sockagphoto/iStock Editorial via Getty Images

The Bank of Canada is in a pickle.

Their primary job, as per their annual report, is to conduct monetary policy to “preserve the value of money by keeping inflation low, stable and predictable.”

As they’ve been fighting the rise in inflation this year, they’ve used the most effective tool in their central banking tool kit of raising interest rates.

Yet as they conduct monetary policy to achieve their goal, they’ve wreaked havoc on the Bank’s own finances.

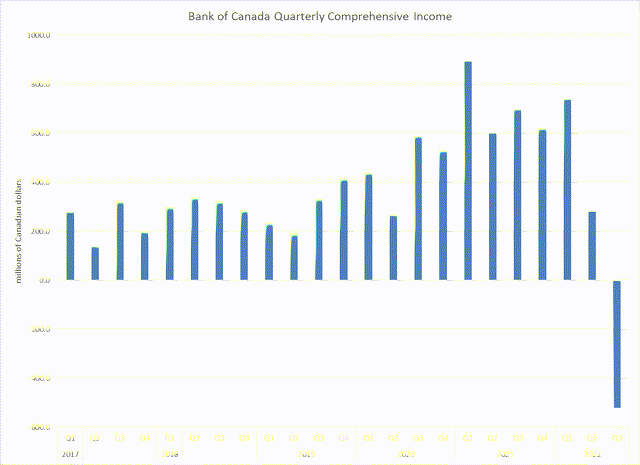

The recently released quarterly report for the period ending September 30, 2022 showed a loss of C$522 million. This is the first loss reported in the 88 year history of the Bank of Canada!

Extricating themselves from this situation will be a challenge.

Inflation

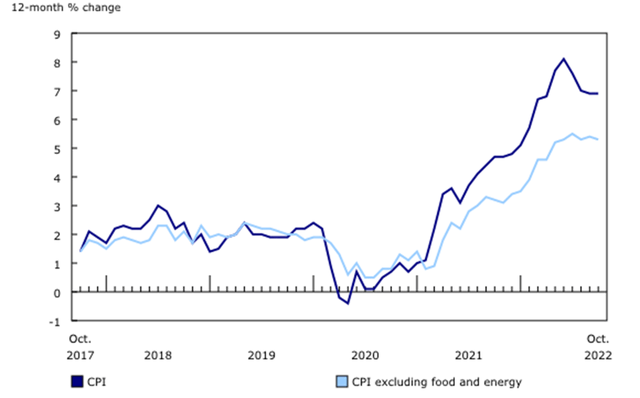

The main objective of the Bank of Canada’s monetary policy framework is to uphold their inflation target of 2%. They set a band of +/- 1% around this central point as their working range.

As can be seen in the chart below, inflation had been quite stable over the past several years, until the band was breached in March 2021.

Inflation continued to climb, reaching a peak rate of 8.1% in June 2022. This represented the highest inflation rate in 40 years!

While the CPI has moderated somewhat, to 6.9% in October, it still remains too high.

Bank Policy Rate

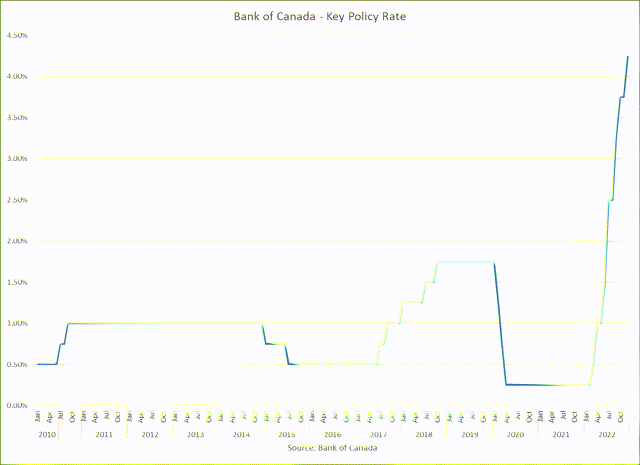

As inflation began rising in the spring of 2021, the Governing Council felt that the uptick was due to pandemic related bottlenecks and was temporary.

It wasn’t until the first quarter of 2022 that they became concerned enough about the more structural inflationary pressures and began to act. The Policy Rate was increased by 25 basis points in March. This first move was quickly followed by 6 subsequent rate hikes as they shifted policy to catch up with the inflation problem.

In total, the Policy Rate was raised by 400 basis points to the current rate of 4.25%, the highest level in 14 years.

Bank of Canada Balance Sheet

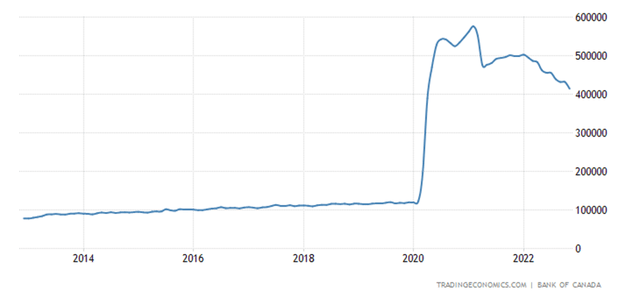

The Bank of Canada resorted to an extraordinary amount of Quantitative Easing (QE) during the pandemic to provide liquidity and monetary stimulus to bolster the economy from the effects of the pandemic. They did this through the purchase of Government of Canada bonds.

The balance sheet exploded from C$120 billion to a high of C$552 billion.

Bank of Canada Total Assets

In C$ millions

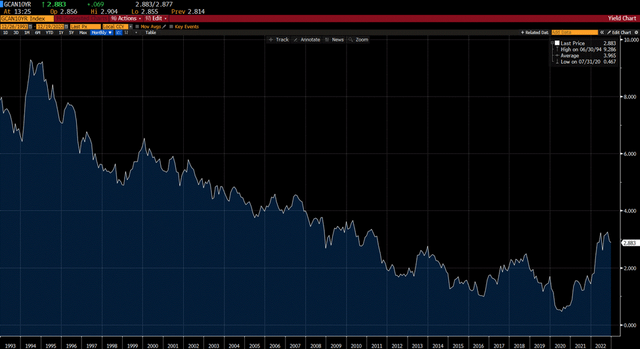

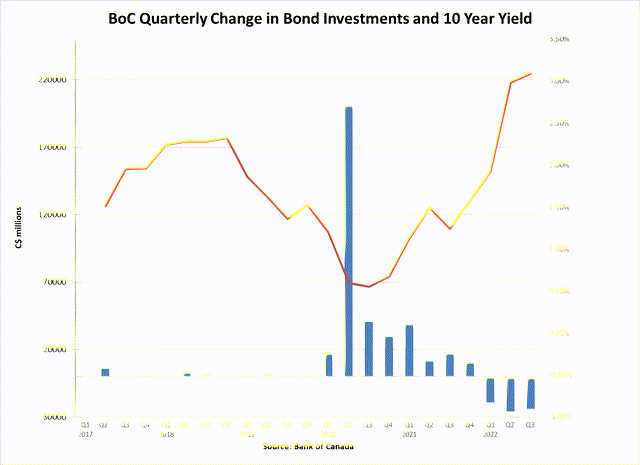

The goal of QE was to lower interest rates to encourage borrowing and to stimulate the economy. The Bank of Canada was successful in doing this as the 10 year yield fell to 0.47% in July 2020, the lowest in its history.

The bulk of the new bond purchases occurred when interest rates were at this historically low level. The Bank purchased C$271 billion of bonds, or 67% of their total portfolio, when rates were below 1.0%. They purchased an additional C$77 billion of bonds, or another 20% of their portfolio, when rates were between 1%-2%. As a result, 87% of the Bank of Canada investment portfolio was purchased when rates were below 2%. Today, with the 10 year yielding 3.0%, the entire portfolio has a market value lower than its cost.

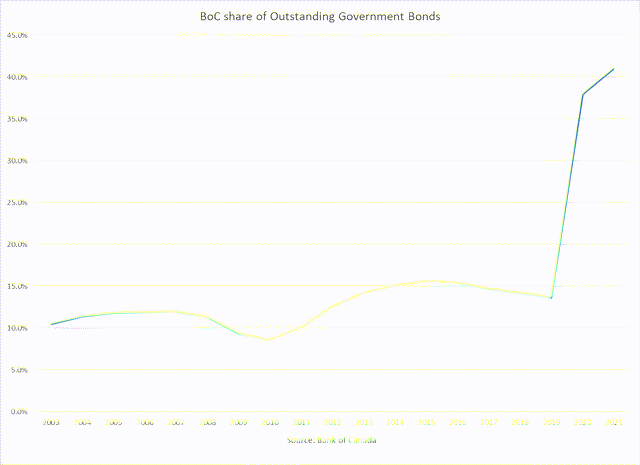

As the Bank increased their bond holdings during QE, they became the primary owner of government debt. Their holdings of Canadian government debt increased from 14% in 2019 to 41% by 2021. As the government borrowed huge quantities of cash to fund their fiscal operations during the pandemic, the Bank of Canada was the main willing buyer at record low rates.

Between 2019, before the pandemic, and 2021 as the pandemic was winding down, the Government of Canada borrowed C$408 billion in the debt market. Of that, the Bank of Canada purchased C$326 billion, or 80% of the new issuance!

Now that Quantitative Tightening (QT) has started and the Bank is no longer buying government debt, a new source of demand must emerge. This has put upward pressure on interest rates.

QE has caused a few problems at the Bank of Canada

First, the assets that the Bank purchased during this period were longer term fixed rate bonds. However, these purchases were funded with variable rate liabilities. This created an asset/liability mismatch, which subjected the Bank to significant interest rate risk. As interest rates have risen, their earnings on their assets remain fixed at a relatively low rate while the cost of their liabilities is rising. This is what caused the C$522 million loss in the third quarter.

The bank projects that they will continue to incur operating losses at least through 2024.

Second, as interest rates have risen, the value of the Bank’s holdings have declined. This event, though, was anticipated when the QE engine was cranked up during the second quarter of 2020 and the Bank made proper arrangements for when it happened. In conjunction with the Government of Canada an Indemnity Agreement was put in place whereby the Government will indemnify the Bank for any losses occurring as the result of asset sales.

Since most of the assets are carried on the balance sheet at Fair Value, the amount of this potential indemnity also shows up on the balance sheet. It is listed as an asset and called “Derivatives-indemnity agreements with the Government of Canada.”

As of September 30th, this Derivative asset was C$31.5 billion. This is the potential liability to the taxpayers for the Bank’s unrealized losses. The Banks Total Equity is only C$954 million. Consequently, the unrealized loss is 33 times the Bank’s equity. If interest rates continue to rise, this Derivative asset will only grow larger.

The bank has been shrinking their balance sheet, mainly through security maturities and roll-offs. This is part of their QT policy that was implemented in March 2022. As of September 30, total assets have decreased by C$120 billion, a 22% decline.

Implications

Tiff Macklem, Governor of the Bank of Canada, has addressed these problems. Speaking before the House of Commons finance committee he said losses don’t affect the central bank’s ability to conduct monetary policy.

He said “Our policy decisions are driven by our price and financial stability mandates. We do not make policy to maximize our income.”

To a certain extent, this is true. The Bank can cover operating losses by drawing down a reserve fund, and there is even the possibility of allowing the equity to go negative for a period of time. But this is not an ideal situation.

Central banks have the ability to create reserves to cover their obligations, but this is inflationary. It therefore would exacerbate the problem they are trying to solve with their monetary policy.

There are also political implications for reporting significant losses. This puts the burden on the taxpayers, and could create public pressure for unsound policies.

It also could lead to credibility problems within the Bank. For a central bank to be effective, they must have the confidence of the marketplace, and without this they are lost.

The Bank of Canada has to figure a way out of this pickle.

Be the first to comment