Justin Sullivan

After the completion of its spinoff of Warner Bros. to create the new stock Warner Bros. Discovery (WBD), AT&T (NYSE:T) finds itself all alone once again. The stock sunk after releasing second quarter earnings, largely due to a cut to its free cash flow guidance. A dividend cut has not helped either, though the stock is still yielding 6%. The stock trades for just over 9x free cash flow, but any cash after the dividend will likely be directed toward paying down debt for many years. In light of the projected delay in cash returns, the stock is actually not trading nearly as cheap as it appears.

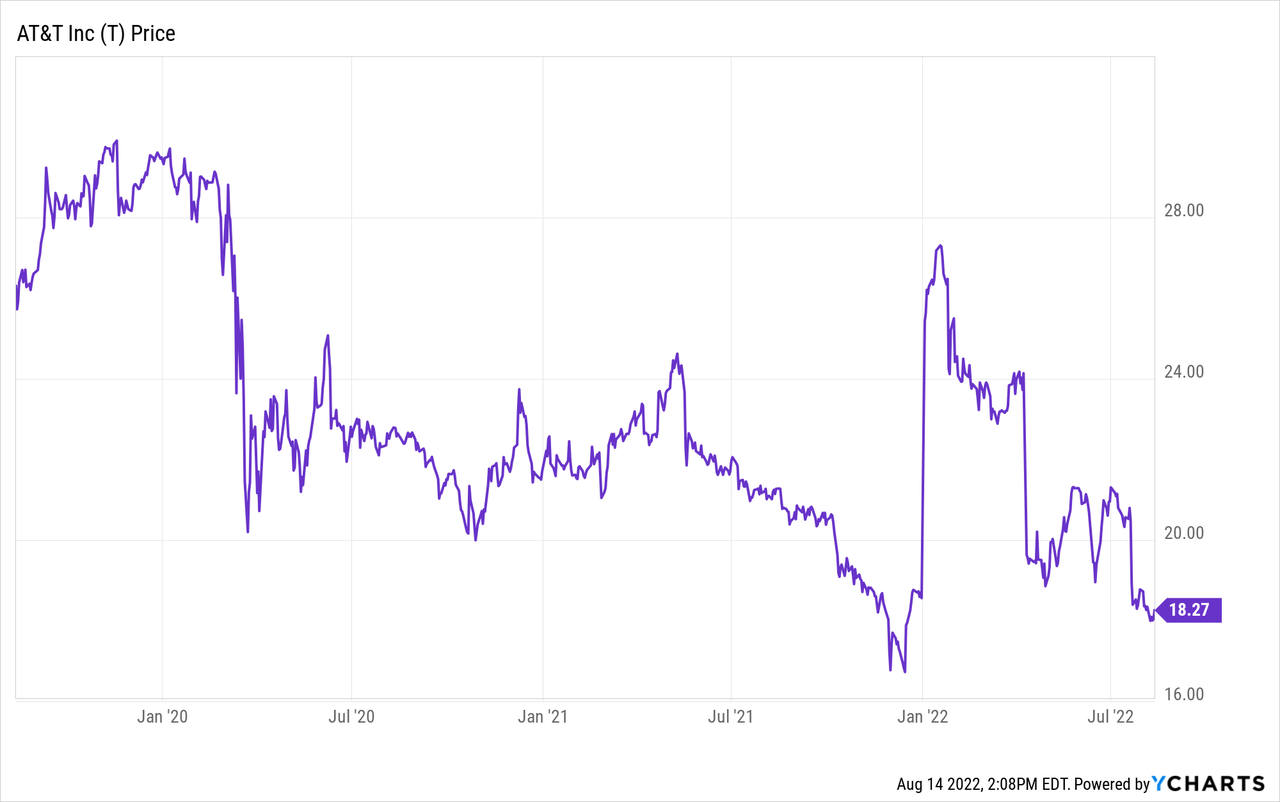

T Stock Price

T has had a rough year even though it is no tech stock.

I last wrote about T in March where I discussed why I viewed the stock to be sellable heading into the spin-off of WBD. The stock has delivered 4% total returns since then, but I continue to see the stock as lacking compelling reasons to buy even today.

AT&T Stock Key Metrics

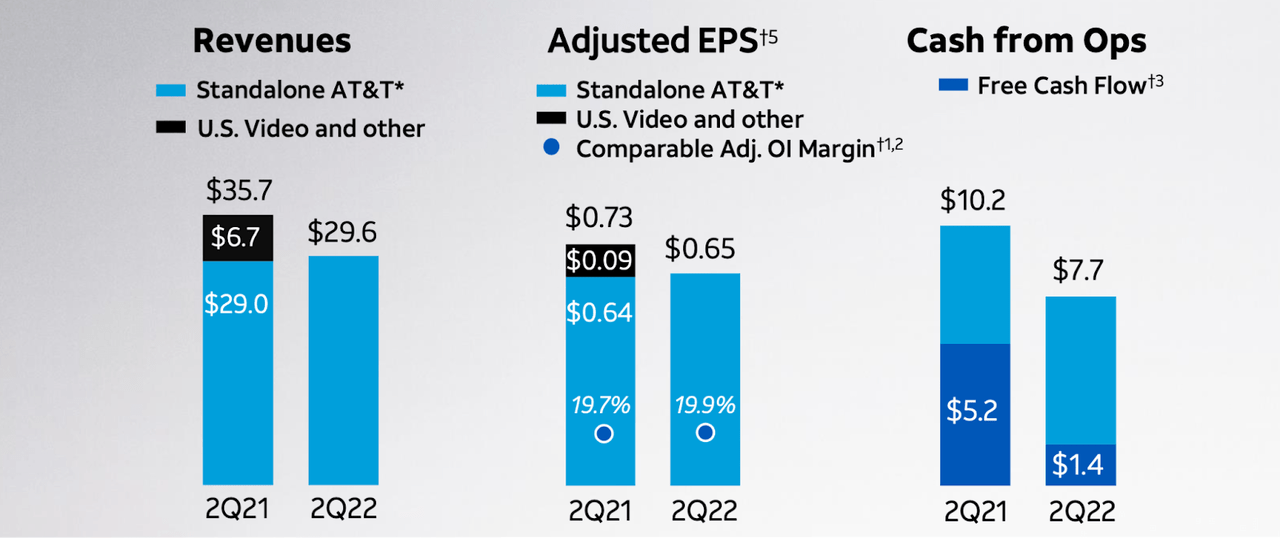

T’s latest quarter saw some surprising subscriber strength though it did not necessarily lead to bottom line strength, as adjusted EPS barely grew at $0.65 per share.

2022 Q2 Slides

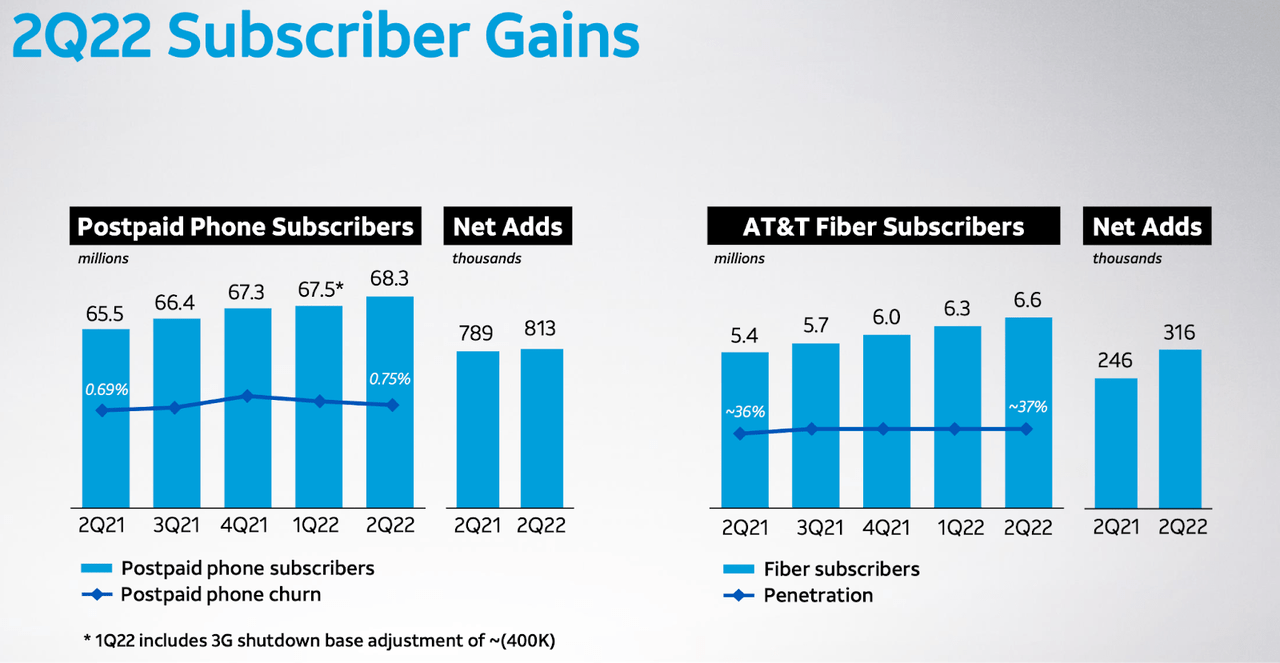

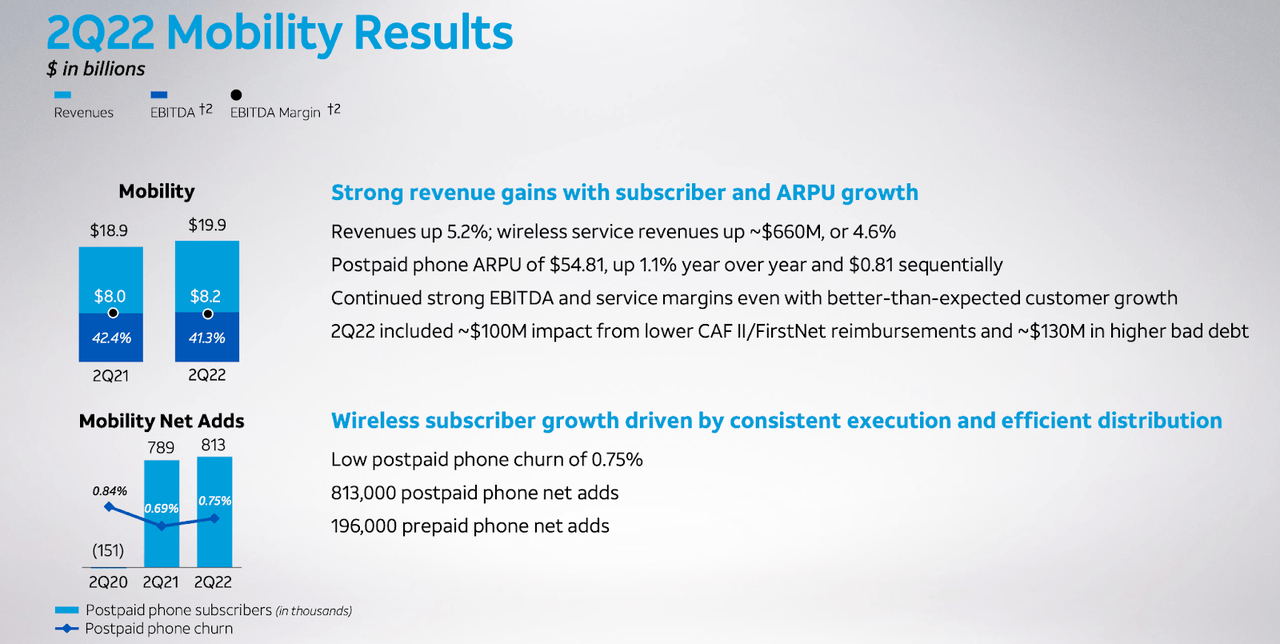

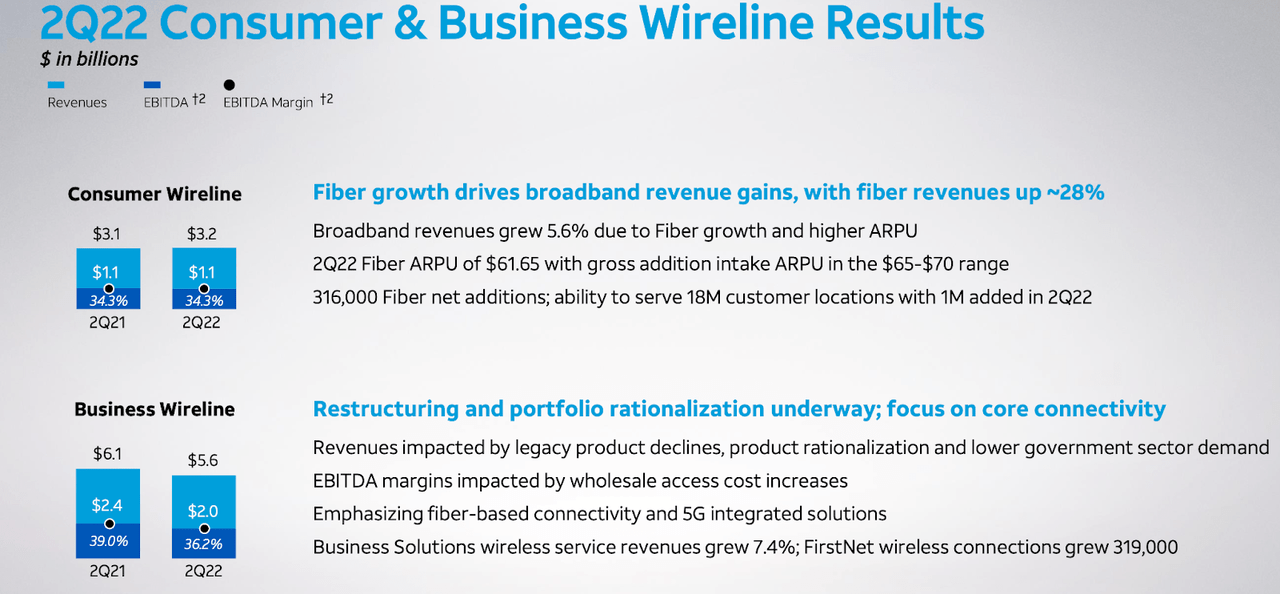

T added 813 postpaid subscribers and 316 fiber subscribers in the quarter.

2022 Q2 Slides

T was also able to increase mobility average revenue per user by 1.1% to $54.81.

2022 Q2 Slides

In general, T has been able to sustain stronger ARPU growth in its broadband division (which makes sense, I am sure many readers can relate to the consistent price increases of the internet).

2022 Q2 Slides

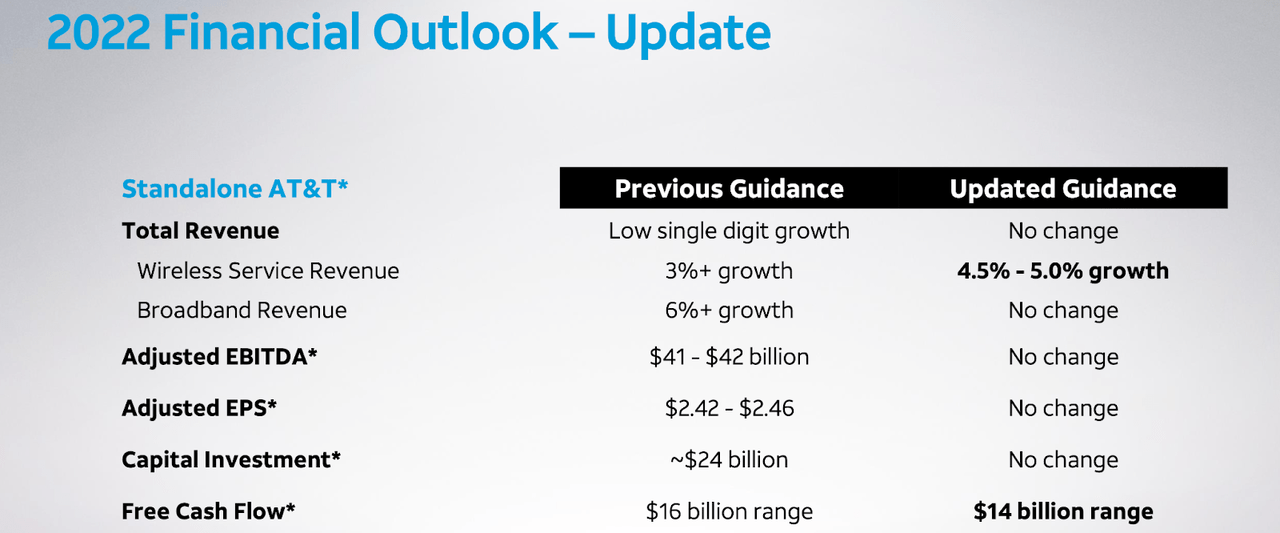

T left its outlook mostly unchanged though it did reduce its free cash flow guidance from $16 billion to $14 billion.

2022 Q2 Slides

That shortfall was explained as being mainly due to increased timing of consumer collections. There still remains the question of how T expects to meet even the reduced guidance. While T has only generated $4.2 billion of free cash flow thus far, it expects to reach $14 billion by the end of the year due to the fact that it had front-end loaded its capital investments, leading to lower capital investments in the second half of the year.

T continues to expect $24 billion of capital investment this year as well as $24 billion of capital expenditures in 2023. What sent the stock falling?

I suspect that it was due to commentary on the conference call which implied that it may not be able to achieve the previously guided $20 billion of free cash flow next year, despite having reiterated in the prior quarter. Sure, inflation and macro-headwinds are taking its toll across the market, but I doubt many T investors expected that disappointment only a few months after the prior quarter.

T ended the quarter with $131.9 billion of debt, representing a 3.2x debt to adjusted EBITDA ratio. Management has indicated that its priority is to bring leverage down to 2.5x debt to EBITDA. The $1.11 per share annual dividend should consume around $7.9 billion of cash flow annually. Based on $16 billion to $20 billion in annual free cash flow, T might need as many as 5 years to right size its balance sheet.

Is T Stock A Buy, Sell, or Hold?

As a result of spinning off WarnerMedia, it reduced its annualized dividend to $1.11 per share. That places the stock at a 6% dividend yield. I suspect that many investors are instead looking at the ample free cash flows – T trades at an 11% free cash flow yield. A bullish investment thesis might go as follows: collect a well-covered 6% dividend yield while you wait for the company to pay down debt. Once the company brings leverage in-line with its 2.5x target, it may aggressively increase its dividend or repurchase shares. The stock would potentially deliver multiple expansion much earlier in anticipation of the increased shareholder returns.

While I can respect the simplicity of that thesis, I remain skeptical. Based on the numerous acquisitions over the past decade (DirecTV and Time Warner stand out), it is clear that T’s management team may have some issue with “simple capital allocation.” As a former T shareholder myself, I remember that management has previously made promises regarding reducing leverage. T had initially thought that it could reduce leverage down to 2.5x debt to EBITDA by 2018, but leverage stands at 3.2x debt to EBITDA 4 years later even after it jettisoned much of its debt to WBD. This is a case where the management track record stands in the way of what should be a clear-cut thesis. What’s more, I wonder if the rise of 5G will negatively impact the broadband business, leading to some cannibalism in that business line. The broadband business has historically helped offset slow mobility growth to juice overall growth rates – this is a tail end risk which makes the 11% free cash flow yield look quite justified. Nonetheless, the stock is by no means expensive with a 6% immediate dividend yield and the potential for increased shareholder returns within several years. Perhaps this is a name which investors should keep an eye on, tracking to see if debt to EBITDA ratios continue falling and only buying later as the prospects for aggressive share repurchases surface. For now, I rate the stock a buy as the valuation is not compelling in the current environment (I continue to favor growth stock after the tech crash) and there are few catalysts to justify multiple expansion.

Be the first to comment