Justin Sullivan

AT&T (NYSE:T) is down 25% year-to-date. Well, that’s the market average you say. Sure but the key difference is AT&T never achieved the returns the market did over the years. As a (bag) holder of AT&T for more than a decade, we can attest that this stock has been nothing short of disappointing for many years.

Some companies may justly argue that they have been silent beneficiaries (during easing) and innocent victims (during tightening) of the Fed’s monetary policies, while executing their strategies unwaveringly. AT&T’s management cannot say that with a straight face after years of failed endeavors and lack of strategic conviction. Just when you thought they were focusing on being the best telecom provider, they went into media/content. Just when you thought they were building a content empire, they spun off. All the while, debt continued to kill shareholder returns.

Fast forward to 2022. AT&T completed the Warner Bros. Discovery (WBD) spin off. Inflation and Fed worries added to an already uncertain future. Add in slightly unrelated events like the War and Oil concerns. And for its part, the company slashed its free cash flow estimates. All these factors have together combined to push AT&T’s stock to a level where even someone in a decade of pain with the stock is looking at it again with interest. To highlight how bad things are for AT&T’s stock, the yield is almost two percentage points higher than the forward PE. Outside of REITs, it is hard to imagine a regular stock in this boat, ever.

AT&T PE and Yield (SeekingAlpha.Com)

As much as it hurts being a shareholder, AT&T deserves this pessimism. So, why are we talking about a dividend increase here in spite of all these issues?

Two reasons:

- Affordability: AT&T can afford it as shown by the analysis below.

- Prior to the WDB spin off announcement, AT&T had a history of announcing dividend increases in the last quarter of the year, with the new dividend effective from each January.

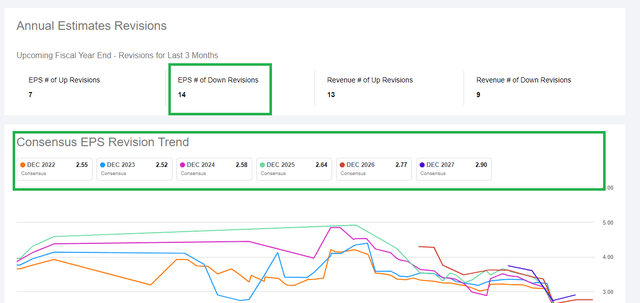

Let’s us get into the affordability aspect in detail. We tend to do this two different ways: based on EPS and based on Free cash flow. Since it has not been a full year yet since the WDB spin off, using trailing EPS will be a bit misleading. So, let’s use forward estimates. At the current annual dividend rate of $1.11 per share and expected forward EPS of $2.54, the stock has an attractive payout ratio of 43.70%. But forward earnings are all estimates and can go down, especially in the current environment where everything looks bleak. But AT&T and Verizon (VZ) have seen so many downward revisions in the past 3 months that make the current estimates look reasonable. As experts have pointed out, the last piece of the puzzle for the market to find a bottom is companies admitting that things are not good. To the company’s credit, AT&T did guide down on free cash flow already. Even if EPS is guided down further from here, the payout ratio has enough room to at least maintain current dividend and to give some room for future increases when things improve.

T EPS Revisions (SeekingAlpha.Com)

Let’s look at free cash flow. When evaluating dividend coverage, most investors and analysts tend to look at earnings per share [EPS]. We prefer free cash flow as a better indicator of financial health for these reasons:

- Earnings tend to be up and down depending on rare events and write-offs.

- Earnings are more prone to GAAP-related fluctuations.

- Cash flow is king.

We evaluated the free cash flow based dividend coverage after AT&T reported its Q1 earnings. The payout ratio using FCF was a reasonable 68%. Let’s see how things look using the Q2 numbers.

- Total shares outstanding: 7.2 billion

- Current quarterly dividend per share: $0.2775

- Quarterly FCF required to cover dividends: $1.998 billion

- FCF in Q2: $1.4 billion

- Payout ratio using FCF: 142% ($1.998 billion divided by $1.4 billion)

Ok, let’s chew on those numbers again. 142%? Yes, that’s correct. No wonder the stock got killed after earnings and has been weak since. But the two bullets shown below from the company’s Q2 results offer a few reasons to not get overly negative, if not get positive.

- “We’re also decreasing full-year free cash flow guidance to the $14 billion range to reflect heavy investment in growth and working capital impacts related to timing of collections”

- “Our results the last eight quarters demonstrate that our deliberate strategy of focusing on growth is helping us gain valuable customer relationships, and we’re confident in our ability to maintain this momentum while also continuing to reduce debt and deliver an attractive dividend“

So, what’s positive in the points above? First, the reduced free cash flow of $14 billion for the full year means AT&T’s dividend coverage based on FCF looks a whole lot better if you use the full year’s numbers instead of each quarter. That is, at an annual dividend commitment of about $8 billion, the payout ratio works to 57% based on $14 billion in free cash flow. Second, they are investing in growth and while that brings bad memories, this time it is growth in the business they know more about. Third, the mention of debt reduction and delivering an attractive dividend show they still have some concerns for shareholders, despite the stock performance showing otherwise.

To summarize the affordability section, both forward EPS and full year Free cash flow projections show the company has enough room to at least maintain the dividend, if not increase. Now, to the verdict. Do we believe AT&T should and will announce a dividend increase in December? No. In fact, we plead, “nooooooo.” Investors are right now focused quite a bit on debt reduction and this becomes even more important with the cost to borrow at ridiculous highs. Sure, their loans are likely from the past with lesser rates but debt reduction is direct savings, especially for a company with negative to no growth.

Conclusion

Investing in stocks require humility. So does writing about stocks. On both fronts, we admit that we were clearly wrong on AT&T. We did write in a few of our past articles that if the company took on more unrelated debt or made one more major acquisition that would be the last straw. AT&T hasn’t done either of those yet. But we clearly overestimated their ability to run two distinct companies (Telecom and Media/Content) when they showed little competence in running just one.

That said, AT&T is being looked so negatively that some are already predicting another dividend cut. We don’t believe a dividend cut is already on the cards. Nor do we believe an increase is coming up this December. But if things improve in the economy and if AT&T stays disciplined in reducing debt, the undervaluation should lead to respectable returns coupled with the 6% yield.

Be the first to comment