Design Cells

Shares of under-the-radar CAR-T player Autolus Therapeutics (NASDAQ:AUTL) have lost over a third of their value over the past year. Over the previous 5 years, they are down 78%.

The space in which the company operates has incrementally gained attractiveness to me as an investor, as commercial stage CAR-T players are finally putting up respectful sales numbers in quarterly reports. This includes Bristol Myers’ (BMY) Q2 update in which Abecma (BCMA CAR-T) more than tripled quarter over quarter revenue to $89M and is on its way to annualized $450M sales. That’s quite impressive, considering the drug was approved just over a year ago. Not to be left out, Gilead’s (GILD) Yescarta sales were up 66% for Q2 and Tecartus sales increased 78% year over year.

I continue to expect more deal activity and accelerating clinical momentum in this space, especially for allogenic approaches for which we have exposure via Adicet Bio (ACET) and Fate Therapeutics (FATE).

As multiple readers brought Autolus Therapeutics to my attention as a possible beneficiary of increased investor dollars directed to the CAR-T space, I’m looking forward to revisiting and sharing my thoughts with you.

Chart

Figure 1: AUTL weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares hit a high of $16 back in 2020. From there, they’ve steadily drifted south perhaps due to a lack of material news flow. My initial take is that investors with 2 year+ time horizon would do well to accumulate a position at present levels as we await pivotal data for lead indication and accelerating clinical momentum for the rest of the multi-faceted pipeline.

Overview

I took the time to listen to management’s investor call at the European Hematology Association annual meeting. For a company with enterprise value of just $100 million, I believe the pipeline is impressive providing a number of intriguing shots on goal in indications of significant unmet need.

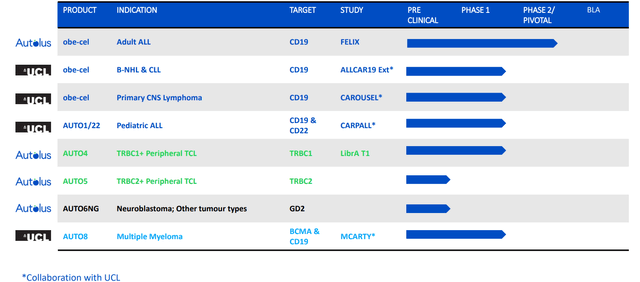

Figure 2: Pipeline (Source: corporate presentation)

Much of the current focus is on the FELIX pivotal study in adult ALL for lead drug candidate obe-cel. Although they are pursuing the crowded target of CD19, there is some differentiation here via fast off-rate binder to reduce the amount of inflammation per target cell in cancer which in turn reduces amount of immunotoxicity in patients, reducing exhaustion in CAR-T cells and thus improving engraftments and overall persistence. It’s currently being tested in phase 2 study in adult refractory ALL and work is ongoing in other indications to expand its potential (NHL, primary CNS lymphoma, follicular lymphoma, DLBCL).

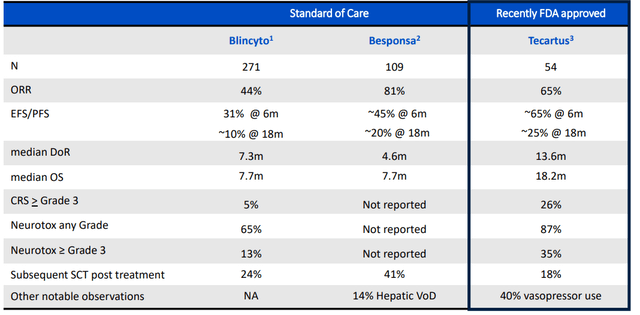

The opportunity in adult ALL is interesting, as there are over 8,000 new cases diagnosed worldwide and addressable patient population in last line is 3,000. Median overall survival is less than 1 year in relapsed/refractory adult ALL. While it’s true that combination chemo enables 90% of patients to experience complete response, only 30% to 40% of them achieve long term remission. Current T cell therapies for these patients include Blincyto and Tecartus, both of which are highly active but frequently are followed by subsequent treatments such as alloSCT. Blincyto has a favorable safety profile (few cases of severe CRS and ICANS) but is limited in terms of convenience (continuous IV infusion during 4 week treatment cycles). Tecartus, on the other hand, has a much more challenging safety profile to manage with severe CRS and high level of ICANS (requires vasopressors for many patients). The larger opportunity for obe-cel to capitalize on is to expand the addressable patient population in earlier lines of therapy. So far, obe-cel has shown event free survival beyond 30 months and again the numbers match up quite well compared to competition.

Figure 3: Unmet need in adult r/r ALL as reflected in benchmarks set by approved agents (Source: corporate presentation)

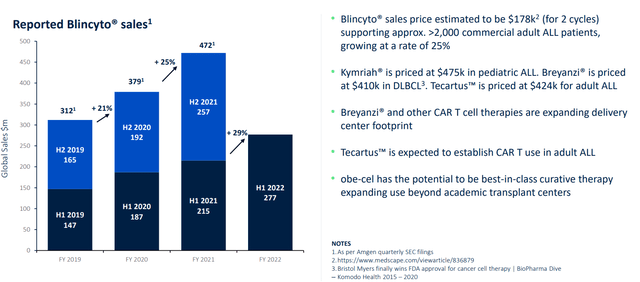

Additionally, one factor I appreciate that is a net positive for the company and investors is that IF pivotal data is positive and obe-cel gets approved, they’d be launching into a steadily growing market opportunity (annual revenue growth of 25% for current market leader Blincyto).

Figure 4: Adult ALL market is clearly expanding with significant growth expected in coming years (Source: corporate presentation)

Moving on to the FL cohort, they treated 7 patients, lost 1 to Covid and all the others remained alive and well in complete remission. For DLBCL, 7 patients were treated and 6 remain in complete metabolic remission (median follow up of 9.2 months and up to 19.1 months as data continues to accumulate). They also treated 3 mantle cell lymphoma patients, of which 1 relapsed at 6 months (however it was a skin relapse that was salvaged with radiotherapy and allograft). The other 2 patients remained in metabolic remission. They also started treating patients in the broader CLL indication, of which 2 of 3 had gone into metabolic complete remission in the bone marrow. They are also evaluating obe-cel in primary CNS lymphoma, a type of DLBCL with particularly poor prognosis where initial treatment is often intensive and performance status of patients is poor. While they did not see any grade 3 or 4 CRS (cytokine release syndrome), they did see some ICANS but fortunately it was not grade 3 or 4 (perhaps the ICANS was simply due to progressive disease). Despite having no disease outside the CNS and lots of prior rituximab treatment exposure, they still saw lots of nice expansion of obe-cel outside the blood. Interestingly, obe-cel can result in remissions in patients with quite large lesions. Overall response was 4 of 6 for this population, but some patients converted from stable disease to normal MRI (caveat that this is very early data).

Overall, the obe-cel franchise has shown a favorable and consistent profile across these indications. For mantle cell, DLBCL FL and CLL overall response rate of 90%, good CR rate and again excellent safety provides an appealing target profile especially from a patient’s point of view.

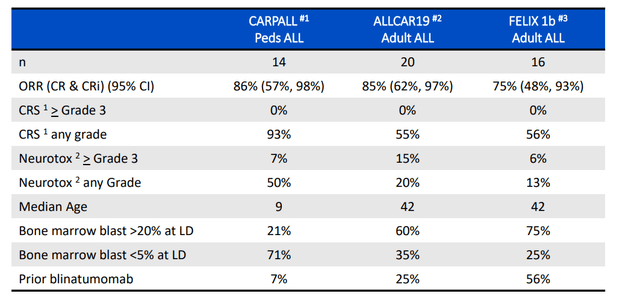

Figure 5: Obe-cel safety profile, emphasis on CRS and neurotoxicity (Source: corporate presentation)

Additionally, as more and more time goes on we are seeing that responses are durable. The next step is to treat 10 patients per each expansion indication as well as finish the primary CNS lymphoma trial.

Let’s move on to AUTO1/22 in the CARPALL study in pediatric acute lymphoblastic leukemia. CD19 negative antigen escape is a common cause of treatment failure here. Management notes that CD22 is a much more challenging antigen. Their CD22 CAR is sensitive to low antigen density, while the obe-cel component is left as unchanged as possible. The main thing to note is Kymriah is the standard of care and these patients were Kymriah ineligible. 4 patients had received Kymriah and 3 had CD19 negative-disease coming into the study. Manufacturing led to a nice product profile with balanced CD19 CD22 double CAR positive T cells. They saw nice expansion and engraftment in patients. Unfortunately, one patient was presented with a severe neurotoxicity but otherwise it was well tolerated. 9 patients were in molecular remission. 2 patients had relapse (not due to antigen loss) and 1 patient became MRD positive at 12 months. 3 patients who were CD19 negative going into study went into molecular remission, which I see as highly important of the drug candidate doing what it was designed to do. To conclude, they showed they can make the product, that it expands and persists with favorable safety profile and is working for patients going into remission. They are pleased with response rate and ongoing remission rate. Again, there is limited follow-up but they have not observed any antigen negative relapse.

Moving onto the early-stage programs of AUTO4 and AUTO5 in peripheral T cell lymphoma (PTCT), management notes that T-cell lymphomas are essentially uncommon non-Hodgkin lymphoma. For all lymphoid neoplasms there are 80,000 new diagnoses a year in the US and 7% to 10% are T cell or NK cell neoplasms. These are quite heterogenous with poor prognosis (29 or 30 different subtypes). Some are present primarily in the blood or the skin (cutaneous). New therapies often target specific features of the tumor and standard therapy typically consists of chemo combination. In a registry of over 700 patients with newly diagnosed T cell lymphoma (primarily children and young adults), majority of those with ALK-ALCL subtype were cured (long term remission) with HOP-like chemo. For other subtypes, however, the majority did not respond or relapsed after initial therapy between years 1 and 4. A minority of these patients have long term remission from initial therapy (as high as 25% for certain subtypes, below 10% for more aggressive T cell lymphomas). For the more common subtypes chemo is a reasonable treatment, whereas for others CHOP-based regimens are not recommended (including indolent and chronic diseases were remissions are short-lived). It’s important to keep in mind that dose intensification often results in greater toxicities, particularly of a hematologic nature. Upfront transplantation in PTCL resulted in 44% to 51% 5 year survival rate in a separate registry. Looking at the ECHELON-2 study where they added Seagen’s (SGEN) brentuximab vedotin to CHOP there was a clear benefit in terms of progression-free survival and overall survival (median OS not met in either arm with 66.8 months follow-up). Allogeneic stem cell transplant data in relapsed setting resulted in 40% cure rate with most cures consisting of complete remission. Standard FDA approved drugs in the US achieve response rates of 25% to 30%, of which 10% to 15% of these patients experience complete remission (brentuximab vedotin is the outlier). So again, there is tremendous unmet need for effective therapy with durable remission. As for novel drug candidates & approaches in the clinic for T cell lymphoma, these include JAK inhibitors, PI3K inhibitors, EZH 1/2 inhibitors, bispecifics, anti-CD47 antibodies, CD5 CAR-T, allogeneic anti-CD70 CAR-T cells, CD30 CAR-T, etc.). However, all these drugs target multiple subsets and still don’t achieve long term durable remission. It’s also very early days for immune therapy including cell therapies and checkpoint inhibitor studies (most are in phase 1). To summarize, some patients experience cure with combination chemo (25% or so overall, maybe 45% for those that endure the most intensive regimen suitable for certain subtypes such as anaplastic large cell lymphoma). Most attempts to improve therapy have been adding agents to upfront therapy, where there’s been a bit of success and much failure so far (especially in trying to minimize additive toxicity).

The benefit of the TRBC1/TRBC2 approach is that it’s applicable to 95% of TCL subtypes (high and homogenous expression). Autolus’ strategy is to use a companion diagnostic to identify whether a patient expresses TRBC1 or TRBC2. For the phase 1/2 study of AUTO4, 80% of these 10 patients treated were at stage 3 or 4 disease with 3 median lines of therapy. There were no limiting toxicities in dose escalation (25M cells up to 450M cells) and only mild cytopenias. There was just 1 grade 3 CRS event and no grade/cases of ICANS. Thus, the drug candidate was generally well tolerated. Early data was encouraging especially at the two highest doses of 225M and 450M doses. All 4 of those patients were in complete metabolic remission at month 1, and 3 of 4 had that remission ongoing at 3 months. 2 patients are still in remission now. Management highlights one case study where the patient had 4 prior lines of therapy and never achieved CR, then achieved complete metabolic remission on AUTO4 and remains in clinical remission at month 5. The goal from here is to enroll further patients to find recommended phase 2 dose, optimize product profile and then prepare for a pivotal study.

Select Recent Developments

In August of last year Autolus received substantial validation and a vote of confidence via deal with the $69 billion Moderna granting the larger peer an exclusive license to develop mRNA therapeutics incorporating Autolus’ proprietary binders for up to four immuno-oncology targets. Upfront payment was not disclosed, but will be received for each target along with royalties on net sales for all products commercialized.

Flash forward to November 8th, where the company received another vote of confidence as well as funding from Blackstone (BX) which provided up to $250M in equity and product financing to support advancement of obe-cel as well as next gen therapies in the clinic. Structure of the financing is interesting, as it consisted of $50M payable upon closing and the remained based on development and regulatory achievements along with separate $100M private placement of Autolus’ American Depositary Shares.

Moving on to January this year, I appreciated how management laid out priorities for value creation including principally progress in the FELIX phase 2 study along with updates on other pipeline candidates. Other earlier stage assets such as AUTO6NG in neuroblastoma and AUTO8 in multiple myeloma are progressing in phase 1 studies, though I would not expect data until 2024 at the earliest.

Lastly on April 25th, the company received the coveted RMAT (Regenerative Medicine Advanced Therapy) designation for obe-cel in the ongoing FELIX phase 2 study in adult relapsed/refractory B-Acute Lymphocytic Leukemia. The benefit of this designation is that it facilitates and speeds up development and regulatory review with authorities, which we all know otherwise can be a painstakingly slow process.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $216M as compared to net loss of $42M. I’m assuming that they have operational runway of 1 year, though as usual I’m being conservative. Q2 research and development expenses increased to $38M, while G&A rose to $8.3M.

I like that they are building out a new 70,000 square foot commercial manufacturing facility in the UK (to begin operations 2H 2023 with capacity of 2,000 batches per year with option to expand capacity as needed). My experience has been that companies with internal manufacturing capacity are worth more than those who utilize CROs, and also that they make for more attractive takeover targets.

As for upcoming material milestones, initial clinical results from the pivotal FELIX trial are now expected Q4 2022 with full data to be presented at medical meeting 1H 2023. Longer term follow up data from phase 1 ALLCAR19 extension trial of obe-cel in r/r B-NHL and CLL is also planned for 2H 22.

Longer term follow up data from phase 1 CAROUSEL trial in primary CNS lymphoma is planned for 2023, while phase 1 CARPALL extension study data of AUTO1/22 in pediatric ALL is planned for 2H 22.

Finally, AUTO4 updated data with longer follow-up is planned for 2H 22.

The earlier-stage programs of AUTO6NG in neuroblastoma patients and AUTO8 in multiple myeloma will have initial data 2H 2023.

As for accumulated deficit, total of $521M since inception of company in 2018 seems on the high side. To be far, CAR-T companies are known for burning a lot of cash especially in early stages and for that matter later on with launch ramp up as they mature.

As for prior financings, I’m not sure what price point Blackstone private placement took place at, but February 2021’s public offering occurred at $7/ADS (representing almost a double from present levels).

As for institutional investors of note, Frazier Life Sciences owns 5.1% stake and Blackstone Group owns a whopping 22.6% stake.

Moving onto useful nuggets from members of the ROTY community, member Jv9fox notes his skepticism in regard to commercialization and manufacturing process (perhaps foreseeing distribution challenges across Europe). He states that Blincyto sales point to an attractive and growing opportunity, but the burden of proof on the company is on being able to capitalize in terms of manufacturing and historically, that’s been difficult for small enterprises to do well. Respected investors on Twitter I keep tabs on believe 2x-4x upside is possible from present levels if FELIX data is good and BLA is accepted by the FDA.

As for IP, management notes for AUTO1 they may look to commercialize ex US first followed by launch in US after expected expiration of any applicable third-party patents covering AUTO1 (between 2023 and 2025). This adds a degree of uncertainty to investing thesis, but it is not a dealbreaker and appears to be a short-term issue. The company does have an exclusive IP license agreement with UCL to 25 patent families. Matt Biotech from Biotwitter helped clear the air for me, highlighting patents on granted families out to mid-to-late 2030s. Not launching in the US until late 2024 anyways would indeed imply this is a short-term issue.

Final Thoughts

To conclude, I like the setup here with pivotal data approaching for FELIX study (along with additional phase 1 data catalysts) amidst the backdrop of a steadily improving environment for commercial CAR-T players with growing sales likely to lead to further consolidation as big pharmaceutical companies take the lead with their greater resource base. I typically look for situations with accelerating clinical momentum and we’ve clearly found that here. The patent issues we uncovered do make me a bit nervous, but again they appear short-term in nature and are not a dealbreaker in light of the appealing nature of the lead commercial opportunity for obe-cel and multi-faceted nature of the pipeline. Lastly, it’s worth noting that T-cell lymphomas have not benefitted from innovation including immunotherapy the same way that B cell lymphomas have, so in that light the story could get better as we receive more data for TRBC1+/TRBC2+ program.

For readers who are interested in the story and have done their due diligence, AUTL is a Buy and I suggest accumulating shares below the $4 level.

From an ROTY perspective (focus on next 12 months), I am tempted to establish a pilot position in the near term as I think the Q4 data for FELIX is a clear needle-mover at the currently low $100M enterprise value. On the other hand, it’s well-known to readers that I’m still not the biggest fan of autologous CAR-T given the challenges posed by scaling up manufacturing to meet demand, and that’s a difficult hurdle for me to overcome. Playing devil’s advocate, I do wonder if Q4 data catalysts will be enough to move share price substantially or whether it will take signs of commercial success before valuation is duly rewarded.

As for additional risks, in light of established players experiencing accelerating momentum with sales, I think manufacturing to scale will be accomplished whether Autolus successfully goes it solo or is bought out by a larger player. Cash burn is also a cause for concern, and I would expect significant dilution via secondary offering by the first half of 2022. Lastly, consider that the CD19 space on the whole has been highly competitive and at some point Autolus could find itself competing with big pharma companies that sport much higher cash balances and thus resources to maximize their advantage.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. Look forward to your thoughts in the Comments section below. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment