vencavolrab/iStock via Getty Images

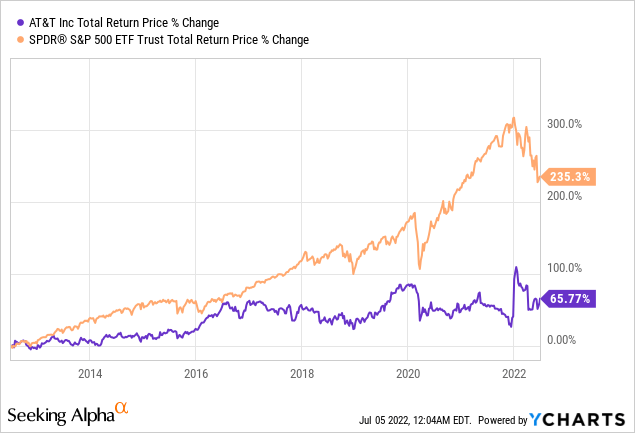

AT&T Inc. (NYSE:T) has underwhelmed over the past decade, with heavily leveraged ill-fated acquisitions leading to massive underperformance and ultimately culminating in a steep dividend cut. While the company has spun off its media business (WBD) along with a hefty pile of debt in an effort to better focus on its core telecom business and take a step forward towards deleveraging, the forward outlook for T is bleak. With little to no dividend growth expected for the foreseeable future, T is effectively a dying dividend growth stock.

Instead of investing in washed-up has-been dividend growth stocks like T simply for the high current yield, we prefer opportunities like Cogent Communications Holdings, Inc. (NASDAQ:CCOI) for communications exposure.

In this article, we will share why we believe that T’s best days as a dividend growth stock are behind it and why investors looking for an attractive blend of current yield and dividend growth in the communications space are much better served by investing in CCOI instead.

T’s Dividend Growth Decline

T’s reckless issuance of tens of billions of dollars in debt over the past decade, which it spent on ill-timed share buybacks and ill-fated acquisitions (such as the bloated acquisition of DirectTV just as online streaming giants like Netflix (NFLX) were beginning to dominate), have since led to massive goodwill write downs and severe underperformance.

However, while shareholders were undoubtedly unhappy about how management mishandled their money, they were still willing to stick around because T was one of the highest yielding Dividend Aristocrats around and investment grade to boot. Furthermore, inflation was still low at the time, so T was seen as a wonderful retiree annuity of sorts that also gave you equity upside optionality. The high dividend yield (typically in the mid to high single digits, depending on market conditions at the time) went a long way towards funding retiree living expenses, especially given that it typically exceeded the 4% Rule that many use as a rule of thumb for retirement planning and budgeting. Meanwhile, the low to mid-single digit annual payout hikes easily kept up with inflation, thereby preserving retiree’s purchasing power.

Even if the stock perennially underperformed the stock market, the knowledge that you were getting what appeared to be a safe dividend yield and that it would continue to gradually move higher roughly in line with inflation enabled retirees to sleep well at night. However, while all appeared great on the surface, the reality was that management was eviscerating shareholder value and that the clock was ticking on the dividend’s sustainability. By taking on mountains of cheap debt, management was able to preserve an attractive payout ratio while creating the illusion that the payout was safe even as they continued to hike it. However, eventually that debt would have to be paid back and the acquisitions being made with the debt were not even earning enough to compensate management for the cost of the debt in some cases.

As a result, the day finally came when the company became overwhelmed by the combination of the CapEx needs of its businesses, its debt servicing requirements, and the increasingly burdensome dividend. At first, management tried to have the best of both worlds by saying they were simply going to cease dividend growth, but still hold the payout steady. Since then, however, management has been forced to rip off the band aid with a massive dividend cut. Retirees have been burned badly and have little reason to trust management or invest in the stock moving forward.

T’s Bleak Dividend Growth Future

Consensus analyst estimates paint a very bleak picture for T’s dividend growth future, forecasting a meager dividend per share CAGR of 0.4% through 2026. When combined with the current yield of 5.3%, the total return proposition is hardly mouthwatering and likely won’t even keep up with inflation in the near-term at least.

On top of that, T still has a mountain of debt that will consume most of management’s excess cash for the foreseeable future, putting a weight on growth potential, and T also trades at a hefty EV/EBITDA premium to its historical average. It currently trades at a 8.74x EV/EBITDA, whereas its historical average is 6.76x. As a result, if interest rates continue to rise, T could see further multiple compression, resulting in even lower total returns than the yield plus growth profile suggests.

Buy CCOI Stock Instead

The good news is that investors looking for a communications stock that pays both a high current dividend yield and still enjoys impressive dividend growth potential that could keep up with inflation even in the current environment are not without hope.

CCOI is an internet-providing telecommunications stock that has been growing its dividend rapidly in recent years and – after the recent pullback in its stock price – now offers a projected forward yield of 6%. Our conviction in the investment thesis was strengthened after management reiterated support for the dividend and increasing shareholder returns when it reported its Q1 FY2022 results. Highlights from the period included:

- CCOI posted another quarter with low single-digit year-over-year revenue growth along with an expanding EBITDA margin. The expanding EBITDA margin was especially impressive given the macro headwinds we are facing and reflects just how well-run the business is.

- That said, CCOI will need to boost its growth rate moving forward back towards more normalized levels (mid single-digit revenue growth rate) in order to sustain its $0.025 per share quarterly dividend payout increase streak. Still, the CEO expressed full confidence that this would take place on the earnings call, stating in response to an analyst question about the sustainability of the dividend growth rate:

I can comment on the past 39 quarters because they’ve already occurred and that is a rarified club of companies that have that level of dividend growth pace and consistency. In terms of the future, I fully anticipate to be able to do that. I cannot make a promise. We’re going to continue to monitor the situation. But based on the patterns as they exist today, we have a great deal of confidence in our ability to generate increasing amounts of free cash. And then the decision will be to evaluate market conditions and determine whether we should accelerate buybacks or continue to accelerate the dividend.

Overall, we remain very bullish on CCOI as a very well-run company that combines a very high ~6% current yield with the potential to continue growing that dividend at a high single digit to low double-digit rate for the foreseeable future. In fact, the consensus analyst estimate for dividend per share growth through 2026 is a 10% CAGR. If it can successfully execute that potential, it is one of the most attractive dividend growth stocks available today. Another thing we really like about the company is how willing management is to speak at length with us, doing deep dives into the state of the industry and how it impacts the value proposition of their stock.

Investor Takeaway

The total return and dividend track records of these two companies says a lot about them and the quality of their management teams. One is a dying dividend growth stock that has frittered away tens of billions of shareholder wealth, culminating in a devastating dividend cut for retirees invested in the stock. The other is a rapidly growing dividend stock which – due to market pessimism about changing enterprise internet needs in the wake of COVID-19 – is now also offering a very high dividend yield. That said, management remains heavily invested themselves and has signaled confidence in not only the viability of the current dividend payout, but also the potential to continue growing it at an aggressive pace.

As a result, we are long CCOI and have no plans to add T anytime soon.

Be the first to comment