jetcityimage/iStock Editorial via Getty Images

Today, we’re taking a look at Avery Dennison (NYSE:AVY). The unique positioning of this Company, its strong product offering, and also excellent management means that this name has been bandied about our headquarters quite a bit recently. Also, thanks to its position as a supplier to the consumer staples industry, we can also use the company as a gauge for the temperature of the economy.

Avery Dennison is, in its own words, “a materials science and manufacturing company specialising in the design and manufacture of a wide variety of labelling and functional materials.” it operates in three main sectors: label and graphic materials, retail branding and information solutions, and industrial and healthcare which make up 63%, 29%, and 8% of revenues respectively.

First of all, let’s take a look at the Q1 results to see what we can deduce about the business.

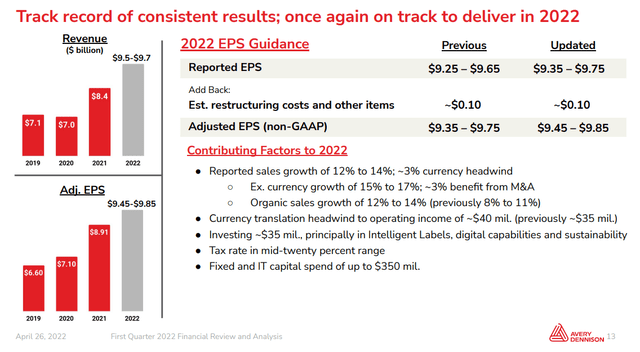

Group net sales increased 14.5% to $2.3 billion. The label and graphic materials segment saw sales increase by 8% to $1.5 billion, the retail branding information solutions sector saw sales increase by 41% to $679 million and the industrial and healthcare materials saw a decrease of 1% to $190 million. Thanks to this strong performance, the group raised their FY 2022 adjusted EPS guidance from $9.35-$9.75 to $9.45-$9.85. Chairman and CEO Mitch Butier said, “Our strong performance comes at a difficult time as COVID-19 continues, supply chains remain tight and inflationary pressures persist. Despite these challenges, we have raised our outlook, and we continue to expect strong top- and bottom-line growth for the year,” He continued “We remain confident that the consistent execution of our strategies will enable us to meet our long-term goals for superior value creation through a balance of profitable growth and capital discipline.”

So there we have it. Strong performance amid difficult conditions, but followers of the Mare Evidence Lab will know that we have covered a lot of companies who have had stellar Q1s. What sets apart Avery Dennison from the others?

Innovative product offering with strong growth, and exposure to so many different industries and geographies which provides a diversification safety net.

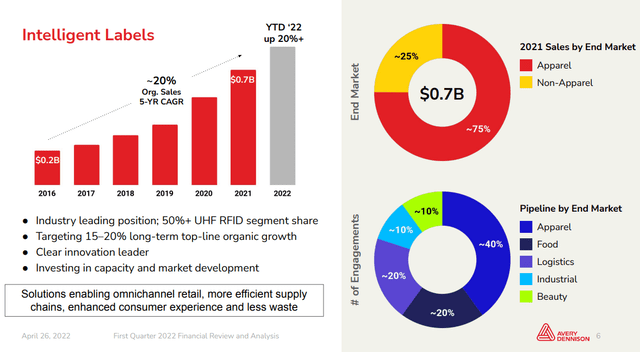

Let’s start by looking at its innovative products. Avery Dennison has an industry-leading position in smart labels, labels which use RFID (radio frequency identification) technology, a segment which is seeing a CAGR rate of roughly 20%. Though in 2021, around 75% of sales were for the apparel market, the current pipeline is much more diverse, which can be noted in the graphic below.

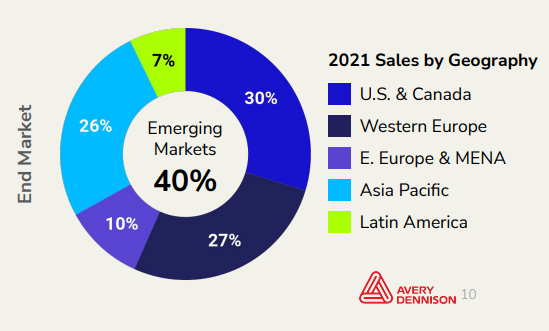

One of the other reasons why we like the Company is the defensive element of having such a diverse client base not only by industry but also geography. Avery Dennison says that the products are “used in nearly every major industry” and we have added a snap below of the labels and graphic materials revenue breakdown by geography.

Avery Dennison

Another key takeaway when we spoke to the management was on order numbers. The group has major retail clients such as Walmart and Target, both of which have issued profit warnings recently, however, the group has seen no reduction in order numbers from these retail giants, confirming our idea around the relative strength of the group.

Avery Dennison is run very well, the Company is innovating yet is protected from the dangers to which other companies are falling foul, and its industrial and geographical diversification provides us with great confidence. Looking at the valuation, the company is trading at with a forward P/E of 16.6x, higher than the peer average of 12.5x. Also, the EV/EBITDA commands an even higher premium at 11.2x vs the peer average of 8.7x. But you know what they say, if you pay peanuts, you get monkeys. We take confidence in Avery Dennison’s track record and ability to grow revenues and EPS, we initiate our coverage with a buy rating.

Be the first to comment