mtcurado

We recently performed a top-down analysis of the EU insurance sector, and we confirmed AXA (OTCQX:AXAHY, OTCQX:AXAHF) as our favorite pick. In our scenario analysis, the French insurance giant scored the highest in terms of yield (including buyback and dividend payment) and one of the lowest in terms of valuation (despite a strong Solvency II ratio). Today, we are back to comment on the company’s quarterly results and its latest development.

Q3 results

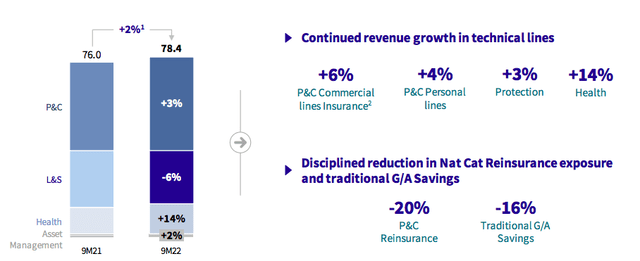

During the half-year results presentation, AXA positively surprised the market with a strong set of numbers. In Q3, the main company’s financial indicators were down on a quarterly basis. Here at the Lab, we previously analyzed AXA’s 10-year performance, and in the latest quarterly publication, we are noticing the same trend in the business line with a strong performance in health, a downward trend in life insurance, and resiliency across the P&C division.

AXA segment snap (AXA Q3 results presentation)

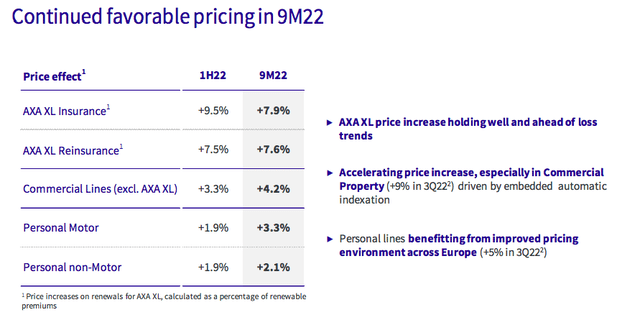

Cross-checking Street estimates, AXA achieved a small beat to the average analyst consensus on the revenue line, signaling a positive performance in all the regions. Going to the divisional performance, AXA health insurance and AXA commercial lines continue to be the key supportive catalyst for the company. The former was particularly strong in top-line sales, especially in AXA’s home country with volume up by almost 30%, while the latter continue to grow despite the AXA XL performance. This was supported by a strong pricing environment and higher market share, mainly in Europe.

AXA pricing power (AXA Q3 results presentation)

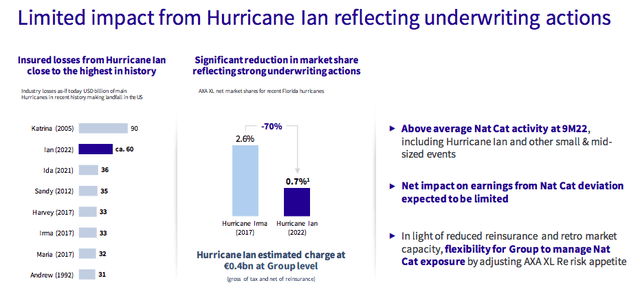

Speaking of the negative development, AXA’s life division continues to suffer. This was driven by an important reduction of unit-linked products as well as a negative impact in Asia due to COVID-19 outbreaks. Important to note is Hurricane Ian, which hit the southeast of the United States at the end of September and notoriously deteriorated the insurance sector results (particularly on the side of Swiss Re). The French giant estimated that it will incur a net loss of approximately €400 million (before tax and net of reinsurance). This is based on a total claim estimated at $60 billion, implying a net loss share of just 0.7%. Even if it is detrimental for AXA’s performance, this shows the significant natural catastrophe exposure reduction achieved by the company in recent years. If this unfortunate event had happened in 2017 and in 2020, AXA’s loss shares were estimated at 1.5% and 1%. Today, the French insurer has much less volatility on its P&L and might solely focus on earnings growth.

AXA Hurricane Ian’s impact (AXA Q3 results presentation)

Conclusion and Valuation

Before going to the valuation, AXA’s solvency ratio declined due to 1) higher market volatility, 2) Hurricane Ian’s impact, and 3) lower equity performance. However, the company is well-capitalized, and the solvency ratio stood at 225% (much higher than the regulatory requirements). AXA recently published a publication on IFRS17, and crucial to note is the fact that the company is not expecting any material changes in earnings. Therefore, they reaffirmed their 2023 outlook, so did our valuation. AXA is currently trading at a 15% discount on its P/E historical average. Therefore, we continue to value AXA with an outperforming rating and a target price of €29 per share based on an 11x P/E ratio in 2023.

Be the first to comment