Starcevic/E+ via Getty Images

Opportunity Overview

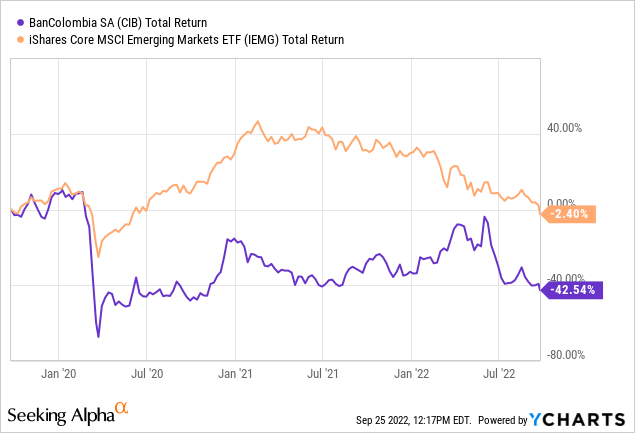

I took advantage of last week’s pullback in equities, coupled with the declining oil price, and have initiated an initial position in Bancolombia SA (NYSE:CIB). Bancolombia SA is Colombia’s largest bank and operates in other regional companies. Colombia is an attractive emerging market destination, which will likely outperform the MSCI emerging markets Index. Some positive factors include:

-

Colombia’s economy grew at a record pace this year

-

Equities in South American markets, including Colombia, trade at record low valuation

-

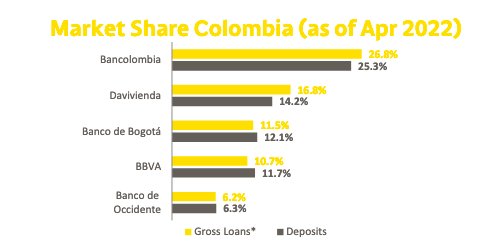

Bancolombia has a strong market share in Colombia and other markets and had double-digit loan growth this year

-

Stocks in Colombia trade near a decade low

YCharts

There are many key risks to investing in Colombia and emerging markets, which is why I’m starting with a smaller position and gradually accumulating. Below are some of my main concerns:

-

There will likely be additional Fed rate hikes later this year, which will spook equity markets. There is not a clear indication that supply-side issues have been resolved, and rate hikes will likely not have a major impact on inflation.

-

Colombia’s economic growth will decline from the higher base experienced during the first half of this year. This will result in lower loan growth/ROE for banks in Colombia.

-

Emerging market risks have been accelerating, primarily related to sovereign debt and inflation. China/Taiwan tensions would greatly disturb the MSCI Emerging Markets Index.

The Global X MSCI Colombia ETF (GXG) is also a decent vehicle to gain exposure to Colombia, but I prefer investing in Bancolombia and other ADRs.

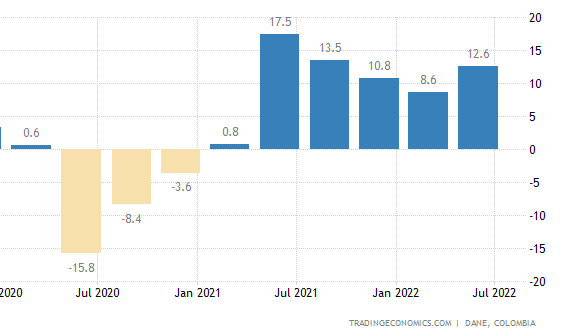

Growth to Decline in 2023

Colombia’s GDP growth has exceeded expectations in recent quarters, but growth will likely decline in subsequent years. GDP grew by 12.6% during Q2 2022, compared to the previous projection of 8.6%. Colombia’s quarterly GDP growth was slightly above 3% before Covid and has fluctuated significantly.

Trading Economics

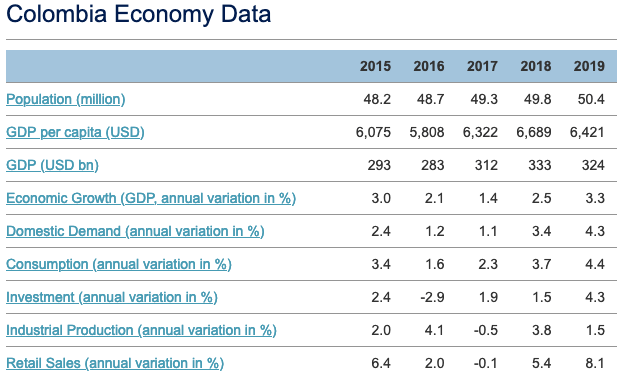

The OECD projects 6.1% growth this year and 2.1% GDP growth in 2023. Before COVID, Colombia’s economy was only growing between 1.4-3.3% per year, so projected growth in 2023 would be in line with historical norms.

Historical Growth Before COVID

Focus Economics

However, other indicators, such as rising inflation and unemployment, are on the rise, which could result in lower growth. For example, unemployment was between 14-15% during 2020-2021, near its multi-decade (1999-2000) historical high of 20%. Growth below 3% is not out of the question.

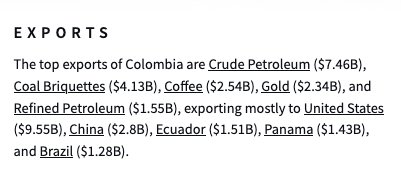

Export Trends

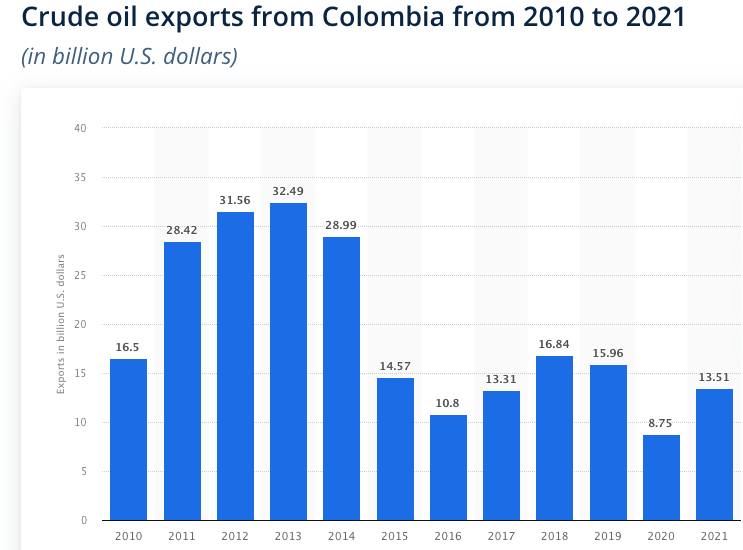

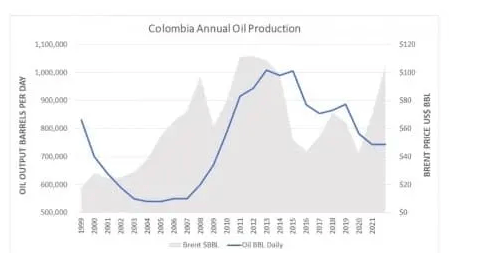

Crude/refined petroleum and coal exports account for 41% of Colombia’s total exports, and around 38.3% of its exports go to China and the United States. Colombia does plan to attempt to diversify away from oil exports into other categories, yet commodity price movements have allowed Colombia to achieve above-average growth relative to regional peers.

OEC

Colombia’s crude oil exports grew by 54% during 2021 but are still well below 2013-2014. However, crude exports of around $13.5 billion in 2021 only represented approximately 5% of the country’s GDP. However, ramping up oil exports seems to not fall in line with the new political direction the country has taken since August.

Statista

Colombia’s high-tech exports have nearly doubled since 2007, although this still does not represent a high % of the country’s exports.

Inflation and Rates

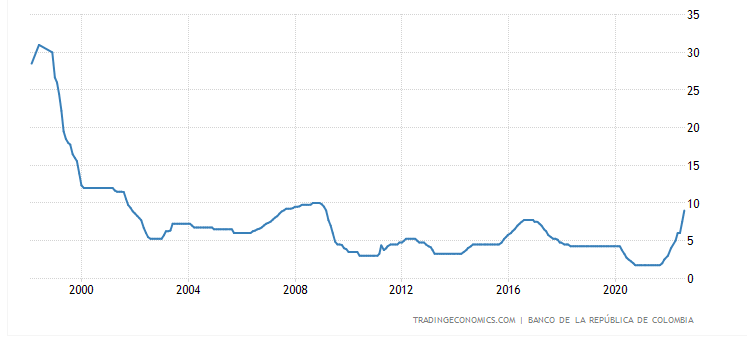

Inflation in Colombia recently reached a 23-year high of 10.2% in July. Like many countries in South America, Colombia has had to hike rates substantially this year, but rates are still below the previous peak in 2008.

Inflation in Colombia

Trading Economics

Furthermore, rising inflation in Colombia has not only been a product of supply disruptions but also because of stronger demand in the country due to more favorable growth trends. The main risk moving forward is supply chain shocks and global commodity prices, not demand-driven inflation.

Future Outlook

Colombia’s new government also plans to launch a bill that will tax oil exports and raise around $5.76 billion next year (1.7% of GDP). Petro has been vocal about Colombia being overly dependent on oil for growth and has spoken out against fracking. This is poor timing, as oil at a new low of $79/barrel is still attractive to Colombia on a relative basis.

US EIA/Colombia Ministry of Mines and Energy/Yahoo Finance

2022 would have been a good time to exploit the higher price of oil and ramp up oil exports, especially as other countries have been unable to meet quotas.

Tourism Outlook

Colombia’s tourist arrivals reached around 77% of the 2019 peak levels recently and could benefit further, especially as more long-term tourists choose to visit the country. However, this may not significantly contribute to economic growth, as tourism only currently accounts for around 2% of GDP. Even tourist-dominated countries like Thailand are good examples to look at, as tourism only accounts for 4.9% of the GDP in Thailand (Colombia’s population is around 35% larger).

New Export Oriented Growth Strategies

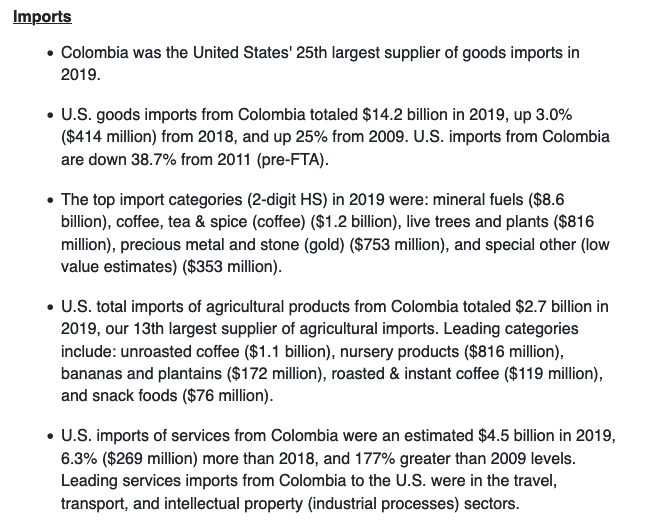

The United States is an important export market for Colombia, but there is still room for considerable growth. Colombia was the United States’ 25th largest supplier of exports prior to COVID, but this has declined substantially since 2011.

USTR

Regional peers that have outpaced Colombia include Mexico and Brazil. Moreover, countries like Mexico have historically relied more on importing components and assembling final products, similar to some frontier markets in Asia. Although there is little added value in this process, countries can still use this as leverage to create economic diversification and favorable growth. Colombia’s minimum wage of $225 is attractive for an emerging market, which makes Colombia a potential location for long-term nearshoring. IADB recently projected that nearshoring could add $78 billion in exports to Latam/Caribbean economies. Colombia could have the potential to be an ideal location in the future. For now, oil and tourism are more relevant economic catalysts.

Banks in Colombia

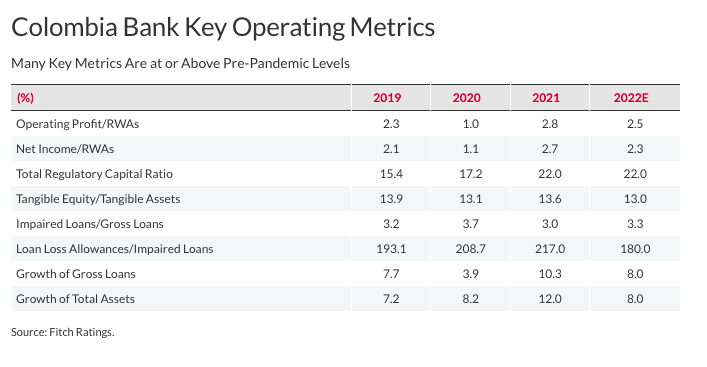

As mentioned previously, betting on banking ADRs is a good strategy as these companies have favorable market shares in Colombia and abroad. Furthermore, the ETF already invests 40% in banks and invests strongly in utilities and energy. Only around 5% of the ETF’s assets are invested in consumer stocks. A blend of consumer and banking stocks could be one of the best ways to access the market. Banks in Colombia have kept NPLs at a reasonably low level, even after experiencing negative growth in 2020. One key risk moving forward is an increase in NPLs in the coming years, largely due to interest rates rising to new highs. Colombian bank’s NPLS ratios ( defined as 90 days overdue) reached 2.8% during Q1 2022 and had 2.2x coverage. NPL levels are still slightly above the peaks experienced in 2007-2009.

Fitch Ratings

Loan growth rebounded substantially during 2021, but will likely decline more during 2022-2023 as growth normalizes. This may cause conditions to be in line with 2018-2019. There may be additional pullbacks in Colombian banking stocks in the coming months if oil remains below $80/barrel and there is additional market turmoil due to Fed rate hikes.

Company Overview

However, Bancolombia looks like a relatively safe bet now and is an easy way to gain exposure to Colombia. The company also has a global presence in Guatemala, El Salvador, Panama, Puerto Rico, and the Cayman Islands. The company has over a 25% market share in Colombia, and the company’s loan book in Panama, El Salvador, and Guatemala accounts for 27% of its total loans.

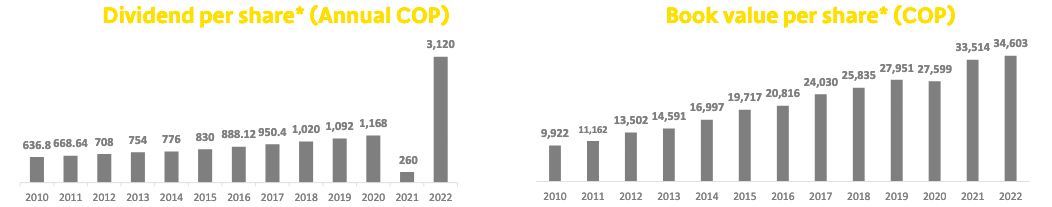

CIB

The company has tripled its book value per share since 2011 ( local currency) and still has a relatively attractive dividend yield. However, the greater opportunity is in share price appreciation, as the stock is down 15% YTD and 40% in the past five years.

CIB

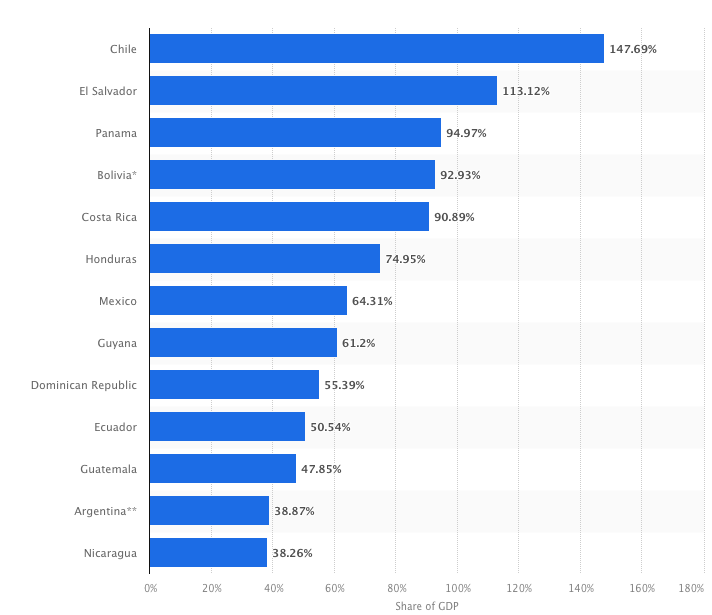

One problem in South/Central America to note is that domestic credit as a % of GDP is relatively high. However, Colombia is more favorable than other markets such as Chile, Panama, Costa, and Mexico to name a few.

Statista

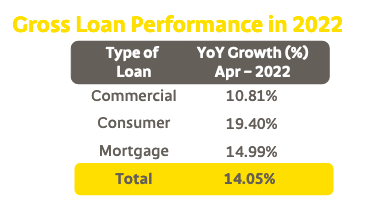

In Colombia, loans as a % of GDP is 55.5% ( 26.34% commercial loans, 15.33% consumer Loans and 7.67% mortgages). Banks have still delivered strong loan growth, which has largely been driven by consumer loans and mortgages.

CIB

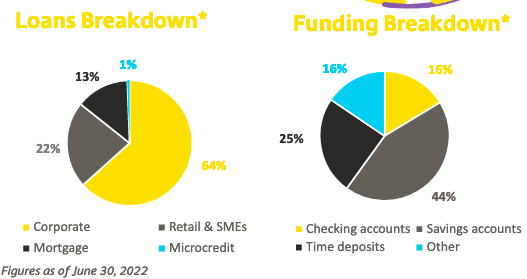

Loan growth will likely fall below 10% by 2023 as economic growth declines leading into 2023. Bancolombia is not heavily focused on mortgages like other regional banks such as Banco De Chile. Corporate clients account for 64% of its total loans, while retail and SMEs only account for 22%. However, management is focusing strongly on supplying more loans to SMEs to help them reactivate as economies open up again.

CIB

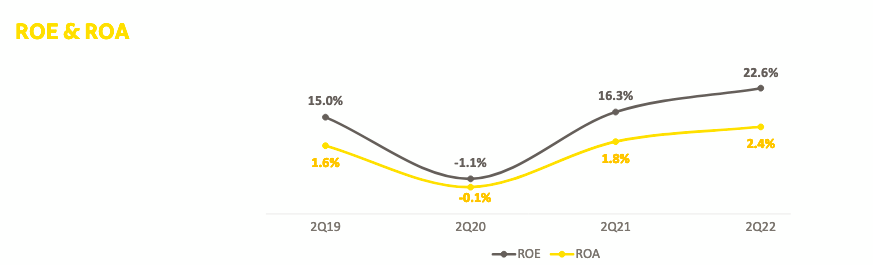

Bancolombia has also focused on providing more products to retail clients, including preapproved lines of credit. The bank has also captured more share in the debit/credit card segment, which is projected to grow at 10% through 2025. Only 10% of Colombia’s population currently uses a credit card, so there is ample room for growth in this area. Bancolombia’s ROE rose to a record 22.6%, but this should fall below 20% by the end of 2022 as economic growth declines. This is a regional trend that has occurred in other markets such as Chile, which is being driven by 2021-2022 rate hikes.

CIB

Final Thoughts

I think this is one of the best vehicles to access Colombia, especially since the Global X MSCI Colombia ETF already invests 40% of its assets in financial companies. I would rather make a concentrated bet on Colombia’s largest bank. The sell-off this week was a great time to accumulate. I have been following this stock for years, and previously covered it in 2015. I have not been this excited about South American equities for a long time.

MSCI

Colombia currently trades at a very steep discount to MSCI Emerging Markets, which makes investment justifiable in my view even though there are relevant macro and political risks ahead. I am still approaching with caution because emerging market equities are risky, and economic conditions will not improve in Colombia next year. It only makes sense to enter now if you are willing to accumulate and hold until 2025-2030.

Be the first to comment