edichenphoto/iStock Editorial via Getty Images

A short revisitation of AvalonBay Communities (NYSE:AVB) is in order at this time. While the company does offer some incredible amounts of conservative stability due to a high-quality portfolio of real estate assets, there comes a time when those returns can no longer be upheld due to a too-high valuation.

For AvalonBay, that time was several months back – and I’ve been tepid on the company ever since then, slowly rotating out my position in favor of more undervalued companies.

Let’s revisit AvalonBay.

Revisiting AvalonBay and the company’s returns

At its heart, AvalonBay is a solid, high-quality real estate company. Over 290 communities and around 87,500 homes in the US make the company a major player in California, Metro NY/NJ, New England, the Pacific Northwest, and other, appealing coastal areas. Its lack of exposure to the Sunbelt/Texas is a disadvantage, and an argument you will find why many investors choose other REITs over this one.

AvalonBay has seen massive RoR due to the recovery from pandemic lows. I myself am a major beneficiary of this trend, having invested tens of thousands of dollars at what essentially was cheap valuations for incredibly qualitative assets.

If the company fell in a similar manner again, I would certainly repeat this pattern that resulted in an RoR of 96.5% since the pandemic low of $135/share and a P/FFO of 14.4X.

But that’s just the thing. Too many investors confuse past performance with future potential returns – and there sometimes is a very low correlation to these, due to the massively inflated valuation that a company can trade at because of outperformance.

I believe AVB is one such business.

This isn’t some message that AvalonBay won’t be able to pay dividends, or somehow see abysmal numbers. The company has a continued 2022 vacancy of under 4%, and these numbers are even improving. As of February 2022, the economic occupancy for the company’s units is at 96.4% which is excellent.

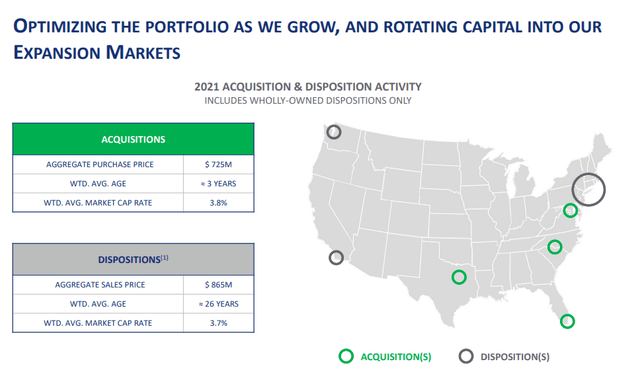

The company also reported a 12.4% YoY 4Q21 core FFO growth, albeit a near-5% decline YoY to 2020. Rental revenues were also down for the full year, around 2.1%. The company started plenty of new developments to increase the appeal across its portfolio, with a clear pattern for portfolio optimization. Coastal areas to the east and west are out – sun-belt and Texas, and some inland areas are in.

AVB Portfolio Diversification (AVB IR)

The company also observed clear improvements in the move-in rent values, up 23% in 2021, with lower overall seasonality to the numbers. The company’s effective rent changes have averaged over 10% for five consecutive months, indicating a reversal in the negative trend that preceded this in 2020 and early 2021. This was especially true in Florida, which was up 26.3% for the final quarter.

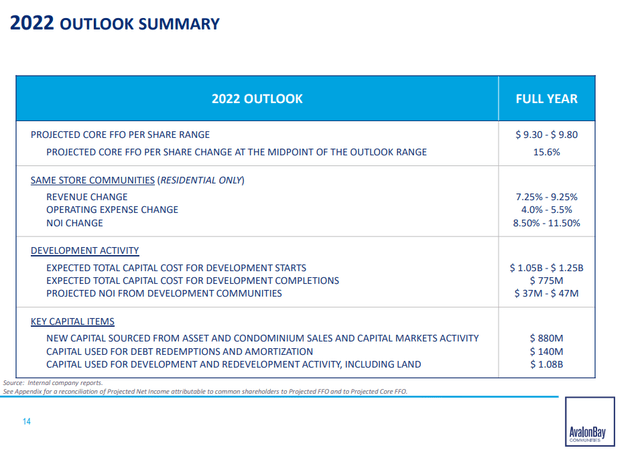

The company continues to see good fundamentals for its business of apartments, and the expectation is for a healthy sort of growth going into 2022 and beyond. The outlook for the company includes a 15.6% expected Core FFO change going into 2022, with the following specifics for the outlook.

This FFO growth should be the result of redevelopment, new investments, pushed down somewhat by dispositions and market impacts, as well as increased overhead incomes and lower JV incomes.

Rent relief concessions are still a thing as well, and this has the potential to increase income as well.

Overall, it can be said that AvalonBay is focusing on increasing its portfolio appeal through a wider diversification in community locations, producing earnings and FFFO growth through effective and profitable developments at attractive spreads above current cap rates. NOI margin improvement is a continual goal for the REIT as well and given historical trends, this does not seem to be impossible for AvalonBay. The company showcases continued rental revenue growth.

No, the fundamentals of the company cannot be criticized. Its investment-grade balance sheet, its diversification – current as well as future diversification – and its massive development pipeline all speak to the fact that the company could be continuing on its positive trajectory and tradition for years to come.

However, by focusing only on these qualities, you’re missing perhaps half or more than half of the complete picture of the company. Valuation is the core of any successful investment – even if the company quality is another fundamental requirement of success here.

AvalonBay – The valuation

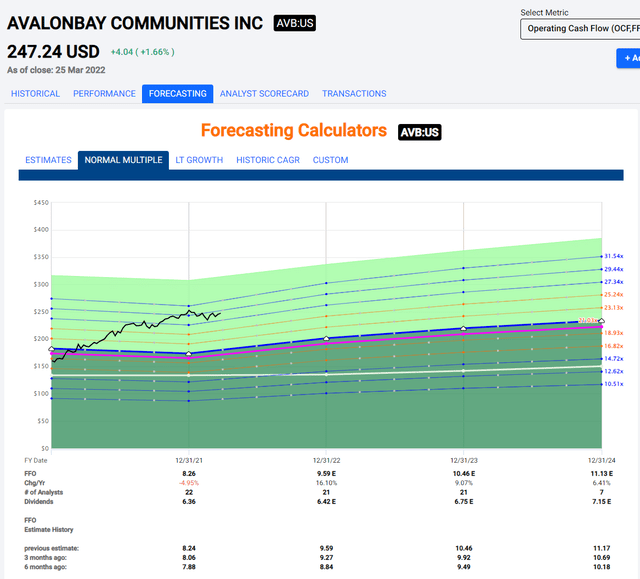

The valuation for AvalonBay remains unattractive, to my mind, despite the expected FFO growth in the 10-15% range for 2022. These growth numbers come at relatively high levels of certainty – though analysts do miss their estimates about 15-25% of the time even with a 10% margin of error. So, perfect – not so much.

No, the problems with AVB aren’t fundamentals – they’re valuation-related.

AVB Valuation (F.A.S.T Graphs)

The question is simple. Do you believe that a 10% estimated FFO growth with a 25% forecast miss chance from AVB is worth 27-28X P/FFO?

If yes, then there should be no issue investing in AvalonBay here. You’d make around 10% annualized if it materializes. Not a bad annual RoR all in all.

The problem is, I don’t share that assessment.

Even though it’s A-rated, the company is still a residential REIT, and its coastal exposure, especially the California/Northwest exposure does pose some risks in the valuation. I don’t believe the current valuation properly discounts for the risk this portfolio exposure could pose in a negative trend in these regions. We see this in the rental growth rates – non-core areas like Florida and Colorado grow better than their legacy portfolio/community areas.

I don’t want to give you the impression there are fundamental-type risks to the company. That’s not what I’m saying. I’m saying there are valuation-related risks to AvalonBay.

At any time the company traded at this valuation, or anywhere close to it, the correct way to act for the past 20 years, would have been to sell at a profit. AvalonBay always fell down to more conservative levels again after a valuation spike, allowing for a combined upside of dividend yield as well as capital appreciation. At any time in the past 20 years, if you had bought the company at 28X+ P/FFO, your annualized RoR would have been between 4-7%, and that’s if we say that you bought prior to the financial crisis. While such returns are not necessarily bad, these are all measured compared to the clearly-inflated multiple of nearly 29X we’re currently at.

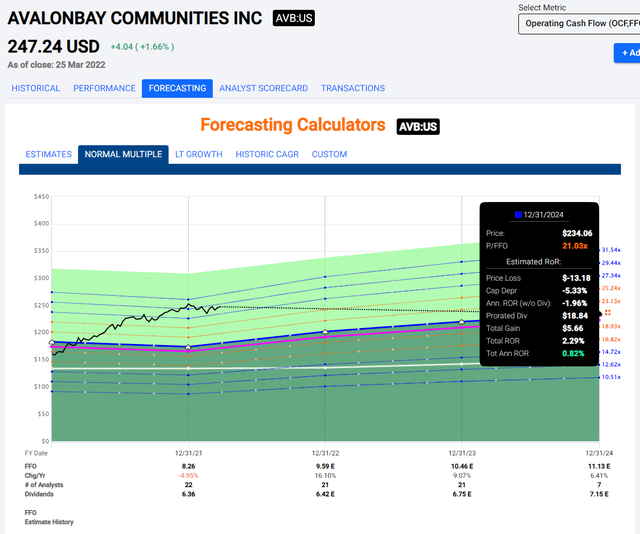

The very clear, better choice to my mind is profit rotation here. I’ve already done that and come away with massive RoR. Even if you assume a 26-28X forward P/FFO, your returns will be no greater than 10% annually. The downward risk when considering a potential 15-20-year average P/FFO multiple of 20-22X, is more along the lines of 0-2% annually.

AVB Upside/Downside (F.A.S.T Graphs)

I’ve noted several of the previous articles on this company are positive. I’m not saying AVB can’t go positive. I’m saying I’m unwilling to pay for 10-12% ROR with a 28-29X P/FFO multiple with this company. It’s not justifiable for me.

My conservative PT for AvalonBay is far, far, lower than the current $230-240 range the company seems to be trading in.

In order to ensure that you get good returns, you’ll want to invest at lower multiples. That’s why S&P Global, despite having an average PT of $264, between a low of $234 and $285, has 18 out of 23 analysts at a “HOLD”, “Underperform” or “Sell” rating. Even these analysts, despite their positive PTs, don’t exactly buy AVB at these prices, going by their recommendations.

For me, it’s crucial that I “BUY” at my actual price targets. My previous PT for AVB was around $208. Given the 2021 numbers, I’ve updated my valuation models and now consider it a “BUY” at $210/share. This would represent around 21.5X P/FFO, which would give us a 10-11% annualized RoR at 21-22X P/FFO, which is where I’d want to be/where I want to buy.

I don’t see the upside that other contributors/analysts see at these multiples. To me, the company doesn’t deserve that much of a premium, and that’s why I’m at a “HOLD” here.

I’ve rotated around 95% of my AVB position at various times at this point – and I’m very happy with that position.

Thesis

My thesis for AvalonBay is that the company is a solid, quality REIT with a definitive upside at the right valuation. However, I’m unwilling to go higher than a $210/share price target, up from my $208/share back before Christmas.

This means that AVB is currently would have to drop around 15% before I’d consider it buyable.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Be the first to comment