JHVEPhoto

The big Canadian banks, such as Bank of Montreal (NYSE:NYSE:BMO)(TSX:TSX:BMO:CA), are some of the best investments that provide stable long-term growth. Is it a good time to buy BMO stock? Let’s find out!

[Bank of Montreal reports in Canadian dollars, so the figures below are also in C$ unless otherwise noted.]

BMO is even older than Canada, as the former has its roots stretching as far back as 1817, whereas Canada was founded in 1867. Over the years, BMO has worked its way up to become the eighth-largest North America bank by assets.

The economy is not at all rosy right now. Among others, billionaire Ray Dalio is predicting a recession coming to the U.S. And if so, Canada wouldn’t be unscathed and will follow as it has in the past. And these are the key markets for BMO.

Bank results are tied to economic health

Bank results are sensitive to economic boom and bust. For example, during the recession due to the global financial crisis around 2008 and the short-lived recession in 2020 because of impacts from the coronavirus pandemic, BMO and its big Canadian bank peers witnessed declines in their earnings.

Particularly, BMO serves more than 12 million customers with core markets in Canada and the United States. Specifically, in fiscal 2021, the bank generated net revenue of 58% in Canada and 36% in the U.S. By operating segment, it reported net revenue of 34% in Canadian Personal & Commercial Banking, 21% in U.S. Personal & Commercial Banking, 23% in Capital Markets, and 22% in Wealth Management.

It’s a good thing to be able to concentrate resources in two key markets. Unfortunately, there’s an increased likelihood of recession in both Canada and the U.S.

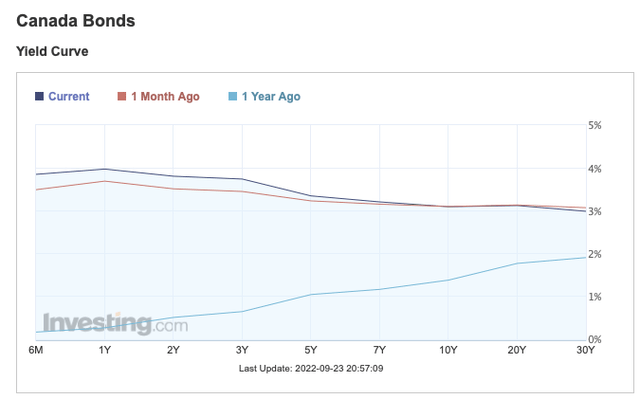

You’ve probably heard of the unsettling inverted yield curve that’s happening in both countries now, where short-term interest rates are higher than long-term interest rates for debt of the same credit quality.

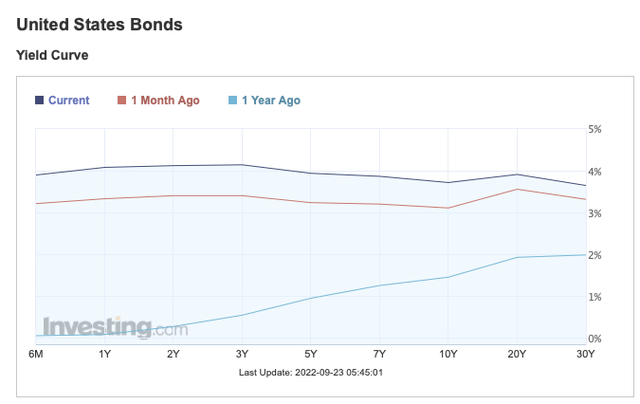

The yield curve looks similar in the U.S. as well.

Both graphs show that a year ago, the yield curve indicated a normal and healthy economy, where the yield curve had a positive slope. A normal yield curve makes sense because longer-term debt pay out higher interest rates for the greater interest rate risk. (The longer the duration of the debt, the higher probability interest rates will change.)

Today, short-term interest rates are rising too quickly, which will drive bond prices lower. As well, historically, inverted yield curves have preceded recessions. The higher chance of a recession from high inflation and central banks (Bank of Canada and the Federal Reserve, respectively) raising the benchmark interest rates to curb inflation are what have been weighing on stocks, including BMO.

In the past two recessions, BMO saw meaningful drops in earnings, but it maintained or increased its dividends. For example, based on ex-dividend dates, BMO froze its dividend from October 2007 to July 2012 around the global financial crisis.

Similarly, it froze its dividend from January 2020 to October 2021, as restricted by the Office of the Superintendent of Financial Institutions, which regulates federally-regulated financial institutions in Canada to ensure the soundness of the country’s financial system.

Profitable and above-average growth

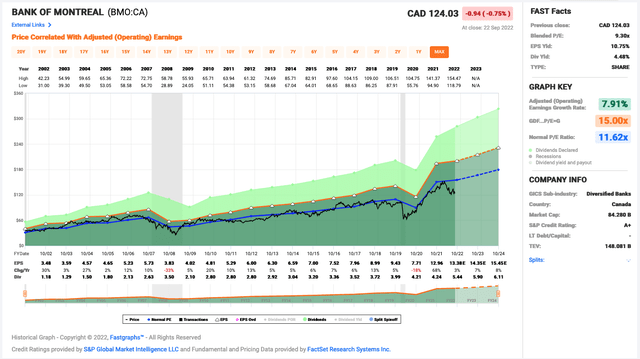

The bank has medium-term objectives of adjusted earnings-per-share (“EPS”) growth to be 7-10% and average annual adjusted return on equity (“ROE”) of at least 15%.

Its three-, five-, and 10-year adjusted EPS growth rates are 13.0%, 11.5%, and 9.4%, respectively. All periods exceeded the midpoint target of 8.5%, which is impressive.

Its 10-year adjusted EPS growth rate beat the Big Five Canadian banks’ average rate of approximately 8.0% in the period — as did its five-year rate beating the average of 8.9%.

Its three-, five-, and 10-year adjusted ROE are 13.6%, 13.8%, and 14.0%, respectively. When the economy doesn’t do well, it’s natural that its ROE would be lower.

For example, in 2020, in which the North American economies were negatively impacted by economic shutdowns from the coronavirus pandemic, BMO’s adjusted ROE was 10.3%.

Actually, consistently getting adjusted ROE of about 14% is decent, although it would be better if it could achieve higher adjusted ROE, as it targets, going forward.

Regardless, because of the tendency of higher earnings growth than the average of the Big Five Canadian banks, BMO stock has outperformed the industry (using the BMO Equal Weight Banks Index ETF (TSX:ZEB:CA) as a proxy) in the last one, three, five, and 10 years in terms of total returns.

As of writing, BMO’s 10-year annualized returns were 12.47%, beating the industry’s 10.86%.

Is BMO stock a Buy yet?

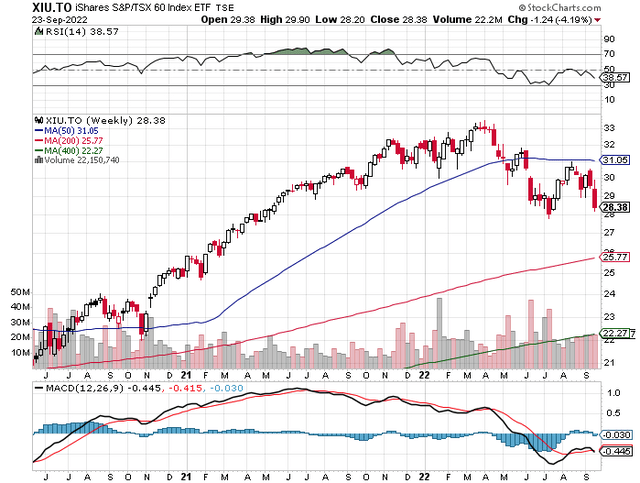

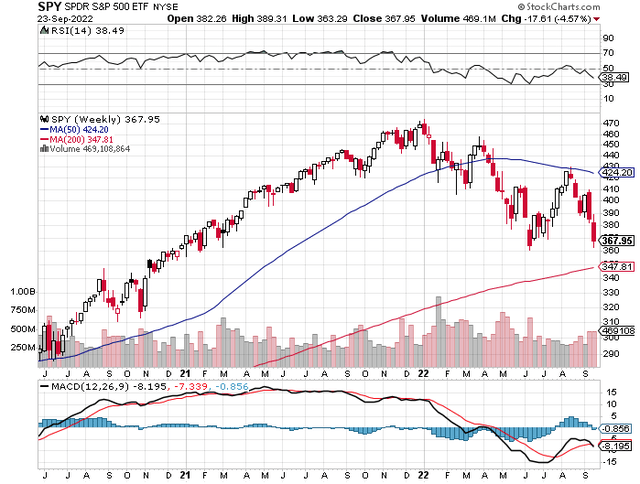

From a macro point of view, we’re not out of the woods yet. Stock markets are leading indicators of the economy. Both the Canadian and U.S. stock markets, using iShares S&P/TSX 60 Index ETF (TSX:XIU:CA) and SPDR S&P 500 ETF Trust (SPY) as proxies, haven’t shown signs of basing yet.

However, by the time stocks recover, the economy would already be healthy and fine again.

Therefore, we prefer to focus on the underlying business. Given BMO’s long history of operation (being the oldest bank in Canada) naturally leads to it being the Canadian company with the longest dividend streak. 2022 marks the 194th consecutive year of BMO paying out dividends.

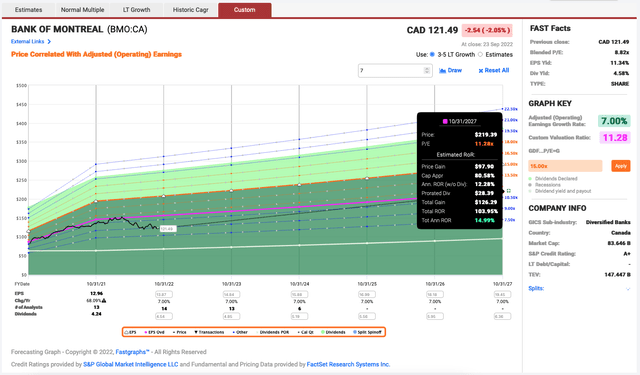

At C$121.49 per share, BMO stock trades at a discount of approximately 19% from its long-term normal valuation. It’s not at bargain levels yet, but it’s still a nice discount versus earlier this year. (It’s down 21% from its 52-week high.)

Currently, BMO stock offers a decent yield of almost 4.6% on an estimated payout ratio of about 41% this year, which would be at the low end of its target range of 40-50%.

Let’s be conservative and assume an adjusted EPS growth rate of 7% (the low end of management’s target) and valuation expansion to its long-term normal valuation of 11.28 times earnings — the stock would deliver annualized returns of close to 15% over the next five years or so.

This return would roughly double the August inflation rates in Canada (7.0%) and the U.S. (8.3%). So, parking money in a solid bank like BMO is a good way to go for long-term investors. Besides, no one expects a prolonged period of high inflation because central banks would do their job by countering it with rising interest rates.

Investor Takeaway

We don’t know when the market will bottom or how bad a potentially soon-to-come recession would be. However, we think it’s a good idea to accumulate shares on weakness of quality dividend stocks like BMO that pay nice dividend yields, tend to outperform the industry, and can more than maintain investors’ purchasing power over the long term.

Be the first to comment