wdstock/iStock Editorial via Getty Images

AT&T (NYSE:T) has put its shareholders through the wringer over the last little while as details of the merger remained behind closed doors for longer than many expected. But, we have finally got some clarity and I still think this is a great deal for AT&T. I will do my best to break down how this shakes out and what the prices could look like post-merger, but the real winners here are the AT&T shareholders who get a piece of a new media company and also get to keep what they had in a newly focused telecommunications company that is going to be jumping on the 5G train in a big way. I hope this helps give some nervous and confused AT&T shareholders peace of mind.

How In The World Does This Breakdown?!

As we approach the record date of April 5th, we continue to get a better idea of what we can expect to see. Let me clear one thing up. The spin-off is not happening on April 5th. It will happen roughly one to two weeks after the April 5th record date. So, investors will not see their shares of WBD until closer to Easter.

I’ve seen many shareholders say they have no idea what’s going to happen and they are just going to hold on for dear life. I will attempt to break it down with respect to each entity and what we can expect to say. Keep in mind, there is still some time left, so the values could change but the math will remain the same.

Okay, so AT&T shareholders of record at the close on April 5 will receive (tax-free) an estimated 0.24 shares of Warner Bros. Discovery (WBD) for each share of AT&T held.

AT&T currently has 7.16 billion shares outstanding. 0.24 of that works out to 1.71 billion shares of WBD. Discovery shareholders will see their 506 million outstanding shares + preferred units outstanding turned into 695 million shares of WBD. This is how you get AT&T owning 71% and Discovery 29%.

As for how they will be priced, I think the best proxy for the WBD potential price is Discovery (DISCA). This is because those shares will be swapping 1 for 1. So this means that, wherever Discovery is trading, (currently $26.25), it is safe to assume that is roughly where WBD will be post-spin-off.

To figure out how AT&T will get re-rated, all we have to do is take Discovery’s share price and multiply it by 0.24. As of today, that gives us $6.30. From there, we take AT&T’s current share price ($23.99) and subtract $6.30. This gives us an estimate of $17.69 for AT&T post-spin-off.

As for the dividend, we know there will be an annual dividend paid out by AT&T of $1.11. That translates to a 6.27% yield which maintains AT&T’s status among the best dividend payers in the market. AT&T shareholders will hold the exact same amount of shares in AT&T that they held before the close.

What Can We Expect From AT&T Going Forward?

I have been saying for a while now that I think this move will be extremely beneficial for AT&T shareholders going forward. The result will be a much more laser-focused company. AT&T shareholders have seen what happens for years when you try to diversify a business that doesn’t need to be diversified. It’s going to be boring, and boring is good. Especially when you have cash flows coming in like AT&T will.

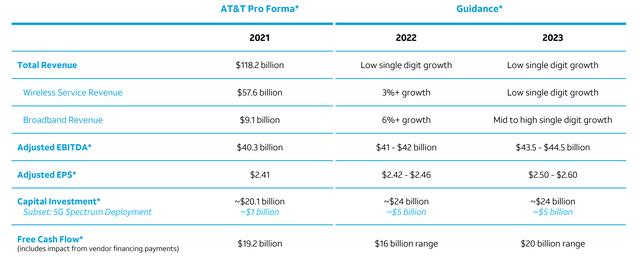

Looking below, we can get a good picture of what is to come. I want to draw your attention to the bottom. We can see that free cash flow is set to reach $16 billion in 2022, and that will surge to $20 billion in 2023. That is mostly thanks to cost savings rolling into positive cash contributions. By the end of 2023, AT&T is targeting ~$6 billion in savings. There is about $3 billion already in the bank, with another $1 billion expected this year, and $2 billion in 2023. Revenue will be very modest or “boring” with low single-digit growth, and CapEx is going to be $24 billion, $5 billion of which will contribute to the 5G movement.

All in all, it looks pretty good. Like I said, much cleaner. Much more straightforward. And the objectives are very clear. As investors see how they operate I think more investors will flock to AT&T, and not just for the juicy dividend.

The metric I will continue to watch going forward will be free cash flow. If we see a sudden drop, it may be time to run for the hills. But, based on what the company has laid out I do not have many doubts in my mind that this is all going to work out. At the end of the day, shareholders will be the winners.

What Does The Price Say?

When price and story line up, good things typically happen. One of the reasons that I like AT&T here so much is how little risk you absorb. What this means is that it allows for greater position sizes. Let me illustrate.

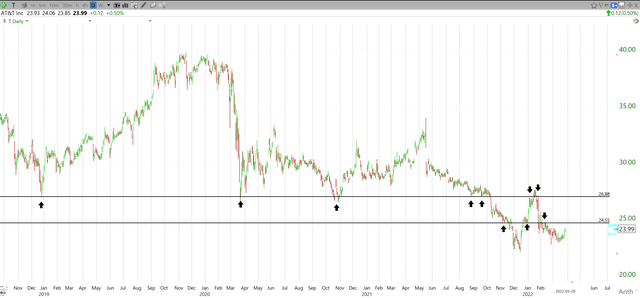

Looking below, we can see that the stop is a pretty obvious one at $22.65. I wouldn’t want anything to do with AT&T any lower than that. From the current share price, that would mean I would max out at a 5.5% loss from current levels. Typically when you put in a stop, it’s somewhere in the 8-12% range. To determine how large your position should be, you should always set a % of your account you’re willing to lose on any one trade/position. For many, that is 1-2%. This means, if you have a $100,000 account, you’d only risk $1,000. Which then leads to me buying $26,854 worth (Using 1.5% risk).

If I move that stop to 8%, I can only invest $18,000 and maintain my risk factor. While smaller moves will take me out, I don’t need the same size of return concerning percentage points to make “decent” money on the trade. Not to mention the dividend benefits that come from earning more shares.

So we have a stop of $22.65, what about price targets? Currently, I have two: $24.55 and $26.88. Looking below, we can see why. Both of these levels have been points of support and resistance. $24.55 is more recent and would be a sign that the bottom is in for now. As for $26.88, we can see it dates back as far as late 2018. If you zoom out even further, you can see that it actually dates back into the ’90s. I would expect some resistance here if we get back to this level in the next few months. $26.88 is about a 12.5% return from current levels. Can’t argue with that for a stock that doesn’t historically produce much in terms of capital gains.

If you take anything from this piece, I hope it is risk management. I’ve learned the hard way, and trust me, stops are game-changers. The “great equalizer” if you will. Things remain quite volatile out there and there is a lot of uncertainty in the world. The one thing that is always true at the end of the day is price. Live by it. The one thing to keep in mind here is that the actual values will change once the spinoff is complete, but the levels will be the same.

Wrap-Up

As you can see, I feel very confident that everything is going to work out in favor of AT&T shareholders at the end of the day. The dividend will likely be yielding over 6% which isn’t too far off from what shareholders are used to and remains among the best in the market. AT&T is going to be a laser-focused company going forward that is driven by cost savings, which lead to increased free cash flow. I don’t think we will see a ton of movement in share price leading up to the record date. Once it’s all said and done, I would be looking at adding AT&T should the technical piece line up with the story. Until then, I will watch and see what happens.

Be the first to comment