cemagraphics

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on January 29th, 2023.

Advent Convertible and Income Fund (NYSE:AVK) has seen its discount widen some since we last covered it. While I noted it was an interesting fund, that was one of my main takeaways. With the discount now widening further, I’m still on the fence as I see better prospects elsewhere. That being said, if you are searching for higher yields – despite the possibility of a cut – then AVK could be more appropriate at this time.

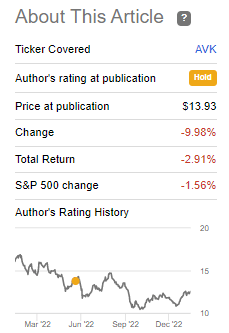

Since our last coverage, the fund’s price has dropped further. However, on a total return basis – factoring in the distributions that the fund has paid out – the results have been more favorable. At least, when compared to the broader market, the results haven’t been too detrimental. The S&P 500 isn’t an appropriate benchmark, but it can provide us with some context. Also note that since the fund’s discount has widened, that’s also reflected in the share price returns here negatively.

AVK Performance Since Prior Update (Seeking Alpha)

The Basics

- 1-Year Z-score: -0.23

- Discount: -5.22%

- Distribution Yield: 11.22%

- Expense Ratio: 1.56%

- Leverage: 44.13%

- Managed Assets: $806.7 million

- Structure: Perpetual

AVK’s investment objective is “to provide total return, through a combination of capital appreciation and current income.” They will attempt to achieve this by “investing at least 80% of its managed assets in a diversified portfolio of convertibles securities and non-convertible income securities.” They will also invest “at least 30% of its managed assets in convertible securities and up to 70% of its managed assets in lower-grade, non-convertible income securities, although the portion of the Fund’s assets invested in convertible securities and non-convertible income securities will vary from time to time.”

With the fund’s declining assets in the last year, it would appear the fund’s expense ratio ticked higher. The expense ratio went from 1.40% to 1.56%. When including leverage, which they have plenty of that, the expense ratio goes to 3.54%. That was from fiscal 2021’s 2.77%.

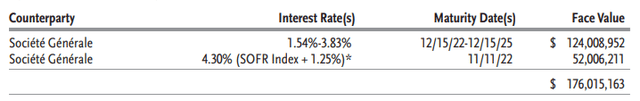

In this case, the leverage expenses rocketed higher due to increasing interest rates. This is negative for leveraged funds but even more negative for those running some of the highest leverage. In fact, they upped their borrowings from $168 to $173 million in the year. They also listed ~$176 million in reverse repurchase agreements, an increase from last year’s ~$156 million.

AVK Reverse Repurchase Agreements (Guggenheim)

Most other funds held steady with leverage, and some even had to deleverage. I suppose at least this means they didn’t have to deleverage. However, it also leaves them at greater risk in the future for deleveraging if things go south again. Fortunately, the markets have been experiencing some recovery since October (that’s the fund’s fiscal year-end), which should mean they have some cushion from a deleveraging event.

When looking at their borrowings, the majority of these are listed at fixed rates, which would have helped shelter it from some of the negative impacts of interest rates. So they weren’t totally exposed here to higher interest rates. Here is a look at the breakdown from the fund’s last report.

AVK Borrowings Stats (Guggenheim)

Performance – Better Discount, Not Good Enough

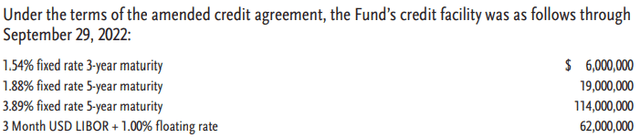

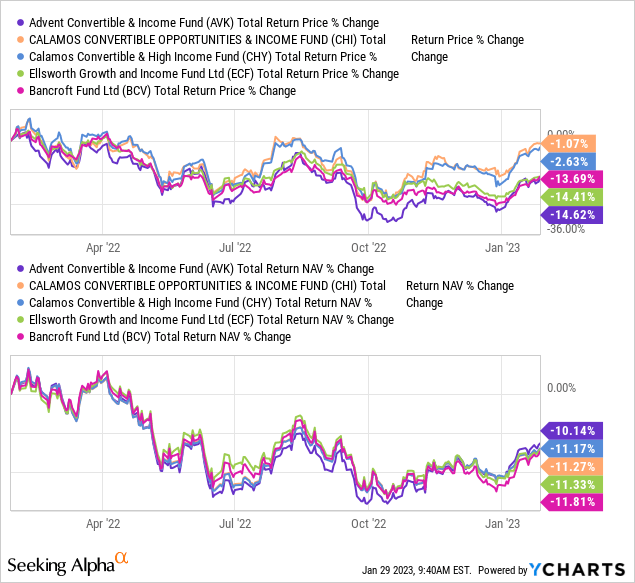

AVK has been the worst performer over the long term compared to several of its peers. That includes the Calamos twins, Calamos Convertible Opportunities & Income Fund (CHI) and Calamos Convertible & High Income Fund (CHY). I’ve also included Ellsworth Growth and Income Fund (ECF) and Bancroft Fund (BCV) from the Gabelli lineup due to being quite similar funds.

Ycharts

That being said, the fund has been a better performer over the last year on a total NAV return basis. It wasn’t by a significant amount, but it could still be seen as a bit promising. Despite that, the fund’s total share price return has dropped relative to the rest of these peers. That resulted in AVK’s discount opening up.

Ycharts

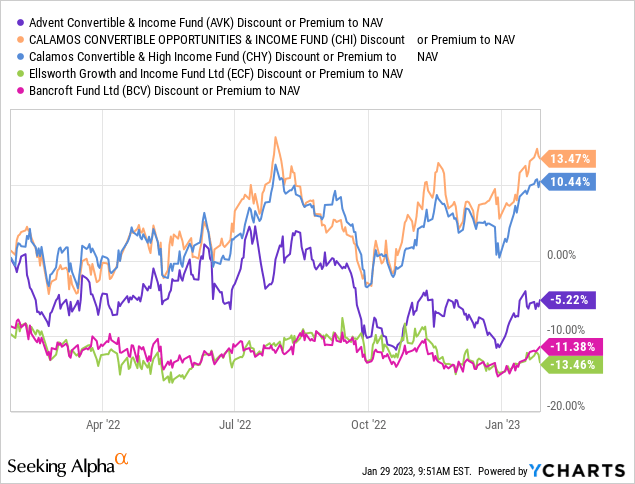

We covered CHY recently, and due to the sky-high premium (even higher at the time for CHI), it was time to rotate out. I tend to hold onto funds even while they’re at premiums, but sometimes the premiums get too high even for me. They were hitting near all-time high premium levels for these funds. They are only rivaling their 2006/07 premiums that shot up to ~20%.

These premiums may remain static for quite some time, and that can end up happening as we’ve seen historically. It can take years for overvaluations to correct. Still, it means that in the future, the chances of the fund providing successful or positive results become more difficult when they also have to work against such elevated premiums. So some might be curious if AVK is an appropriate rotate candidate. In that way, the cut to ‘income’ wouldn’t be as material.

However, ECF and BCV still present better relative values in their discount than AVK. One of the reasons that AVK gets a better valuation is its much higher distribution yield. This isn’t unexpected, as many CEF investors choose to go with much higher yields when selecting funds. It’s natural to reach for yield, but that can sometimes end up being burned.

Interestingly, AVK touched near that tempting ~10% discount level a few months back, then again briefly a month ago. That would have been a great time to consider the fund. If it gets back to that level, that’s where I’d be more tempted to consider the fund. However, that also coincided with the lows of the overall market.

Note how CHI, CHY and AVK all experienced this discount widening. ECF and BCV were less impacted, which highlights the risk of funds with higher valuations – they are more volatile.

Ycharts

Distribution – A Cut Is Possible

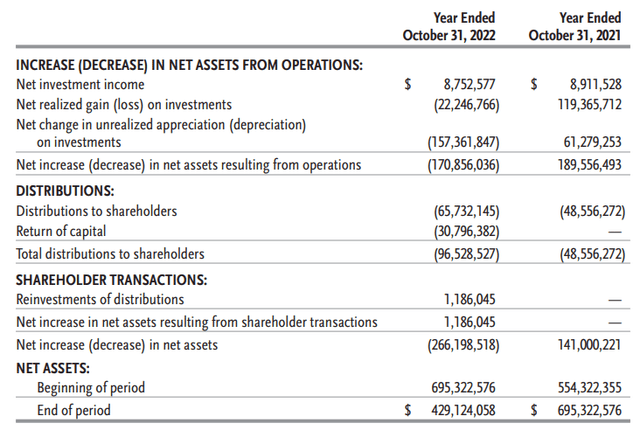

Interest rates have increased since their last report, but their net investment income didn’t take too much of a hit for the most part in their latest report yet. Their total investment income reported year-over-year also stayed relatively flat, going from ~$27.793 million to ~$27.445 million.

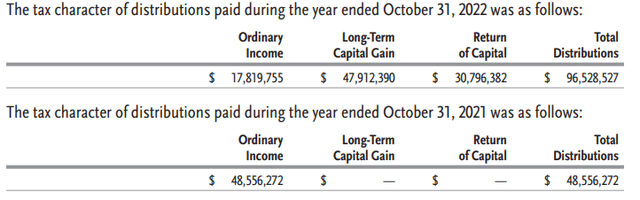

Like most convertible funds, much of the distribution paid out to shareholders will be covered via capital gains. Future distributions become uncertain if they don’t have capital gains regularly. A year isn’t generally too much to get worked up about, but multiple years could be an issue.

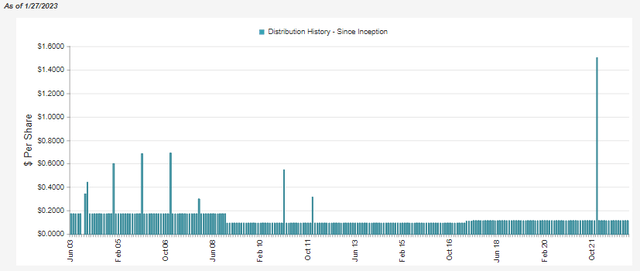

Note that the fund’s distribution to shareholders in the last year also includes a massive year-end special. That accounted for nearly $48 million, roughly doubling what the fund paid out in the prior fiscal year.

AVK Annual Report (Guggenheim)

So with 2022 being a soft year, it isn’t necessarily a bad sign. However, it is more looking at the elevated distribution yields. Investors receive an 11.22% distribution yield on the market price at the time of writing. On a NAV basis, it comes to 10.63%. It is this particular metric that is something that needs to be watched.

This metric tells us that the fund needs to earn 10.63% on its underlying portfolio to cover its payout to shareholders. That’s a fairly high hurdle for any fund to produce, so I’m cautious here and wouldn’t be too shocked to see a cut. Albeit, we were coming out of a bear market, and any recovery (as we’ve been getting, actually) is going to reduce this level further and further.

The fund also doesn’t just adjust its distribution aggressively. They will maintain the same payouts for years, at least based on history. That can be a positive for shareholders to provide predictability. The fund was also able to fund a massive special distribution at the end of 2021. That came from the strong gains the fund could produce in 2019/2020. That’s where the $119.4 million in realized capital gains came in for fiscal 2021.

AVK Distribution History (CEFConnect)

For tax purposes, the fund’s distribution had a higher allocation to ordinary income in 2021. Only around 10% of that portion was identified as qualified dividends.

However, then in 2020, the entire distribution was characterized as ROC. So the ROC classifications would lose their benefit in a tax-sheltered account.

The breakdown was more spread out in fiscal 2022 due to the year-end significantly altering the total.

For tax-sensitive investors, holding this fund in a tax-sheltered account could be more appropriate due to the unpredictability of the distribution characterization.

AVK Distribution Tax Classifications (Guggenheim)

AVK’s Portfolio

The fund managers are extremely busy in this fund. In the prior fiscal year, turnover came to 186%. That wasn’t even the highest turnover, either. In fiscal 2020, the portfolio turnover rate came to 242%.

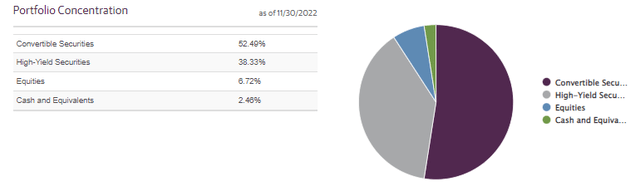

That means the portfolio can change pretty significantly from update to update, at least in terms of what they hold. The overall broader allocations stay relatively similar. As a reflection of that, the fund’s asset allocation of convertible securities against high-yield securities has remained fairly static from our previous update.

AVK Asset Allocation (Guggenheim)

These weightings differed a bit from the peers we had listed above from the perspective of not holding as much in convertible securities. CHI and CHY carry around ~65%+ in convertibles, with high-yield being squeezed down to around 25%.

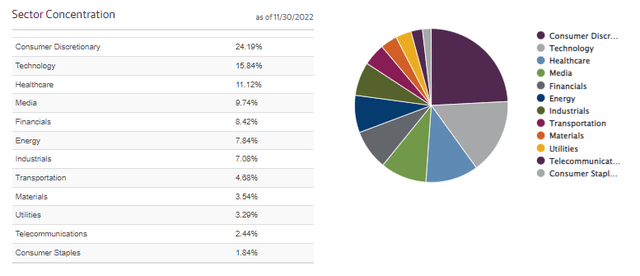

We can start seeing some fairly meaningful changes in sector allocation, although not dramatically. The consumer discretionary and tech sectors still comprise the weight of the fund. However, the weightings here have shifted from consumer discretionary’s previous 21.36% weighting and technology’s weighting of 20.60%.

AVK Sector Exposure (Guggenheim)

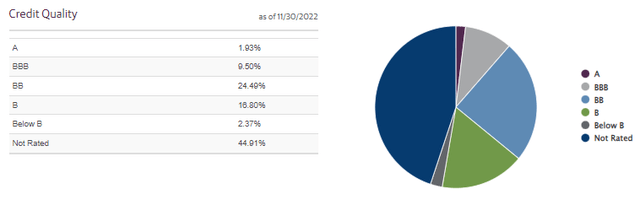

Similar to other convertible funds, AVK’s credit quality breakdown is mostly tilted towards being not rated or unrated securities. This is because they carry significant exposure to 144a issues, meaning they aren’t registered and are privately placed securities. Those investments make up 70.7% of the fund’s total net assets at the end of October 2022.

When going the privately placed route, they can save time and costs associated with getting these bonds rated. The buyer is a qualified institutional buyer, so the due diligence is put onto their shoulders.

AVK Credit Quality of Portfolio (Guggenheim)

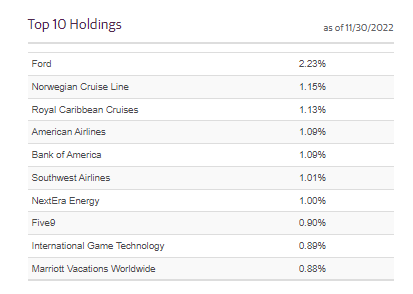

When looking at the top holdings, we see an interesting mix of names. A diverse group of names makes up only around 11.37% of the fund. That helps highlight that the fund is quite diversified. CEFConnect lists the number of holdings at 337 in total. In this case, the Ford (F) convertible at 2.23% could almost be considered an overweight position relative to the weightings of the other names.

AVK Top Holdings (Guggenheim)

Looking more at the Ford position, it gives us fairly limited details on the holding. However, this position is also present in ECF and BCV. In our previous BCV article, we know this is a zero-coupon convertible bond. That means that the only gains will come from capital gains, potentially. BCV also has this convertible from Ford as its largest holding.

AVK Ford Position (Guggenheim)

One metric I wasn’t able to find for AVK was the portfolio duration. That can be an important statistic in fixed-income funds for coming up with an idea of how interest rate sensitive their portfolio might be.

Assuming could be dangerous here, but generally, convertible funds aren’t overly interest rate sensitive. This becomes even more true when yields on the offerings are so low, which is exactly what we’ve experienced in the last couple of years when interest rates were zero before the Fed started raising. As an example, CHY listed that their portfolio duration was only 2.6 years. That could be somewhat similar to what we would expect with AVK.

Conclusion

AVK’s discount has come down some from our prior update. Before getting too excited here, I would still be looking for an even deeper discount. The fund’s discount did drop near ECF and BCV discount levels a few months ago when the broader market made new lows. It then touched near that discount level a month ago too. That level appears to be a strong time to consider adding the fund and is a much more appealing level. The fund’s distribution is at risk at the moment. However, I believe a cut could still be averted if the market rebound continues.

Be the first to comment