SimonSkafar

Avista Corporation (NYSE:AVA) is a regulated electric and natural gas company that serves customers in much of the Pacific Northwest. The utility sector in general has long been favored by conservative investors such as retirees due to the general stability of their business models. In addition, many of these companies have among the highest dividends available in the market, with Avista itself yielding a phenomenal 4.81% at the current price.

This is one of the highest yields in the sector, which resulted from a rather significant stock decline over the past six weeks. This has made the stock somewhat cheaper than the last time that I discussed the company, but it does still remain one of the more expensive utilities in the sector. The decline was likely due to the company’s second-quarter 2022 earnings being somewhat weak, but its guidance remained steady. In this article, we will specifically discuss the events that transpired during the second quarter, although the overall thesis has not changed significantly.

About Avista Corporation

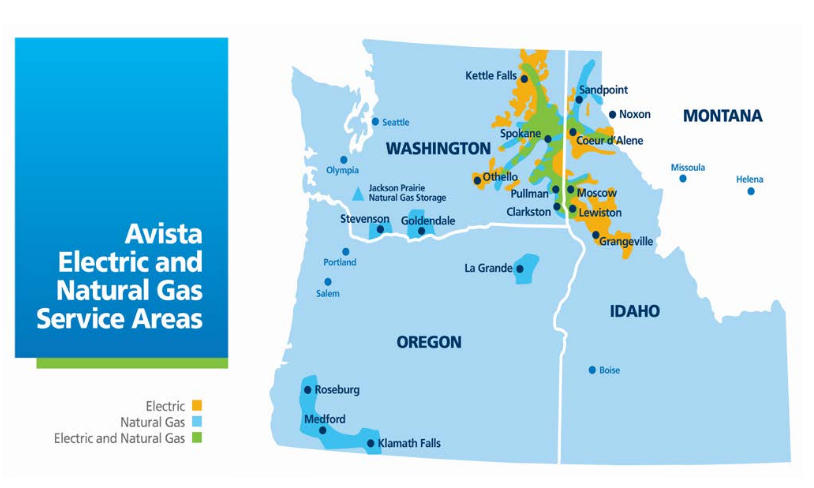

As stated in the introduction, Avista Corporation is a regulated electric and natural gas utility that operates primarily in the Pacific Northwest states of Washington, Oregon, Montana, and Idaho, although it also has operations in Alaska:

Avista Corporation

This is a remarkably large coverage area, spanning approximately 30,000 miles. However, it is primarily rural and not particularly populated. The company only serves 402,000 electric and 368,000 natural gas customers. This is a fairly attractive split because the fundamentals of electricity and natural gas are somewhat different. Most particularly, the two utilities are somewhat seasonal. For example, natural gas see by far their highest consumption and revenues during the winter months of the year, primarily the first quarter. This is because natural gas is mostly used for space heating, which is needed when the weather is cold.

Electricity is consumed year-round, which does give electric utilities more stable cash flows from quarter to quarter. However, electricity is still somewhat more heavily consumed during the summer months as many people like to run air conditioners and similar appliances that might not be run in the winter. That Avista has a customer profile that is fairly balanced between the two different types of utilities thus helps it balance out its cash flows over time by smoothing out seasonal fluctuations.

The fact that the company’s customer base is smaller than we might expect given the size of its service area does not stop it from enjoying many of the same characteristics that we have come to expect from other utilities. In particular, the company enjoys remarkably stable cash flows over time. We can see this by looking at Avista’s trailing twelve-month operating cash flows in the past several quarters:

Seeking Alpha

The reason for this should be fairly obvious. After all, most people consider electric and natural gas services to be essential for our modern way of life. As such, they will typically prioritize paying their utility bills ahead of making more discretionary purchases during times when money gets tight. In addition, many people of limited means are able to secure government aid, which even provides stability for some of the most vulnerable people to income declines. This is a characteristic that could prove very important in the near term, as the United States has now seen two quarters of consecutive negative gross domestic product growth, so it is technically in a recession. There are predictions that we will also see the third quarter of negative gross domestic product growth, which would exacerbate the current economic problems in the United States. These are the conditions in which we are likely to begin to see declining disposable incomes, which makes the stability of a company like Avista highly valuable.

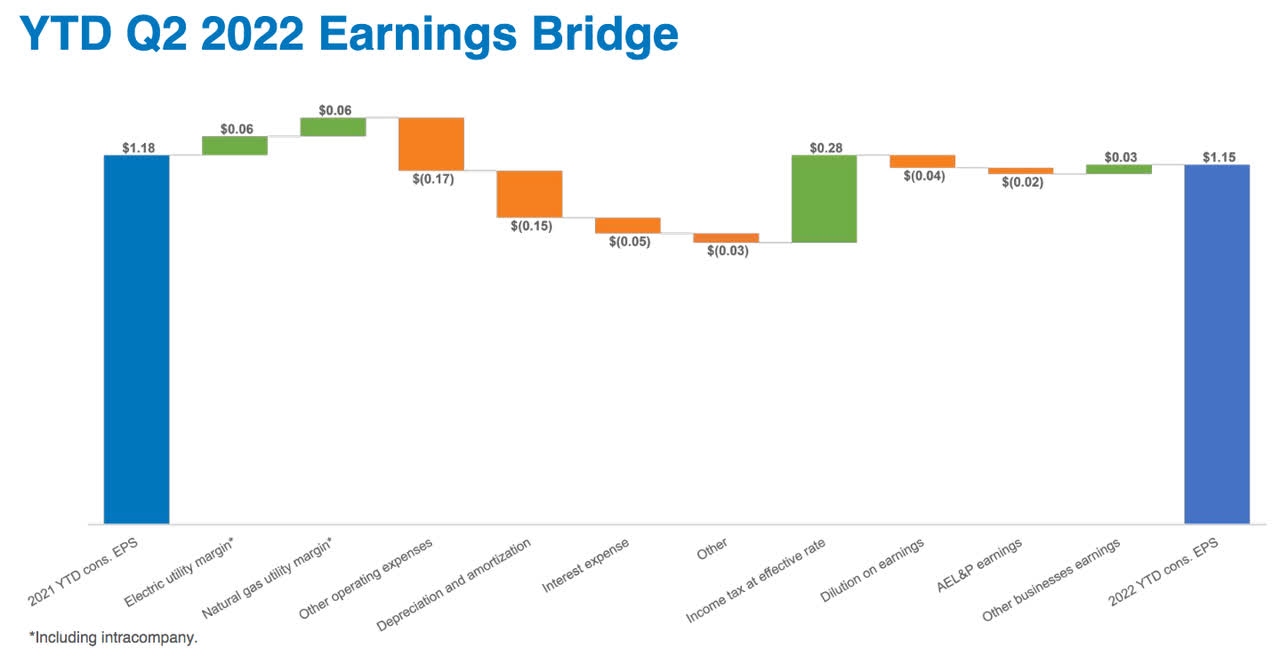

With that said, Avista has seen some declining cash flow in the past few quarters, although it has not yet been significant. We saw this, too, in the second quarter of 2022, in which Avista saw its net income decline from $14.074 million a year ago to $11.453 million in the most recent quarter. Unfortunately, the only thing that Avista officially stated is that the decline was primarily due to higher operating costs:

Avista Corporation

It seems likely that one of the major causes of the higher operating costs here is fuel expense. As everyone reading this likely knows, both crude oil and natural gas were significantly more expensive during the second quarter than they were during the second quarter of 2021. One of the biggest costs that electric utilities incur is purchasing natural gas to fuel their power plants and support their truck fleets.

Natural gas utilities have similar problems, particularly if they are unable to increase their prices sufficiently to account for the higher natural gas prices. In addition to this, the company took a $4.0 million write-off related to the disposal of dry ash disposal system assets. It is important to note, though, that this was a non-cash expense and so is not nearly as big of a deal as if the company actually had higher bills.

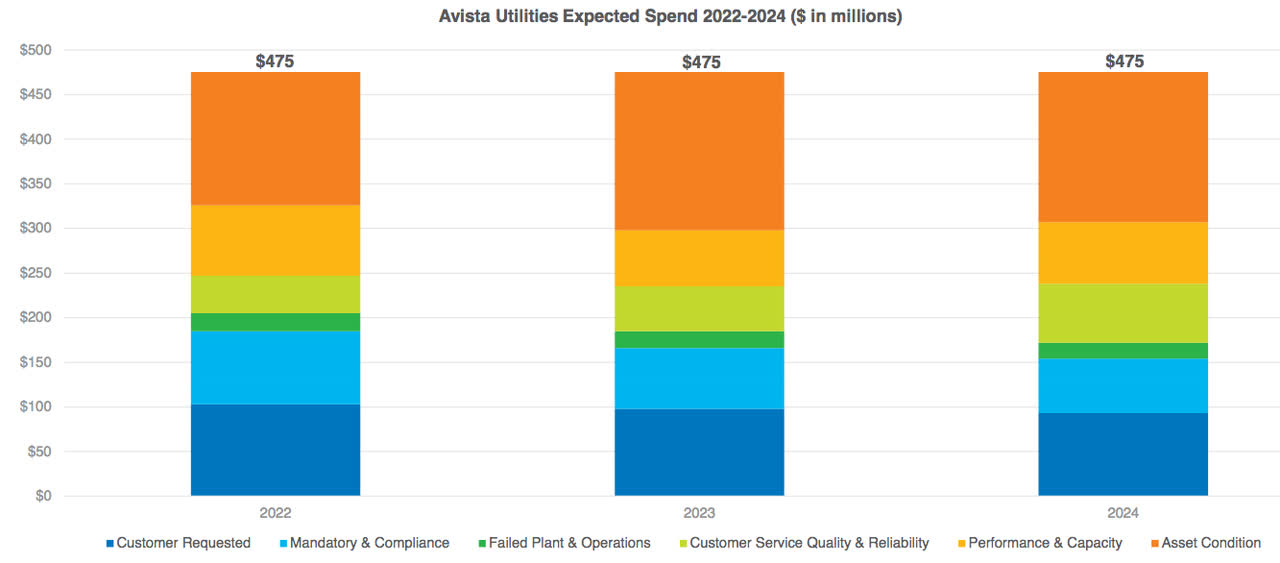

Although the decline in net income and earnings per share year-over-year is somewhat disappointing, the company is positioned to deliver growth over the next few years. It is going to accomplish this by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase in the rate base allows the company to increase the price that it charges its customers in order to earn this specified rate of return. The way that the company grows its rate base is by investing money into modernizing, upgrading, and possibly even expanding its utility-grade infrastructure. Avista Corporation is planning to do exactly this by investing approximately $425 million each year over the 2022-2024 period into its asset base:

Avista Corporation

This should be able to grow Avista’s rate base at a 5% compound annual growth rate over the period. Admittedly, this is not as aggressive of a rate base increase as some other utilities offer but it should still be sufficient to grow Avista’s earnings per share at a 4% to 6% compound annual growth rate over the long term. When we combine this with the company’s current 4.81% dividend yield, it seems likely that Avista will be able to deliver a 9% to 11% total return annually going forward, which is certainly not unattractive for a generally conservative investment.

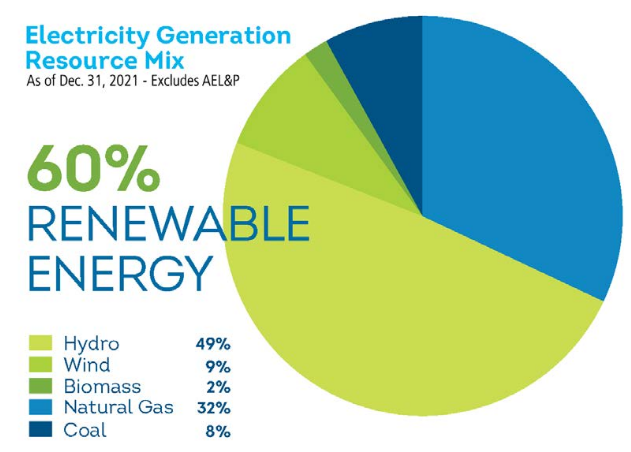

As mentioned earlier, one of the things that have been weighing on utilities is the rising price of natural gas that they use to power their electric generation. However, Avista is not as exposed to this as many of its peers due to the geography of the region in which the company operates. Its service area contains a great many reasonably powerful rivers carrying runoff from the Rocky Mountains west to the Pacific Ocean. This has allowed the company to generate a substantial amount of its electricity from renewable sources. In fact, fully 49% of its electric generation comes from hydropower alone, and fully 60% overall comes from renewable sources:

Avista Corporation

This is a much higher percentage than most other electric utilities, which could prove to be an advantage for the company’s stock price. As I mentioned in a recent article, the various environmental, social, and governance funds around the world represent a tremendous amount of purchasing power. These funds tend to invest in things that are focused on reducing carbon emissions, so they seem likely to like Avista because of its already incredibly strong renewable credentials. Should the stock attract the attention of these funds in a significant way, then it will likely push up the stock price or at least put a floor under it that prevents it from declining too far. This may make the stock somewhat more appealing than a few other utilities that are not nearly as heavily invested in green energy for someone that is looking to preserve their wealth.

Financial Considerations

It is always critical that we investigate the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid. This is typically accomplished by issuing new debt to repay the existing debt as it matures, which can cause a company’s interest expenses to increase following the rollover, depending on overall market conditions. In addition to this, a company must make regular payments on its debt if it is to remain solvent.

As such, any event that causes its cash flow to decline may push the firm into financial distress if it has too much debt. Although utilities like Avista tend to enjoy remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector so this is still a risk that we should not ignore.

One metric that we can use to measure a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. In addition, it tells us how well the company’s equity can cover its debt obligations in the event of bankruptcy or liquidation, which is arguably more important.

As of June 30, 2022 (the most recent date for which data is currently available), Avista Corporation has a net debt of $2.6146 billion compared to $2.2375 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.17, which is slightly worse than the last time that we looked at the company. Here is how that compares to a few of the company’s peers:

|

Company |

Net Debt-to-Equity Ratio |

|

Avista Corporation |

1.17 |

|

DTE Energy (DTE) |

2.23 |

|

Eversource Energy (ES) |

1.41 |

|

OGE Energy Corp. (OGE) |

1.17 |

|

Exelon Corporation (EXC) |

1.60 |

As we can see, Avista Corporation’s ratio appears quite reasonable compared to its peers. This is a very positive sign as it should indicate that the company’s leverage is reasonable and that it should not pose any particularly large risk for investors. Overall, there does not appear to be anything to worry about here.

Dividend Analysis

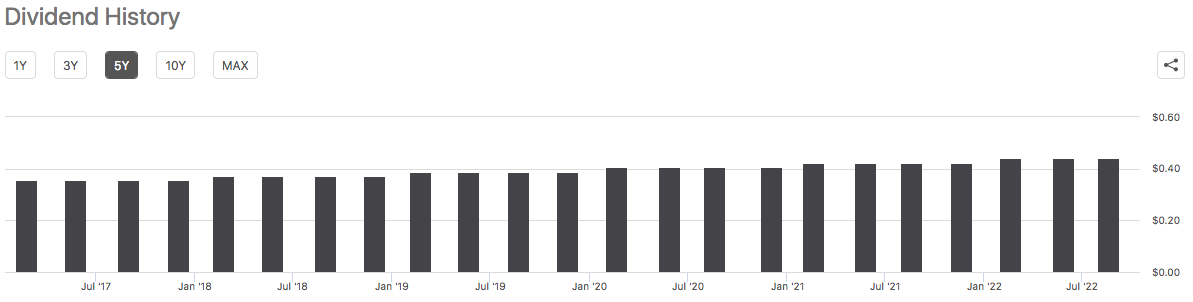

One of the biggest reasons that many investors purchase shares of utility companies is because of the remarkably high dividend yields that many of these firms tend to possess. Avista Corporation is certainly no exception to this as the stock yields 4.81% at the current price, which is substantially higher than the 1.70% yield on the S&P 500 index (SPY). In addition to this, Avista Corporation has a history of raising its dividend every year:

Seeking Alpha

This is something that is highly attractive, particularly considering today’s inflationary environment. This is because inflation is constantly reducing the amount that you can buy with the dividend that you receive from the company. As a result, it can feel that one is getting poorer and poorer with time. The fact then that the company pays out more money each year helps to offset this effect because the higher amount of money helps maintain the purchasing power of the dividend that you receive from Avista. This is something that is especially important for retirees that are depending on their portfolio incomes to pay their bills.

Naturally, we want to ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and cut the dividend since that would reduce our incomes and likely cause the stock price to decline. The usual way that we analyze a company’s ability to pay the dividend is by looking at its free cash flow. The free cash flow is the amount of money that is generated by the firm’s ordinary operations and is left over after it pays all its bills and makes all necessary capital expenditures. This is the money that can be used to do things such as reduce debt, buy back stock, or pay a dividend. During the trailing twelve-month period that ended June 30, 2022, Avista Corporation had a negative leveraged free cash flow of $119.7 million. This was obviously insufficient to pay any dividend, let alone the $123.6 million that the company actually paid out to its investors. This may at first appear quite worrying.

However, it is not unusual for a utility to finance its capital expenditures through the issuance of equity and especially debt. It will then use its operating cash flow to cover the dividend. During the twelve-month period that ended June 30, 2022, Avista Corporation had an operating cash flow of $283.2 million, which is easily enough to cover the $123.6 million dividend with money left over for other purposes. Thus, it does appear that the dividend is probably quite safe and investors should not have to worry too much.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Avista Corporation, one method that we can use to value it is looking at a metric known as the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the company may be undervalued at the current price and vice versa. However, there are very few stocks that have such a low ratio in today’s market. This is particularly true in the relatively low-growth utility sector. Thus, the best way to value the stock is to compare it to its peers in order to determine which company has the most attractive relative valuation.

According to Zacks Investment Research, Avista Corporation will grow its earnings per share at a 5.38% rate over the next three to five years. This is in line with the figure that we used to calculate the stock’s potential total return earlier so it seems pretty solid. This gives the company a price-to-earnings growth ratio of 3.52 at the current price. Here is how that compares to the company’s peer group:

|

Company |

PEG Ratio |

|

Avista Corporation |

3.52 |

|

DTE Energy |

2.97 |

|

Eversource Energy |

2.85 |

|

OGE Energy Corp. |

4.62 |

|

Exelon Corporation |

2.29 |

Unfortunately, this is not particularly good to see, as Avista Corporation looks to be considerably more expensive than its peers at their present prices. It is cheaper than the last time that we looked at the stock, but not by much. This could be due to the company’s impressive environmental credentials as discussed earlier. The fact that it is holding up much better than its peers overall would thus serve to validate our thesis with respect to the environmental, social, and governance funds discussed earlier. However, a more conservative investor may want to see if a more attractive price presents itself. There is no guarantee that this will actually occur though. It might be worth considering overall, especially given the fact that the stock is relatively flat over the past year (a rarity today) and it boasts a very high dividend yield.

Conclusion

In conclusion, Avista Corporation still looks to be a fairly expensive utility stock with an excellent yield. There was a bit of a selloff following the second-quarter earnings report, but the stock has still been reasonably flat over the past year when compared to its peers. This could be a sign that its impressive environmental characteristics are beginning to attract the attention of the funds that are specializing in this, and it could position the stock better than some peers to weather a stock decline that might accompany a recession. The firm also boasts a remarkably strong balance sheet, so it should be somewhat less risky than its peers. Overall, an investment in Avista Corporation could be worth thinking about.

Be the first to comment