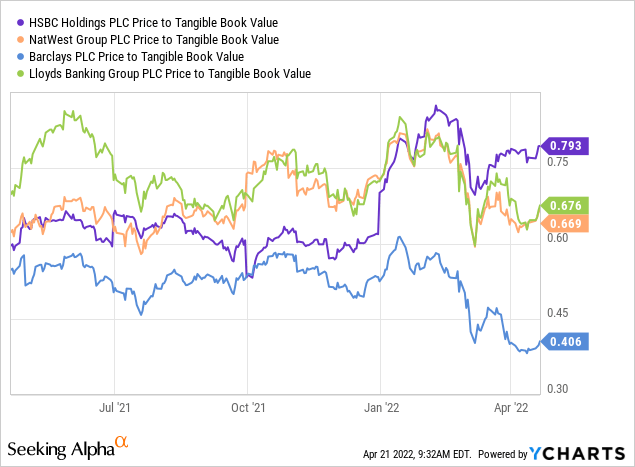

UK Bank stocks HSBC (HSBC), Lloyds Banking Group (LSE:LLOY) (LYG) Barclays and NatWest (NWG) have seen their share price recently start to slide as the economy adjusts back from the stimulus “sugar rush” in 2020 and 2021.

UK banking Stocks (Ycharts)

High inflation numbers have led some news outlets to believe a recession is coming. In general rising interest rates can increase bank profit margins, but if they rise too much or too fast this can cause an economic slowdown as the cost of credit rises, which reduces business profits and household income.

Overview: Top U.K. Banks

NatWest and Lloyds are truly domestic players and have large exposure to UK businesses and retail banking. This can be a positive if the UK economy does well, for example NatWest recently reported profits of close to £3 billion ($3.9 billion). Whereas Lloyds Bank tends to correlate performance strongly with the housing market as the largest mortgage provider in the UK. However, this domestic focus is a risk due to lack of revenue diversification.

Barclays offers the best of both worlds, they have a large retail banking operation in the UK and a global investment bank. However, investment banking does tend to be an area of volatility when it comes to profits. For example, the company’s first half results show £11.3 billion in income and £6.6 billion coming from the investment banking division, thus profitability swings could be expected.

HSBC is “the world’s local bank” they have a strong focus on Asia which makes up the majority of their revenue (64%) and Europe makes up another sizeable chunk at (20%). The company is investing several billion dollars into their wealth management division in China. They recently increased their stake in Chinese broker Qianhai Financial Holdings. They have regulatory approval and have received a license to trade via a Joint Venture, this gives HSBC a unique foothold in the region.

Metrics Comparison

I will compare these top UK banks across five metrics:

-

Common equity tier 1 capital. (CET1) which is a measure of liquidity or risk.

-

Net Interest Margin (NIM) measure of profitability.

-

Return on Equity (ROE)

-

Price to Book (PB) ratio measure of value.

- Price to Earnings Ratio

I will explain these metrics in detail in each section to avoid confusion.

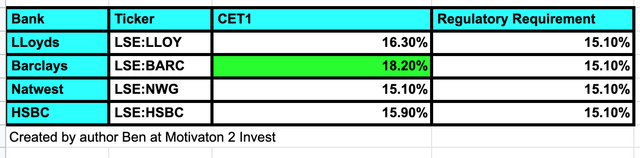

Liquidity (CET1)

The CET1 (Common Equity Tier 1) can be thought of as a measure of liquidity or risk. This is a capital measure which was introduced in 2014 to protect the economy from a financial crisis. All Eurozone banks should have the minimum CET1 ratio of 15.1% of risk-weighted assets in 2022, which has increased from 14.9% in 2021.

UK Banking stocks (created by author Ben at Motivation 2 Invest)

Each of the Banks has strong liquidity measures, but Barclays is the highest with 18.2%. This means that this particular bank could be one of the most secure during a financial crisis, assuming their investment banking division maintains stable.

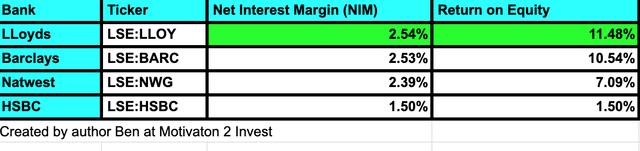

Quality And Profitability

Next we analyze each company’s profitability via the Net Interest Margin (NIM). This is a measure of the spread between what banks borrow credit at and what rate they lend it out at. In this case HSBC scores the lowest which could be due to the ginormous size of the company or just high operating expenses. Lloyds scores the highest at 2.54% which indicates they have the most efficient operation.

UK Banking stocks (created by author at Motivation 2 Invest)

If we also take a look at Return on Equity (ROE) Lloyds has the highest with 11.48% and Barclays has the 2nd highest at 10.54%. Return on equity (ROE) is calculated by dividing net income by shareholders’ equity. Shareholders equity is equal to a company’s assets minus its debt, thus ROE is considered the return on net assets. ROE is basically a measure of management’s ability to generate profits from the equity they have.

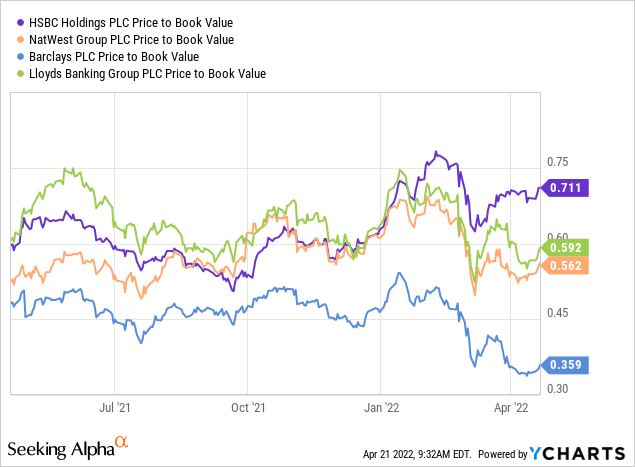

Value

In terms of Price to Book value, Barclays is the cheapest with a P/B = 0.359. This may be a reflection of the market pricing in the risk of the potentially more volatile investment banking cash flows.

Price to Book Value UK banks (created by author at Motivation 2 Invest)

The Price to Book value divides the market value of the company (market capitalization) by the net assets of the company. A lower Price to Book value relative to competitors is generally better as it means you’re paying less for every dollar of the company’s assets. We can also use price to tangible book value (P/TB) which removes “intangibles” such as “goodwill” from the calculation, this is often a better measure in my eyes. Barclays again comes out the cheapest by this measure.

P/TB ratio (Created by author Ben at Motivation 2 Invest)

Which Is The Best?

Each of the largest UK bank stocks offer a unique prospect for an investor’s portfolio. Lloyds offers exposure to the UK housing market which has historically been very strong. HSBC offers exposure to rapidly growing Chinese and Asian Markets. For the best of both worlds, I favor Barclays which scores number one for CET1 and a very close second for their Net Interest margin and Return on Equity. In addition, Barclays trades at the lowest price to book value of the bunch. The major risk with their bank is the volatile nature of the investment banking industry but this does offers growth potential.

Be the first to comment