jetcityimage

Thesis

AmerisourceBergen Corporation’s (NYSE:ABC) recent pullback in share price provides a potential entry point for investors. The company operates in a political landscape that puts a lot of focus on the cost of drugs. The company has struggled over the last decade as generic deflation has been hurting profits.

However, I believe that over the long term, the industry should keep earning around 1% of the total U.S. expenditure on pharmaceuticals. The company should also benefit from the transition to Biosimilars. The company is also not as dependent on generic deflation as it once was due to contract rebalancing, the continuous sourcing of low-cost generics, exposure to higher-margin commercialization services and the high-growth animal health businesses.

Industry Overview

The U.S. spent $4.3 trillion on healthcare in 2021, with $0.8 trillion of that spent on pharmaceuticals. Since 2011, the spending list price on pharmaceuticals has increased by 5.9% per year. Total spending on pharmaceuticals is expected to increase annually by 4.2% until 2025. IQVIA says a total of three hundred new drugs are expected to be launched over the next five years, significantly higher than the level seen on average during the past decade, and are expected to skew toward specialty, niche, and orphan drugs. The two leading global therapy areas are oncology and immunology and are forecast to grow by 9-12% and 6-9% annually through 2026. I believe continued innovation and new drugs coming to market will be good for the entire healthcare industry, including ABC.

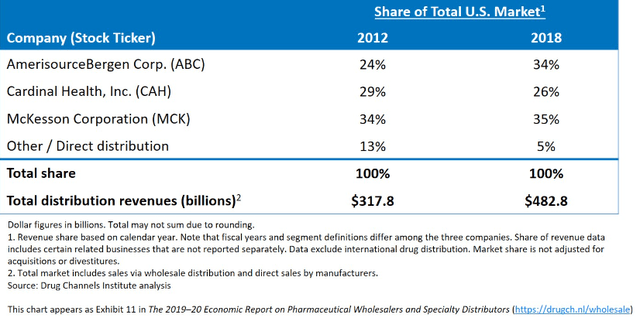

AmerisourceBergen, McKesson (MCK) and Cardinal (CAH) dominate the pharmaceutical distribution industry and are expected to have revenues for 2022 of $240mm, $260mm, and $180mm, respectively. This equates to roughly 0.9% of the total current U.S. pharmaceutical spending of $0.8 trillion. As The pharmaceutical industry grows, I believe these distributors will continue to benefit. ABC has also been able to take market share away from Cardinal over the last decade and might continue to do so.

Big Three Wholesalers Market Share (Drug Channels)

Industry Risks – U.S. Healthcare Spending

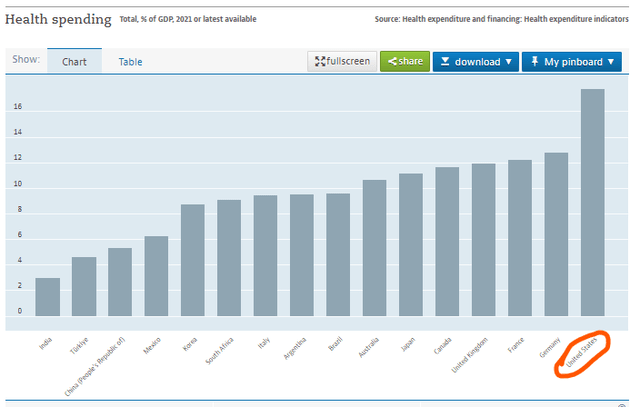

In my view, a significant risk for U.S. healthcare companies is a pullback in total U.S. healthcare spending. The U.S. spends twice as much on healthcare as most other developed nations. This has led to a lot of political pressure to reduce the cost of healthcare and the passing of the recent Inflation Reduction Act.

Health spending as % of GDP (OECD Data)

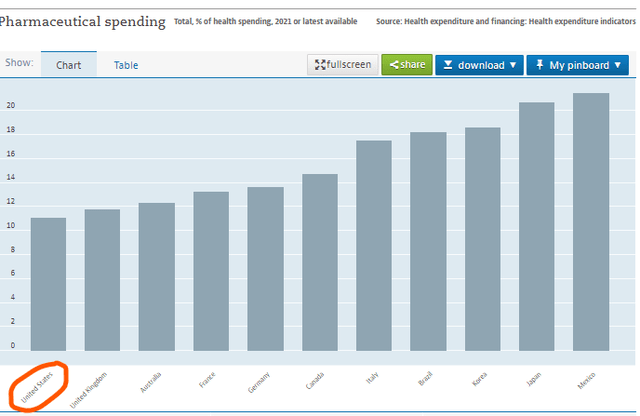

However, despite the inflated cost of pharmaceuticals in the USA, the amount that the US spends on pharmaceuticals as a percentage of total healthcare spending is the lowest out of all the G20 countries.

The ABC CEO recently said,

There is a disproportionate burden on pharmaceutical utilizers versus other forms of medical treatment. So, we think that drugs or pharmaceuticals are the most efficient source of care. And it is misunderstood generally by people who are not in the know as to what a low percentage of overall health care spend rates actually are. People assume it is 30%, 40%, 50%, I heard. But it really is, as you know, somewhere around 13%, 14%

Pharmaceutical spending as % of health spending (OECD Data)

I believe the U.S.’s excessive spending on healthcare is not due to high drug prices, but instead driven by other items such as the cost of insurance, overuse of the system and government healthcare subsidies. I believe if the U.S. spending on healthcare was to come down, the pharmaceutical manufacturers and distributors like ABC would be less at risk, than other parts of the system.

Industry Risk: Recent Legislation

The recently announced Inflation Reduction Act, should bring down pharmaceutical prices and lead to lower investment in new drugs, reducing ABC’s future profits. Under the act, direct price negotiations will start in 2026 on ten drugs from a list of the fifty highest program spending drugs. These ten drugs must have been on the market for more than nine years and have a lack of generic competition. Additional drugs will be added each year afterwards. Importantly this is only for drugs covered under Medicare Part D. Medicare Part B, which covers outpatient medical care such as drugs administered by healthcare professionals, is where ABC is most exposed.

The government will start negotiating prices for Medicare Part B in 2028. I would assume this would only apply to drugs with no generic competition, and hopefully, it will not impact the ABC’s profitable Biosimilar business too much.

Company Overview

ABC is primarily a pharmaceutical wholesaler or distributor. The company also assists Biopharma manufacturers with clinical trials, help community pharmacists with reimbursement contracts, inventory management solutions for community oncologists, supply community health systems and distribute animal products to community veterinarians. ABC has two segments, U.S. Healthcare Solution and International Healthcare Solutions.

U.S. Healthcare Solutions (~77% of EBIT)

In my view, ABC’s distribution business model is importantly different from a logistics company like FedEx (FDX), which gets paid based on weight or size of package, whereas ABC takes ownership of the product and in effect gets paid based on the value of the product it sells to the customer or pharmacy. Over the last 10 years, the company earned an average operating income margin of 1.1% and ABC should benefit from the expected increase in pharmaceutical spending over the next few years.

The company’s biggest customers, Walgreens Boots Alliance or Walgreens (WBA) and Express Scripts/Cigna (CI), account for 31% and 12% of revenue, respectively. Through a 2013 deal, Walgreens now owns 28.2% of ABC. In 2021, ABC extended its agreement to distribute drugs to Walgreens until 2029. ABC and Walgreens also have a separate agreement whereby they negotiate and buy generics together, under an entity called Walgreen Boots Alliance Development GmbH (WBAD). I believe the cross-ownership lowers the chance that ABC would lose this contract.

ABC does not distribute generics for Express Scripts, who do that inhouse, reducing the value of the contract with them. In 2021, ABC extended its distribution agreement with Express Scripts through 2026.

ABC also offers peripheral services such as training, branding and support for independent community pharmacies through their Good Neighbor Pharmacy program. The most important function they provide is ensuring that customers with different insurance providers will be reimbursed at community pharmacies. This is a higher-margin services business that ABC likes to be in.

In my view, one of the fastest areas of growth for ABC is biosimilar distribution. ABC has the largest biosimilar distribution market share out of the three distributors. Biologics and biosimilars use the body’s immune system to get rid of cancer or to lessen treatment side effects. The majority of biosimilar spending falls under Medicare Part B. This is due to the drugs mainly being administered at an outpatient facility.

Biosimilars is a higher margin and higher growth business for ABC for multiple reasons. Biosimilars require different distribution systems. The transporting of a $5,000 box of biosimilar cancer products is quite different to distributing solid pills. Inventory management is very important for customers due to the high-value products having lower shelf lives. Biosimilars are also difficult to manufacture, resulting in fewer manufacturers and are therefore priced at a smaller discount to branded drugs, resulting in higher profits for ABC.

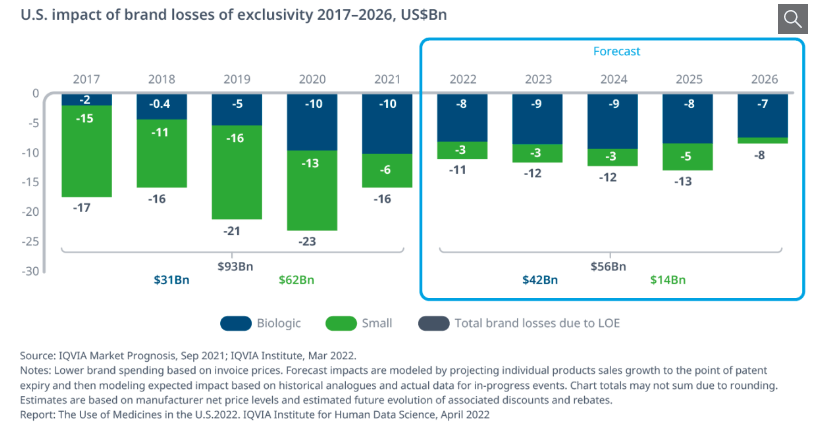

Biosimilars are also expected to be much faster growing. The majority of drugs going off-patent over the next few years will be biologics as can be seen in the chart below.

Brand Losses of Exclusivity (IQVIA)

U.S. Healthcare Solutions – Commercialization (~12% of EBIT) and Animal Health (~6% of EBIT)

I believe ABC’s Commercialization unit to be approximately 12% of the total company EBIT. Within this segment, ABC offers clinical trial logistics and helps manufacturers access the market in several ways, including consulting services.

Clinical trials are run across the communities that ABC serves, and it is vital for the manufacturers to access these patients when conducting trials. Once approved, launching a complex new biosimilar into a Medicare market is understandably difficult and this is where ABC’s services become helpful. ABC helps generic manufacturers get access to the market, provides advice on regulatory environment pricing, quality, the manufacturer’s compliance to the generic formulary and reimbursement. I believe smaller biopharma manufacturers like to use ABC because of the global distribution services they have, whilst large pharma is increasingly outsourcing services too.

ABC’s commercialization and animal health segment made up 20% of operating income in 2021, up from 10%, 10-years ago. The company stopped breaking-out the financials for these segments in 2021. The addressable market for outsourced biopharma services is currently $100 billion and set to grow at 5-10% per year. I believe this high-margin and high-growth segment will continue to grow as a percentage of ABC’s business.

ABC bought MWI Veterinary Supply in 2015 for $2.5bn. The company had an EBITDA of $130mm in 2014. Assuming its segment continued to have operating margins of around 4%, it would have had operating earnings of around $190 million, in 2021 on revenues of $4.7bn. I believe it makes up around 8% of the U.S. segment operating income and 6% of the total company EBIT. I expect the human-animal bond to keep growing and spending on animals to keep increasing. ABC is in a particularly good position given its position as the largest distributor of animal health products.

International Healthcare Solutions (~23% of EBIT)

In the last quarter, the international segment made up 23% of operating income. This segment consists primarily of the international distribution business, Alliance Healthcare, which ABC bought from Walgreens in Q3, 2021. ABC paid $6.5 billion for the business, for an EV / EBITDA multiple of around 11.2x on FY2021 EBITDA of $580 million. I believe ABC bought the business because they knew it well and they liked the fact that 40% of the operating earnings came from services, such as consulting work for the Alpha network of community pharmacists, which is similar to the Good Neighbor in the USA. ABC has a distribution agreement with Boots UK (WBA-owned) signed until 2031.

Within the International Healthcare segment is ABC’s specialty logistics business, World Courier. I calculate this to make up 2% of the total company’s EBIT. It is a high-growth area that offers logistics services for manufacturers that need temperature controls and high-priority shipments. ABC bought World Courier in 2012 for $520 million.

Company Risk – Dependence on generic business

The higher margins earned in the generic business resulted in ABC historically being very reliant on the profits from distributing small molecule generics. Earnings on generic pharmaceuticals are generally highest during the transition period immediately following the initial launch of a product. Profits subsequently fell with prices. With 90% of all the medication now being generic, there remain limited periods of high income from generic transition remaining.

However, since 2017 the company has been rebalancing contracts. To help ensure the company makes better returns on brand, specialty brand and on generics. In addition, the company’s continuous sourcing of low-cost generics has helped margins.

Company Risk – Biosimilars

The process of manufacturing Biosimilars is complex, but this could potentially become much more commoditized with time, resulting in a larger number of competing products. ABC does not do well when there are multiple generic manufacturers simultaneously making a generic, a so-called, “jailbreak.”

The company, however, says that they have not seen a jailbreak with biosimilars. At the moment there are mostly only a few biosimilar manufacturers resulting in product pricing not falling off a cliff like many of the single molecule generics.

Financials

ABC has said it expects this year’s adjusted EPS to be in the mid-range of $11.00. However, this number is adjusted and excludes the opioid litigation expense of $6.1 billion which is being paid and accrued over 18 years. As of August 2022, 48 of 49 eligible states have settled opioid-related claims.

I believe the ABC valuation should include these expenses. I have calculated the after-tax fair value of these opioid settlement payments using a discount rate of 5% at $3.1 billion or $15 per share. If you add the $15 to the current share price of $150, you get a price or $165. This gives you a 2022 PE of 15x on the expected EPS of $11.00

During the company’s latest investor day, the company said that they expect to have operating income growth over the longer-term of 5-8%, in both the U.S. and International segment, with 3-4% growth coming from capital deployment. The company expects the growth to come from continued pharmaceutical innovation in human and animal health.

Assuming the current year EPS of $11.00 grows at a long-term growth rate of 5%, the lower end of the organic growth, and discounting it at 10%, results in a valuation of about $220. Versus my adjusted price of $165, leaving 33% upside.

Conclusion

ABC has recently pulled back and provides a potential entry point for investors. The company operates in a political landscape that puts a lot of focus on the cost of drugs. The company has struggled over the last decade as generic deflation has been hurting profits.

However, higher biosimilar utilization is expected to continue as several biosimilars are set to hit the market over the next few years. The company is also not as dependent on generic deflation anymore due to contract rebalancing, the continuous sourcing of low-cost generics, exposure to higher-margin commercialization services and animal health businesses. Long-term, the business should keep taking 1% of the 30% of the U.S. expenditure on pharmaceuticals.

Be the first to comment