Tarcisio Schnaider/iStock Editorial via Getty Images

In a previous report, I discussed the first quarter results for Azul (NYSE:AZUL) and while I do like how management is transforming the business, reality is that while many airlines are currently exceeding analyst expectations, Azul is not. Since analyzing the Q1 2022 performance, shares have lost 34% of their value while the S&P 500 is flat. In this report, I will look a bit deeper into the share price performance and analyze the Q3 2022.

Azul Loses in Sell-Off

One thing to keep in mind is that shares of Azul actually gained 1.28% since reporting third quarter results. The sell-off is largely caused by worries that freshly elected President Lula will significantly increase spending, which sent the Brazilian stock market down almost 8% and weakened the Brazilian currency. Azul was caught in that sell off losing over 19% of its value. So, while the airline saw its share prices decline significantly, I don’t think that was driven by the quarterly results but more by the concerns on the economic policy of the new administration which sparked a broader sell-off.

Profits Back At Pre-Pandemic Levels

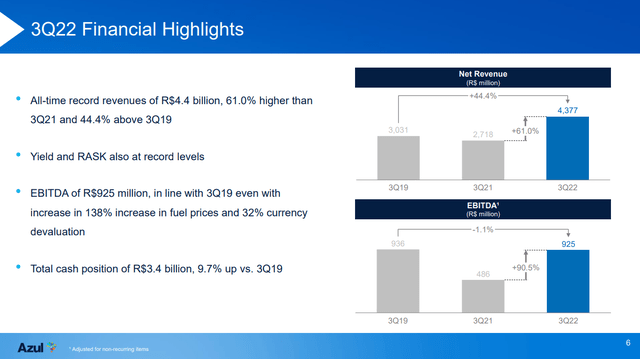

Financial highlights Q3 2022 (Azul)

Year-over-year, revenues increased by 61% to BRL 4.38 billion but what’s more interesting is the comparison to pre-pandemic levels. Revenues compared to 2019 increased by 44.4% on capacity that was 6.5% higher. That’s obviously driven by the strong demand environment that pushed fares up by 42.6% and corporate fares are even 150% of pre-pandemic levels with volume only 80% recovered.

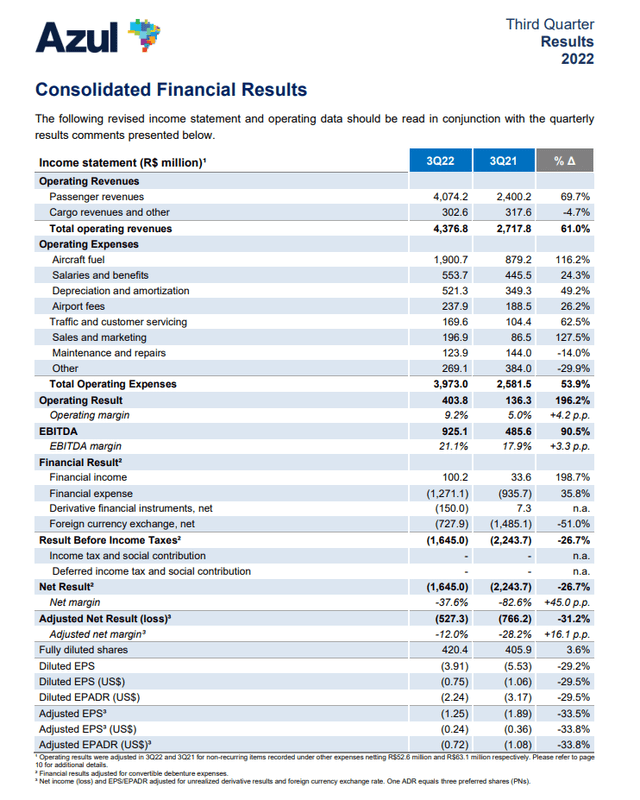

Consolidated Results Q3 2022 (Azul)

From an operational point of view, we see significant improvement in the margins but it should be noted that the operating margin of 9.2% is way lower than the 18% margin seen in 2019. Furthermore, adjusted loss was BRL 527.3 million so even when adjusting for forex revaluation Azul was still lossmaking.

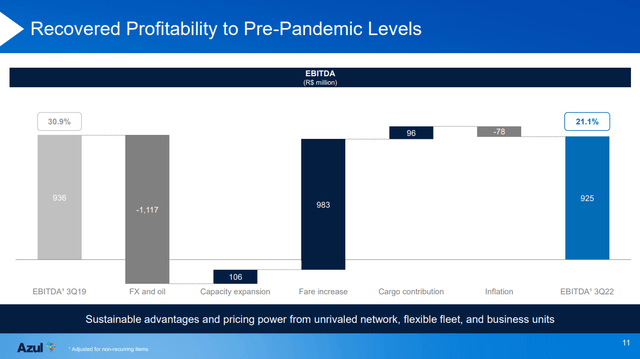

EBITDA bridge (Azul)

The EBITDA bridge with 2019 shows how FX and fuel prices have provided significant pressure on results. With capacity expansion and fare increases the earnings would get to BRL 908 million on top of which cargo provides a BRL 96 million improvement. That itself would bring the earnings to slightly over BRL 1 billion, but this is offset by BRL 78 million in inflation resulting in EBITDA to be just slightly lower than the 2019 results. Overall, EBITDA has been more or less recovered but we see that those margins are significantly lower than in 2019 which is not odd given the sharp increase in oil prices.

Cash And Debt

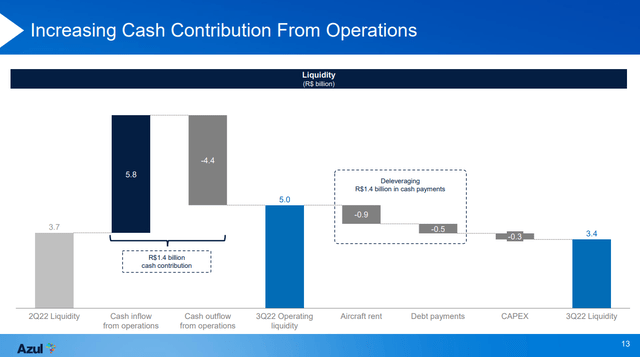

Liquidity Q3 2022 (Azul)

Cash flow from operations was BRL 1.4 billion compared to BRL 2 billion in the previous quarter. Liquidity slightly decreased as Azul also continues deleveraging which brought the company’s net debt to BRL 17.9 billion up from BRL 17.2 billion in the previous quarter. This is primarily driven by the company focusing on growing its fleet rather than significantly reducing its net debt. The good news is that Azul reached its leverage target of 6 as measured by net debt to EBITDA one quarter ahead of schedule and that measure now stands at 5.7x down from 6.3x last quarter and 11.2x last year but it still has a long way to go before reaching the 3.3x figure from 2019.

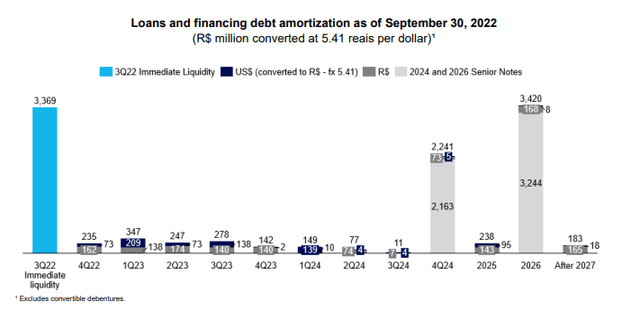

Debt maturity profile (Azul)

Looking at maturing debt and the immediate liquidity, one thing is important to note and that is until Q4 2024 Azul has no significant debt maturing. With their current liquidity they can easily pay off the debt for the coming two years and then burn off a significant amount of the debt to be repaid in the fourth quarter of 2024. Azul currently is opting for a growth strategy instead of retiring debt as its recent financial results make lenders more willing to just collect the safe interest payments from Azul on the debt that they have.

The Opportunities and Risks for Azul Stock

Looking at where Azul is heading, I would say they’re performing strongly. Whereas other airlines can only dream of having capacity fully recovered or even profitability fully recovered, on an EBITDA basis Azul has already recovered 99%. The company is focusing on growth and more particularly growing with a fuel-efficient fleet. Its specific fuel consumption as measured by liters per available-seat-mile is down 7.7% and that obviously provides a reduction on the fuel bill though with fuel prices being so much higher than three years ago you will hardly notice, but the cost efficiency is baked into those new aircraft that Azul is adding to the fleet and the company is benefiting from it now and will benefit from it in the future when fuel costs drop. Furthermore, the company is adding more Embraer (ERJ) E2 jets which are more fuel efficient by technology and have 18 more seats. So that increases the overall topline opportunity for those jets on a lower unit cost basis.

The loss of $0.72 per ADR was $0.04 worse than analysts expected, but given the increase in share prices post-earnings one can wonder how much the market really cared about the miss. The main risk for Azul seems to be Lula’s presidency and that risk is two sides, namely underperformance of the Brazilian stock markets and secondly actual weakness in operating results for Azul.

So, the Brazilian stock markets have sold off and the Brazilian Real came under pressure on fears of unbridled spending from the Lula administration. That uncertainty creates fear on the markets, and over the longer term, if Lula’s policy plan has an adverse impact on the economy it could destabilize the currency leading. For Azul that would mean that their cost in Brazilian Real goes up for cost items that are dollar-denominated and overall demand could decrease leading to softening in unit revenues while the company has opted to grow its capacity rather than reducing debt.

Conclusion: Azul Is A Good Stock But Uncertainty Defines Stock Performance

I continue to believe that Azul is performing well. It’s operating above 2019 capacity levels and is actively transforming the fleet to reduce fuel costs and increase revenue potential by means of upgauging. Its recent purchase of additional Airbus A330neo aircraft fits that strategy. Azul is not yet at margin levels and leverage levels previously seen and business travel also has some way to recovery volume wise and I believe an average Wall Street price target of $11.18 per share reflects those opportunities.

However, on a political level there are pressures. Firstly, Lula’s policy plan might include expanding budgets and expenses that could pressure the economy and erode demand drivers for which Azul is positioning its business, and secondly as I’m writing this report Jair Bolsonaro, the former President of Brazil, has opposed the election results which could further put pressure on stock markets.

So, in Azul I see a strong business that’s shaping itself diligently for the future but that future is paved with political and economic uncertainty. Once that fades, I believe shares of Azul can fly higher. As a result, with the risks in mind, I rate Azul a Hold instead of Buy even though I’m charmed by their business plan.

Be the first to comment