Australian Dollar, AUD/USD, Japanese Yen, USD/JPY, US CPI – Asia Pacific Market Open

- Australian Dollar whipsawed by violent market reaction to higher US CPI

- It seems the longer-term path for the Fed hasn’t changed for the time being

- USD/JPY continues to push past levels where Japan intervened, be careful

Recommended by Daniel Dubrovsky

Trading Forex News: The Strategy

Thursday’s Market Recap – US CPI Report and the Violent Market Reaction

The sentiment-linked Australian Dollar was whipsawed by investors on Thursday as markets reacted sporadically to September’s US inflation report. Overall, the data surprised to the upside, as expected. Headline CPI clocked in at 8.2% y/y versus 8.1% anticipated. The arguably more important core gauge crossed the wires at 6.6% y/y versus 6.5% seen.

The largest component of core – shelter – was a key component in driving September’s print. It continues to show that the housing market is driving underlying price pressures as food and energy relatively slow down. This is not a good sign for the Federal Reserve, which may have to increasingly worry about inflation de-anchoring from expectations in the long run.

Yet, in just hours the Australian Dollar recovered back to square one as the US Dollar pulled back and Wall Street closed in the green. The average true range of the Nasdaq 100 after the dip and rebound was 658, the largest in one month. Such price action is not uncommon in these times. One day you have a massive rally, the next it gets completely eviscerated and vice versa.

Taking a closer look at what the market thinks the Federal Reserve must do reveals two key things. The first is that we added almost an extra hike in 6 months. The second is that down the road, the rate outlook hasn’t changed by much if at all. All this means is that the ‘pivot’ will have to be more rapid to bring down rates in the same amount of time as before. Maybe that is what inspired risk-taking.

Australian Dollar Reaction to CPI Data and Aftermath

Friday’s Asia Pacific Trading Session – Optimism Ahead, Watch USD/JPY

Given Thursday’s Wall Street session, it seems that some optimism might be in store for Friday’s Asia-Pacific trading session. This could bode well for the Australian Dollar if regional stock markets climb, such as the ASX 200 or Nikkei 225. Traders may be also paying close attention to USD/JPY.

The Japanese Yen has been weakening past levels when Japan’s government intervened to stem a selloff in the local currency. At 147.25, USD/JPY is heading for its third day above 146 as it approaches the 1998 high at 147.65. Breaking the latter means the highest point since 1990. This may open the door to stronger intervention, risking violent price action in the Yen.

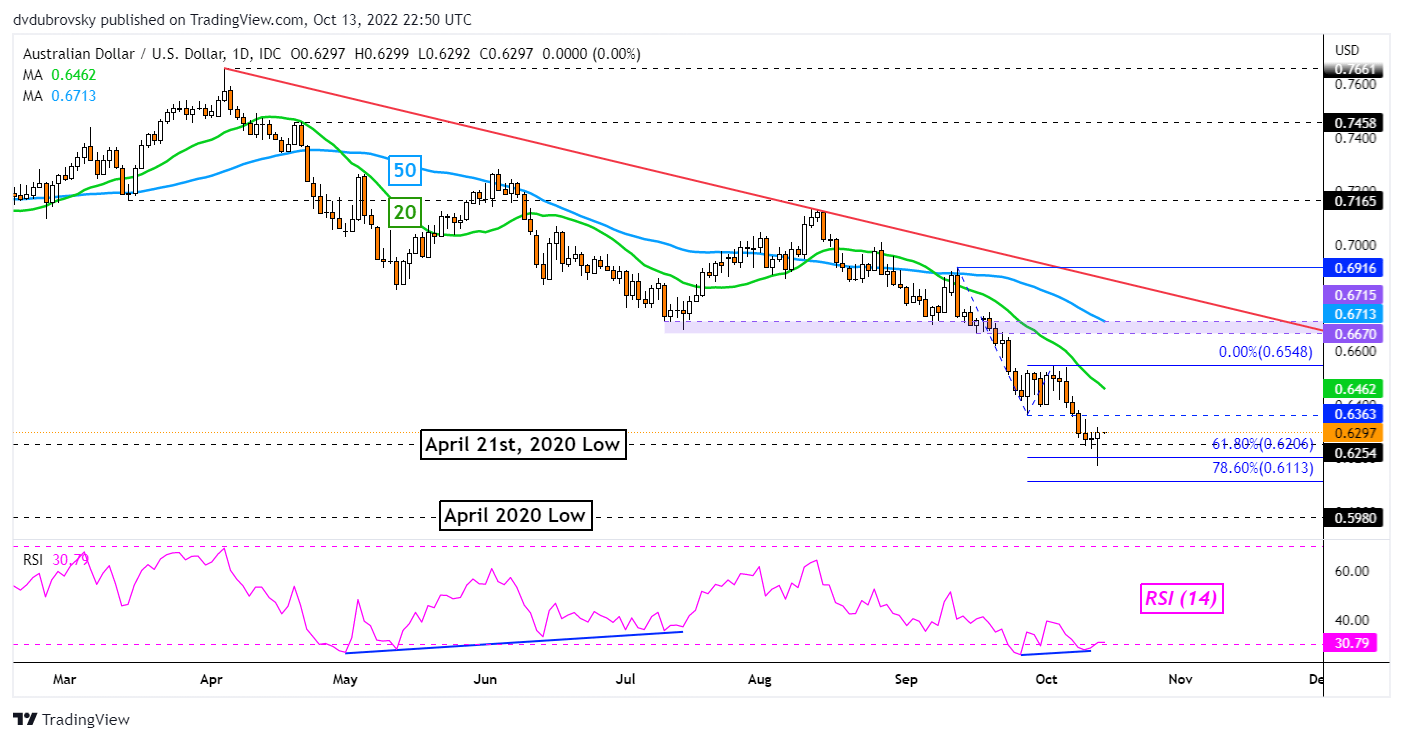

Australian Dollar Technical Analysis

On the daily chart, AUD/USD has now struggled to close under the April 21st, 2020 low at 0.6254 for a third day. Positive RSI divergence does show that downside momentum is fading. This could precede a turn higher. But, the 20-day Simple Moving Average (SMA) could hold as resistance, maintaining the dominant downside focus.

Recommended by Daniel Dubrovsky

Building Confidence in Trading

AUD/USD Daily Chart

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or@ddubrovskyFXon Twitter

Be the first to comment