bazilfoto

ATRI – Atrion Corporation

Defensive healthcare continues to catch a strong bid in the back end of FY22 offering equity portfolios a defensive overlay to clamp equity beta and reduce downside risk. Earlier in the year, we had advocated to buy Atrion Corporation (NASDAQ:ATRI) for these reasons, noting that investors had continued to turn up the heat on resiliency and quality factors.

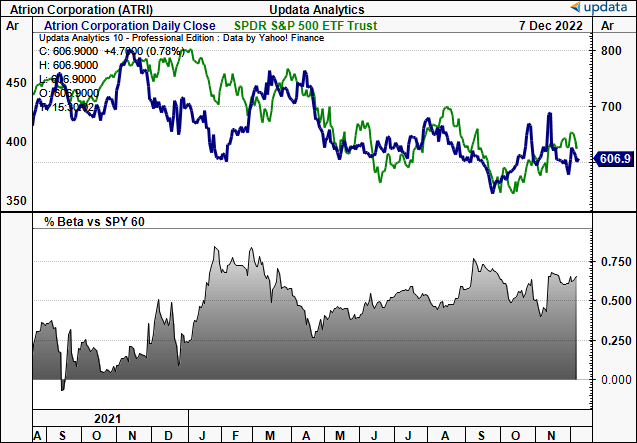

What we observed in ATRI was a low covariance to the benchmark, with idiosyncratic premia related to its breadth of offerings across fluid delivery, ophthalmology, and others. You can see the 12-month performance of the stock vs the benchmark below, with its corresponding equity beta in the bottom frame. You can also check out our previous publication on ATRI here:

Exhibit 1. ATRI price performance vs. S&P 500 with corresponding equity beta [bottom frame]

Data: Updata

Following its latest set of numbers, we’d like to follow up on our positive comments on the company.

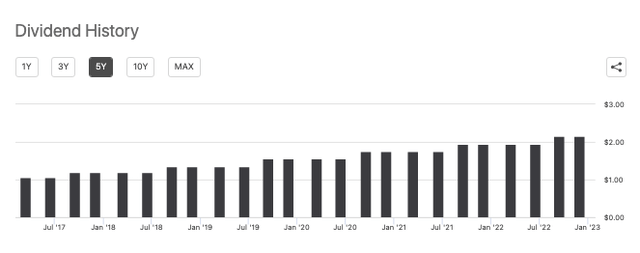

We continue to rate ATRI a buy, based on the same factors outlined in our last publication. As a reminder, this included attractive valuations, defensive sector positioning, strong core offerings and the ongoing stream of dividend growth to first cover the downside but also ratchet up our total return. You can see ATRI’s long-term dividend growth in the image below. Rate buy, price target $616.

Exhibit 2. ATRI quarterly dividend stream, FY17–date

Data: Seeking Alpha, ATRI “dividends”

ATRI Q3 earnings – numbers continued to ratchet up for a record quarter

Switching to the quarter, we’d note it was a record third quarter revenue result for the company.

Revenue of $44.6mm represented a YoY growth of 3.8%, driven by growth in its U.S and international markets excluding Europe. The latter tightened by ~13% YoY. COGS widened by 800bps driven by higher revenue volumes and variable costs associated with this.

In fact, OpEx narrowed by $262,000 YoY to $8.1mm, with downsides from stock-based comp. and lower R&D investment. It pulled this down to operating income of $9.6mm, representing a year-over-year growth of 30bps. Segmented revenue saw a YoY increase across the board, with upsides in each of the fluid delivery, cardiovascular and ophthalmology divisions.

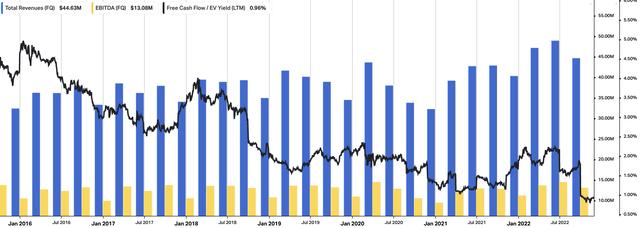

We also saw net income for the quarter lift to $8.8mm or $4.94/share, representing a year-over-year growth of 8.1%. Investors can see a wider look-back of the company’s cyclical revenue growth in the exhibit below.

Last time, we commented on the company’s declining FCF yield, however noted this was justified from its strong c.15% trailing return on invested capital, even when factoring dividend outflows into the equation.

You can see in the chart below that core EBITDA remains cyclical within the ranges shown, and this adds to the predictability of future cash flows in our estimation – a strong point in estimating the stock’s valuation.

Exhibit 3. Cyclical revenue and core EBITDA prints a standout for ATRI, adding to the predictability of future cash flows

Data: HBI, Refinitiv Eikon, Koyfin

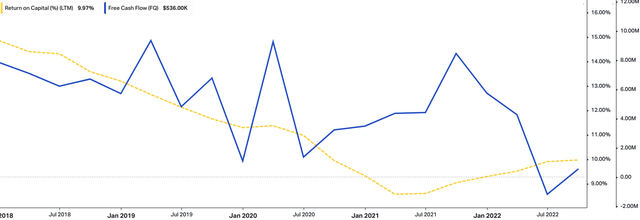

As mentioned above, the coupling between the company’s free cash flows and return on capital remains a standout. As it recognizes free cash outflows, its capital budgeting strategy still harvest a c.10% trailing return on capital [Exhibit 4].

Again, these are resilient characteristics in the current landscape, where the cost of capital is increasing, and the availability of capital is drying up. To print a ~10% trailing return on capital adds the layer of resiliency into the equity risk of an equity-focused, long-only portfolio in our estimation. Therefore, as in our last publication, we continue to see value derived from ATRI in this regard.

Exhibit 4. FCF and return on capital coupling still a standout from previous analyses, and adds in a layer of resiliency to equity portfolios

Data: HBI, Refinitiv Eikon, Koyfin

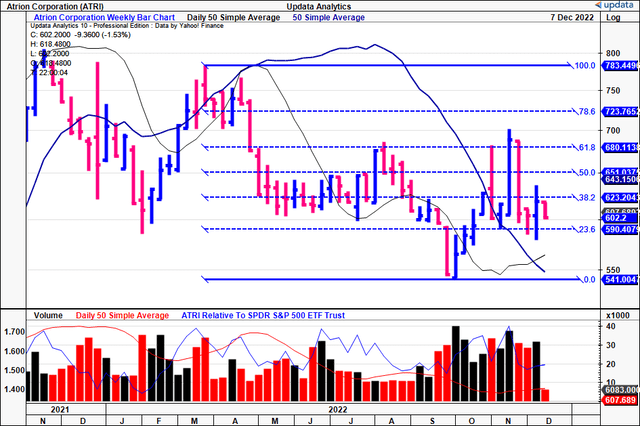

ATRI technicals also corroborate upside support

Judging from the chart series below, we estimate that investors are overwhelmingly positioned long in ATRI. After re-rating to the downside in last FY21, it has held the line across FY22.

Tracing the fibs down from the May FY22 high to the September bottom, we see the stock has traded in a range of $590–$620 for the past 3 weeks. Prior to this, there was upside volatility, with price distribution up to $680.

The stock has walked sideways within this range for the past 8 weeks. However, at the same time, the volume trend has been ascending and is resting well above the 10-week average.

The combination of sideways price action and ascending volume is evidence of support in our estimation. We’d look to price distribution lifting back towards 50% of the retracement channel, or $643, then a move back to $680 after this.

Exhibit 5. ATRI weekly bars showing good support at $590–$620 ranges

Data: Updata

Valuation and conclusion

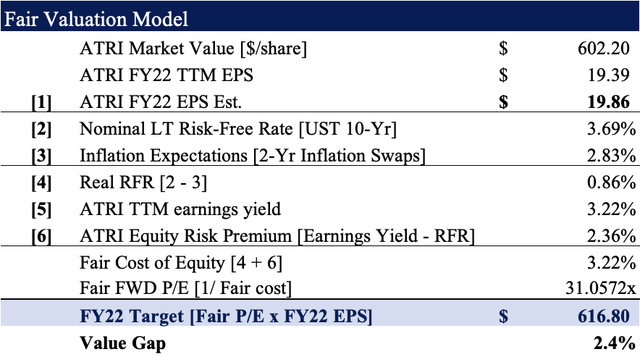

It’s worth noting that the stock is trading at 31x trailing earnings, and ~19.8x trailing EBITDA. Last time, we priced the stock at $632, looking at a fair forward P/E of 33x.

Based on its long-term growth rates of EPS to date, we estimate a FY22 EPS of $19.86 for the company. Hence, we’ve narrowed in this valuation and price the stock at $616, or ~31x forward earnings.

Hence, we believe investors are paying a fair and reasonable price for access to the resiliency characteristics described above.

Exhibit 6. Revised price target for ATRI

Note: Fair forward price-earnings multiple calculated as 1/fair cost of equity. This is known as the ‘steady state’ P/E. For more and literature see: [M. Mauboussin, D. Callahan, (2014): What Does a Price-Earnings Multiple Mean?; An Analytical Bridge between P/Es and Solid Economics, Credit Suisse Global Financial Strategies, January 29 2014] (Data: HBI Estimates)

Net-net, we continue to rate ATRI a buy on value and resiliency. Our latest findings show that there’s been no deviation of the company’s key features, and that investors are buying a stock at 31x trailing earnings that offers an ongoing stream of income via its dividend payout and strong return on capital. Rate buy, price target $616.

Be the first to comment