dimarik/iStock via Getty Images

Lifting the Foot Off the Gas for Monetary Tightening

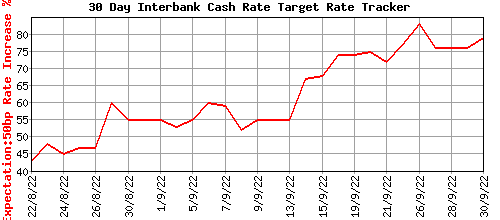

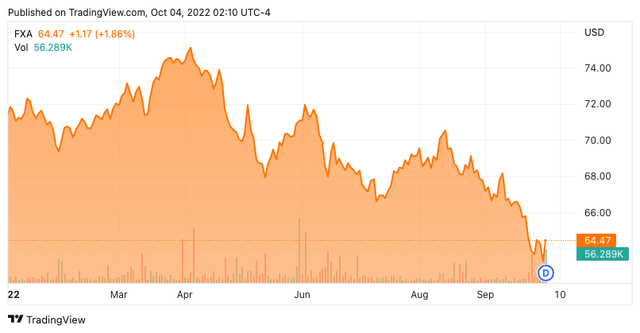

The Reserve Bank of Australia (RBA) is no longer sounding so urgent about inflation. Four months ago, I interpreted the RBA’s statement on monetary policy as supportive of a stronger Australian dollar, the Invesco CurrencyShares Australian Dollar Trust ETF (NYSEARCA:NYSEARCA:FXA), versus the U.S. dollar (UUP). However, FXA never lifted further from those June highs and instead drifted lower from there. FXA even hit prices last seen in the first month of the pandemic. In its October statement on monetary policy, the RBA surprised markets by lifting its foot off the gas for monetary tightening with a 25 basis point (bps) hike. The market’s odds for a 50 bps hike almost reached 85% going into the RBA’s meeting.

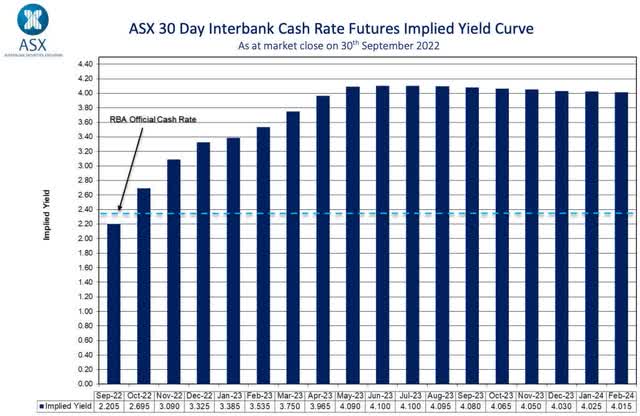

Markets had high expectations for a 50bps rate hike going into the RBA’s October meeting. (ASX RBA Rate Tracker)

I interpret this kind of surprise as a signal for a slower pace of monetary tightening and even a lower ceiling for the top of the cycle. Likely sensing a similar signal, financial markets immediately marked the Australian dollar down overnight. Although the U.S. dollar is finally losing some steam, I do not expect FXA to benefit much given what looks like a slower pace for monetary tightening.

Bond Competitiveness

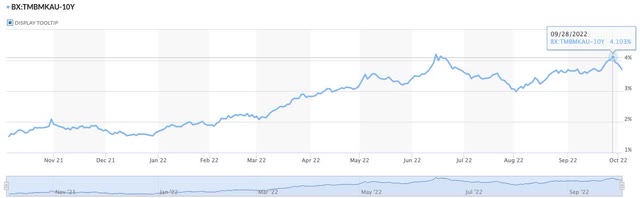

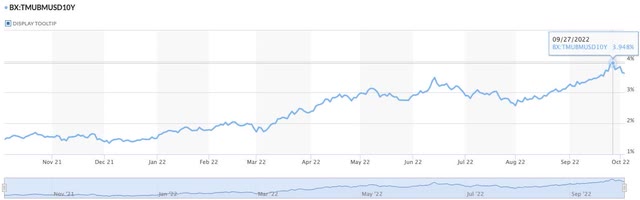

The Australian dollar’s drift lower also surprised me given the Aussie’s competitiveness in bond yields until recently. While the Australian 10-year government bond peaked in June, the U.S. 10-year did as well. The big difference came from the rebound in yields from the summer lows. The U.S. 10-year shot up to new highs while the Aussie languished and peaked right at the June highs. The lower-than-expected rate cut will likely keep pushing yields lower; advantage goes to the U.S. dollar.

The Australian 10-year bond looks like it has topped out at 4.0%. (MarketWatch) The U.S. 10-year may have topped out at 4.0% but it sliced through its summer high along the way. (MarketWatch)

Rate Competitiveness

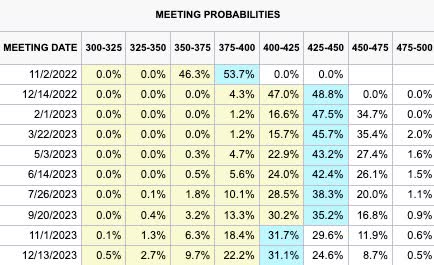

Finally there are rate expectations for the central banks. Fed fund futures peg the peak of interest rates at 4.25% to 4.50% in December. The ASX 30 Day interbank cash rate futures implied yield curve has the RBA topping out its rate just under 4.2% out to March, 2023. The rate markets have both central banks drifting to 4.0% by the end of 2023. I would have figured the FXA could hold its own given these projections. Now the rate profile for Australia will likely diverge and further constrain upside for the Australian dollar.

Markets expect the Fed to end 2023 at 4.0%. (CME FedWatch Tool) Markets expected the RBA to end 2023 around 4.0% (ASX RBA Rate Tracker)

Bullish on the Australian Economy

The RBA’s statement remained bullish on the economy which I also earlier interpreted as a slight advantage for the Australian dollar. Australia’s central bank expects unemployment to continue to decline in coming months before slowing economic growth brings the trend to an end: “The unemployment rate in August was 3.5 per cent, around the lowest rate in almost 50 years. Job vacancies and job ads are both at very high levels, suggesting a further decline in the unemployment rate over the months ahead.” Accordingly, the RBA expects wages to continue higher. The Bank’s central forecast is “for CPI inflation to be around 7¾ per cent over 2022, a little above 4 per cent over 2023 and around 3 per cent over 2024” which is the same forecast from the August statement. Compared to May, the RBA sees hotter inflation this year with little to no impact on inflation in 2023 or 2024.

The Trade

On balance the Australian dollar has less appeal than it had when I assumed the downward drift in FXA was coming to an end. Now I see a rangebound currency at best unless the U.S. dollar suddenly goes into a cycle of significant weakening. I am holding on to my small position given FXA is at historically low levels and looks like a bargain bet on the future of higher commodity prices during an economic recovery. However, I dropped plans to add to the position. I lifted my foot off the gas of bullishness on FXA – at least until the currency ETF trades above its July low of $66.25.

The Invesco CurrencyShares Australian Dollar Trust ETF (FXA) has continued to drift lower despite several supporting catalysts. (Seeking Alpha)

Be careful out there!

Be the first to comment