JasonDoiy/iStock Unreleased via Getty Images

Main thesis

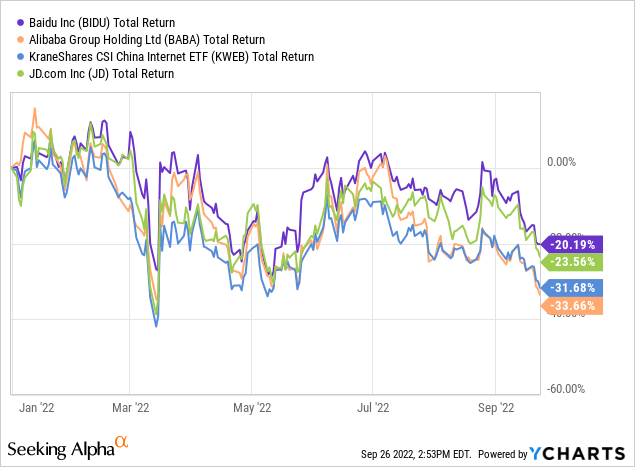

In 2022, infrastructure risks that caused selloffs a year earlier continued to put pressure on Chinese ADS shares. The worsening volatility of Chinese stocks has not bypassed Baidu, Inc. (NASDAQ:BIDU). Baidu is down 20.2% YTD. That’s still better than the sector’s performance, though.

Many investors believe that the risks are exaggerated and see stocks as undervalued. So, if you don’t really fear China, Baidu’s case is still solid and the stock looks attractive.

Why you should be afraid

By law, all companies listed in the U.S. must file audit reports certified by accounting firms directly with the SEC or they will be delisted from U.S. exchanges. This becomes a real delisting risk for Baidu as Chinese regulators do not want to transfer the necessary information abroad. An the end of August, WSJ reported that the U.S. and China reached an auditing agreement. However, according to Reuters, citing South China Morning Post, China would only allow redacted audit data to be released, and that will not sit well with U.S. regulators. The publication notes that similar points have already been reached in 2016, but then the Chinese government decided to withhold the information.

In addition, it’s important to remember the important role of the Chinese Communist Party in Baidu’s business, as the company is regularly subject to huge fines. These risks should always be kept in mind if you are investing in Chinese companies. I believe that they completely overshadow the entire positive investment thesis about investing in Chinese ADSs.

Another weak point of Baidu is the stagnation of iQIYI (IQ). The number of subscribers of the “Chinese Netflix” fell to 98 million, compared to 101 million for the Q1 2022. iQIYI, although one of the most popular online entertainment services, is still barely profitable and stagnant. The service was originally aimed at large quality series and shows, but over the past 7 months, the creating process has stopped again. In general, the platform is a stopper for the development of AI-directions of Baidu and a kind of hole for the budget. At the end of February, the management of the service requested $285 million from the parent holding Baidu to complete several projects. iQIYI places a heavy burden on the company.

Absolute leader

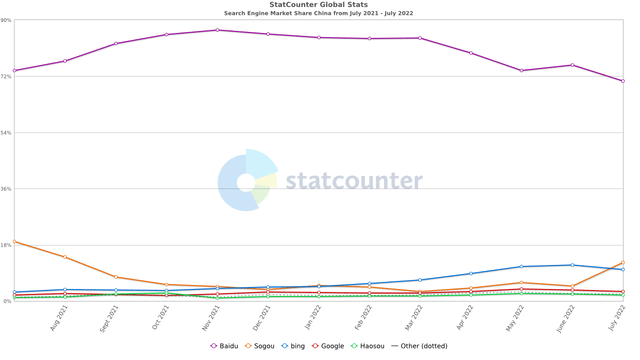

Baidu’s search engine is the undisputed leader in China. The company provides a search engine that has practically no alternative for Chinese residents, since Western counterparts are mostly blocked in the country.

Bing and Google occupy less than 10 percent of the market and are unlikely to grow further due to the total control of the authorities over the information space. Sogou, on the other hand, is a niche albeit fast-growing story.

Baidu’s share in the Chinese search engine market (StatCounter)

Baidu’s size gives the company a huge advantage over its competitors. In the second quarter of 2022, Baidu app’s MAU increased to 628 million and daily logged-in users reached 84%. This creates a massive network effect. User queries optimize search engines, so Baidu’s dominance in this segment should help the platform deliver more accurate results than its competitors. This allows them to keep traffic acquisition costs low and at the same time attract more advertisers.

The company’s efforts to build its own content ecosystem through the Baijiahao platform, smart mini-programs, and managed landing pages will also boost its competitiveness and user retention.

AI projects

IDC named Baidu as the top cloud service provider in the Chinese market in its IDC 2022 H1 Report. Developers and enterprises can easily access and create customized AI solutions for various industries using Baidu’s set of cloud-based modular solutions. Baidu provides a wide range of AI services in speech recognition, computer vision, natural language processing, optical character recognition, video analysis, and structured data analysis.

China provides solid ground for the development of AI. According to McKinsey, the AI development in the country could add $600 billion to the economy by 2030. The state is interested in the development of such technologies.

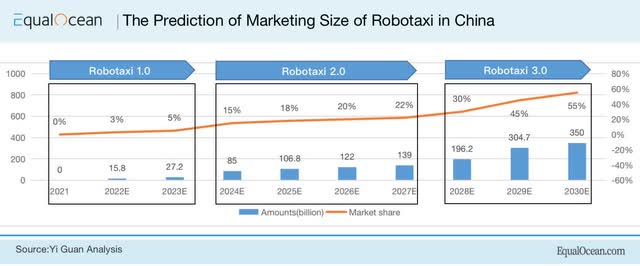

Separately, it is worth noting the merits of the company in the field of autonomous driving. Baidu’s Apollo system supports L3 and L4 levels of autonomous driving and is equipped with HD maps to enable intelligently driven vehicles on city roads. Apollo Go made 287,000 rides in Q2, up 46% from Q1. The company already has strategic partnerships with automakers to equip their passenger cars with upgraded Apollo systems. This segment currently generates insignificant revenues. However, the company has great potential as the market is expected to grow rapidly in this decade. According to EqualOcean citing Yi Guan Analysis, the market size will reach ¥350 billion ($52.3 billion) by 2030 and the penetration rate of Robotaxi will grow to 55%.

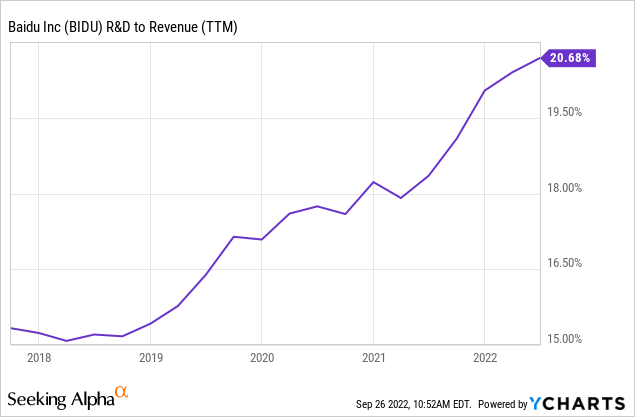

In recent years, Baidu has been investing heavily in research and development through Baidu Ventures. The company intends to increase the number of projects to enter new markets, which is a positive sign for long-term investors.

Valuation

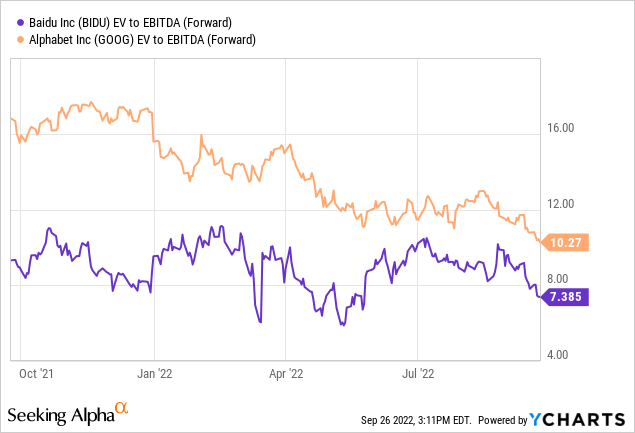

Baidu looks undervalued compared to U.S. search engine giant Alphabet (GOOG, GOOGL). The stock trades at a low 7.3x EV/EBITDA, compared to Alphabet’s 10.2x.

This almost 30% spread is due to environmental risks and Baidu’s revenue stagnation in recent years. And if nothing can be done about environmental risks, then revenue should recover with the normalization of the advertising business. Baidu is cheap, and if institutional investors start to return to China, then we can expect the spread in valuation between foreign peers to narrow.

Conclusion

Baidu, like all Chinese stocks, carries incredible structural risks that cannot be ignored. But besides this factor, the company has good prospects. It has a solid business footing in the market-dominant search engine and advertising business, and many very promising and fast-growing AI projects.

Baidu’s position appears to be stronger than that of other Chinese tech giants, like Alibaba (BABA, OTCPK:BABAF) or JD.com (JD, OTCPK:JDCMF), as the company’s core business is not under competitive pressure. Market monopolization allows Baidu to set its own rules and raise prices.

All in all, if you think delisting risks won’t materialize, CPC will ease the pressure on private companies, and the ballast in the form of iQIYI will subside, then BIDU looks like a solid long-term buy.

Be the first to comment