Australian Dollar Talking Points

AUD/USD approaches the 50-Day SMA (0.7311) as it extends the rebound from the September low (0.7170), but the Reserve Bank of Australia (RBA) interest rate decision may drag on the exchange rate as the central bank is widely expected to retain the current policy.

AUD/USD Rate Recovery Susceptible to Dovish RBA Forward Guidance

AUD/USD appears to have reversed course following the failed attempt to test the August low (0.7106), and the exchange rate may stage a larger recovery during the first full week of October as it carves a series of higher highs and lows.

As a result, AUD/USD may stage another attempt to trade back above the 50-Day SMA (0.7310), but more of the same from the RBA may produce headwind for the Australian Dollar as the central bank plans to “purchase government securities at the rate of $4 billion a week and to continue the purchases at this rate until at least mid February 2022.”

It seems as though the RBA is on a preset course as the central bank acknowledges that “the outbreak of the Delta variant had delayed, but not derailed, the recovery,” and Governor Philip Lowe and Co. appear to be on track to retain the current policy throughout the remainder of the year as “progress towards the Bank’s goals was likely to take longer and was less assured.”

As a result, AUD/USD may struggle to retain the rebound from the yearly low (0.7170) amid the diverging paths between the RBA and Federal Reserve, but a further recovery in the exchange rate may lead to a flip in retail sentiment like the behavior seen in August.

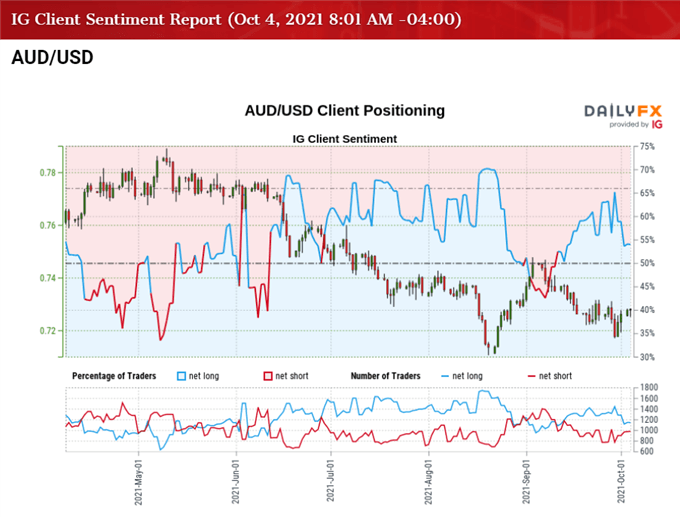

The IG Client Sentiment report shows 52.92% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 1.12 to 1.

The number of traders net-long is 7.12% higher than yesterday and 8.50% lower from last week, while the number of traders net-short is 10.22% higher than yesterday and 18.44% higher from last week. The decline in net-long position comes as AUD/USD extends the rebound from the September low (0.7170), while the rise in net-short interest has alleviated the tilt in retail sentiment as 58.20% of traders were net-long the pair last week.

With that said, AUD/USD may stage another attempt to trade back above the 50-Day SMA (0.7311) as it extends the rebound from the September low (0.7170), but the RBA rate decision may rattle the recent rebound in the exchange rate as the central bank remains in no rush to normalize monetary policy.

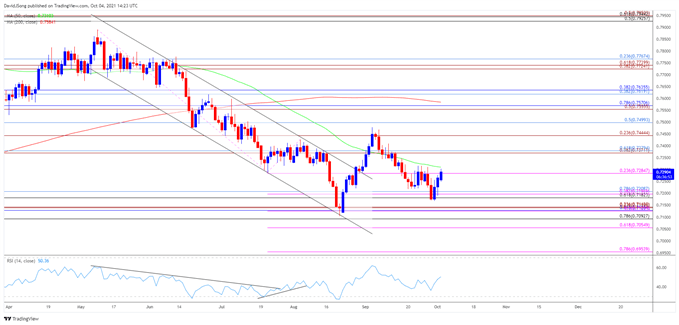

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, AUD/USD sits below the 200-Day SMA (0.7584) for the first time in over a year, with the decline from the May high (0.7891) pushing the Relative Strength Index (RSI) into oversold territory for the first time since March 2020.

- As a result, the 50-Day SMA (0.7311) established a negative slope as AUD/USD traded to fresh yearly lows in the second-half of 2021, and the rebound from the August low (0.7106) may turn out to be a correction in the broader trend it trades back below the moving average.

- Nevertheless, AUD/USD appears to have reversed ahead of the August low (0.7106) as it extends the rebound from the September low (0.7170), with a move above the 50-Day SMA (0.7311) opening up the 0.7370 (38.2% expansion) to 0.7380 (61.8% retracement) region.

- However, another failed attempt to push back above the 50-Day SMA (0.7311) may push AUD/USD back towards the Fibonacci overlap around 0.7180 (61.8% retracement) to 0.7210 (78.6% retracement), with a break of the September low (0.7170) bringing the 0.7130 (61.8% retracement) to 0.7140 (23.6% expansion) region on the radar.

- A break below the August low (0.7106) brings the 0.7060 (61.8% expansion) to 0.7090 (7.8% expansion) region on the radar, with the next area of interest coming in around 0.6950 (78.6% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment