celsopupo/iStock via Getty Images

While it can be tempting to buy a stock that looked interesting after that stock falls, sometimes a decline in price is warranted. A great example of this playing out could be seen by looking at Ball Corporation (NYSE:BALL), a global beverage packaging play that focuses largely on the production of aluminum cans and other related products. In recent months, shares have taken a beating even as revenue has risen nicely. The company has been negatively impacted by declining profits and cash flows, which should not be surprising in this inflationary environment. At one point, I felt as though if shares fell meaningfully, that the company might offer an attractive upside. But due to the continued deterioration in the firm’s bottom line, I would make the case that shares need to fall further still to make for a good purchase at this time.

Difficult times

The last time I wrote an article about Ball was back in July of this year. In that article, I found myself impressed with the strong revenue and earnings growth the company had exhibited. Having said that, I did acknowledge that the cash flow figures of the company were rather disappointing. However, another downside was that shares looked rather lofty relative to what other similar firms were trading for. These factors, all combined, led me to keep my ‘hold’ rating on the firm, reflective of my belief at that time that shares would generate returns that more or less matched the market moving forward. Unfortunately, that call has not proven to be all that great so far. While the S&P 500 is down by 4.7%, shares of Ball have generated a loss of 29.2%.

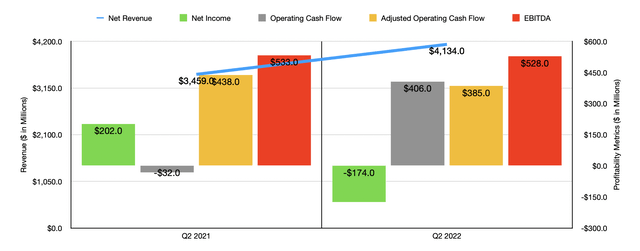

Author – SEC EDGAR Data

This extreme return disparity is no fluke. But before we get to the bad stuff, we should touch on the positive side of things. This namely relates to revenue growth. In particular, I’m interested in financial results covering the second quarter of the company’s 2022 fiscal year. That is because this is the only quarter for which new data is available that was not available when I last wrote about the firm.

During that time, revenue came in strong at $4.13 billion. That’s 19.5% higher than the $3.46 billion generated the same quarter only one year earlier. According to management, this increase in sales was driven almost entirely by the pass-through of higher aluminum prices and other inflation-related costs to its customers. However, pricing and product mix also helped the company by an unspecified amount.

Although revenue rose nicely, management did report a significant decline in profits. The company went from generating a net profit of $202 million in the second quarter of 2021 to generating a loss of $174 million the same time this year. There were two primary drivers behind this change. First and foremost, during the quarter, the company reported a gross profit margin of only 16.7%. This was down from the 20.2% experienced only one year earlier.

Though seemingly small, that disparity spread across the sales achieved in the latest quarter would have impacted pretax profits to the tune of $144.7 million. The second big driver was a $479 million swing in business consolidation and other activities. The vast majority of this change came as a result of a $438 million impact across the beverage packaging operations the company has in the EMEA (Europe, Middle East, and Africa) regions in which it operates.

This, in turn, was attributable to a $435 million impairment loss on assets located in Russia. Even if we only look at cash flow, the picture did worsen. Operating cash flow went from negative $32 million in the second quarter of 2021 to positive $406 million the same time this year. But if we adjust for changes in working capital, it would have gone from $438 million down to only 385 Marion dollars. And over that same time, we also saw a modest decrease in EBITDA, with the metric declining from $533 million to $528 million.

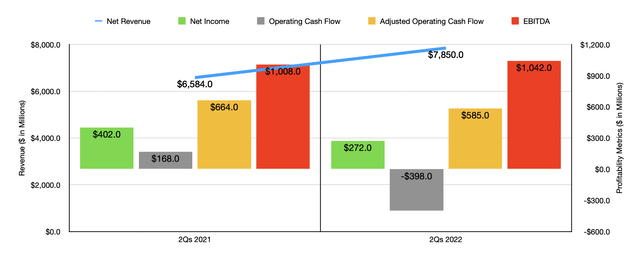

Author – SEC EDGAR Data

As you can see in the chart above, financial performance for the first half of the 2022 fiscal year as a whole has mostly been worse than performance at the same time last year. Yes, revenue for the company did improve, climbing from $6.58 billion in the first half of 2021 to $7.85 billion the same time this year. But net income fell from $402 million to $272 million. Operating cash flow declined from $168 million to negative $398 million, while the adjusted figure for this dropped from $664 million to $585 million. And over that same window of time, the only profitability metric to improve was EBITDA, with an increase from $1.01 billion to $1.04 billion.

Understanding what the future holds for Ball is rather complicated. In addition to suffering from volatility on the bottom line, the company is also going through some interesting changes. In August of this year, for instance, the company announced that it had decided to cease production at two of its beverage can manufacturing facilities that collectively generated revenue in the latest quarter of $251 million.

This has been done in an attempt to decrease costs. And in September of this year, the company finally made good on its promise to divest its operations in Russia. The original announcement of this plan was back in March of this year. But details were never offered until management announced, on September 21st, that they had sold their beverage packaging operations in Russia in exchange for $530 million. We already know at least some of the impact this decision had so far this year as I covered already. But we do not yet know the full impact on the company’s top and bottom lines from this transaction.

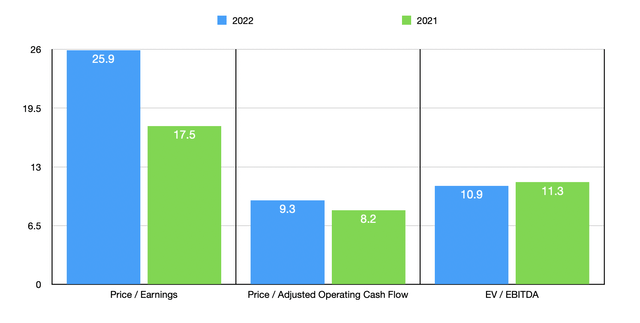

Author – SEC EDGAR Data

The simple way to try and forecast whether or not the company makes for an attractive prospect is to annualize results experienced during the first half of 2022. Doing so, we would get net income of $594.1 million, adjusted operating cash flow of $1.66 billion, and EBITDA totaling $2.02 billion. Using these figures, we can see that the company is trading at a forward price-to-earnings multiple of 25.9, at a forward price to adjusted operating cash flow multiple of 9.3, and at a forward EV to EBITDA multiple of 10.9. If instead, we were to use the data from 2021, these multiples would be 17.5, 8.2, and 11.3, respectively.

As part of my analysis, I decided to compare the company to five similar players. On a price-to-earnings basis, these firms ranged from a low of 8.5 to a high of 28.4. In this case, four of the five were cheaper than our prospect. Using the price to operating cash flow approach, the range was between 6.4 and 18, with two of the five being cheaper. And using the EV to EBITDA approach, the range was between 7.1 and 41.9. In this scenario, three of the five prospects were cheaper than Ball.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Ball Corporation | 25.9 | 9.3 | 10.9 |

| Crown Holdings (CCK) | 24.7 | 11.3 | 41.9 |

| AptarGroup (ATR) | 28.4 | 18.0 | 12.4 |

| Berry Global Group (BERY) | 8.5 | 6.4 | 7.3 |

| Silgan Holdings (SLGN) | 13.6 | 12.1 | 10.1 |

| Greif (GEF) | 10.5 | 7.8 | 7.1 |

Takeaway

Truth be told, I am rather surprised how far shares of Ball have fallen. Due to some one-time transactions, combined with higher costs, profits and cash flows are suffering. It’s unclear how much more of an issue this will end up being. Ultimately, if I felt as though the fundamental pain were over, I would see shares as being cheap enough to warrant a more bullish rating. But since there is still some uncertainty about what the future holds, I do believe that a ‘hold’ rating is still appropriate at this moment.

Be the first to comment