Florent Molinier

Investment Thesis

Badger Meter’s (NYSE:BMI) sales are benefiting from the strong demand in the end market despite the rising concern related to interest rate hikes and uncertainty in the economy. The strong demand and the supply chain challenges led to the backlog growth in Q2 FY22, which should benefit its future revenue growth. The company saw some modest improvement in the supply chain constraints in Q2 FY22, which should improve further in 2H FY22. Additionally, the company should benefit from the infrastructure investment stimulus of $1 trillion in the U.S., weather-related events such as drought, launching innovative products, and advancements in digital solutions. The margins of the company should improve further with pricing actions and the sale of higher-margin products.

BMI Q2 Earnings

Badger Meter recently reported its second-quarter FY22 financial results that were better than expected. The net sales in the quarter increased 12.2% Y/Y to $137.83 mn (vs. the consensus estimate of $133.1 mn), whereas the diluted EPS in the quarter grew 18.8% Y/Y to $0.57 (vs. the consensus estimate of $0.51). The sales growth was due to strong demand, a modest improvement in the production output, and ongoing higher price realizations. However, the strong U.S. dollar did reduce sales by ~$2 mn in the quarter. The operating margin in the quarter improved by 80 bps Y/Y to 16.6% due to higher sales volume, pricing actions, and lower selling engineering and administrative costs as a percentage of revenue, which helped the diluted EPS in the quarter increase by 18.8% Y/Y.

Solid revenue growth potential

The low double-digit sales growth in the quarter was due to 14.4% Y/Y growth in the total utility product line and 3.8% Y/Y growth in the Flow Instrumentation product line. The sales growth in the utility product line was due to higher sales of ultrasonic meters, ORION cellular radio endpoints, and BEACON Software-as-a-Service revenue. SaaS revenue as a percentage of total revenue was ~5% in the quarter. Despite a higher interest rate environment and the uncertainty of softening in the economy, the order rates grew at a good pace and the backlog remained at elevated levels at the quarter end. The sales in the Flow Instrumentation product line were led by double-digit sales growth in North America, offsetting the effect of the strong U.S. dollar on the organic sales outside of the U.S. The solid demand trends across the majority of end markets were partially offset by supply chain constraints, limiting production.

Looking forward, the company’s backlog, order rates, and bid funnel should support the company’s long-term growth. Despite the increasing market-wide concern about rising interest rates and the recession dampening demand, the industry fundamentals for Badger Meter remain strong. The industry fundamentals include the critical nature of metering infrastructure, replacement-driven demand, customers’ long-term investment mindset, and stable SaaS revenue. The water industry has secular tailwinds from climate-related weather events such as droughts and aging water infrastructure. The current drought situation in the U.S. should be beneficial for BMI’s meter demand as people will want to monitor their water usage. The infrastructure stimulus bill of $1 trillion should also benefit the company starting in FY23 and beyond. These tailwinds, coupled with the company’s innovative solutions in water quantity and quality product lines, Choice Matters portfolio, and advancements in software and digital solutions to drive operational efficiency, should help tackle the macroeconomic uncertainties. The “Choice Matters” portfolio offers a broad-based range of products such as mechanical meters (both composite and brass), ultrasonic meters, and different variations of radio technology, better positioning BMI amongst its competitors. The company’s strong balance sheet with no outstanding debt obligations gives it an opportunity to expand its facility to support the strong demand and make strategic acquisitions.

Margins

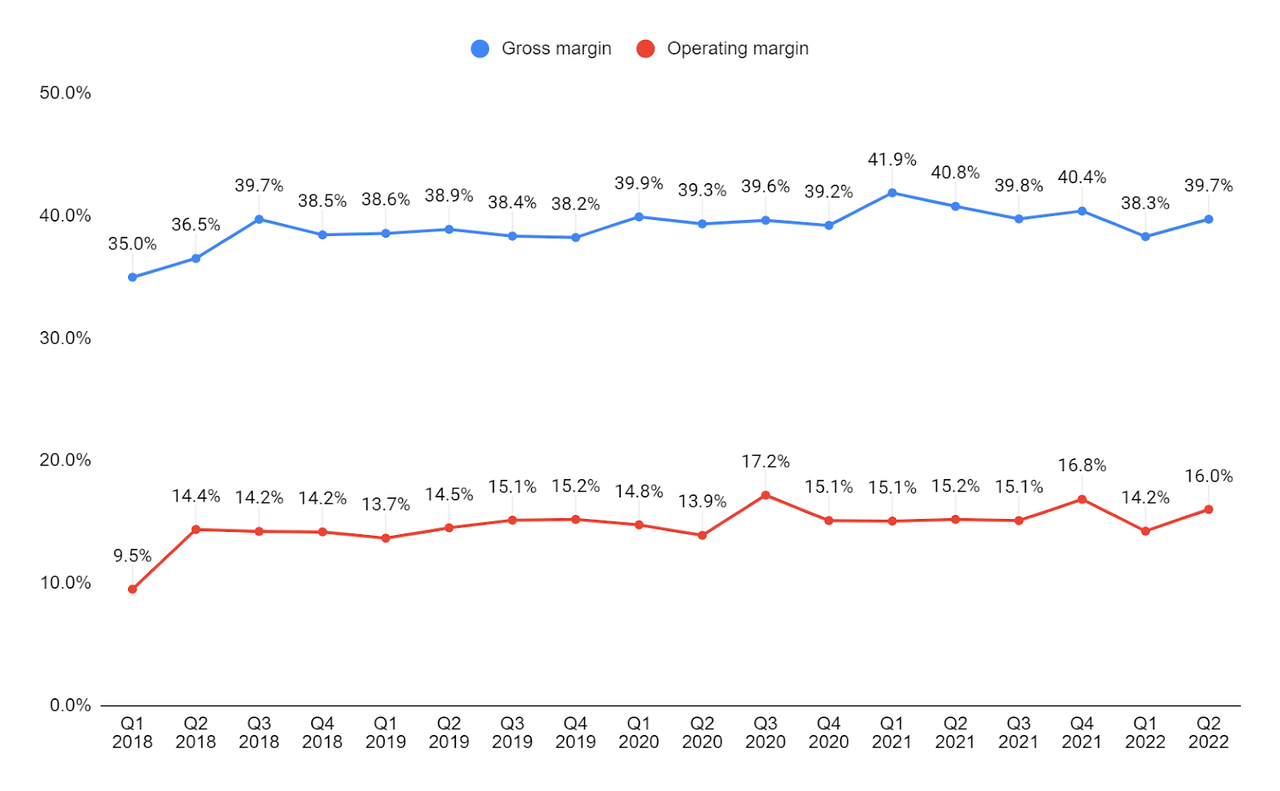

The gross margin of the company in Q2 FY22 was down 110 bps Y/Y to 39.7% despite favorable product mix trends due to inflationary cost pressure across the business portfolio, partially offset by value-based pricing. However, the gross margin improved by 140 bps sequentially due to higher manufacturing output and the improving pace of price and cost dynamics. The operating margins improved by 80 bps Y/Y and 180 bps sequentially due to the higher sales volume.

BMI’s gross margin and operating margin (Company data, GS Analytics Research)

To offset the inflationary cost pressure, the company has been taking pricing actions through a combination of value-based pricing initiatives and commodity-based price increases in some cases. The value-based pricing initiative was started at the end of FY20 by BMI to price its customers based on the value it provides to its customers. The pricing initiatives, coupled with sales growth of higher margin products such as radio meters, Eseries meters, and BEACON, should drive the margin growth of the company moving further.

Valuation & Conclusion

The stock is currently trading at 39.68x FY22 consensus EPS estimate of $2.25, which is not much discount to its five-year average forward P/E of 40.41. I like the company’s revenue and margin growth prospects but the valuation is not attractive at all. After recent correction many industrial stocks are trading at attractive levels and I believe it is the time to look for stocks trading at a meaningful discount to their historical levels. With Badger Meter trading almost in line with its historical valuations, I am on the sidelines on this one.

Be the first to comment