RiverNorthPhotography

Thesis

We presented in our pre-earnings article on AT&T (NYSE:T) urging investors to capitalize on its highly attractive dividend yields, coupled with oversold momentum.

Therefore, with such pessimism baked into T as it collapsed to its October lows, a positive earnings release would likely galvanize buyers to jump on the bandwagon.

So, that was precisely what happened as T has surged nearly 12% from our previous article, as it closed in on its near-term resistance. However, we urge investors to be wary about joining the queue to buy now as we believe its near- and medium-term upside has likely been reflected.

Investors need to consider that the market has likely not re-rated T but rather allowed a mean-reversion opportunity, which has already occurred. With an NTM dividend yield that has reverted close to its 10Y mean, T’s valuations seem more well-balanced now.

Management’s confidence in its Q3 commentary highlighting its confidence in meeting its free cash flow (FCF) guidance, was instrumental in the liftoff. However, questions remain as T remains embedded in a long-term downtrend.

While we believe that the market has likely reflected its near-term challenges through the recession, we deduce that T could still pull back from its recent surge and trade sideways for some time.

As such, we revise our rating on T from Buy to Hold and urge investors to be patient.

T’s Valuation Is More Well-Balanced Now

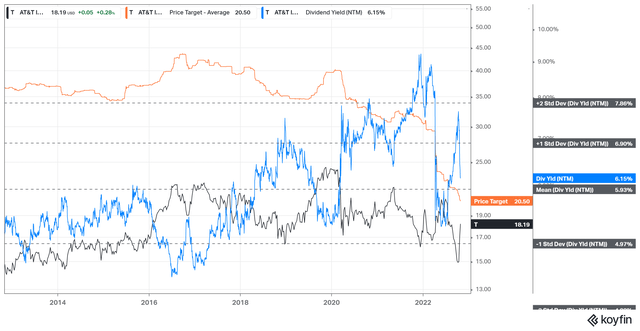

T NTM Dividend yields % valuation trend (koyfin)

As a result of the momentum spike, T’s NTM dividend yields fell significantly from its undervalued zone. It last traded at a yield of 6.2%, quite close to its 10Y mean of 5.9%.

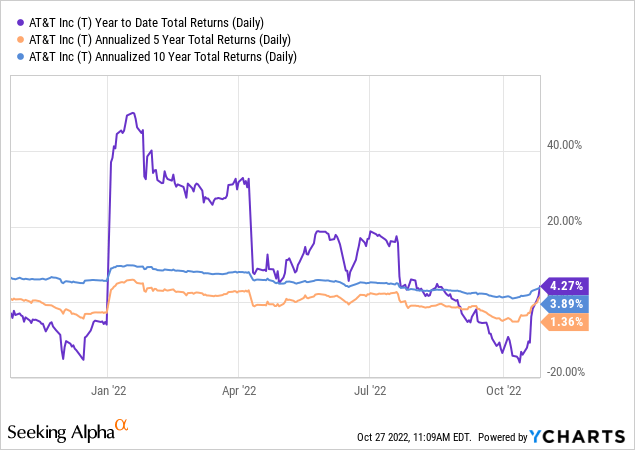

Moreover, the YTD underperformance of T against its historical averages has also normalized with the surge. As seen above, T’s YTD total return of 4.27% is now above its 5Y and 10Y total return CAGR of 1.36% and 3.89%, respectively.

Hence, for the market to re-rate T much higher would likely require T to be considered significantly undervalued, proffering a robust mean-reversion opportunity.

However, a glance over its valuation against its peers doesn’t suggest such a bifurcation. T last traded at an NTM EBITDA multiple of 7.1x, in line with its peers’ median of 6.95x (according to S&P Cap IQ data).

AT&T’s Free Cash Flow Guidance For 2023 Remains Uncertain

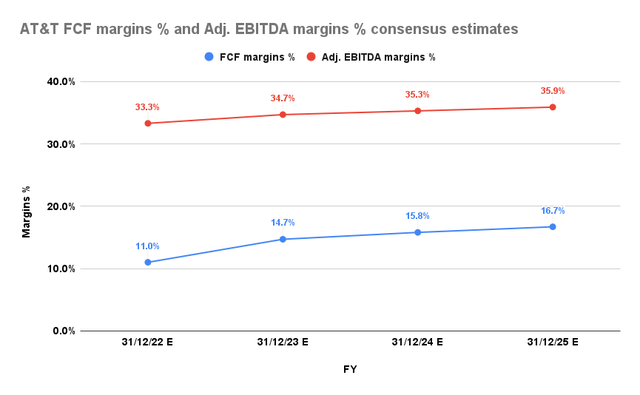

AT&T Adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

Management’s reiteration of its FCF guidance for FY22 was music to investors’ ears. But, investors should also consider that management was not ready to guide FCF for 2023 other than highlighting: “We continue to expect EBITDA growth and higher free cash flows in 2023.”

Notwithstanding, management cautioned that it sees worsening macro risks and highlighted that AT&T would not be immune to these challenges. Accordingly, while management highlighted it was not ready to guide for FY23, we postulate that its FCF guidance for FY23 could come in below the current consensus estimates.

The current estimates are predicated on AT&T posting an FCF of about $19.7B in FY23, quite close to management’s previous guidance of $20B. That translates to an FY23 FCF margin of 14.7%, higher than FY22’s estimated 11% margin.

Therefore, we postulate that without a higher guide than the current estimates, T would struggle for further buying momentum from the current levels.

Is T Stock A Buy, Sell, Or Hold?

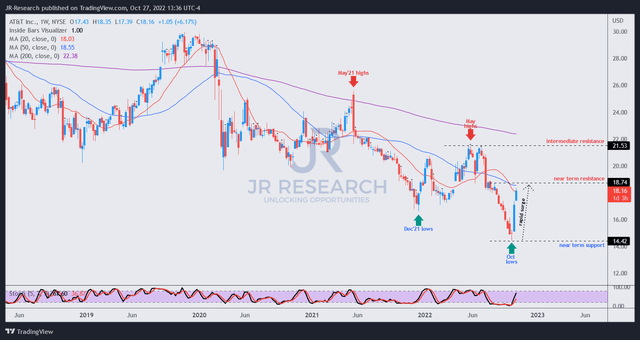

T price chart (weekly) (TradingView)

Investors are reminded that T remains in a medium- and long-term downtrend. Therefore, unless we see a potential change in trend, we will continue to base our assumption against its dominant trend bias.

As seen above, the rapid surge from its October lows has likely met with stiff resistance. Several dynamic resistance levels could also impede further buying upside unless the market decides to re-rate T materially.

However, we have yet to glean any decisive change in trend and believe the recent rally merely indicates a counter-trend reversal, which has likely reflected T’s near-term upside.

Hence, we believe T would struggle for sustained buying upside from the current levels unless the market anticipates that AT&T’s fundamentals would improve dramatically from these levels.

Coupled with a well-balanced valuation, we urge investors not to chase the momentum surge.

Accordingly, we revise our rating on T from Buy to Hold.

Be the first to comment