howtogoto/iStock via Getty Images

The income tax created more criminals than any other single act of government.” – Barry Goldwater

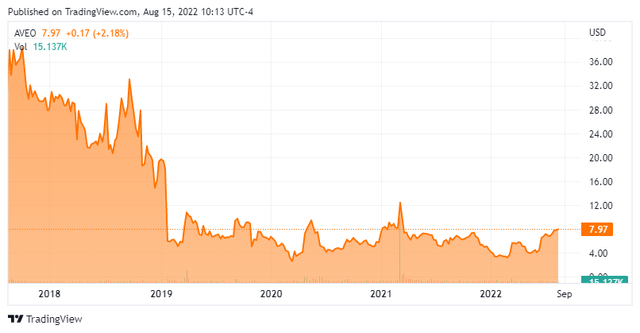

The last time I wrote about AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) was after it was “sideswiped” by an FDA decision in early 2019. That article counseled patience, which was good advice in hindsight as the company eventually cleared that FDA hurdle. FOTIVDA, also known as Tivozanib, finally was approved approximately a year and a half ago for treating relapsed or refractory advanced renal cell carcinoma (R/R RCC) in a third-line setting.

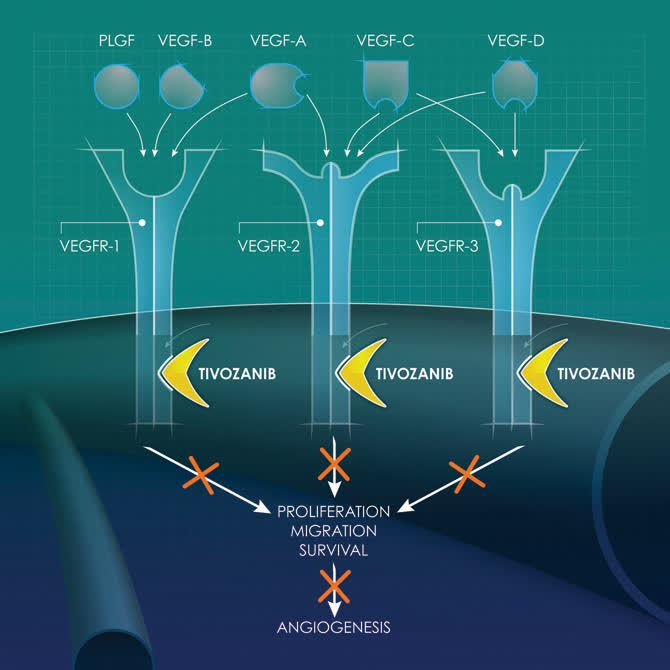

Company Website

FOTIVDA is an oral, once-daily, vascular endothelial growth factor receptor tyrosine kinase inhibitor. The drug should deliver just north of $100 million in sales this fiscal year. Therefore, it seems a good time to peak back in on this small but fast-growing oncology concern. An analysis follows below.

Company Overview:

AVEO Pharmaceuticals is located in Boston. The company is focused on developing and commercializing medicines for oncology. The stock currently trades at around eight bucks a share and sports an approximate market capitalization of $275 million.

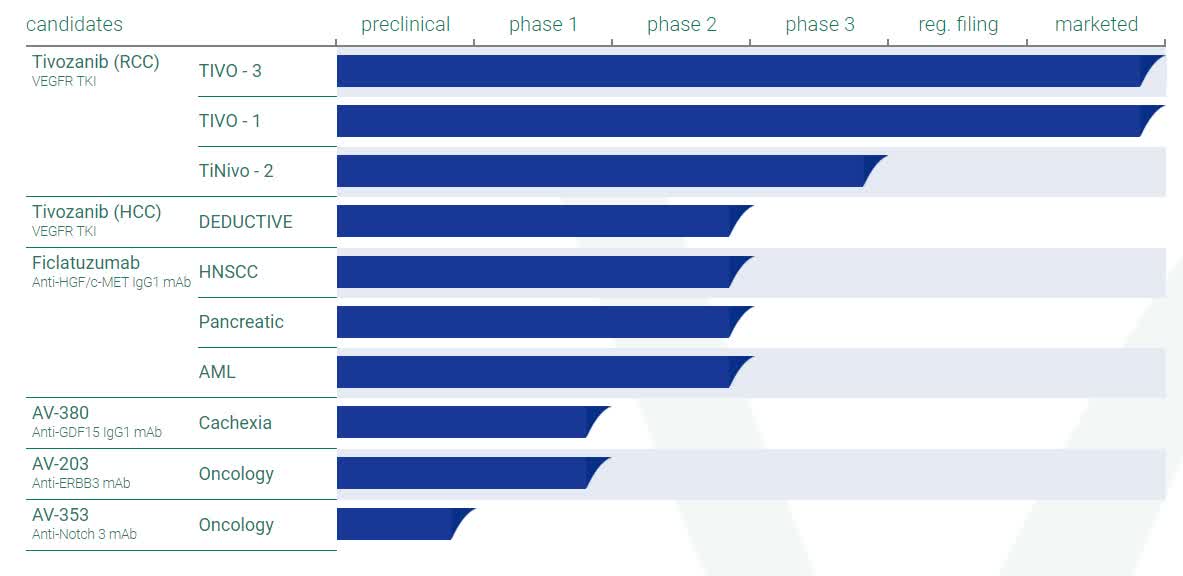

The company is currently enrolling patients in a Phase 3 ‘TiNivo-2’ clinical trial evaluating tivozanib in combination with Bristol-Myers Squibb’s (BMY) antibody nivolumab or OPDIVO. The study is targeting PD-1 and results will be compared to tivozanib monotherapy in patients with R/R RCC who have progressed following prior immune checkpoint inhibitor therapy. If the data is favorable, this could result in FDA approval of tivozanib in combination with OPDIVO in R/R RCC and expand the market opportunity for FOTIVDA into the larger second-line R/R RCC setting.

The company is also developing Ficlatuzumab. This is a potent hepatocyte growth factor (HGF) immunoglobulin G1 (IgG1) inhibitory antibody that binds to the HGF ligand with high affinity and specificity. AVEO Pharmaceuticals has conducted a Phase 2 trial of ficlatuzumab as a single agent or in combination with cetuximab (ERBITUX®) in patients who relapsed or were refractory to prior immunotherapy, chemotherapy, and cetuximab (pan-refractory) with metastatic head and neck squamous cell carcinoma or HNSCC. The company has stated it expects to make a go/no-go decision on the initiation of a pivotal Phase 3 study of ficlatuzumab in HPV negative HNSCC following feedback from the FDA. The compound does have Fast Track designation for this indication, and management continues to seek a strategic partner to fund development expenses.

Company Website

The rest of AVEO’s pipeline consists of earlier staged compounds and not germane to this analysis.

First Quarter Results:

On August 4th, the company posted second quarter numbers. AVEO Pharmaceuticals had a GAAP loss of 24 cents a share in the quarter, beating the consensus by four cents a share. Revenues were up just over 230% on a year-over-year basis to $25.3 million, roughly in line with the consensus.

Net FOTIVDA sales came in at $25 million, up 271% from the same period a year ago and some 24% above that of 1Q2022. Leadership reaffirmed its full year 2022 FOTIVDA U.S. net product revenue guidance of $100 million to $110 million

Analyst Commentary & Balance Sheet:

Since first quarter results were posted, four analyst firms including Robert W. Baird and Stifel Nicolaus have reissued Buy ratings on AVEO Pharmaceuticals. Price targets proffered range from $12 to $17 a share. Here is the note from the analyst from SVB Securities who reiterated his Buy rating and $15 price target on August 4th.

We believe this revision may drive additional growth, although the company noted they are still in a review process to integrate the NCCN upgrade into their promotional materials. The 2L RCC trial evaluating Fotivda + Opdivo, TiNivo-2, remains on track to complete enrollment in 2Q23. The company has decided to focus on commercial efforts and early stage compounds that they can eventually partner, which has led to a revised FY22 R&D expense guidance of $50mn, down from $60mn-$70mn previously. In an effort to streamline the R&D expenses, the company announced that they are discontinuing further enrollment in the Phase 1b/2 DEDUCTIVE trial cohort B of Fotivda + Imfinzi in 2L hepatocellular carcinoma [HCC] patients, and will not elect to fund a 1L Phase 3 trial.“

Approximately four percent of the outstanding float is currently held short. The company ended the second quarter with just over $75 million in cash and marketable securities on its balance sheet. Leadership believes with the cut in projected R&D expenses (referenced in the analyst note above), it has enough funding for all planned operational activities into at least mid-year 2023. There has been no insider activity in the stock so far in 2022.

Verdict:

The current analyst consensus has AVEO Pharmaceuticals losing approximately 75 cents a share in FY2022 even as revenues rise some 160% to $110 million. The company is projected to swing to just north of a 30 cent a share profit in FY2023 as sales top $170 million.

AVEO is marching nicely along the journey to profitability and is not expensive at least than three times forward sales given its growth. There is a question around whether the company might do a capital raise along that path. However, that seems the one negative around this story. This small-cap firm is seeing solid growth from its franchise product, and it could be approved for a larger indication sometime in 2024 if trial results are supportive. AVEO enjoys solid analyst support. A developmental partner for ficlatuzumab could boost the stock considerably. The company also would seem to make a logical buyout partner for a larger player looking to expand their oncology footprint if M&A activity picks up in the sector.

This is a name I have profitability played via covered call orders for years, and that is the strategy I will continue to employ around this small-cap oncology concern. This risk mitigation strategy is more a reflection on my view of the overall market than my view on AVEO.

There’s nothing wrong with the younger generation that becoming taxpayers won’t cure.” – Dan Bennett

Be the first to comment