David McNew/Getty Images News

Earnings of Banc of California (NYSE:BANC) will most probably dip next year due to higher provisioning and operating expenses. On the other hand, subdued loan growth and low-margin expansion will likely keep earnings from declining too much. Overall, I’m expecting Banc of California to report earnings of $1.93 per share for 2022, up 104%, and $1.75 per share for 2023, down 10% year-over-year. Compared to my last report on the company, I’ve reduced my earnings estimate mostly because I’ve slashed my loan growth estimates. The December 2023 target price suggests a high upside from the current market price, which shows that the market has overreacted to the earnings outlook. Based on the total expected return, I’m upgrading Banc of California to a buy rating.

Third Quarter’s Disappointing Performance Compels a Reduction in the Loan Growth Estimate

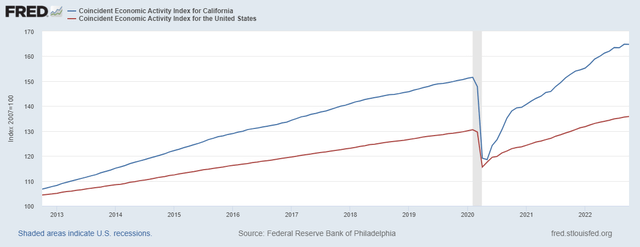

Banc of California disappointed me by reporting a significant decline in its loan portfolio of around 2.2% during the third quarter, or 8.7% annualized. According to the management’s disclosures given in the conference call, Banc of California experienced a pullback in loan demand due to the expectations of further rate hikes and a resultant slowdown in economic activity. It’s very unfortunate that the local economic activity is suffering when the state is doing quite well. The company operates throughout California, particularly in Southern California from San Diego to Santa Barbara. The economic activity in the state is currently very robust when compared to its own history as well as the national average.

The Federal Reserve Bank of Philadelphia

Unfortunately, it seems that the state’s healthy economy is not translating into loan growth for Banc of California. As a result, I’m expecting loan growth to remain under pressure in future quarters.

On the plus side, Banc of California has recently acquired Deepstack Technology, which will enhance the bank’s payment capabilities. The management hopes that the increased facilities will attract more depositors, as mentioned in the earnings presentation. If successful, the increase in deposit customers will naturally boost loan growth.

Considering these factors, I’m expecting the loan portfolio to grow by 1% in the last quarter of 2022, taking full-year loan growth to 1.5%. For 2023, I’m expecting the loan portfolio to grow by 4%. Compared to my last report on the company, I’ve reduced my loan growth estimates for both 2022 and 2023 due to the third quarter’s disappointing performance.

Meanwhile, I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 7,639 | 5,894 | 5,817 | 7,159 | 7,269 | 7,564 |

| Growth of Net Loans | 15.6% | (22.8)% | (1.3)% | 23.1% | 1.5% | 4.1% |

| Other Earning Assets | 2,370 | 1,280 | 1,415 | 1,502 | 1,370 | 1,397 |

| Deposits | 7,917 | 5,427 | 6,086 | 7,439 | 7,353 | 7,652 |

| Borrowings and Sub-Debt | 1,696 | 1,398 | 822 | 820 | 1,055 | 1,076 |

| Common equity | 714 | 717 | 712 | 970 | 973 | 1,063 |

| Book Value Per Share ($) | 14.2 | 14.3 | 14.3 | 16.0 | 16.2 | 17.7 |

| Tangible BVPS ($) | 13.3 | 13.5 | 13.5 | 14.3 | 14.2 | 15.7 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Deposit Mix Improvement to Provide Some Relief

Banc of California’s net interest margin remained unchanged during the third quarter at 3.58%. One achievement during the quarter was that the management was able to increase the non-interest-bearing deposits to 40.4% of total deposits from 37.4% of total deposits at the end of June 2022. This improvement will make the average deposit cost stickier than before.

Unfortunately, the loan mix isn’t as favorable as the deposit mix. Variable-rate loans made up just 0.32% of total loans at the end of September 2022, as mentioned in the earnings presentation. Therefore, the average loan yield can’t be expected to reprice quickly as interest rates rise.

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis points hike in interest rates could increase the net interest income by 3.6% over twelve months. Considering these factors, I’m expecting the margin to grow by five basis points in the last quarter of 2022 and ten basis points in 2023.

Growth of Provision and Operating Expenses to Pressurize Earnings

Banc of California surprised me in its latest earnings release by reporting zero net provisioning for yet another quarter. This trend cannot be maintained because of the threats of a recession and the anticipated loan growth. Nevertheless, provisioning will likely remain subdued because of the loan portfolio’s good credit quality. Thanks to the rapidly improving asset quality, allowances rose to 232% of non-performing loans by the end of September 2022 from 187% at the end of December 2021. Partly due to this high coverage, I’m expecting the provisioning to remain below normal in the coming quarters. I’m expecting the net provision expense to make up around 0.19% of total loans in 2023, below the last five-year average of 0.36%.

Apart from higher provisioning, next year’s earnings will also suffer from higher non-interest expenses. Inflationary pressures will likely lift operating expenses, thereby hurting earnings. On the other hand, the anticipated subdued loan growth and slight margin expansion will support the bottom line.

Overall, I’m expecting Banc of California to report earnings of $1.93 per share for 2022, up 104% year-over-year. For 2023, I’m expecting earnings to dip by 10% to $1.75 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 286 | 248 | 225 | 254 | 314 | 335 |

| Provision for loan losses | 30 | 36 | 30 | 7 | (28) | 14 |

| Non-interest income | 24 | 12 | 19 | 19 | 26 | 28 |

| Non-interest expense | 233 | 196 | 199 | 183 | 196 | 205 |

| Net income – Class A | 23 | 3 | (1) | 50 | 118 | 105 |

| EPS – Diluted -Class A ($) | 0.45 | 0.05 | -0.02 | 0.95 | 1.93 | 1.75 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on Banc of California, I estimated earnings of $2.02 per share for 2022 and $2.08 per share for 2023. I’ve reduced my earnings estimates mostly because I’ve slashed my loan growth estimates.

Upgrading to a Buy Rating

Banc of California is offering a dividend yield of only 1.6% at the current quarterly dividend rate of $0.06 per share. The earnings and dividend estimates suggest a payout ratio of 13.7% for 2023, which is below the historical average. Nevertheless, I’m not expecting an increase in the dividend level as the company does not regularly change its dividend.

I’m using the historical price-to-tangible book (“P/TB”) and the peer price-to-earnings (“P/E”) multiples to value Banc of California. The stock has traded at an average P/TB ratio of 1.17 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 13.3 | 13.5 | 13.5 | 14.3 | ||

| Average Market Price ($) | 18.9 | 14.6 | 12.1 | 18.5 | ||

| Historical P/TB | 1.42x | 1.09x | 0.90x | 1.29x | 1.17x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $15.7 gives a target price of $18.4 for the end of 2023. This price target implies a 20.5% upside from the December 20 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.97x | 1.07x | 1.17x | 1.27x | 1.37x |

| TBVPS – Dec 2023 ($) | 15.7 | 15.7 | 15.7 | 15.7 | 15.7 |

| Target Price ($) | 15.3 | 16.8 | 18.4 | 20.0 | 21.5 |

| Market Price ($) | 15.3 | 15.3 | 15.3 | 15.3 | 15.3 |

| Upside/(Downside) | (0.0)% | 10.3% | 20.5% | 30.8% | 41.1% |

| Source: Author’s Estimates |

Historically, Banc of California’s P/E multiple has been very erratic. Therefore, it’s best to take the peer average to value the company instead of the historical average. As of the close of December 20, the peer average P/E ratio was around 9.1x, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $1.75 gives a target price of $15.8 for the end of 2023. This price target implies a 3.8% upside from the December 20 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.1x | 8.1x | 9.1x | 10.1x | 11.1x |

| EPS 2023 ($) | 1.75 | 1.75 | 1.75 | 1.75 | 1.75 |

| Target Price ($) | 12.3 | 14.1 | 15.8 | 17.6 | 19.3 |

| Market Price ($) | 15.3 | 15.3 | 15.3 | 15.3 | 15.3 |

| Upside/(Downside) | (19.1)% | (7.6)% | 3.8% | 15.3% | 26.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $17.1, which implies a 12.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 13.7%.

In my last report, I adopted a hold rating with a target price of $18.4 for December 2022. I think the market has overreacted to the earnings outlook as BANC is currently trading at a significant discount to the target price. Based on my updated total expected return, I am upgrading Banc of California to a buy rating.

Be the first to comment