Eloi_Omella

Azure Power Global Limited (NYSE:AZRE) is a pure-play renewable energy developer and provider in India focusing on solar energy generation. It is among the fastest-growing renewables players in India, operating 45 utility scale projects with a combined rated capacity of 2,633 MWs as of 31st December 2021.

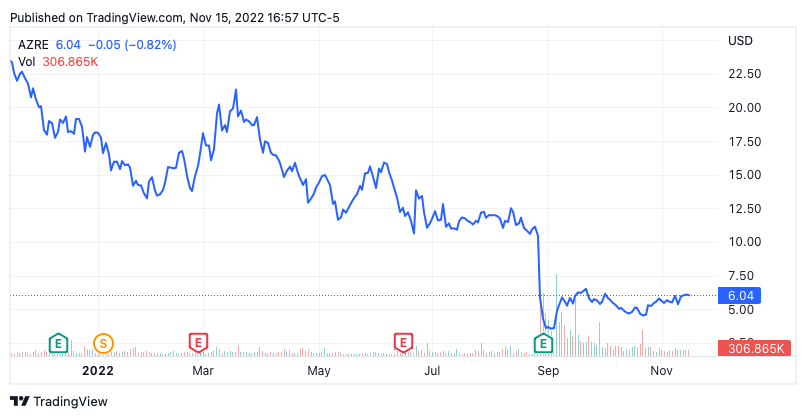

However, Azure’s recent stock price took a dive under the new macroeconomic regime with rising inflation and interest rates, worsened by controversies involving whistleblower allegations, public interest litigations, legal disputes, and the CEO’s resignation. Although some events are unrelated, they significantly shook investor confidence, and Azure stock now trades at $6 per share as compared to more than $23 just a year ago. It is also worth noting that AZRE has also delayed the filing of its annual report for FY 21-22 (ended March 31, 2022), even though there was a brief management update in August earlier this year.

Despite having relatively strong prospects in achieving profitability, recent controversies and uncertainties around key risk factors have imposed huge speculative risks onto AZRE. I would only recommend a “hold” rating for Azure stock’s short-term performance.

AZRE 1Y Stock Chart (Author)

Business Fundamentals

AZRE laid out its competitive strength as having attractive and sustainable IRR through low cost of capital, project cost, and fixed power price tariffs. With the current industry landscape, it does not look particularly promising. There exists strong regulatory tailwind as India is targeting 280 GW of solar energy installation to fulfill its goal of achieving 450 GWs of total installed renewable energy by 2030, which would be around 45% of its total electricity demand. However, with its recent launch of production-linked incentives to promote domestic manufacturing of solar modules and cells, AZRE may be adversely impacted, as 40% and 25% of custom duties will be applied to imported solar modules and cells – which is the majority of its supply. Besides, despite having a large 4.5 GW pipeline, 2 GW worth of development is largely halted, as PPAs (Power Purchasing Agreements) have not been signed by SECI following inadequate responses by DISCOMs. Hence, there is potentially a further shock in store for investors who have not been confident in AZRE if the pipeline does not come to fruition.

AZRE Competitive Strength (AZRE)

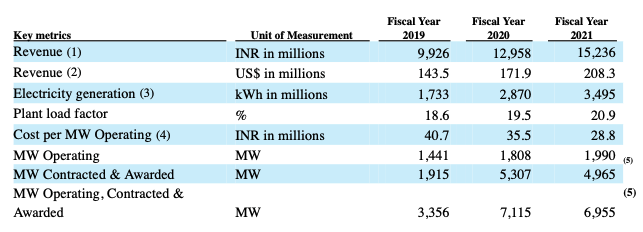

On the other hand, AZRE had a track record of delivering improving operational efficiency, with a steady increase in plant load factor and decrease in cost per MW operating as shown in the table below. However, its benchmark tariff for the PPAs signed mostly followed a fixed-rate structure over a 25-year period without adjusting for inflation, which seems bizarre.

AZRE Key Financial and Operational Metrics (AZRE)

Financials

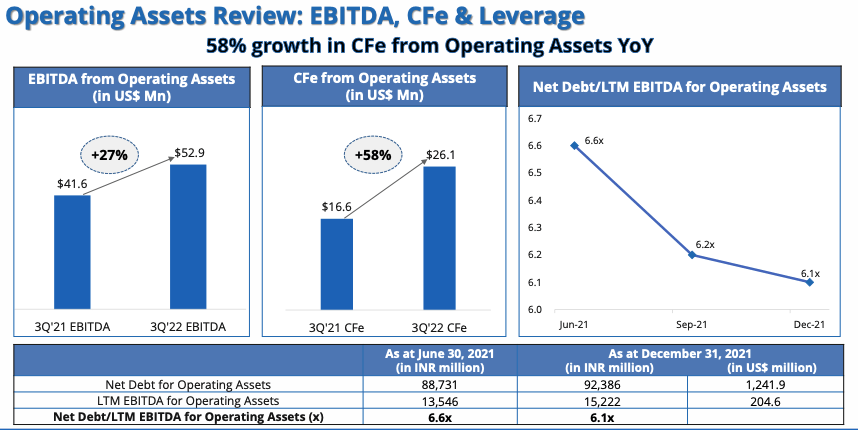

With growing margins, AZRE had seen a promising trajectory towards profitability (bear in mind that AZRE still has a negative $36.8mn of net income as of late 2021) with high growth in its EBITDA and Cash Flow equivalent (CFe) from operating assets, while reducing its net debt/ EBITDA to 6.1x as of late 2021.

Operating Assets Review (AZRE)

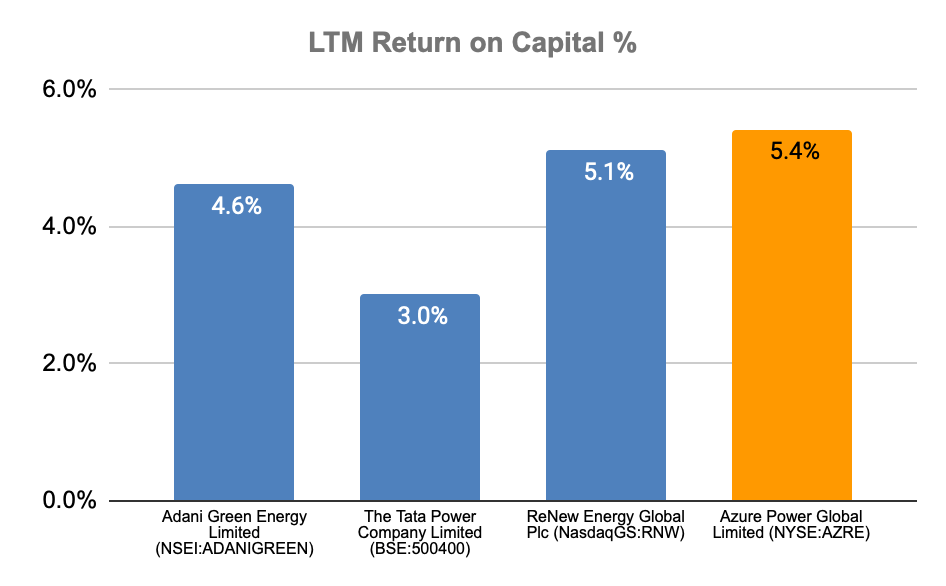

When compared to peers (the main public renewables providers in India), AZRE has amongst the highest LTM return on capital at 5.4%, which demonstrates its effectiveness in capital deployment key to the capital-intensive industry.

Return on Capital (Author, CapIQ)

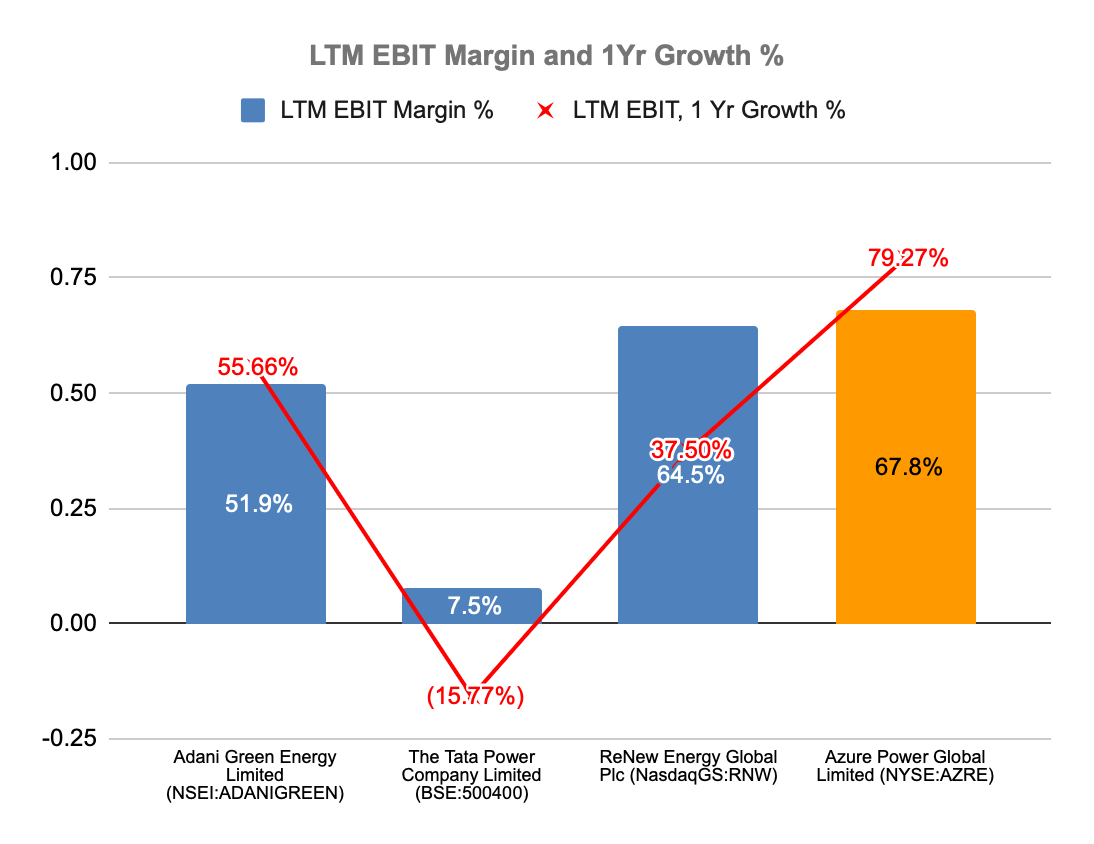

AZRE also showed superior profitability over its peers in terms of EBIT margin and EBIT growth, with an EBIT margin of 67.8% and its 1Y growth rate of close to 80%. This makes AZRE the most appealing and lucrative option, with a track record of high growth and margin.

EBIT Margin and Growth (Author, CapIQ)

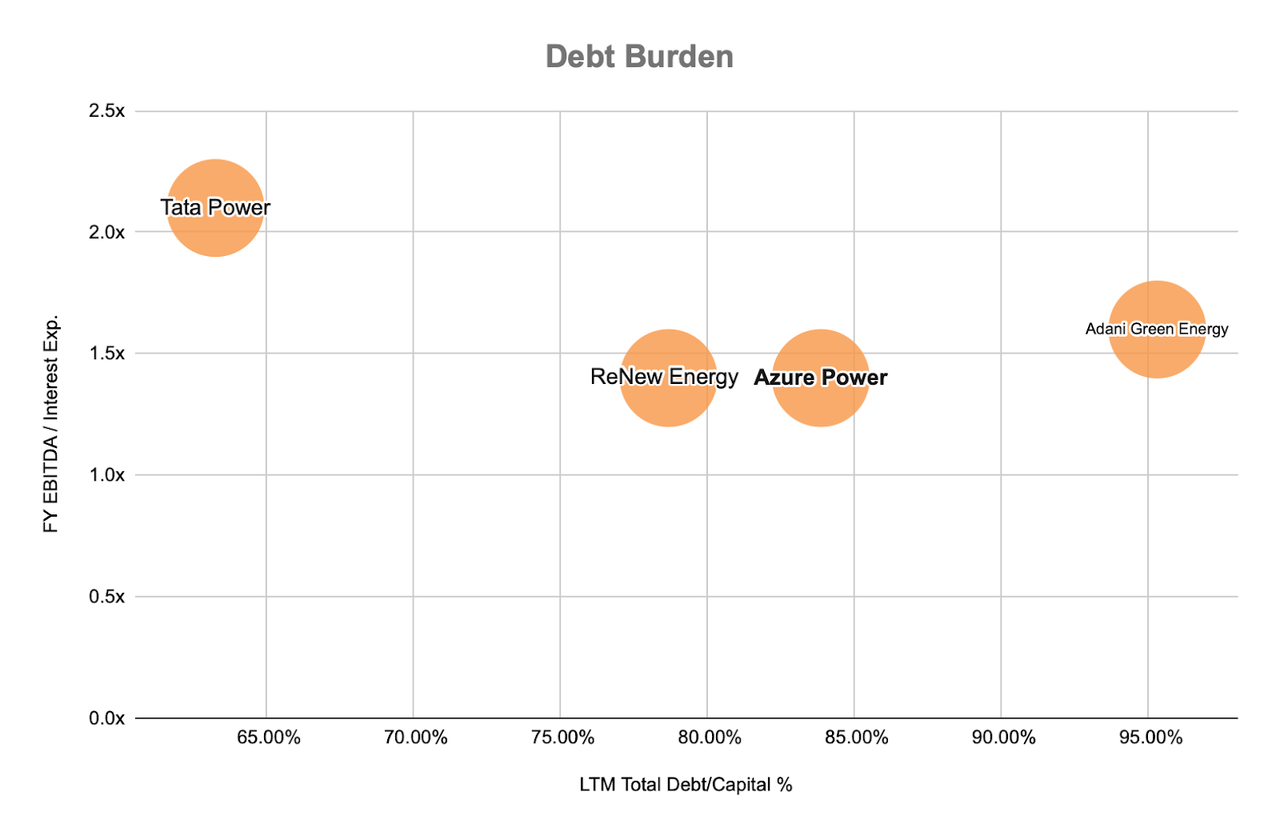

Manageable debt burden (evaluated as a combination of EBITDA/Interest Expense and Total Debt/Capital) is crucial to ensure sustainable debt-funded growth for high capex projects. AZRE has a relatively high proportion of debt with low EBITDA/Interest expense (the higher, the better; the ratio needs to be above 1 for a healthy financial state), which is concerning under the challenging macroeconomic outlook.

Debt Burden (Author, CapIQ)

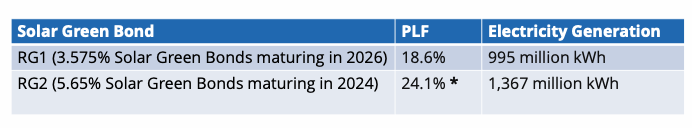

With most AZRE debts being issued at fixed rates (hence more immune to rising interest rates) of above 8% coupon rate, it had successfully raised 2 green bonds at much lower coupon rates at 3.6% and 5.7%. With its recent involvement in various controversies, Azure’s capability to raise more debts at a lower rate becomes more unlikely. Hence, it is crucial to continuously monitor its debt level and interest expense as its key hurdle to achieving sustainable profits.

Latest Bond Issues (AZRE)

Valuation

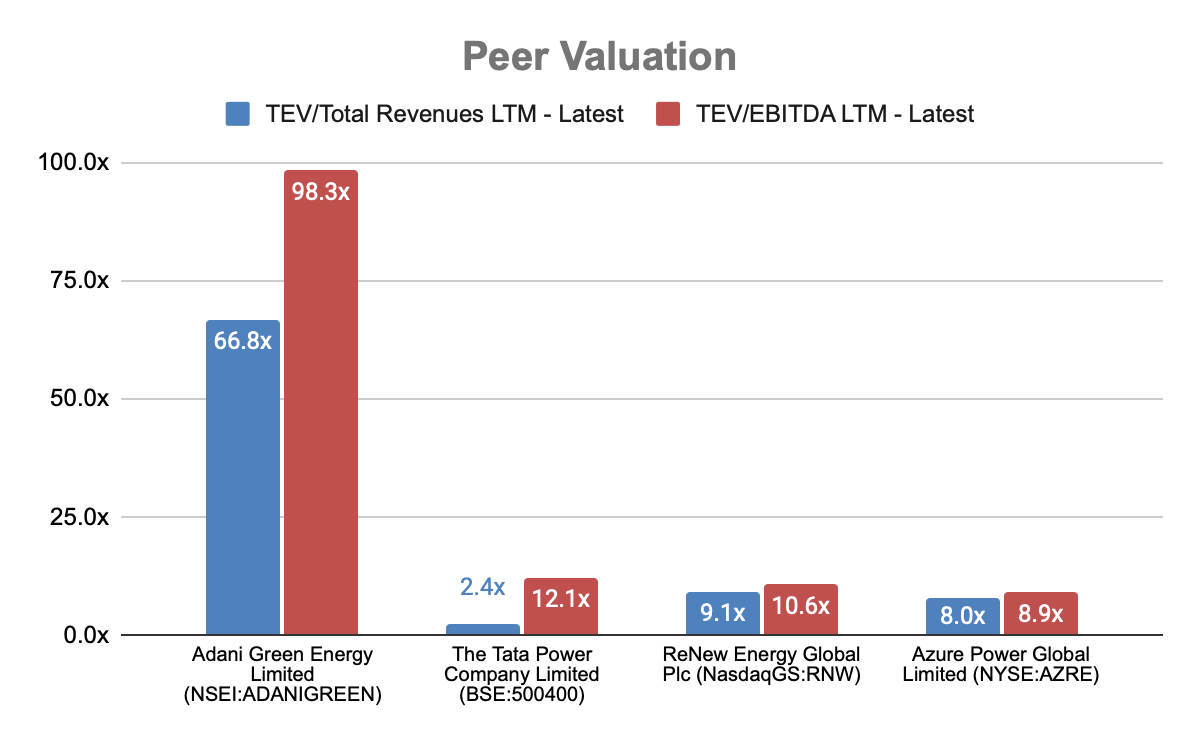

Trading multiples are used for peer valuation, as most competitors are still yet to achieve steady profits – showing AZRE as the most undervalued among its peers, with its TEV valued at 8x of total revenues. The current valuation multiple seems reasonable given its recent negative exposure to controversies.

Peer Valuation (Author, CapIQ)

Risks

There are several key internal and external risks which AZRE must deal with, either immediately or over the long term.

Supply Chain

Production-linked incentives launched by the Indian government may cause AZRE to reassess its existing supply chain, while such policy would also benefit other solar energy providers who own manufacturing capabilities. With increasing geopolitical tension, especially between China and India, there exists a substantial supply risk as some of its largest solar module/cell suppliers are from China.

Inflation and Interest Rates

Rising inflation and interest rates across the globe should also hurt both Azure’s top line and bottom line, as its PPAs are not inflation-adjusted, while rising interest rates will incur greater interest expense to certain debts with floating rates.

Controversies and Governance

Azure’s involvements in whistleblower allegations on procedural irregularities and data manipulations, public interest litigations, and legal disputes are yet to be resolved with minimal disclosures to the public on the details – hence creating lots of uncertainties which deviated its stock returns from the fundamentals. Although Azure has appointed the new CEO previously from IndiGrid, that does not yet guarantee quality and stable governance and leadership within the firm, with many challenges still ahead.

Conclusion

Despite Azure Power Global Limited’s strong financials with maturing prospects towards profitability, its massive debt burden coupled with exposures to controversies and leadership uncertainties are leading to an increasing risk premium as investors lose confidence in AZRE for the near term. Hence, I will recommend a “hold” rating for AZRE in the short term (6 months), with its rating and valuation to be assessed following updates on leadership and controversies.

Be the first to comment