AUD/USD started a fresh decline from the 0.6980 resistance. NZD/USD is also declining and might even trade below the 0.6150 support.

Important Takeaways for AUD/USD and NZD/USD

· The Aussie Dollar started a fresh decline below the 0.6920 support zone against the US Dollar.

· There is a key bearish trend line forming with resistance near 0.6880 on the hourly chart of AUD/USD.

· NZD/USD also started a major decline from the 0.6330 resistance zone.

· There is a major bearish trend line forming with resistance near 0.6215 on the hourly chart of NZD/USD.

AUD/USD Technical Analysis

The Aussie Dollar attempted a fresh increase above the 0.6980 and 0.7000 levels against the US Dollar. However, the AUD/USD pair failed to continue higher above 0.6980 and started another decline.

There was a move below the 0.6950 and 0.6920 support levels. There was a close below the 0.6900 level and the 50 hourly simple moving average. The pair traded as low as 0.6821 and is currently showing a lot of bearish signs.

On the downside, an initial support is near the 0.6800 level. The next support could be the 0.6780 level. The main support is near the 0.6720 level. If there is a downside break below the 0.6720 support, the pair could extend its decline towards the 0.6650 level.

Any more downsides might send the pair toward the 0.6600 level. On the upside, the AUD/USD pair is facing resistance near the 0.6845 level. It is near the 23.6% Fib retracement level of the downward move from the 0.6919 swing high to 0.6821 low.

The next major resistance is near the 0.6870 level. It is near the 50% Fib retracement level of the downward move from the 0.6919 swing high to 0.6821 low.

There is also a key bearish trend line forming with resistance near 0.6880 on the hourly chart of AUD/USD. A close above the 0.6880 level could start a steady increase in the near term. The next major resistance could be 0.6950.

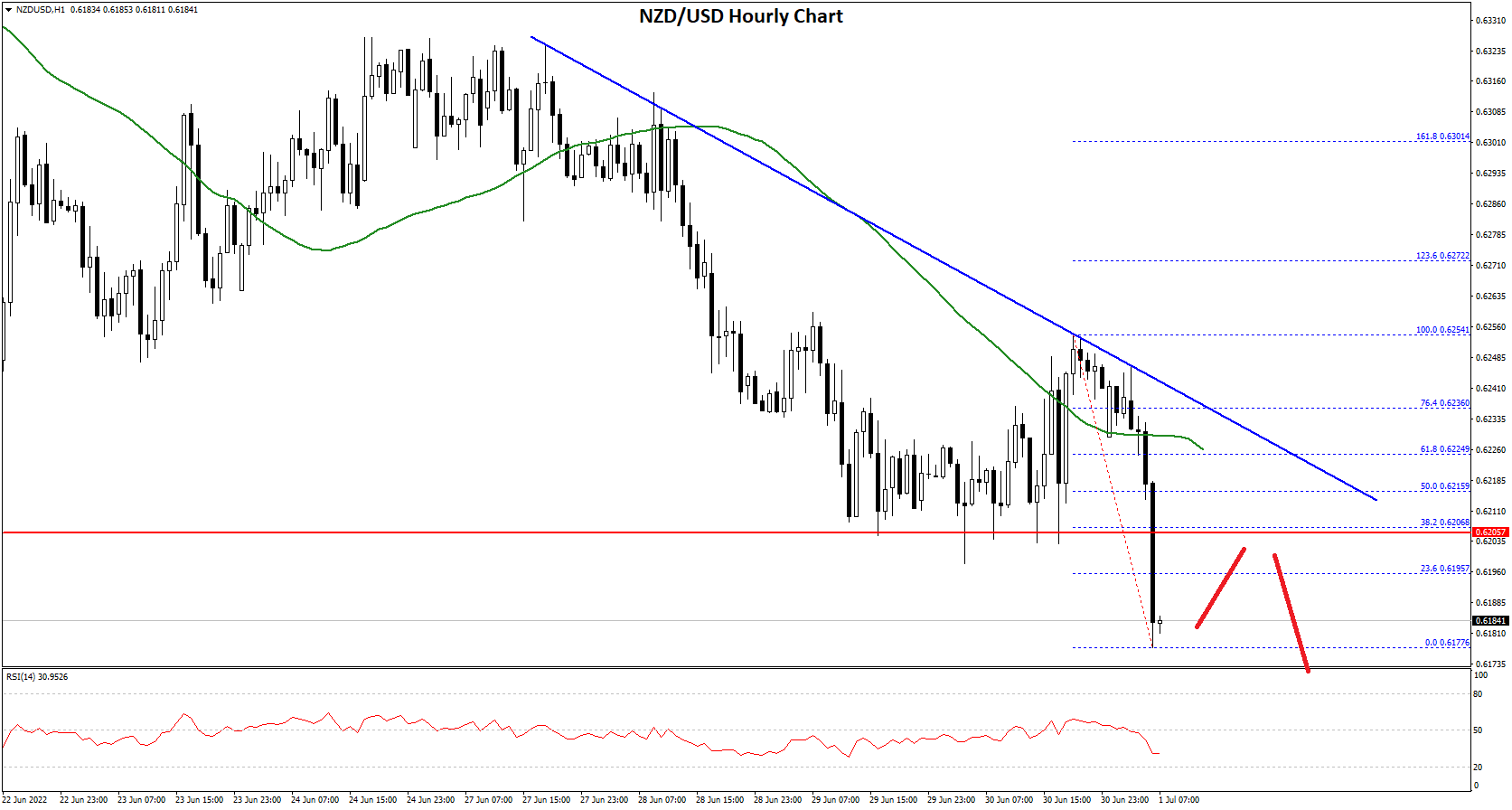

NZD/USD Technical Analysis

The New Zealand Dollar also followed a similar path from the 0.6330 zone against the US Dollar. The NZD/USD pair traded below the 0.6250 support zone to enter a bearish zone.

There was a clear move below the 0.6220 zone and the 50 hourly simple moving average. The pair traded as low as 0.6177 and is currently struggling to recover. On the upside, an initial resistance is near the 0.6205 level.

The 38.2% Fib retracement level of the downward move from the 0.6254 swing high to 0.6177 low is also near the 0.6205 level.

The next major resistance is near the 0.6215 level. There is also a major bearish trend line forming with resistance near 0.6215 on the hourly chart of NZD/USD. It is near the 50% Fib retracement level of the downward move from the 0.6254 swing high to 0.6177 low.

A clear move above the 0.6215 level might even push the pair towards the 0.6250 level. If not, the pair might continue lower. On the downside, an initial support is near the 0.6170 level.

The next support could be the 0.6150 zone. If there is a downside break below the 0.6150 support, the pair could extend its decline towards the 0.6100 level.

This forecast represents FXOpen Markets Limited opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Markets Limited products and services or as financial advice.

Be the first to comment