tupungato/iStock Editorial via Getty Images

Here at the Lab, we like the insurance business. Aviva (OTCPK:AIVAF) was one of the few players still not covered and since our initiation, we were not particularly favored by the stock price development. Our readers might check our previous comps analysis between Aviva and L&G (OTCPK:LGGNY).

- Legal & General: Attractive ROE Will Lead To Appreciation Over Time

- Aviva: Potential Upside From Discretionary Capital Deployments

After a turbulent September, we deep-dive into Aviva’s Q3 trading update, but we will copy and paste some notes from one of our previous publications, in particular, our last update on L&G.

Legal & General: Time To Re-Enter

Since then, the Bank of England heavily intervened to calm the market and the British Prime Minister was ‘likely‘ forced to resign. Looking at the stock price levels, Aviva and Legal & General (with our analysis called time to re-enter) are positively up by 8% and 28% respectively. Our Aviva buy case recap was based on 1) discretionary capital deployments, 2) solid solvency ratio requirements, and 3) a compelling valuation supported by a tasty dividend per share.

Q3 Results

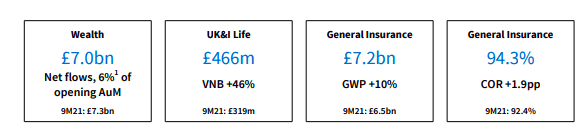

Looking at the aggregate level, Aviva reported good numbers thanks to the positive performance of the General Insurance which partially offset the Life Insurance’s lower results. In detail, the former division’s top-line sales were supported by the growth in gross written premium which was up by 16% on a yearly basis. These positive results were driven by Canada and the UK. At the nine-month level, COR reached 94.3% (and even if it is up compared to last year’s results which were at 92.4%), this was a strong beat versus consensus estimates. In the Life Insurance division, Q3 turnover was down 11% compared to the last year’s same quarter. The new business margin significantly improved but was totally offset by BPA margins (bulk annuities). Despite a positive net flow number in Q3, looking at the 9 months, AuM was down by approximately 4%. This was driven by the ongoing macroeconomic challenges; however, we should note the positive workplace development which increased by 11% thanks to higher employee contribution and wage inflation.

Aviva financials in a snap

Conclusion and Valuation

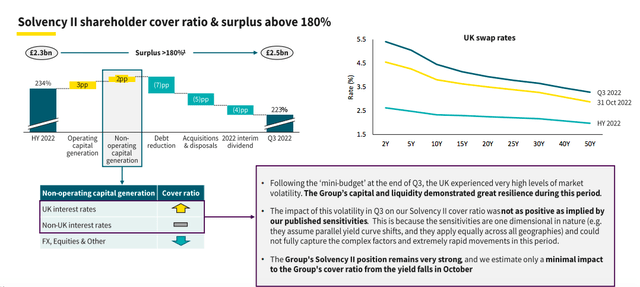

Cross-checking Wall Street analyst estimates, the solvency II ratio was below consensus. Aviva reported a 223% number compared to the average expectation set at 237% (and also down versus the half-year results). Once again, we should report that the company’s lower SII ratio was due to a few one-off events. In detail, Aviva paid the interim dividend, completed an acquisition in the wealth division, and redeemed a restricted Tier 1 debt for a total consideration of £500 million. Despite that, regulators’ requirements set the ratio at 180%, and the company is well above.

Aviva Solvency Ratio development

Aside from the financial consideration, Aviva reaffirmed its share repurchase plan for 2023 and its dividend commitments. The corporate liquidity is still in excess and the company reaffirmed its 2024 financial targets. On the valuation, we reiterate our buy rating target of £5 per share based on the shareholder value at 0.82x versus a historical average of 0.9x (this is based on the latest five years average). Since our follow-up note, the company is up by 8% but still misses a 10% in stock price appreciation (not considering the dividend which is at almost 7% yield). During the years, the company demonstrated a good track record on disposal, the next company’s chapter will be revenue and margin growth in its core segments. Given the positive track record and the company’s commitment to shareholder remuneration (after having increased its DPS by 40% and aligned it with its direct competitors L&G and Phoenix Group (OTCPK:PNXGF)), we believe that the following ratio will drive the stock price appreciation:

- resiliency in the solvency II ratio

- £1.5 billion in center liquidity

- AA credit rating

On the positive upside, Aviva should also benefit from favorable currency development in Canada and as already mentioned from a rebound in its bulk annuities. Major risks that might affect our target price include 1) credit default risk (the company holds £1.4 billion of credit default reserves which approximately are 2% of its annuity bond portfolio), 2) investment markets volatility and uncertainty, 3) sensitivity to credit downgrades and equity markets, 4) lower than expected AuM growth, 5) higher competition in the UK Life sector, and 6) new business development and margins.

Be the first to comment