CatLane/E+ via Getty Images

All values are in CAD unless noted otherwise.

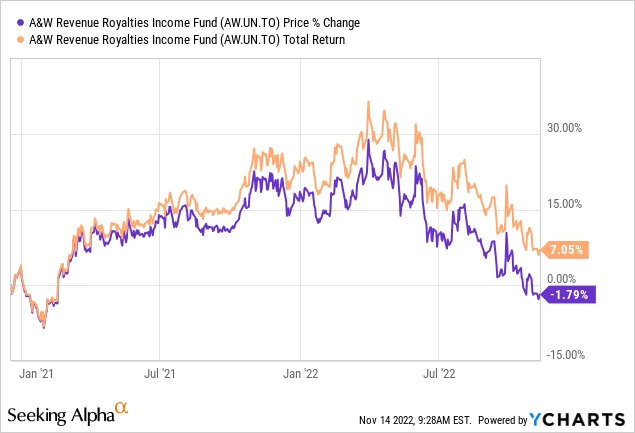

Be it for the speed at which the dividends were reinstated or the price appreciation, A&W Revenue Royalties Income Fund (OTC:AWRRF)(TSX:AW.UN:CA) surpassed our expectations when we last covered it. Some of this faster than expected recovery happened because of the resumption of the royalty payments and repayments of what was owed for February – May 2020. It was trading over our buy price then and we laid out our thinking in the conclusion of that piece:

A&W has surprised strongly on the upside, but we expect the price to cool down a bit. At the very least it has to give us a yield of 5% to come in line with its historical trend. After all, it is called the A&W Royalty Income Fund for a reason. The company is a good hold for income investors. Investors who did buy this fund can look towards $30.00 to add to their position.

Source: A&W Royalties: Distributions Likely To Reach Prior Levels In Q3-2021

It has been interesting times for the investors of this royalty play. The price breached $40 at one time and is now more or less back to what it used to be. The total returns did their job of keeping this investment flat for its holders.

Let us review the recently released results and see if we still think new positions should only be initiated under $30.

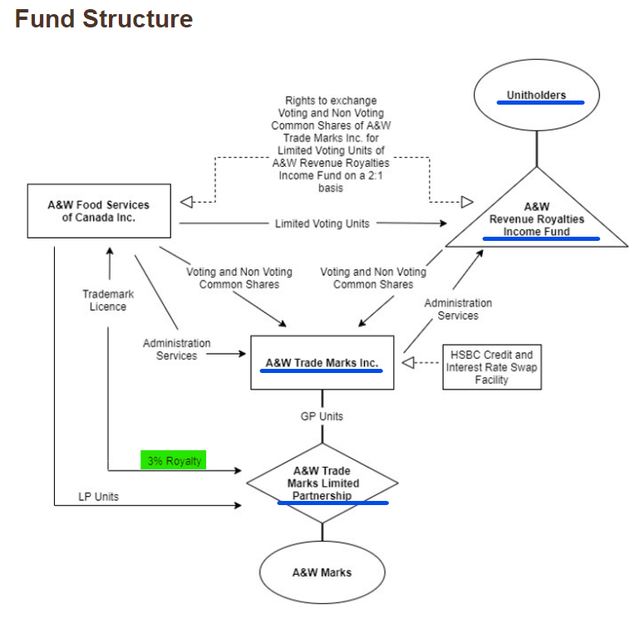

Flow Of Funds

The A&W Restaurants in the royalty pool pay 3% of their gross sales as royalty. This flows to the fund in the form of dividends after the partnership and Trade Marks Inc pay their expenses and retain a reasonable reserve.

A&W Website

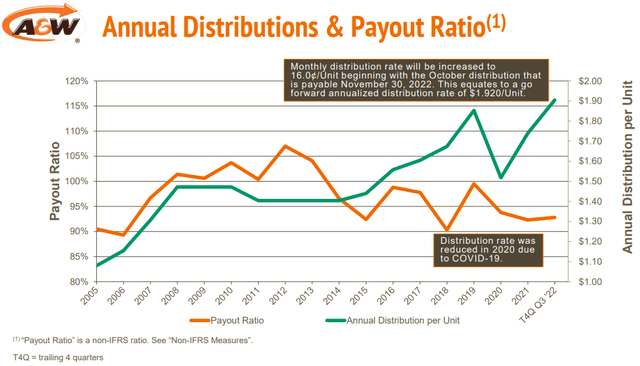

This income fund does not have any expenses of its own and typically aims to maintain a payout ratio of 100% or close to it, barring Covid-19 type events. It also endeavors to provide unitholders regular monthly dividends and as such the payout ratio will show seasonal fluctuations. The fund also pays out special dividends around year end, if it has excess cash in its coffers, like it did for the last two years.

Q3-2022 Presentation

With the most recent increase, the monthly distributions exceed those from pre-COVID-19 days of $0.159. With it now yielding almost 6%, it is back to serving the “income” fund function for its investors.

Ready To Eat All The Way From UK

While still early days, an agreement was signed in June of this year with UK-based Pret A Manger (Europe) Limited.

Q3-2022 Presentation

Besides increasing the royalty pool, growing the same-store sales is the name of the game for royalty plays like these. With the addition of the above brand to their menu, A&W management is certainly taking steps in the right direction.

Q3 Results

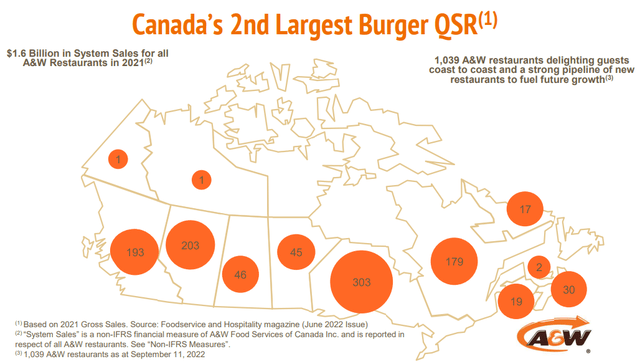

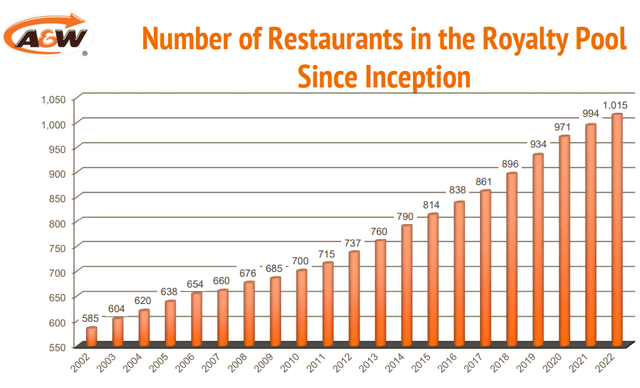

The pool is adjusted annually to account for net new restaurants opened in the preceding year. 21 restaurants were added to the 2022 pool in January of this year, taking the total to 1,015. The 2023 pool will be higher as the number of open restaurants as of September 2022 was 1,039.

Q3-2022 Presentation

In addition to the higher pool compared to 2021, the removal of all Covid-19 restrictions, such as capacity limits and reduced hours, had the restaurants back in full swing this year. Both of these factors had the expected impact and the same store revenue as well as the overall revenue evidenced a year-over-year increase of 4% and 7.4%, respectively.

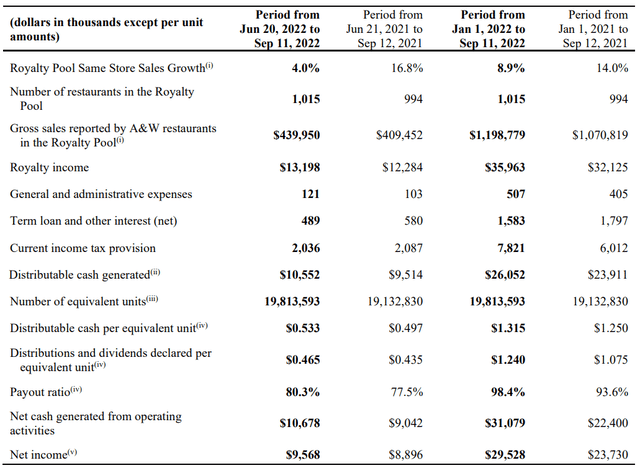

Q3-2022 Financial Report

While this feat was also made easy by the fact that there were a number of restaurant closures in the first three quarters of 2021, A&W managed to pass on modest increases to its customers in the face of higher food and labor prices.

Liquidity and Debt

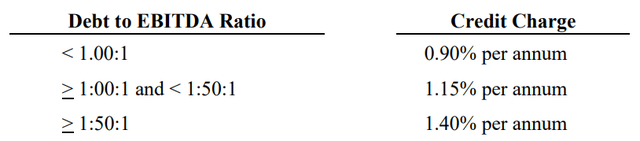

While the fund does not hold any direct debt, Trade Marks Inc does, and it is an entity whose expenses impact the flow of cash to A&W (see fund structure earlier in the article). It has a $60 million banker’s acceptance term loan, the interest rate of which is a fixed 2.80% plus a per annum stamping fee that can range from 0.90% to 1.40% based on its EBITDA Ratio.

Q3-2022 Financial Report

Currently, the EBITDA falls in the middle of the pack and a 1.15% stamping fee is in effect. The portion that is fixed, is done via interest rate swaps which will expire in December 2022. No worries though, since another swap agreement that goes to September 2026 is set to take its place. This one has an ever lower fixed rate of 1.74%. Full marks to management for locking it in low.

Trade Marks Inc also has access to a $2 million demand operating loan facility, all of which was undrawn as of the end of the third fiscal quarter.

Valuation And Verdict

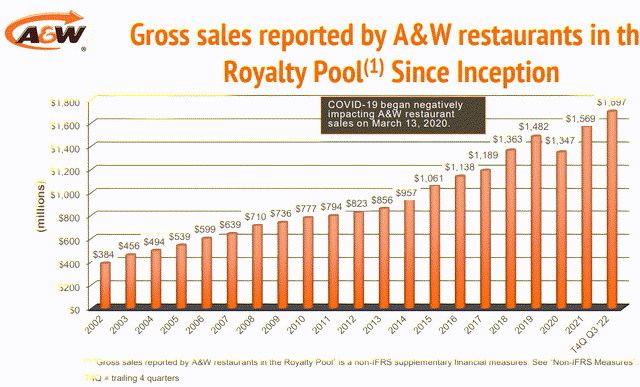

It is really interesting to note that, to date A&W has not had a down year in revenue except for 2020.

Q3-2022 Presentation

And Covid-19 notwithstanding, the number of restaurants in the pool have increased every single year.

Q3-2022 Presentation

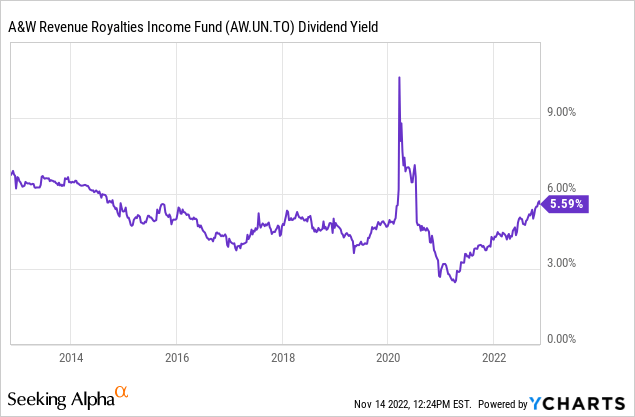

In recent times, but before Covid, the fund yielded between 4%-5%.

At the time of writing this piece, it yields almost 5.8% (current price $33.28, latest distribution 16 cents). By itself, this is a great yield from a very well managed and growing entity, however, with the kind of bargains the market is providing to us today, we would still hold out for a buy under $30, giving us closer to a 6.5% yield. This is about in line with Pizza Pizza Royalty Corp. (OTCPK:PZRIF) that snuck under our buy price just recently.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment