Dilok Klaisataporn

Article Thesis

AT&T Inc. (NYSE:T) reported its second-quarter earnings on Thursday, beating estimates on both lines. But the company also had to cut its free cash flow guidance for the current year, which is why the market reacted very negatively to the report. I do believe that the 10%+ share price drop is an overreaction, and that income investors have a solid buying opportunity right now.

Earnings Overview

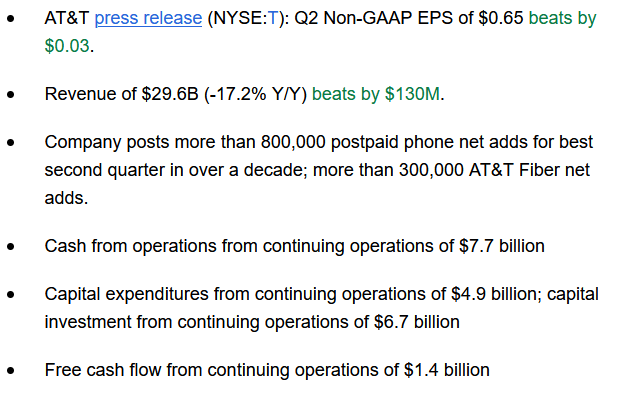

AT&T’s Q2 highlights are reported in the following news item from Seeking Alpha:

Seeking Alpha

Both revenues, as well as earnings, beat estimates, with the EPS beat of 5% being particularly noteworthy. Revenues were down year over year, of course, as the spin-off of the media business made the period not really comparable to last year’s second quarter.

AT&T showed strong progress in adding new customers, as postpaid phone net adds came in at the highest level in more than 10 years. Analysts that had been predicting that AT&T would lose market share versus T-Mobile (TMUS) and others seem to be wrong. In fact, I’d argue that the strong net additions by AT&T in both the most recent quarter as well as in previous periods indicate that the company’s growth investments are paying off. AT&T has been spending heavily on 5G and other growth imperatives, and the strong business growth momentum in the phone business proves them right. AT&T Fiber also had a very solid quarter, with net additions coming in at a 1 million plus annual pace.

Cash Flow: Timing Is Everything

And yet, shares slumped more than 10% on the day of the report, despite the revenue, earnings, and business growth momentum data looking encouraging. The reason for that is AT&T’s free cash flow guidance revision. Instead of $16 billion in 2022, the company is now forecasting $14 billion of free cash this year, with said cash flow being backloaded towards the second half.

Q2 free cash flow stood at a rather slim $1.4 billion, which isn’t enough to pay for the dividend. But looking at free cash flow on a quarterly basis can be misleading, as cash flow can be pretty lumpy due to the impact of the timing of specific payments. When AT&T makes a larger payment for one of its investments in a specific quarter, FCF in that quarter will be lower. On the other hand, a different quarter where fewer such payments are made will have a stronger-than-average free cash flow number.

Looking at annual free cash flows is more important, and things are still looking good there. Even with the lowered $14 billion free cash flow target, AT&T will still be able to cover the dividend easily. With the dividend standing at $1.11, and AT&T having 7.16 billion shares, the dividend costs the company $7.9 billion per year. With a $14 billion annual free cash flow, the dividend is thus still covered at a very healthy 1.8x, which pencils out to a free cash flow payout ratio of 57%. For a high-yield income pick, that’s a very solid dividend coverage ratio, I believe. This is especially true when we consider that AT&T’s business model is pretty resilient versus recessions, as neither consumers nor enterprises will stop using phones during an economic downturn. With resilient cash flows covering the dividend almost twice, there is absolutely no need to fear a dividend cut, I believe.

In fact, even after the $7.9 billion dividend has been paid, AT&T will have a surplus of $6.1 billion of free cash left over, which gives the company ample room to pay down debt or grow its war chest in order to prepare for any potential future crisis.

Importantly, the $14 billion free cash flow guidance does not mean that AT&T’s future free cash generation will be lower compared to what the company had believed in the past. Instead, management gives a couple of reasons why this year’s free cash flow will be lower than expected, while there are signs that FCF in 2023 and beyond will be higher again. One of the reasons for the lower FCF guidance is that AT&T is experiencing headwinds from inflation — their input costs have risen. But CEO John Stankey states that the company is taking steps to revert that impact, e.g., by increasing pricing in order to combat inflationary headwinds to their profitability and cash flows. These price hikes didn’t impact results for Q1 and Q2 yet, but they should have a positive impact on AT&T’s revenues and margins going forward. This is likely one of the reasons why free cash flow is forecasted to improve in H2, and it should have an impact beyond 2022 as well. Once customers are on higher-priced plans, AT&T will continue to rack up higher revenue per customer, which should improve its free cash generation down the road.

Some customers are also paying their bills later, which is pushing cash flows into the future. But they will have to pay eventually, which is why those cash flows aren’t lost forever, which is another reason why I believe that the reduced FCF guidance will not mean that FCF will be lower than expected forever. In the end, some cash flow being pushed from 2022 to 2023 is not great news, but it isn’t a disaster either. It surely does not warrant a $15 billion in destroyed market capitalization in a single day — at least that’s what I believe.

For long-term investors, it is important to look beyond the most recent quarter or the next quarter. AT&T had been guiding to $20 billion of free cash flow in 2023, which will not be subject to any one-time expenses for the media spin-off, and when things are running smoothly for the “new” AT&T. The company did not make any changes to that guidance in the Q2 call, which to me suggests that the reduced FCF guidance for the current year could indeed be a one-time item.

AT&T Is A Buy At Current Prices

But in order to be conservative, let’s assume that 2023 will come in $2 billion below expectations as well. Would that be a disaster? I don’t think so. Following the post-earnings slump, AT&T is now valued at $130 billion. Free cash flow of $18 billion in 2023 would pencil out to a free cash flow yield of 14%, which would be very attractive. Once we account for $7.9 billion of dividend payments, AT&T would have ~$10 billion left over for other purposes. It would likely spend most of that on debt reduction. With H2 FCF being forecasted at $10 billion (FCF in H1 was $4 billion), and with $4 billion of that being needed for dividend payments, AT&T could thus reduce its net debt by $16 billion through the end of 2023.

Net debt at the end of the second quarter was $132 billion, thus AT&T could lower its net debt to around $116 billion by the end of next year. Based on the current EBITDA forecast for 2023 (Wall Street consensus, as reported by YCharts) of $44 billion, that would pencil out to a net debt to EBITDA ratio of 2.64. For comparison, AT&T reports a Pro-forma net debt to EBITDA ratio of 3.23 for the last four quarters. In other words, AT&T could lower its net debt and its leverage dramatically over the next six quarters, while also paying an attractive dividend. If AT&T continued to pay down debt in 2024, it would most likely hit the 2.5x EBITDA target range during the first half of that year, or a little less than 2 years from now. For a long-term investor, that’s not a dramatically long time period. Note that this scenario already assumes that FCF in 2023 will be $2 billion weaker than AT&T has been guiding for, it could thus be too conservative. AT&T might be able to deleverage even faster when it is able to meet or beat its FCF guidance for next year.

At the current share price, AT&T offers a dividend yield of 6.1%, which is pretty compelling. That’s around 4x the broad market’s yield, and also much more than what one can get from AT&T’s most relevant peer, Verizon (VZ), which offers a yield of 5.2%. Based on expected 2022 year-end net debt of $126 billion, and on a current market capitalization of $131 billion, AT&T is trading with an enterprise value of ~$260 billion. That’s just 5.9x next year’s expected EBITDA, which seems like a pretty low valuation.

I do thus believe that AT&T is currently undervalued and that the post-earnings selloff has made AT&T even cheaper than it was before. The reduced FCF guidance isn’t great, but it isn’t an overly large problem, either. The dividend is very well covered, and AT&T will make a lot of progress in reducing debt levels both in H2 as well as in 2023. It seems reasonable to assume that AT&T will hit a leverage ratio of 2.5 in H1 2024, and at that point, shareholder returns could be increased drastically.

Since AT&T is trading at a single-digit free cash flow ratio and ultra-low EV/EBITDA multiple, there is considerable longer-term upside potential. AT&T’s shareholders get a very attractive 6%+ dividend yield on top of that while waiting for the deleveraging scenario to play out over the coming quarters.

Be the first to comment