Andrey Mitrofanov

ATRenew Inc. (NYSE:RERE) is China’s largest pre-owned consumer electronics transaction and services platform. As of 9/30/2022, RERE has 1,804 stores (599 1P stores, 1,189 3P marketplaces, and 16 Paipai Selection) across 256 cities.

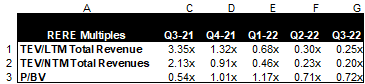

My previous article “ATRenew Expanding Into Non-Electronic Categories In Q2 2022 Provides New Imaginary Space” posted after RERE’s Q2-22 earnings discussed its growth potentials by expanding into new categories. RERE stock price went down from $3.06 to $1.65 in the last three months. RERE is now traded at 0.2x Total Enterprise Value/NTM Revenue, and 0.7x P/B. I see great values for a sector leader with high-double-digit revenue growth YoY, and narrowing operating losses.

Capital IQ

Q3-22 Financial Results

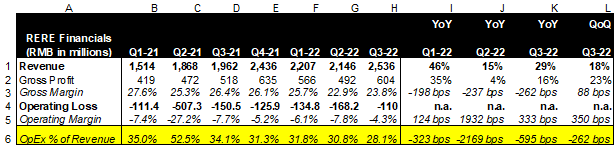

Revenue: RMB 2.54 billion, +29.2% YoY; Operating Loss: -RMB 110 million, vs -RMB 150.5 million PY; Non-GAAP Operating Income: RMB 11 million, vs -RMB 28.5 million PY; Total GMV: RMB 9.5 billion, +14.5% YoY.

RERE revenue growth accelerated from 15% in Q2-22 to 29% in Q3-22. On a QoQ basis, revenue increased by 18%.

Another thing to mention is that RERE Operating Margin improved by 333 bps YoY, and 350 bps QoQ. Operating Expenses as a % of Revenue was reduced by 595 bps YoY and 262 bps QoQ. The improvement demonstrates RERE’s efforts in driving operational efficiencies and economies of scale. I am positive about RERE’s capability to close profitability gap in the next couple of quarters.

Capital IQ

RERE operates the largest pre-owned consumer electronics transaction and services platform, and continues to drive business scale and efficiency via automation

RERE operates the B2 C2B2C closed-loop supply chain and our automation technologies. One thing that sets RERE apart from other competitors is its investment and commitment of driving business scale and efficiency via automation. In order to create more value (or pass more value) to consumers, RERE has to try best to grow its topline while reducing its costs to operate. RERE did that through automation, and I think that was the right investment. The following figure shows the most recent launch of Automated Operation Center in South of China, which demonstrated improvements in transmitting productivity, quality inspection capability, and storage capacity comparing with the existing Operation Center such as Changzhou’s Operation Center.

The success of driving automation and efficiency will eventually be reflected in RERE’s operating margins.

ATRENEW Website

The pre-owned consumer electronics market will grow to RMB 885 billion in 2025 (over 30% CAGR ’21-’25), and is expected to further accelerate with development of technologies

According to iyiou.com, the pre-owned consumer electronics market will grow from RMB 406 billion in 2021 to RMB 885 billion in 2025 (over 30% CAGR ’21-’25). The growth is driven by a strong supply.

According to GlobalData, the consumer electronics segment in China reached $28 billion in 2021, and China is among the major consumer of consumer electronics in the world. I expect the growth of consumer electronics to accelerate in the future as consumers will need more new devices with the development of 5G, Social Media, AI, IoT, and ultimately Metaverse.

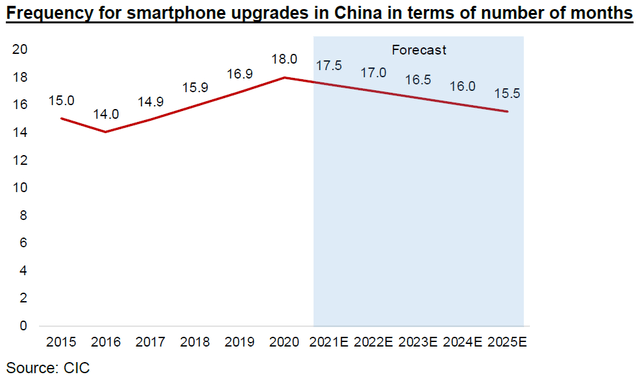

Also the penetration of pre-owned market of the total consumer electronics is currently low (3.7% in 2020 per China Investment Corporation, CIC), and has plenty of room to grow. The following figure shows that on average consumers in China upgrade their smartphones every 16 to 18 months. However consumer electronics have commercial value of much longer periods. For instance, an iPhone has commercial value of up to seven years, and an Android phone has commercial value of up to three to four years.

Gen Z’s growing population and growing spend will continue to drive RERE’s future growth

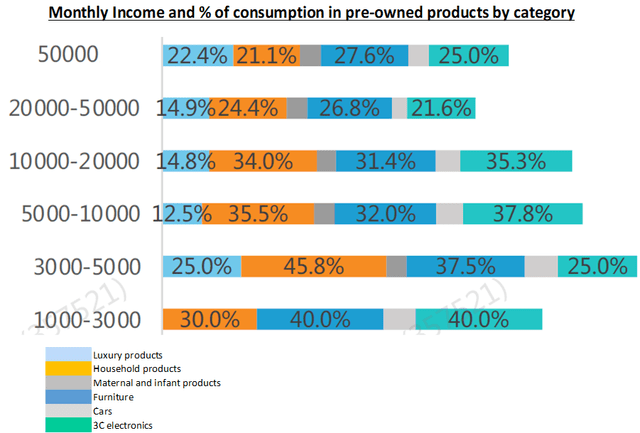

I think RERE’s business model will continue to gain traction from demand side, especially from Gen Z. According to iyiou.com, consumers at age of 14-40 have ~61.8% penetration for pre-owned products. The following figure shows the breakdown of monthly income and % of consumption by category. 3C electronics show meaningful penetration for consumers with varied monthly income.

I expect younger generations than Gen Z will also be active adopters in the future, leading to incremental growth on the demand side.

Additionally, as RERE rolled out new categories such as Luxury products and gold, consumers with higher income (e.g. RMB 20000 above) will likely further increase their spend in pre-owned categories.

Conclusion

RERE is an attractive stock considering 1) RERE is a leader in a massive and growing pre-owned electronics market with significant drivers on both supply and demand sides, and 2) RERE makes the right investment to scale its business top-line and improve its bottom-line through automation.

Be the first to comment